Pepperstone is an ASIC & FCA regulated forex broker that accepts South African traders. They offer competitive spread, wide platform choices, and good support. Read our in-depth Pepperstone Review to find their pros & cons.

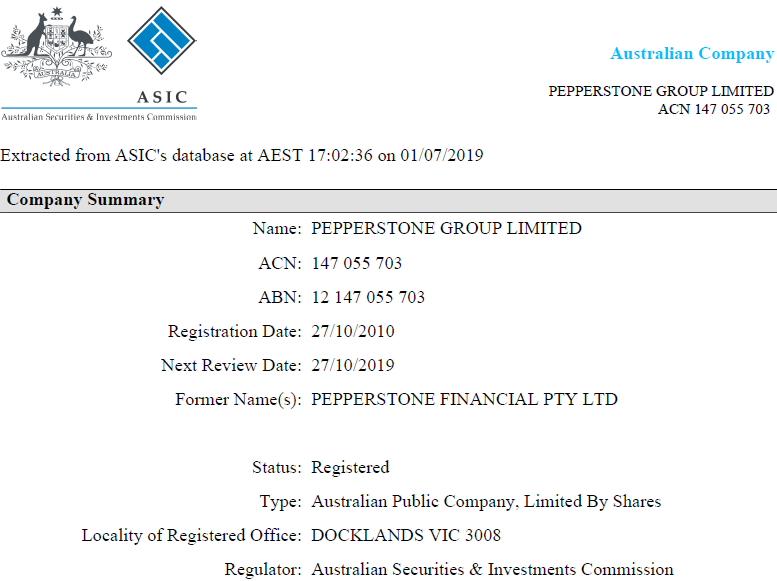

Pepperstone is an Australian forex broker that also offers its services to South African traders also. They were established as Pepperstone Group Limited 2010, and are regulated with ASIC in Australia and FCA in UK.

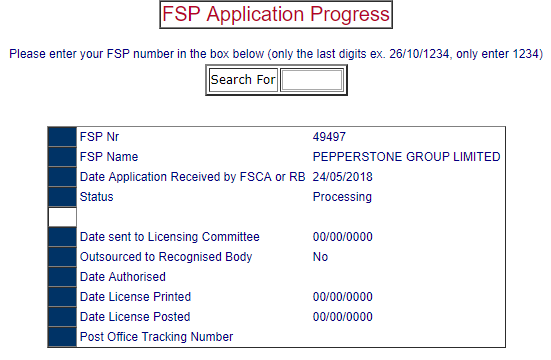

They are not regulated with FSCA (regulator in South Africa), but their Australian & UK regulations still make them a very safe broker.

Their spread is very competitive, support is great, and their platforms are also good. Moreover, Pepperstone offers a wide range of forex trading services with 59 currency pairs. But the negative things are that their commodity, CFDs offerings are very limited, and they also don’t offer cryptocurrency trading. Also, their FX trading leverage is restricted to 1:1 for majors, which some traders may not prefer.

We analysed Pepperstone’s fees, platforms, bonus, customer support & other important factors that could affect South African traders. Read our detailed review to find out all their “pros & cons”.

Let’s start!

Pepperstone Pros

Pepperstone Cons

Table of Contents

| 🏦 Broker Name | Pepperstone Broker |

| 📅 Year Founded | 2010 |

| 🌐 Website | www.pepperstone.com |

| 🏢 Registered Address | Level 16, Tower One, 727 Collins Street, Melbourne, VIC 3008, Australia. |

| 💰 Pepperstone Minimum Deposit | $200 |

| ⚙️ Maximum Leverage | 1:500 |

| ⚖️ Major Regulations | Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC) |

| 🛍️ Trading Instruments | Forex Trading, Commodities, CFDs, Energy |

| 📱 Trading Platforms | MT4 & MT5 for PC & Mobile and Web, cTrader for mobile and web |

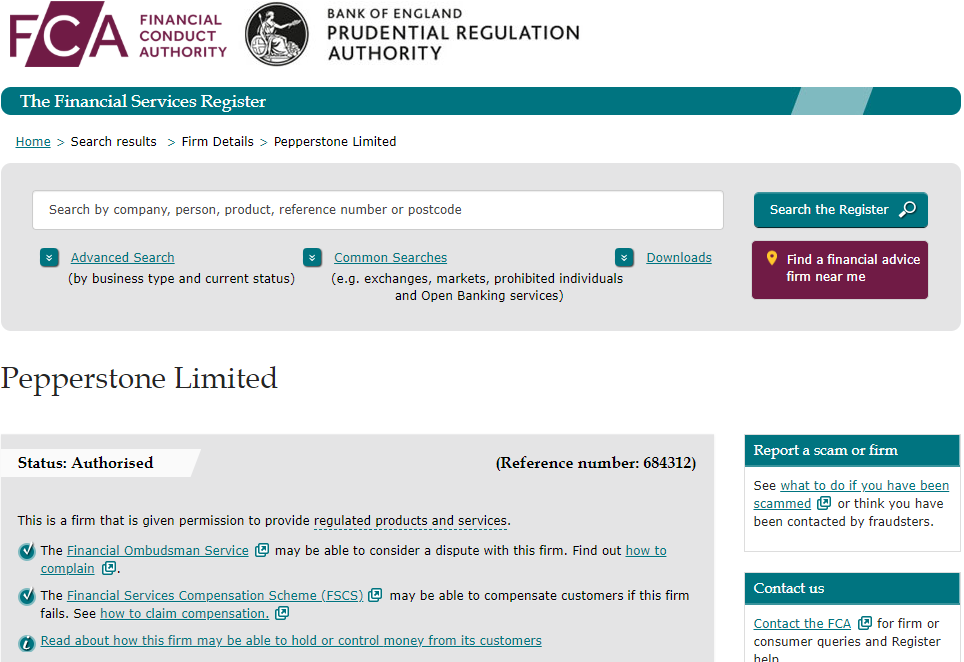

Pepperstone is a globally regulated forex broker, but they are not regulated with FSCA in South Africa yet. They are regulated under 2 of the top-tier regulatory authorities in the world as described below:

Is Trading with Pepperstone safe?

Pepperstone is considered a safe forex CFD broker as they are regulated with multiple top regulators i.e. FCA in UK and ASIC in Australia. But on the downside, they are not registered with South African regulator FSCA, so we gave them the 4 stars.

Despite them not being regulated locally yet, we consider them to be a trusted broker since they are highly regulated in foreign top financial centers outside South Africa.

Also, they have also been around for few years now. They are now one of the largest forex broker in Australia in terms of active daily trading volume, so we say that they are a trusted & reputed broker.

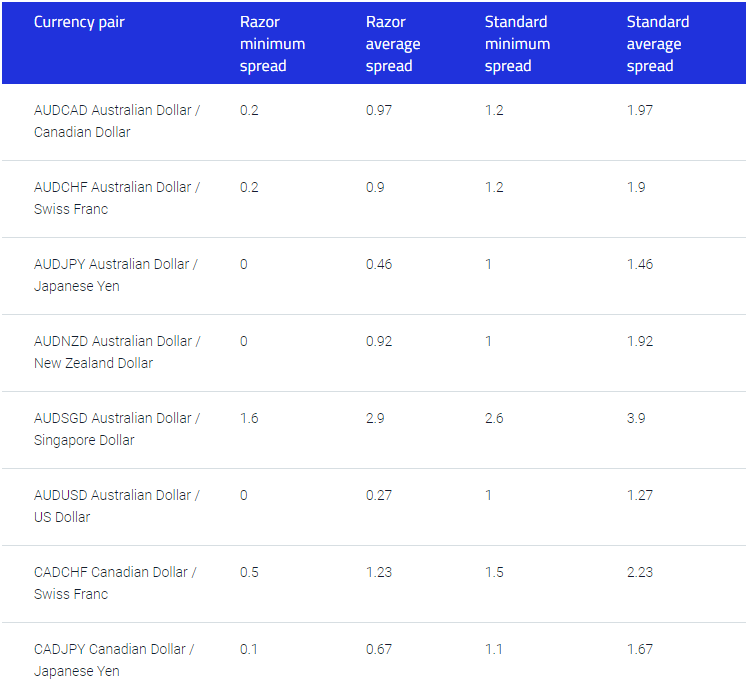

The trading fees at Pepperstone is very low when compared to other brokers in South Africa.

They have low spread & no commissions with their Standard account. Their spread is as low as 0 pips with their ECN account, and the commission is also really competitive.

We did a complete breakdown of Pepperstone’s trading & non-trading fees. You can read and check it from below:

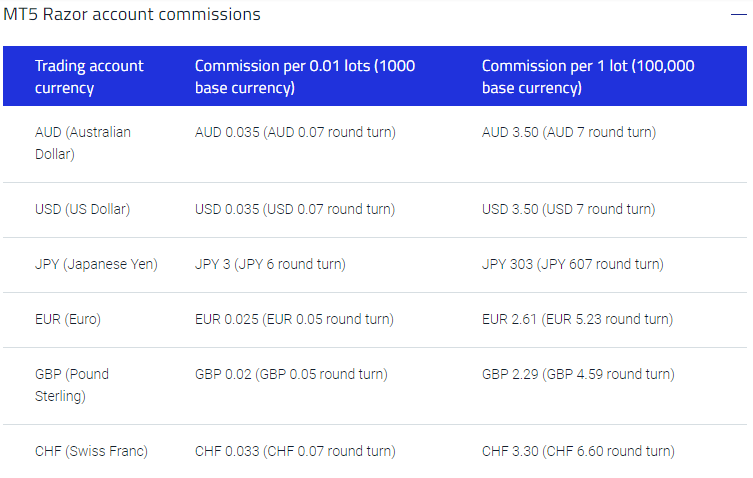

For the trading fees, Pepperstone’s spread is really low for most currency pairs, their commission structure with their Razor account is also very transparent (although a bit on the higher side).

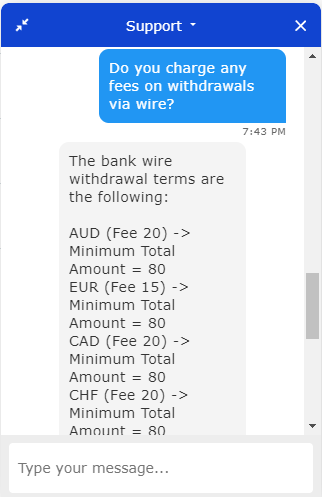

For non-trading charges, they don’t charge any fees on deposits, but you would be charged $20 fees during withdrawal. This makes their non-trading fees quite high, as some other brokers like XM broker & Hotforex charge no fees on deposit/withdrawals at all.

Overall, Pepperstone’s fees is still quite low & transparent.

Pepperstone offers 3 different types of live trading account types and 1 Demo account. Below is the information on all the account types that are offered by Pepperstone in South Africa.

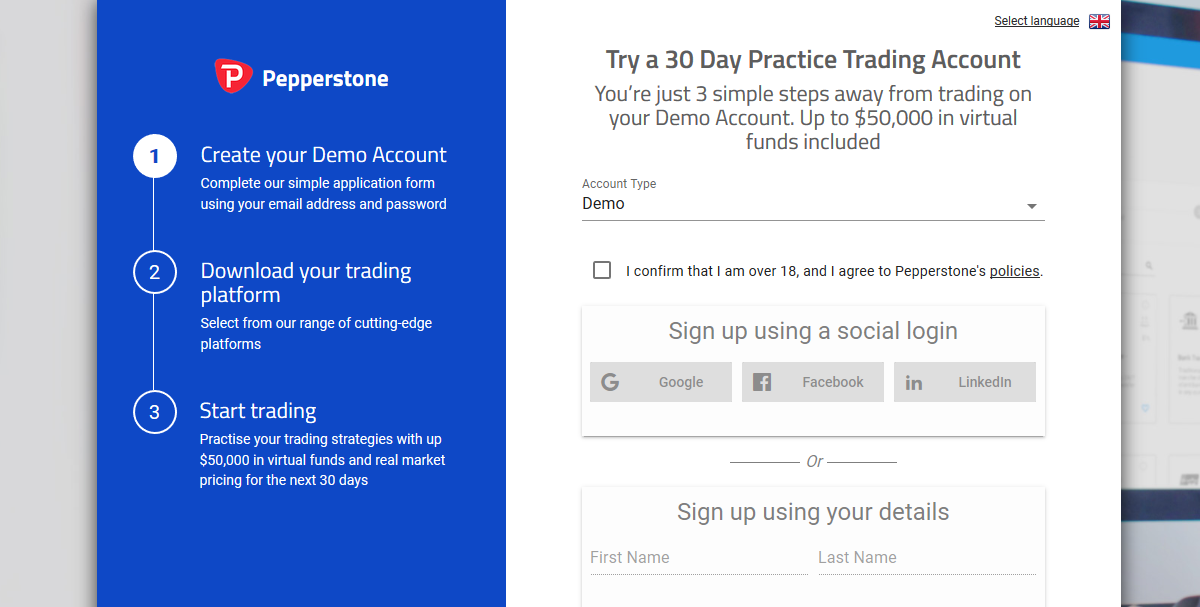

Pepperstone offer Demo account for those traders who are new to forex trading. You can try using their demo account if you want to test your trading strategies.

You can use demo account using platform MetaTrader or cTrader with their risk free environment.

They also offer $50,000 as virtual funds with their Demo account. So you don’t need to add funds to your account to test and start testing your trading strategies.

Moreover Pepperstone also offer leverage of 500:1 same as of provided in live trading account. So demo account is exactly same as of live trading account.

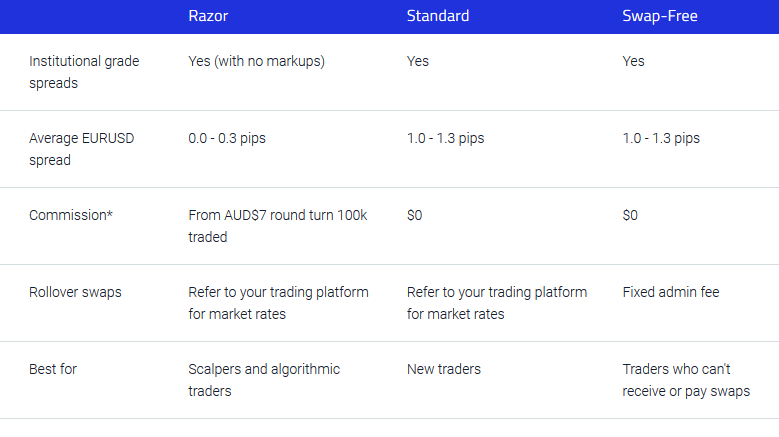

Pepperstone offer 3 types of live trading account which are different from each other’s based on commission, spread and leverage.

Below are the 3 Pepperstone Live trading account that you can choose from:

1) Razor Account: In Razor Account the spread start from 0.0 pips for EUR/USD currency pair and there is commission in this account on the trade volume. This Razor account is best for Scalpers and algorithmic traders. And the minimum account balance should be $200 in Razor account.

2) Standard Account: Standard account is for Beginners who are new in forex trading. There is a $0 minimum account balance required in this account. The spread offer in this account is vary from 1 to 1.8 pips. Moreover there is no commission on trade volume in Standard account.

3) Swap-free Account: This account is interest free account. Swap-free account is for those who do not want to accept interest. The minimum account balance should be $200 in this account. The spread vary from 1 to 1.2 in this account and there is no commission in this account.

Now below are the list of features that are offering with all accounts at Pepperstone:

| Account Types | Commission | Spread | Interest Rate | Minimum Deposit |

|---|---|---|---|---|

| Razor Account | Yes | 0 to 0.3 pips | Yes | $200 |

| Swap-free Account | No | 1.0 to 1.3 pips | Yes | $0 |

| Standard Account | No | 1.0 to 1.3 pips | No | $200 |

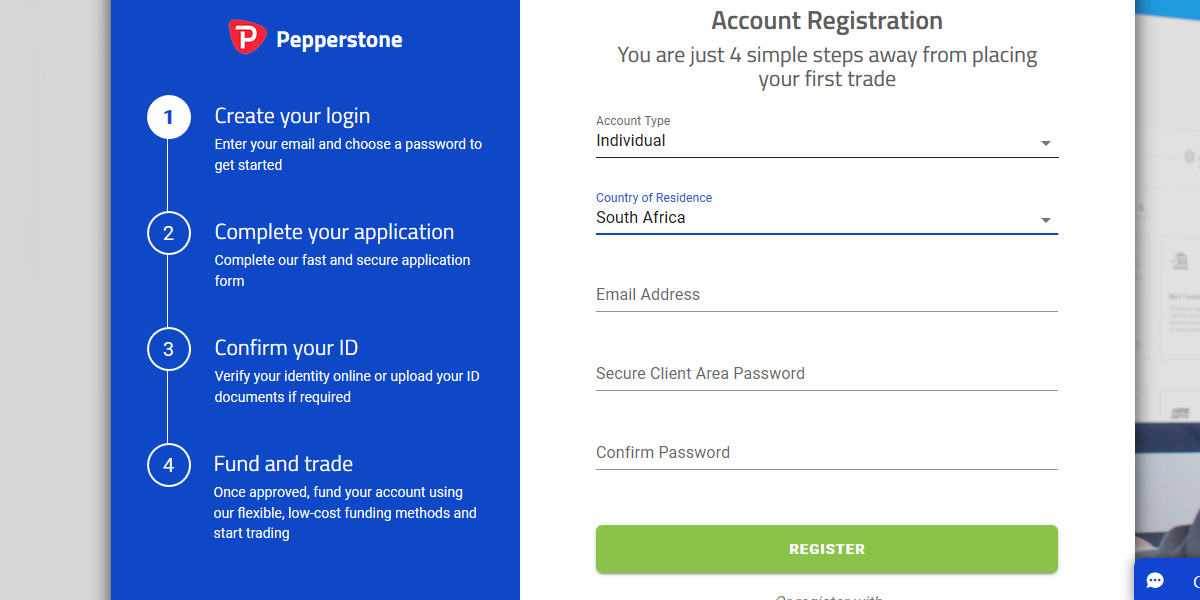

The account opening process with Pepperstone is very easy and includes only few simple steps. It hardly takes 10 minutes to complete the registration process with them.

But their account verification process is quite slow which can take upto 24 hours depending upon the business days.

For opening account with Pepperstone, you need to follow below steps:

Step 1) Register email: First of all you need to open the home page of the Pepperstone for registering your email and set a strong password in Account Registration page.

Step 2) Fill your Personal Information: After registering your email, you need to enter your personal information like Account Types, Country of Residence, etc. You also need to set your base currency from same page.

Step 3) Complete other details: Now you need to fill others details like leverage, account type by selecting it from drop down menus.

At last you will receive account setup complete message on the screen. You can check your registered email for more information of your trading account with them.

Step 4) Account Verification: Before adding funds to your account for trading you need to verify your account by uploading the documents like ID proof such as Driving License, Passport and Address Proof like Electricity bill, Mobile Phone Postpaid Bill.

That’s It! Your account will be fully active with Pepperstone after the above steps. Once it is verified, you should check your registered email for more details and trading account login information.

After that you can login to your account and start your trading.

Pepperstone offers 2 trading platforms which allow their clients to trade with a user friendly interface. Below is the detailed information of all the trading platforms. All these platforms are free to download and are available for mobile, tablet, desktop and web application.

Below are the trading platforms available for trading on Pepperstone:

They are also offering various tutorials and guides which help clients to download, install and start using it.

If you don’t want to download and install it on your device then you can also use WebTrader to access both version on your browser.

It is available in 23 language and has user friendly interface and faster execution.

This means on EURUSD, you typically need a volume of 1600 lots in a month in order to access their API. The API is generally useful if you want to automate your trading & not use any existing platform.

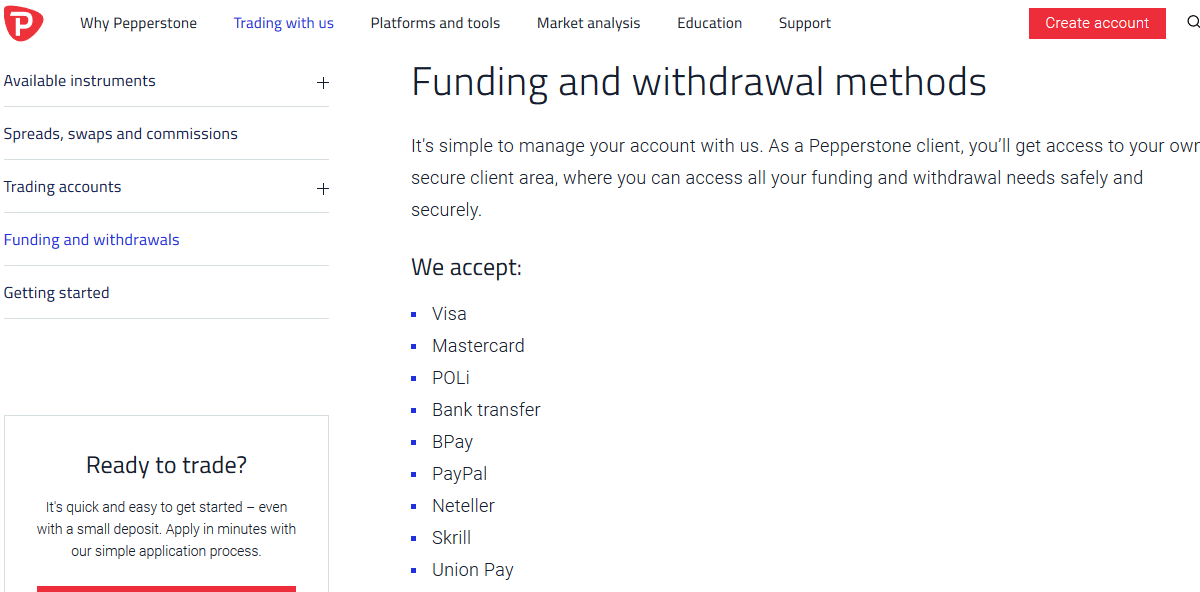

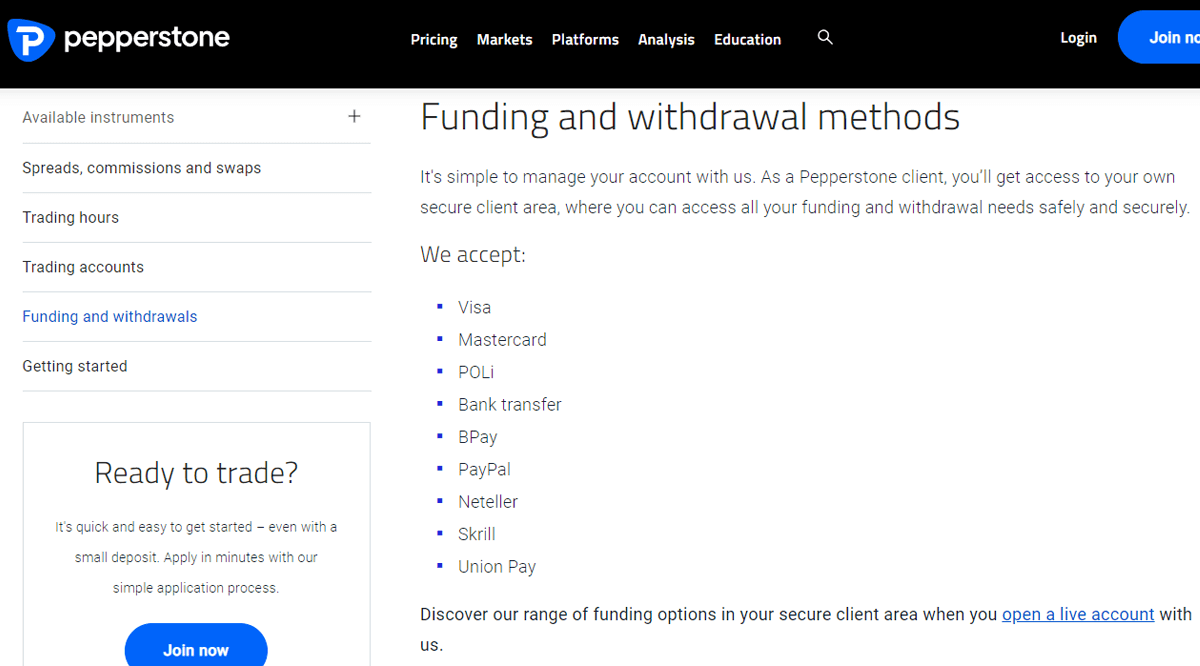

Pepperstone offers many deposit and withdrawal options to add funds or withdraw funds for South Africans. Here are list of methods and their fees.

Adding funds or making a deposit is not free at Pepperstone for both bank transfer and e-wallets. Below is the overview of their 3 funding methods:

Pepperstone withdrawal methods are as following:

Pepperstone has wide deposit & withdrawal methods, but they disappoint in their fees during funding & withdrawals. Many other brokers like XM & Hotforex charge zero fees, so Pepperstone could do better.

Pepperstone does not have any active bonus available for South African clients. They have never offered bonus or loyalty programs in the past, but if they will launch any offer in future then we will list it here.

For now, other brokers like Hotforex & XM are better with their bonus than Pepperstone.

Customer support is a really important factor in our consideration of any broker. And Pepperstone does not disappoint in this area.

Pepperstone’s customer service is available for 24 hours from Monday to Friday. You can get support with them via 3 following channels:

Overall, we found their support to be fair enough. They could do better by offering local phone support for South African traders, but you can always request a callback anytime.

Yes, we do recommend Pepperstone for South African traders.

They are regulated with ASIC & FCA, have really competitive spread, and offer great customer support with very less hold time. Moreover, their website’s user interface is very clean, and they have good trading platforms available.

But on the negative side, they are not yet regulated with FSCA, and their application is in processing status. Moreover, they charge fees on most of their deposit/withdrawal methods, and these 2 factors might be a turn off for some traders.

Overall, Pepperstone is a trusted forex broker & we couldn’t recommend them more.

Pepperstone does not offer accounts denominated in ZAR. Traders have option to choose between 10 account curriencies i.e. AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD and HKD. But South Africans traders can deposit in ZAR, and it will be converted to the currency in which the account is denominated i.e. the account currency.

Pepperstone has a minimum balance of $200 with their Razor account. The spread in Razor account start from 0.0 pips in case of EUR/USD currency pair

No, Pepperstone is not authorized by FSCA in South Africa. Pepperstone Group is regulated by multiple top-tier regulatory authorities including FCA, ASIC, BaFin & CySEC.

Traders can request for withdrawal from the client panel at Pepperstone. You can withdraw with bank wire or with e-wallet options such as Neteller, Skrill or PayPal. E-wallet withdrawals take few hours, but international bank wire transfer takes 2-5 business days on average.

"Do you have experience with Pepperstone? Please consider sharing your experience with a review below – good or bad – doesn’t really matter as long as it’s helpful to other traders!"

We only accept user reviews that add value to fellow South African Traders. Unfortunately, not all reviews that you post with us will be published on the website. For your review to be approved, please share your detailed & honest experience with the broker – either positive or negative. Thank you for helping out other traders with your valueable feedback!

Important: We don't accept any payments or kickbacks from any forex broker(s) to delete or change any reviews. We welcome Forex Brokers to reply to reviews on our website & share their side of the story to keep the process honest and fair for both sides.

Submit Your Review