FXTM is our #8 rated Forex broker in South Africa. They are regulated with top-tier regulator i.e. FSCA (South Africa) & FCA (UK), so we consider them to be safe. Read our FXTM review to know about their fees, accounts, support & more..

FXTM is a FSCA regulated Forex broker that operates in South Africa. They were founded in 2011 & claim to have more than 1 million registered users now.

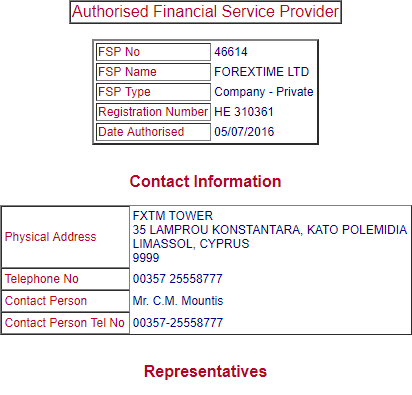

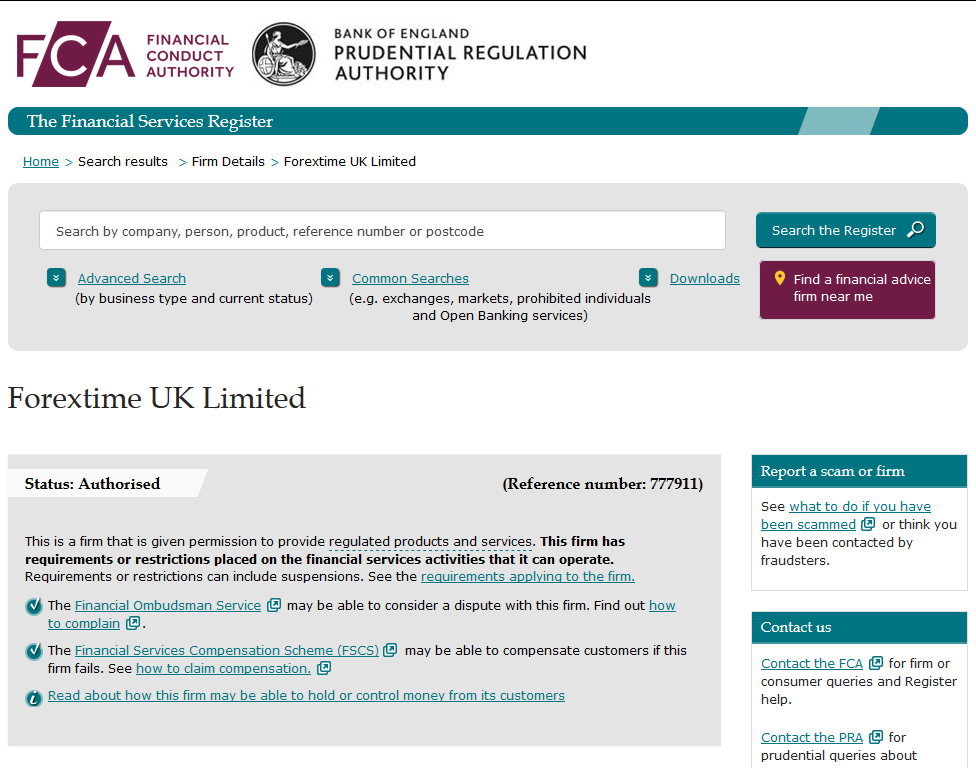

They are highly regulated globally by top-tier Financial regulators in UK, Cyprus. Also, in South Africa, they are licenced by the local regulatory authority i.e. Financial Sector Conduct Authority (FSCA). So it is safe to trade with them.

FXTM’s spread is on the higher side with their Micro account, but very low with their Advantage account which is their ECN type account with Raw spreads & low commission for high volume traders.

Plus, they offer over wide range of trading instruments including 57 currency pairs, CFDs on Spot metals and Indices, share CFDs & cryptocurrencies too. The total number of CFD instruments available on their platform are moderate.

They offer the latest MT5 trading platform as well as MT4, and their support is also quite good & quick, and they even have good trading education resources.

We tracked FXTM’s fees, platforms, bonus, support & lots more for this review. Here’s our in-depth breakdown of all the pros & cons of FXTM, and their User reviews as well!

FXTM Pros

FXTM Cons

Table of Contents

| 🏦 Broker Name | ForexTime (FXTM) South Africa |

| 📅 Year Founded | 2011 |

| 🌐 Website | www.forextime.com |

| Address | FXTM Tower, 35 Lamprou Konstantara, Kato Polemidia, Limassol, 4156, Cyprus Phone – 357 25 55 87 77. |

| 💰 FXTM Minimum Deposit | $50 |

| ⚙️ Maximum Leverage | 1:2000 |

| ⚖️ Regulation | FSCA (South Africa), FCA (UK), CySEC (Cyprus) |

| 🛍️ Trading Instruments | 57 Currencies, Spot Metals, Stock CFDs, Commodity CFDs, Stock Indices |

| 📱 Trading Platforms | MT4 and MT5 for PC, Mac, Web, Android, iOS |

FXTM is highly regulated with top financial regulatory bodies in South Africa, UK & other European countries.

Also, Exinity Limited (the company that owns ForexTime brand & regulated with FSCA) has recently been approved as an ODP. So, the broker is authorized to offer over the counter derivative instruments like CFDs.

FXTM is authorized and regulated under the following Regulators:

Moreover, the company’s security system uses SSL (Secure Sockets Layer) protocol which guarantees secure connection in all types of communication with clients, thereby enabling the safety of transactions and customer information.

They claim to have partnerships with a lot of reputed banks world-wide which necessitates the maintenance of transparency and accountability standards. But we could not find the information on the banks under which they hold the customer deposits in segregated accounts for SA clients.

Still, overall in terms of regulations, FXTM is regulated by multiple highly reputed financial regulators and institutions in the world, hence we consider it to be safe & low risk for SA traders to trade on their platform, mainly because of their multiple regulations.

FXTM is a legal forex broker that has gotten licensed with the FSCA, and their entity “Exinity Limited” is also an approved ODP. Therefore, as per our recent checks, FXTM is legit in South Africa.

Note that this license is for forex, so FXTM are only licensed for this product. The also claim to hold your funds in a segregated bank account.

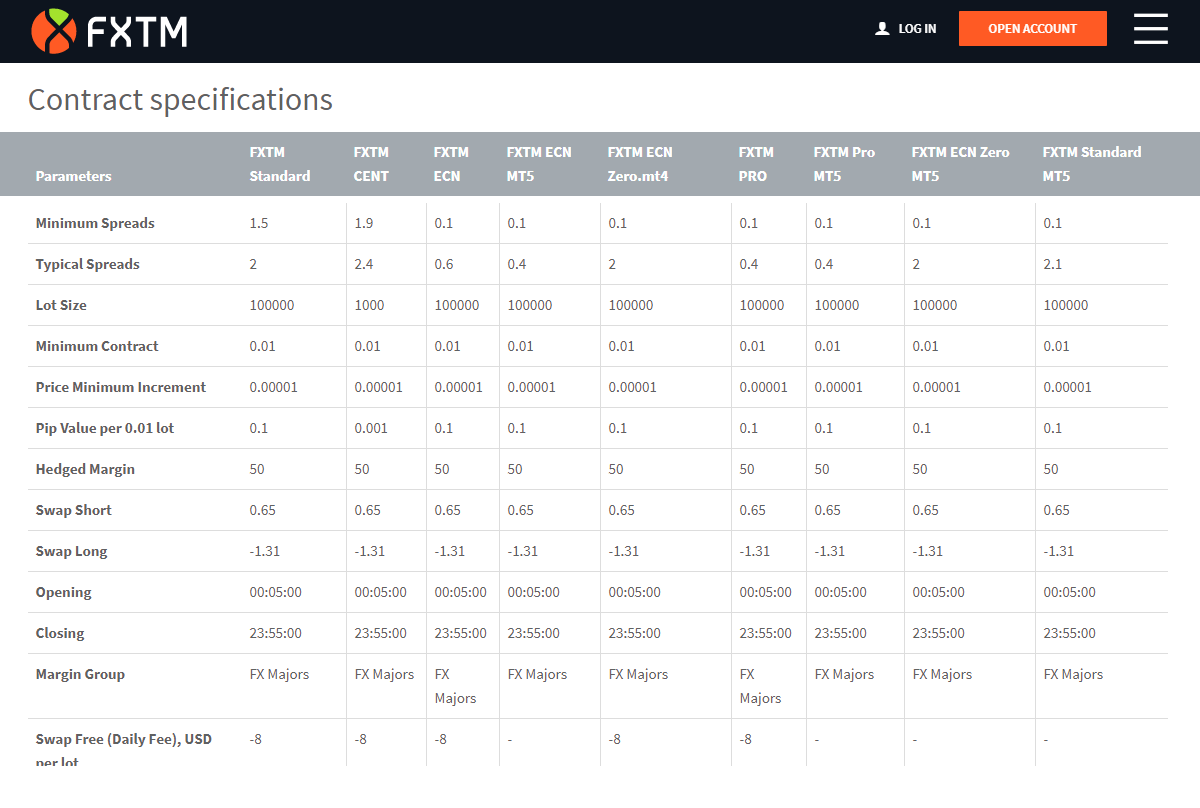

FXTM have higher spread than its competitor South African brokers. Their spread is high with the Micro account, but the total trading fees with their ECN type Advantage Account is quite low.

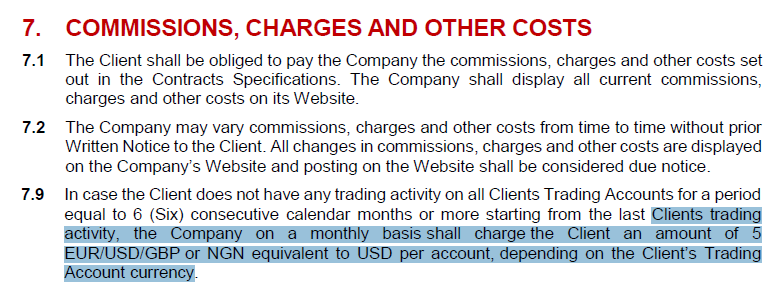

Moreover, they also charge fees on withdrawals via bank wire transfer & transfers in ZAR.

Below is a complete breakdown of all the trading & non-trading fees at FXTM:

During our tests, we found that the Micro accounts at FXTM has very high spread of 2.0-2.4 pips for EUR/USD on average (but may be as low as 2 pips depending on the live market conditions). Overall for Micro account, their spread is a very high compared to the other brokers like XM & Hotforex.

Similarly, for a major CFD instrument XAU/USD, the typical spread is 56 pips with Micro Account & 36 pips with Advantage Plus Account. This is quite high compared to typical spread on XAU/USD of 29 pips at Hotforex, 25 at XM with Ultra Low Account, 30 at Exness.

In case signup with their Advantage MT5 account, the spread is 0 pips on average for EUR/USD, plus volume based commission. This is quite low, and we recommend choosing Advantage account at FXTM for lower spread.

Below image is the comparison of EUR/USD spread for the different account types at FXTM:

FXTM’s trading fees with Micro accounts i.e. their spread are higher than the other regulated forex brokers that we have reviewed.

Although, if you want to trade with an ECN type broker then their overall fees (including spread + commission) is much lower than most other brokers. Their Advantage account has low trading commissions per lot, so the overall trading fees is competitive with this account.

In terms of their non-trading fees. they charge during withdrawals & for in-activity. The withdrawal fees with most methods is not too high, but still there are some other brokers like Tickmill & HotForex that charge zero fees/commissions on withdrawals.

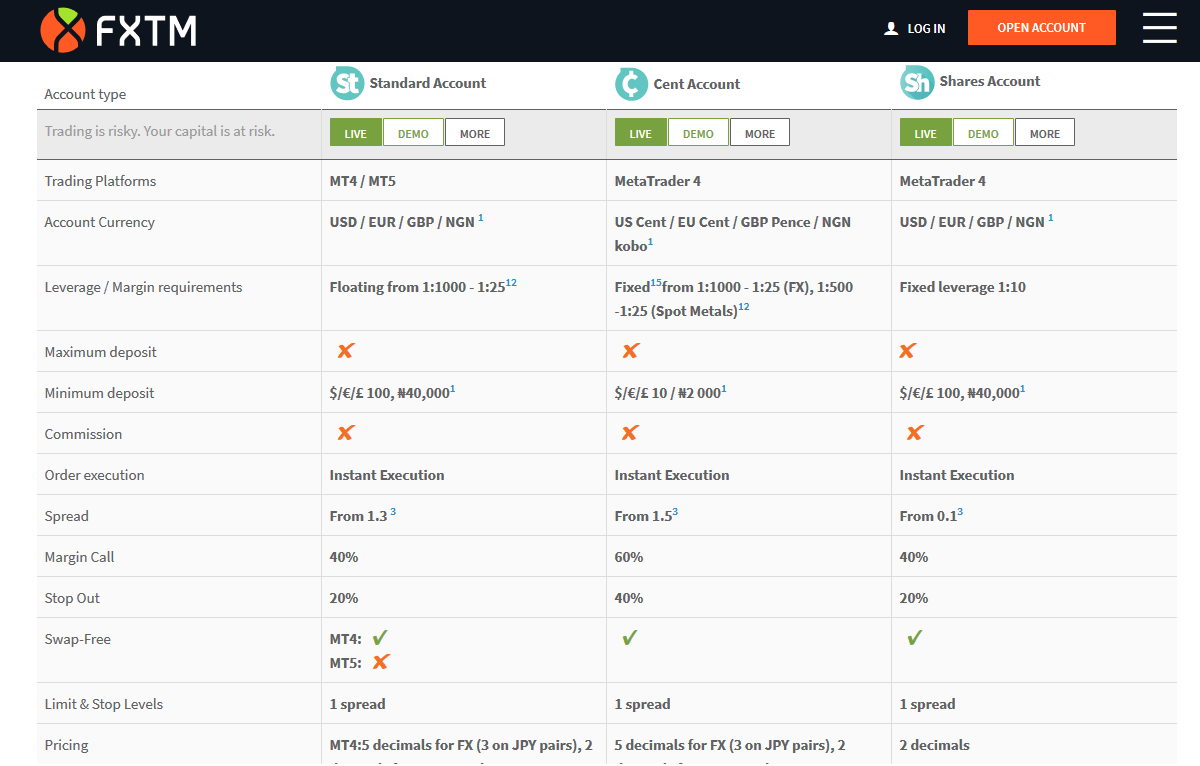

FXTM offers Standard Accounts and ECN Accounts, both of which have variants. Both FXTM account types are offered on MT4 and MT5 trading platform.

FXTM South Africa does not have ZAR account currently. They only offer USD, EUR & GBP account currency options.

If you are looking to open a Trading Account in ZAR currency then you can choose from this list of ZAR Account forex brokers which includes regulated brokers like Hotforex.

There are 3 types of standard accounts that FXTM offers – Standard, Cent and Shares Accounts.

1) Micro Account ($50 deposit): The minimum deposit for a Micro Account is $/€/£ 50, a maximum leverage of 1:1000, access to all forex trading instruments. You can trade in micro lots, a maximum Lot size of 30 per trade upto a maximum number of 100 orders. The margin call level is 40% and stop out is 20%.

2) Advantage Account ($500 deposit): The minimum deposit for Advantage account is $/€/£ 500, a maximum fixed leverage of 1:2000 for FX. This is an ECN type account with Raw spread starting from 0 pips, and there is a volume based commission.

3) Advantage plus Account: The minimum deposit for this account is $/€/£ 500. This is similar to the Micro Account, but the advantages are lower spread than Micro account & higher number of intruments.

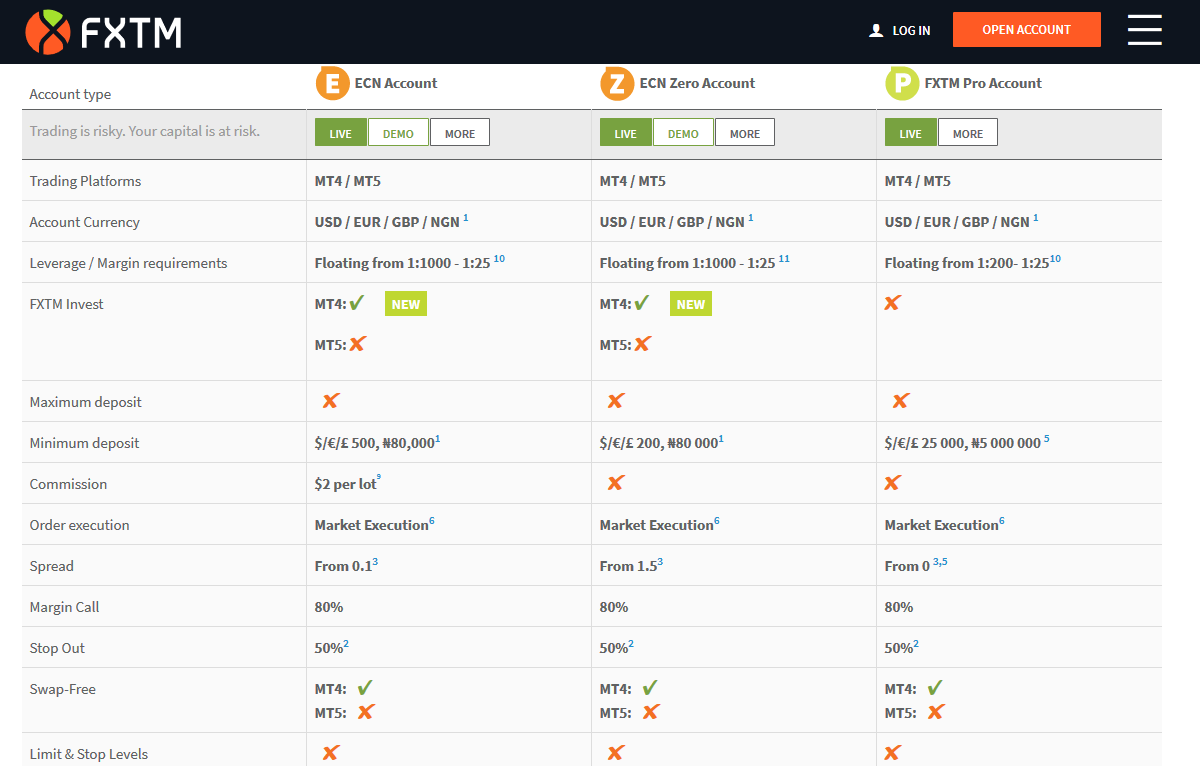

ECN, stands for Electronic Communications Network, where the broker gives direct you access to the live forex markets. Hence, with ECN trading there is no middle man.

Note: FXTM does not offer multiple ECN Accounts now as of June, 2021. They only have Advantage trading account, which is an ECN type account with 0 pips Raw spread plus commission.

Here are the 3 ECN account types offered at FXTM:

1) ECN MT5 Account (recommended & has $500 deposit): The minimum deposit for a ECN Account is $/€/£ 500, a maximum leverage of 1:1000, the average EUR/USD spread is 0.4 pips with access to almost all trading instruments.

With this account You can trade in standard lots, a maximum Lot size of 100 per trade for unlimited number of orders. The margin call level is 80% and stop out is 50%.

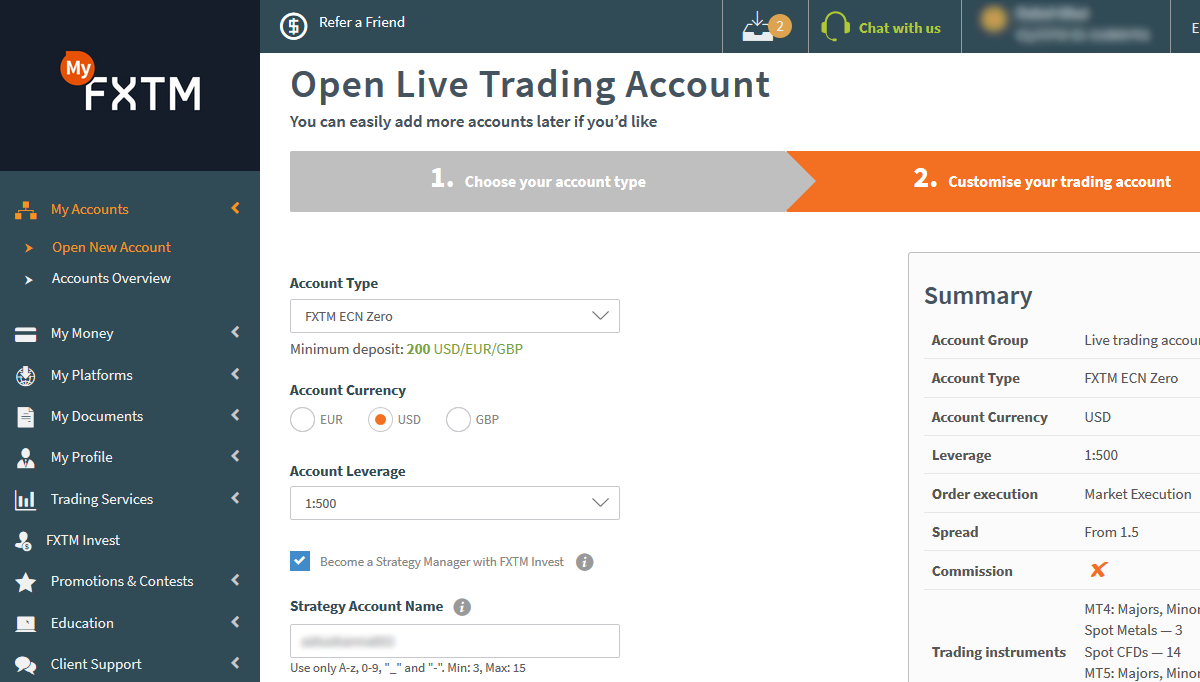

2) ECN Zero Account: The minimum deposit for a ECN Zero Account is $/€/£ 200, with the same leverage, but the spread is much higher than ECN MT5 account.

3) FXTM Pro Account: The minimum deposit for a ECN Account is $/€/£ 25000, a maximum leverage of 1:200. But the average spread is lowest with this account.

Overall, we recommend you to choose FXTM’s MT5 ECN account as the spread is the lowest with this account & the deposit requirements of $500 are also not very high.

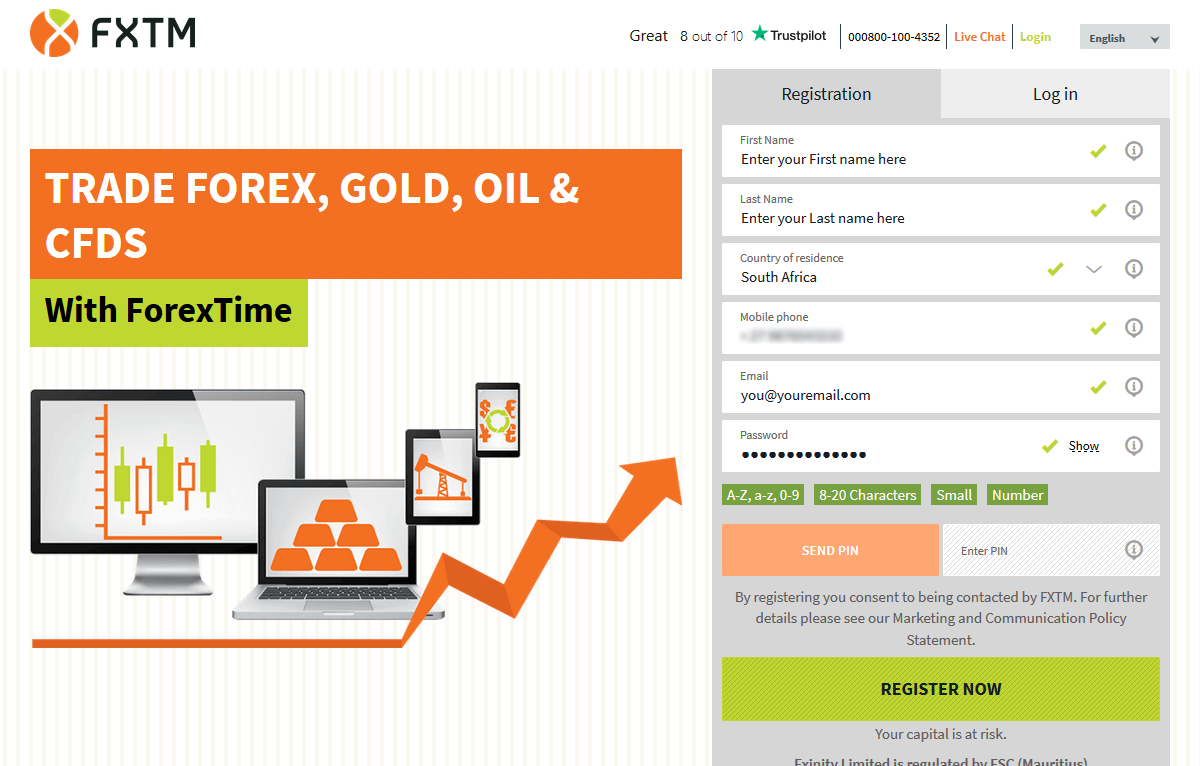

Step 1) Click on Open account button: First of all on your browser open the home page of FXTM and then click on the Open account button at the top right side.

Step 2) Fill the details: Now in open Account page you need to fill the Registration details.

Step 3) Verify the Email: While entering the registration details you also need to verify your email by Clicking on the Send PIN.

Note: You need to enter the PIN receive on your email to complete the verification process.

Step 4) Complete your Profile: Once verification process is completed, you need to complete your profile by entering the details on same page.

Step 5) Choose Trading Account Type & Account Currency: After account setup, you need to choose the trading account type (like FXTM standard account to ECN account). Your preferred account currencly will also be selected on this same page.

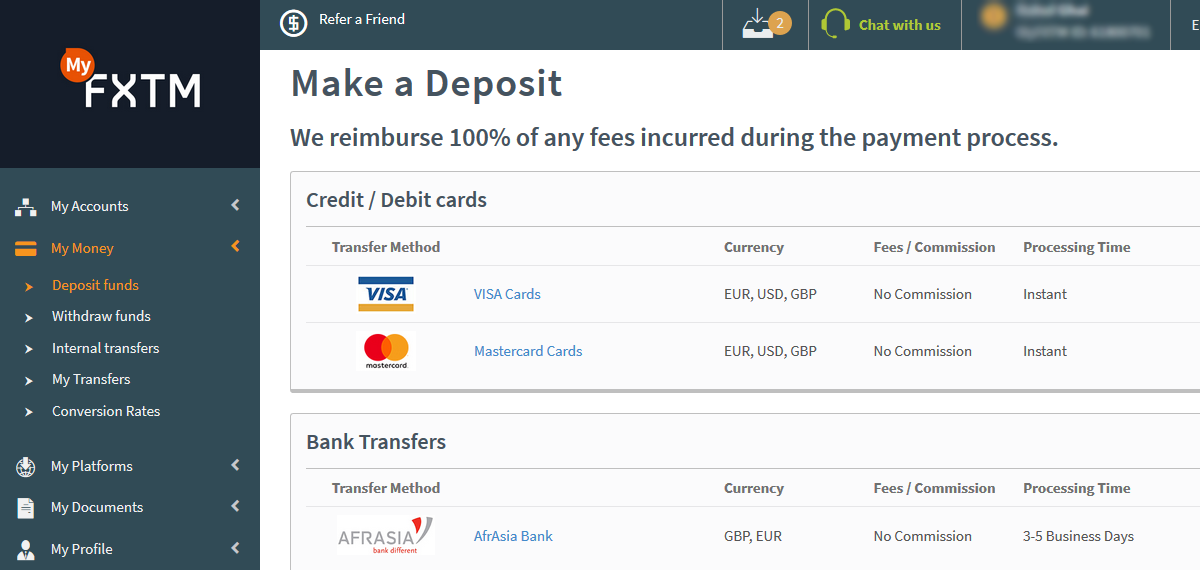

Step 6) Make First Deposit: Once account has been setup, you need to make the first deposit to add funds to start trading in your account.

FXTM offers trading on a wide range of trading markets & their trading instrument offering are much better than most other brokers like Hotforex. They give access to not just trading forex but also other financial instruments like stocks.

Below are the details of the various financial instruments you can trade at FXTM:

1) Forex Trading (57 Currency Pairs): FXTM gives access to forex 24 hours a day, 5 days a week. You have access to trade 7 major and 50 minor, exotic pairs. Their spread for forex trading is lowest with their ECN MT5 Account.

2) Spot Metals: FXTM offers access to trading precious metals like Gold and Silver online. Precious metals are often considered resistant to market events meaning their value is rarely affected during economic events and may even increase during market volatility.

4) Share CFDs: CFDs, short for, ‘Contracts for Difference’ where the parties don’t own the underlying asset but makes profit/loss based on the price fluctuations of the underlying asset. There are some advantages to CFDs that traditional markets don’t offer like low margin requirements, access to global markets, low transactional fee. But they are less regulated than traditional markets, the spread may eat away the profits if there is little movement in the market and high leverage may also increase potential losses.

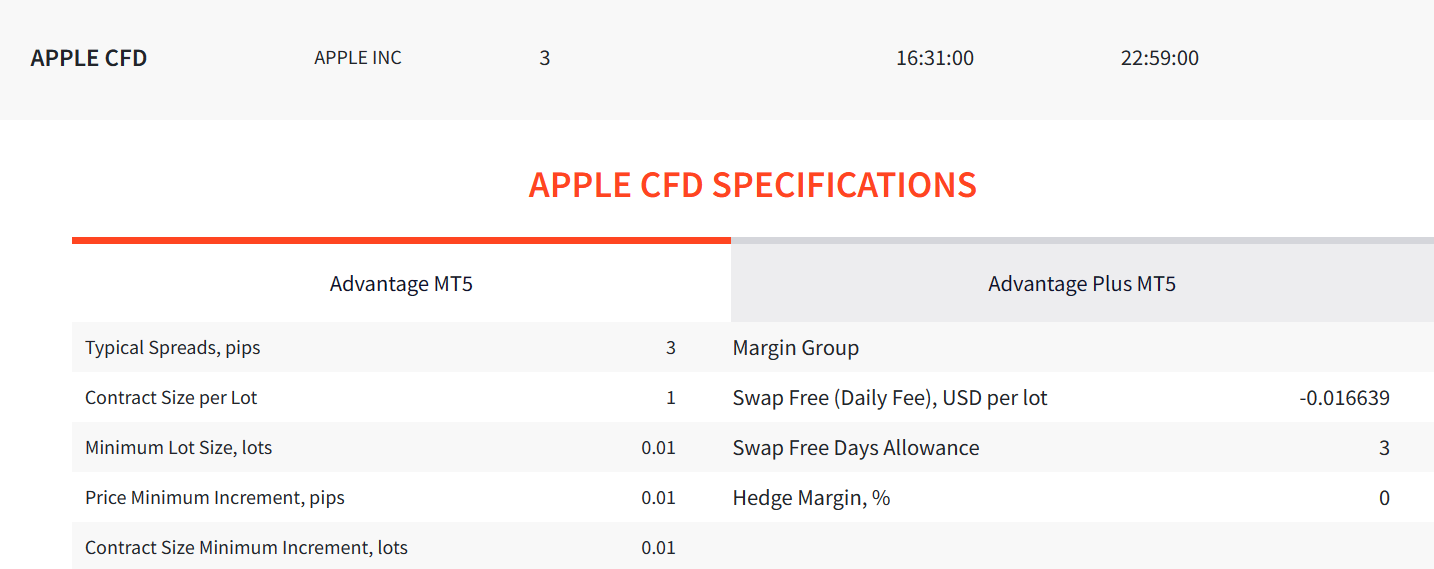

FXTM offer CFD trading on US stocks, European Stocks & Kenyan Stocks. They offer CFDs on 758 US stocks, 50 European stocks & 17 Kenyan stocks. These including large Tech stocks like Apple, Google, Microsoft, Amazon etc. And European listed stocks like Adidas, ASML, BASF etc.

But their typical fees (Spread + Swap charges) at MT5 Advantage account for trading CFDs on stocks is very high. For example, below the the screenshot of their contract specification for Apple CFD. The typical spread is 3 pips. So, if the Apple stock is trading at $150, and you buy 1 Contract of Apple CFD (worth value of 1 Share), then the fees is $3. This is around 2% of the value.

Compared to other brokers like Exness, who charge 0.9 spread for similar instrument, the fees is almost 3 times higher for CFDs on similar stock CFDs.

5) CFDs on Commodities: FXTM gives access to trade on popular commodity markets in UK and USA. CFDs on commodities like gas and oil can be traded on FXTM. Commodities are sensitive to political and economic events, which makes them attractive to traders.

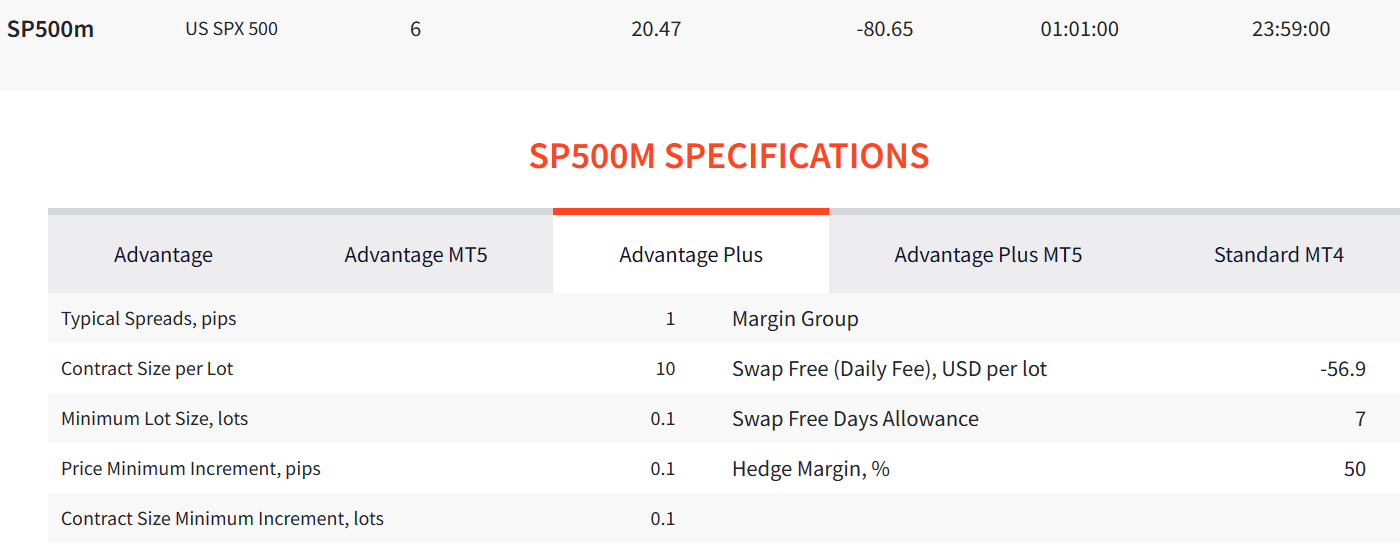

6) CFDs on Indices: FXTM offers to trade indices (plural for Index) where a section of a market can be traded, instead of individual stocks. Depending on the market movement, there will be potential for profits. Examples of Stock market indices would be GDAX, SP500m, UK100, AUS200 etc.

Similar to CFDs on stocks, their fees is also moderate to high on major Indices. Below is the example of their typical contract specification for US500 (S&P500).

7) CFDs on Cryptocurrencies: Cryptocurrencies, or in short, Cryptos, have shaken the financial markets after the Bitcoin is introduced in 2009. They provide an alternative to traditional currencies, are decentralised and unregulated and hence their value. As they are new, they are highly volatility. FXTM offers access to trade the Crypto CFDs against the US Dollar for Bitcoin, Etherium, LiteCoin and Ripple.

8) Stock trading: FXTM offers access to stock trading which is the more traditional form of trading markets. Traders who trade stocks aim to benefit from the increase in value of the stock. The main advantage of stock trading is that a trader can hold a stock for any period of time, hence have the ability to implement a long-term strategy. Unlike CFDs, when you trade a stock, you essentially transacting the ownership of it. Stock trading is also highly regulated and can be considered safe compared to other instruments.

FXTM offers trading services from two trading platforms, MetaTrader4 (MT4) and MetaTrader5 (MT5).

MT4 and MT5 are trading platforms which specializes in forex and futures trading. It is developed by MetaQuotes Software Company.

1) FXTM MT5 Desktop Platform: MT4 & MT5 come for PC/Mac, Android/iOS or just a web trader. MT5 is an improvement over MT4 wherein it is more suited towards a hybrid strategy of both Fundamental and Technical analysis to trade. Hence MT5 also comes with more indicators than MT4.

2) Metatrader for Android/iOS: Mobile (Android/iOS) trading platforms allows you to trade on-the-go. FXTM offers mobile trading with FXTM trader App, MT4 as well as MT5. All are available for both android and iOS. The real-time interactive charts, real-time quotes, technical indicators and a bunch of other features on the mobile platforms makes it easier to fit trading your busy schedule.

Yes, FXTM has an app on Android & on iOS. You can download their ‘FXTM Trader’ app or the MetaTrader App from the Play Store or your App store. The FXTM Android App has over 1 million downloads, with average user rating of 3.9 stars, which is lower than Exness, HFM & other brokers.

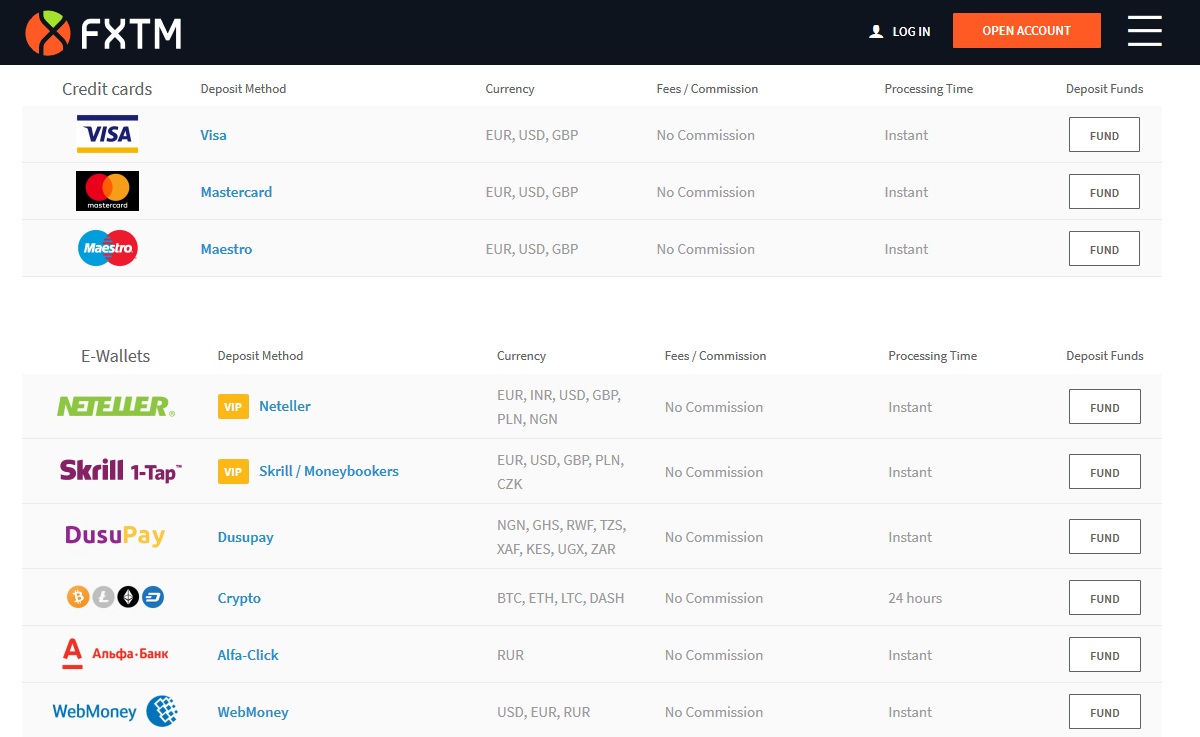

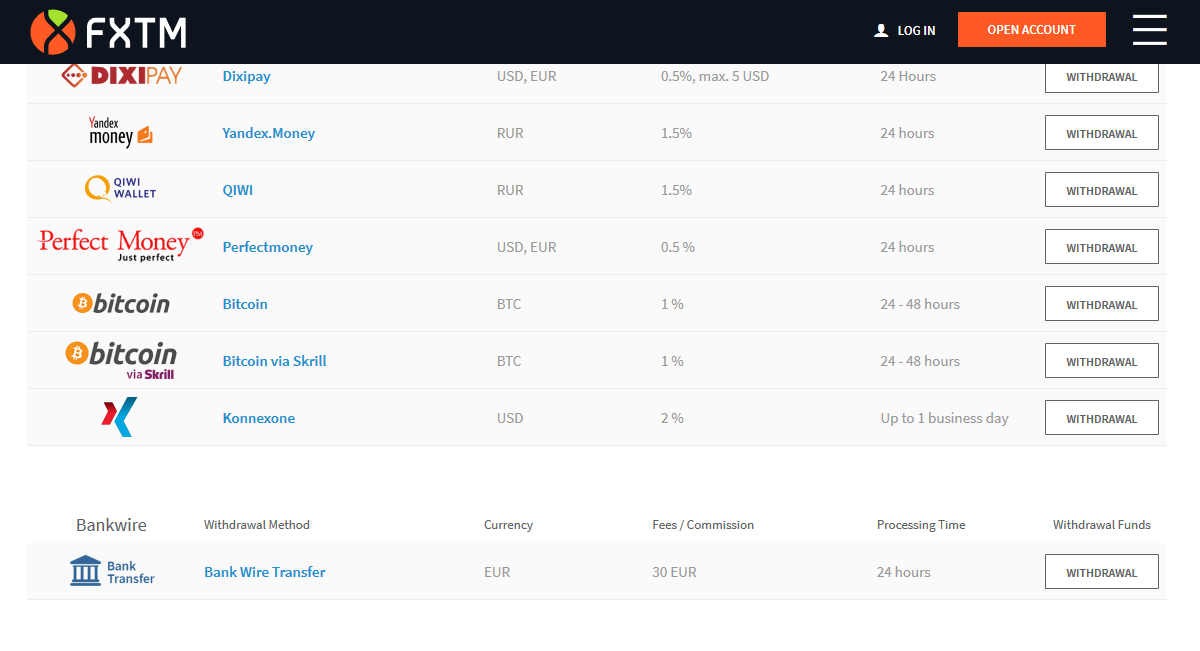

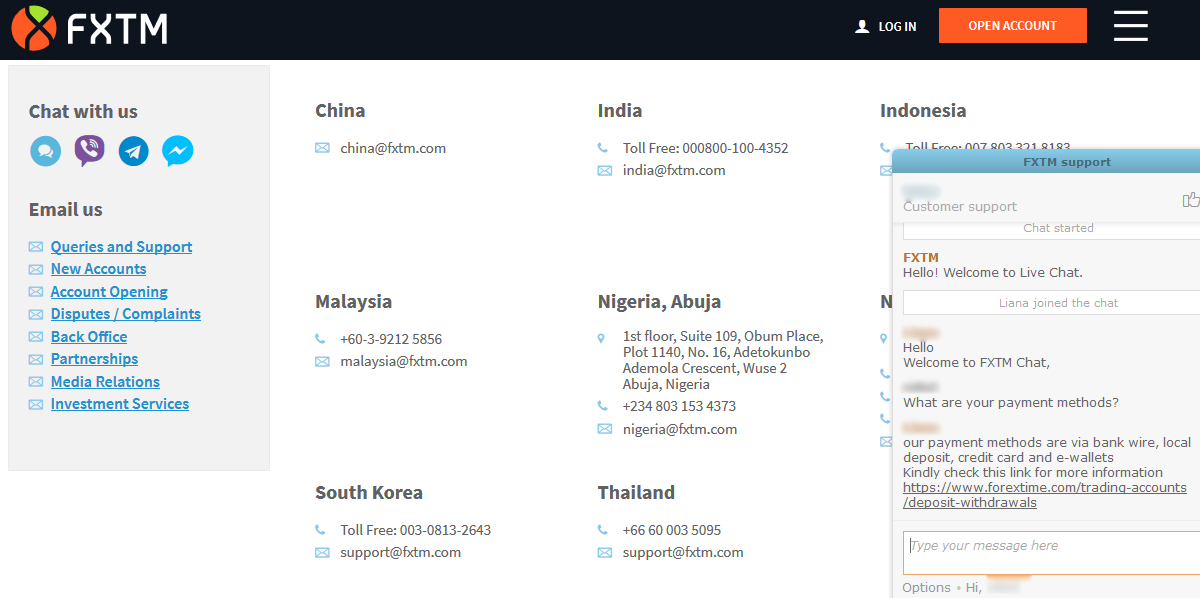

FXTM has many deposit and withdrawal methods for South Africans, but they charge fees on withdrawals via bank transfer. The methods are common for both withdrawal and deposit methods.

Here are some brief description about the payment methods of FXTM.

Amount can be deposited or funds in your account can be added using the below methods:

1) Credit Cards: Master Card, Maestro, Visa can be used to add funds in your account.

2) E-Wallets: Alfa-Click, WebMoney, Dixipay, Neteller, Skrill / Moneybookers and many more are available.

3) Bank Transfer: Transfer from your bank to thier bank account using bank wire transfer option is also available.

1) Debit/Credit Cards: VISA Card, Mastercard, Maestro and China Union Pay can be used.

2) E-Wallets: Neteller, Skrill / Moneybookers, Crypto, Dusupay, WebMoney, Dixipay and many more can be selected as per your preference.

3) Bank Transfer: Bank Wire Transfer option is available to withdrawal funds from your account.

Moreover as per stand KYC (Know Your Customer) terms, you need to verify your account before withdrawing the funds from your account.

The withdrawal can take 48-72 hours for transfers in your SA bank account via wire. Note that FXTM doesn’t pay out the withdrawals in ZAR, so your withdrawal will be in USD (or your account currency).

In some cases the withdrawals can take more time because it is not a local EFT transfer. Alternatively, you can choose to get the withdrawal in your eWallet, but that too takes upto 24 hours (there is not instant withdrawal option for SA traders at FXTM).

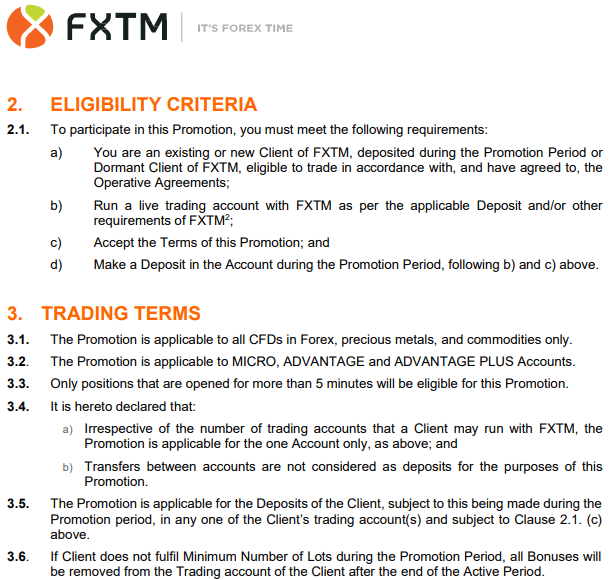

FXTM have an ongoing 30% deposit bonus promo that is available for both new & existing traders in South Africa. New traders who open a Live account & make an initial deposit of $50 can get the benefit of this promo.

Both existing & new traders can get 30% bonus on every following deposit. But the bonus amount is limited to $200. The bonus offer ends on 25th October, 2021.

We have tested and FXTM’s support is really good.

FXTM’s support is available 24 hours during Monday to Friday. While during weekend support hours are 11 AM – 04 PM on Saturday and 12 PM – 08 PM on Sunday.

Although they don’t have a local phone number in South Africa, we still found their support (especially live chat) to be really exceptional in terms of their knowledge & response time.

Yes, we do recommend FXTM.

FXTM is highly regulated broker that is regulated locally with FSCA, and internationally with Top-tier regulators like FCA in UK, CySEC (Cyprus), hence trading with them is safe or low risk for South African traders.

Also, they have good customer support team (both live chat & phone) that works round the clock to offer good service, an easy account opening process, and numerous ways to deposit/withdrawal, including in ZAR.

On the downside, FXTM has high spread with Micro account and some non-trading charges (inactivity fees & fees on withdrawals) due to which we are not in the favour to trade on their Micro accounts. Also, they don’t offer ZAR base currency accounts.

But if you want to go with them then we recommend you to trade via their Advantage account with which they offer as low as 0.1 variable spread, and low commissions per lot.

The minimum deposit amount with FXTM depends on your account type. Traders based in South Africa can open Live trading account from $50 with FXTM Micro account. The minimum deposit with lower spread Advantage & Advantage Plus accounts is $500.

No, FXTM does not offer ZAR account base currency option to their South African clients. Traders can choose between USD, EUR & GBP Account Currency options. But you can deposit in South African Rand (ZAR), which will be converted to your account’s base currency according to conversion based on the latest exchange rates.

Yes, FXTM does have NAS100 CFD indices with Advantage & Advantage Plus trading accounts. The instrument is listed as US Tech 100 on their platform. The typical spread for US Tech 100 CFD at FXTM is 36 pips with Advantage Plus account. But this instrument is not available on their Micro Account.

Yes, the parent company of FXTM is Exinity Limited, and they are licensed as an ODP, with ‘Approved’ application status. They are one of the few licensed ODPs in South Africa, as most other major CFD brokers like HFM, Exness etc. don’t have a ODP license.

FXTM use a local payment gateway which you can use to deposit funds in ZAR (R20 minimum). But the withdrawals in ZAR are not available with this method. You can request withdrawal via bank, but it can take upto 3 days for the withdraw to be processed.

The parent company of FXTM is a FSCA licensed entity. The group is also licensed under FCA, therefore we can say that they are a legit forex broker. You can still lose money in forex trading, even if you are trading through a legit broker like ForexTime. More than 80% of the traders lose their money are this CFD broker.

Yes, FXTM is authorized by Financial Sector Conduct Authority (FSCA) since 2016 under FSP number 46614, under Category I for offering Derivative instruments.

"Do you have experience with FXTM South Africa? Please consider sharing your experience with a review below – good or bad – doesn’t really matter as long as it’s helpful to other traders!"

We only accept user reviews that add value to fellow South African Traders. Unfortunately, not all reviews that you post with us will be published on the website. For your review to be approved, please share your detailed & honest experience with the broker – either positive or negative. Thank you for helping out other traders with your valueable feedback!

Important: We don't accept any payments or kickbacks from any forex broker(s) to delete or change any reviews. We welcome Forex Brokers to reply to reviews on our website & share their side of the story to keep the process honest and fair for both sides.

Comments are closed.

I opened cent account with FXTM, I haven’t experienced any problem since. But the problem with cent account is that the spreads are always wide in major currencies e.g EUR/USD always about 2 pip and some currencies are as wide as 7, 8, 10, 11 pips through out the week. I give them 3 star