Exness is #2 forex broker in our research of the SA licensed forex brokers. They are regulated with top regulators i.e. FSCA, FCA (UK), CySEC (Cyprus). But they are not an approved ODP. We like their very low spreads with Pro Accounts and instant withdrawal options. Read our Exness Review to know more why you should choose them or not!

Exness is one of the largest forex brokers in the world. They were established in 2008 and now have over 209,000 active traders with $4.5 trillion USD monthly trading volume during the August last year. This makes them one of the largest broker in terms of Traded volume.

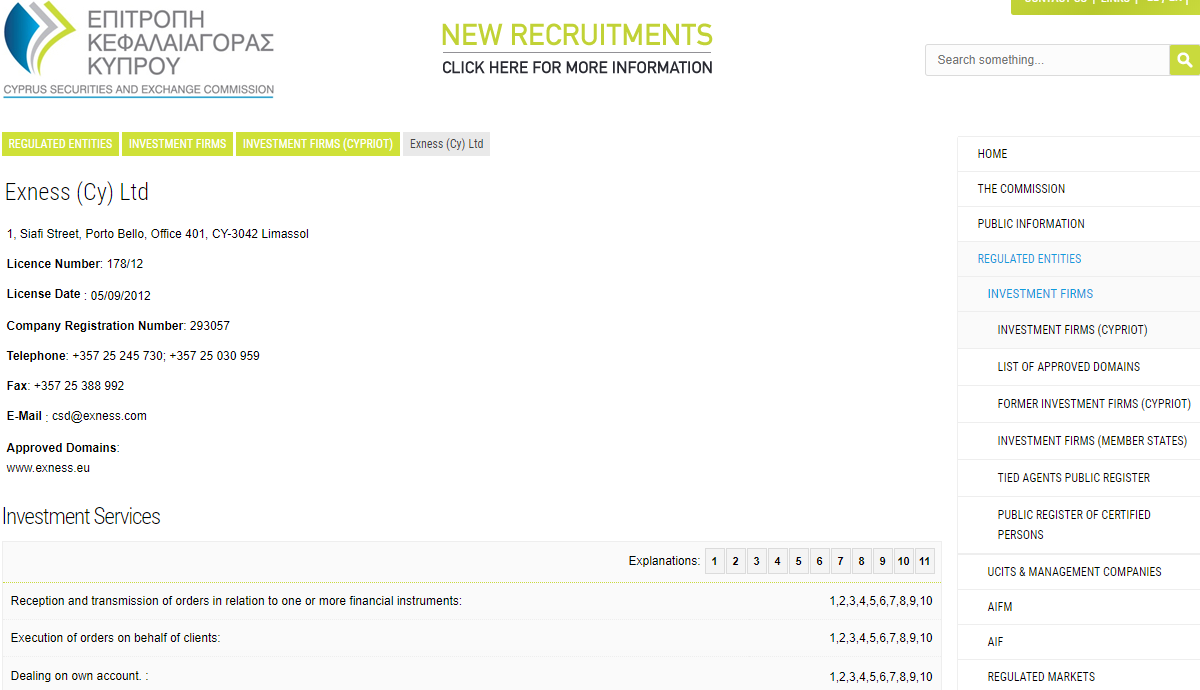

So what makes Exness good? To start, Exness offers really low variable spreads of almost zero pips with their Professional accounts. They are regulated by the FSCA (not approved as ODP) in South Africa, and are also regulated with 2 other top-tier Regulators i.e. FCA (UK) & CySEC in Cyprus. So we consider trading with them to be really safe.

Exness offers ZAR base currency trading accounts & local Internet banking deposit & withdrawals in Rand to traders in South Africa.

We have tested Exness for their regulations, trading account types, overall fees, bonus, customer support & many other factors. Below is our detailed review that you must read before choosing them!

Table of Contents

| 🏦 Broker Name | Exness Group |

| 📅 Year Founded | 2008 |

| 🌐 Website | www.exness.com |

| 🏛️ Registered Address | Central Office Park Unit No.4 257 Jean Avenue, Centurion Gauteng, Johannesburg |

| 💰 Exness Minimum Deposit | $1 |

| ⚙️ Maximum Leverage | 1:2000 |

| 🗺️ Major Regulations | FSCA, FCA (UK), CySEC (Cyprus) |

| 🛍️ Trading Instruments | 107 Forex Pairs, CFDs on 100+ Metals, stocks Cryptocurrencies |

| 📱 Trading Platforms | MT4 and MT5 for PC, Mac, Web, Android, iOS and Linux |

Exness is a licensed and regulated forex broker with many regulators, and they are also regulated with FSCA in South Africa. So trading with Exness is considered safe for traders in South Africa.

But note that Exness is not a licensed ODP, their application status shows ‘applied’.

Exness is regulated with the following regulatory authorities:

Exness is now regulated with FSCA (South Africa). They are also regulated with Tier-1 regulator FCA in UK.

But it is important to note that Exness is not an approved ODP (Over the counter derivatives provider). Exness SC (Ltd) have applied for ODP license under FSCA, but their application is not yet approved. So, they cannot offer derivatives or act as counter-party to any trades.

The entity Exness SC is a market maker, so there may appear a conflict of interest.

But overall, Exness’s regulation with FSCA, FCA is a good thing, as it is an indication that the broker can be considered safe. Exness is regulated with 3 Top-tier regulatory authorities. We consider it somewhat safe to trade with Exness.

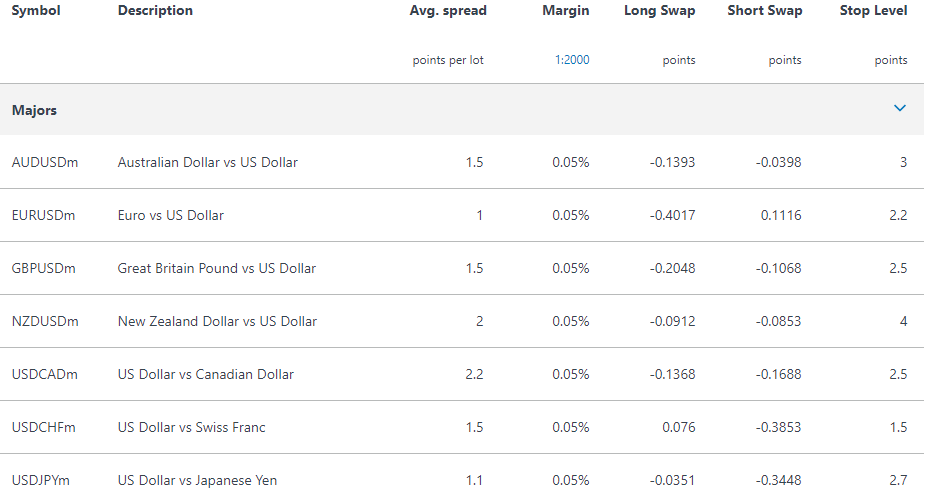

Exness’s spread is very low compared to other brokers, probably even the lowest out of all the regulated forex brokers that we have compared on our website.

Here is a breakdown of all the fees that you will be charged for trading on Exness:

Their spread in general is almost un-matched out of all the brokers offering standard accounts! It is lower than the spread offered by other top brokers i.e. XM (0.8 pips for EUR/USD with Ultra Low & 2 pips with Micro), FXTM (1.9 pips for EUR/USD with Micro account), Hotforex’s spread (on average 1.3 pips for EUR/USD with Premium account).

For Raw Spread & Zero account on $100,000 USD trading volume (1 standard lot), Exness charge commission of $3.5 (each order) for opening and closing the position. That is $7 for both sides. This is a bit higher than the commissions by Hotforex & FXTM with their ECN accounts.

Moreover, there is no commission(s) on trading with their Standard, and Pro accounts.

Swap or Overnight charges can be calculated using the formula:

Lots x Contract Size x Point Size x Swap Short or Swap Long x Number of Days

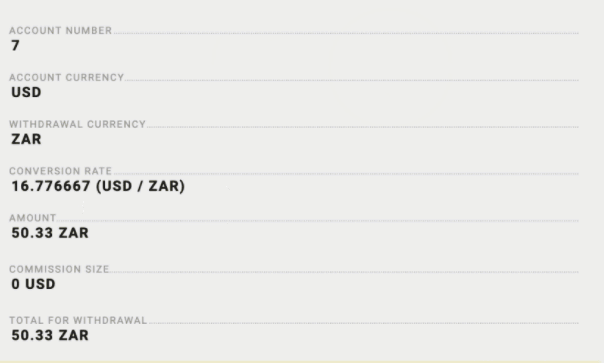

For example, you will see the conversion rates when making the withdrawals. Let’s say the current USD/ZAR conversion rate is 17.80, then you could see 17.50 during withdrawals. If you notice, there is a spread of 0.30 (it’s an example), and this is approx. 1.8% fees during currency conversion to ZAR. So, it is best to have your trading account with the same base currency as your deposit & withdrawal currency.

For example, if you make deposits & withdrawals in ZAR to your local bank account via EFT, then you should preferably set ZAR as your trading account’s base currency. This will save your any cross currency conversion markup/fees when making deposits & withdrawals.

Overall, Exness is very competitive in terms of their trading fees. The spread is very low (lowest in our comparison for most major currency pairs), there are no hidden fees, and commission with Pro account is very straightforward.

For lowest fees (without any extra commission per lot), we suggest their Pro Account which has a minimum deposit of $200, the spreads are low with this account & there is no extra commission per lot.

During off market hours, their spreads are wider. For example, if you are trading late at night, the spreads can be 2-3 pips wider for majors, and much higher for minor currency pairs.

Even during some events, you may experience requotes if the price is moving fast. For example, during news events like NFP, the price of most currency pairs are volatile, and you would experience requotes on market orders.

Also, Exness does not offer guaranteed stop loss protection, therefore your stop may not hit at the price you have set. The actual fill for stop loss could likely be hit few pips more than your actual stop as per our experience on Exness’s platform.

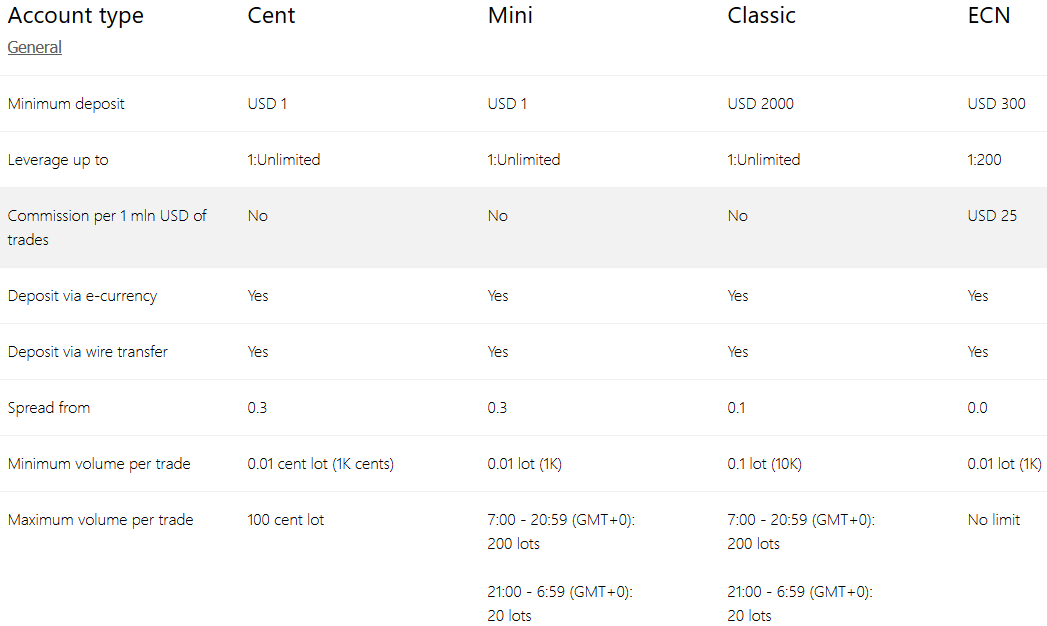

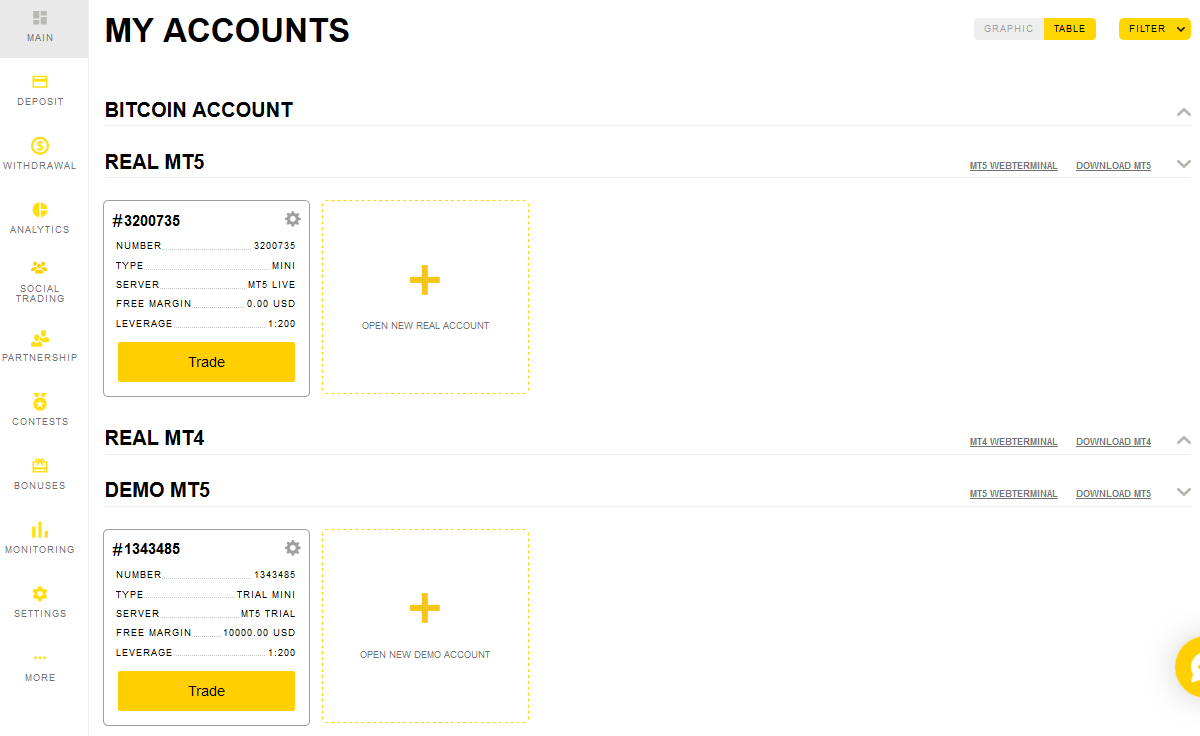

Exness offers Live accounts as well as demo accounts. Below is the detailed description and comparison of all the trading account offered by the Exness.

Exness have ZAR account option for traders in South Africa. You can open your account with ZAR as your account currency, but this account currency cannot be changed later.

So, if you choose to open the account in ZAR, then you cannot later change the currency to USD. But you do have the option to open another trading account with a different account currency from your Exness client panel.

One client can hold multiple trading accounts under their customer account. So, you can have one trading account at Exness with ZAR as your base currency, and another trading account with a different base currency.

Both the Standard & the Pro account types at Exness can be opened with ZAR as your Account’s base currency.

For Standard Account types, Exness has a minimum deposit of R17. If you are depositing via local bank transfer in South Africa, the minimum amount required is R170.

Pro Accounts at Exness require a minimum deposit of R3400 or higher during account opening. For any other deposits, you can make lower deposits as well, depending on the minimum deposit for that payment method.

Exness does offer demo accounts.

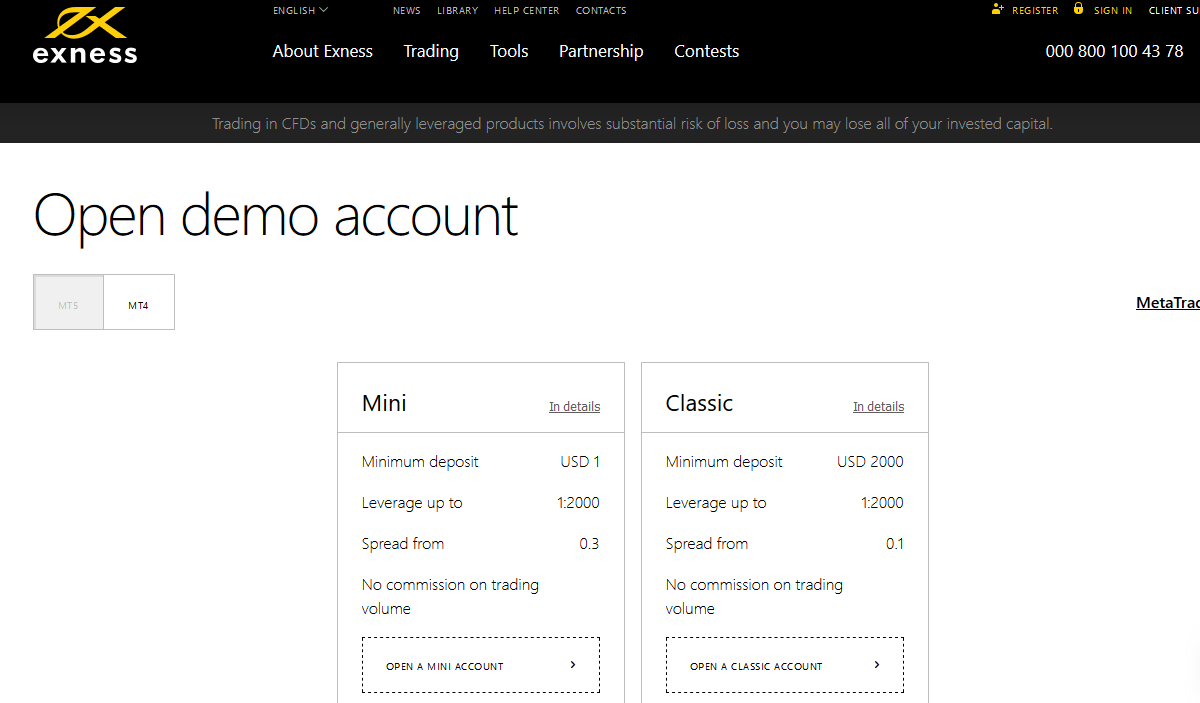

Exness demo account has all the features of their real accounts. They offer demo account for their Mini account, Classic account and ECN account.

Before opening a real account with Exness, you should test out their platform on demo. But like almost every other broker, the environment (spread, bid/ask) on their demo account can be a bit different from Live accounts sometimes, so you should use demo for building your strategy only.

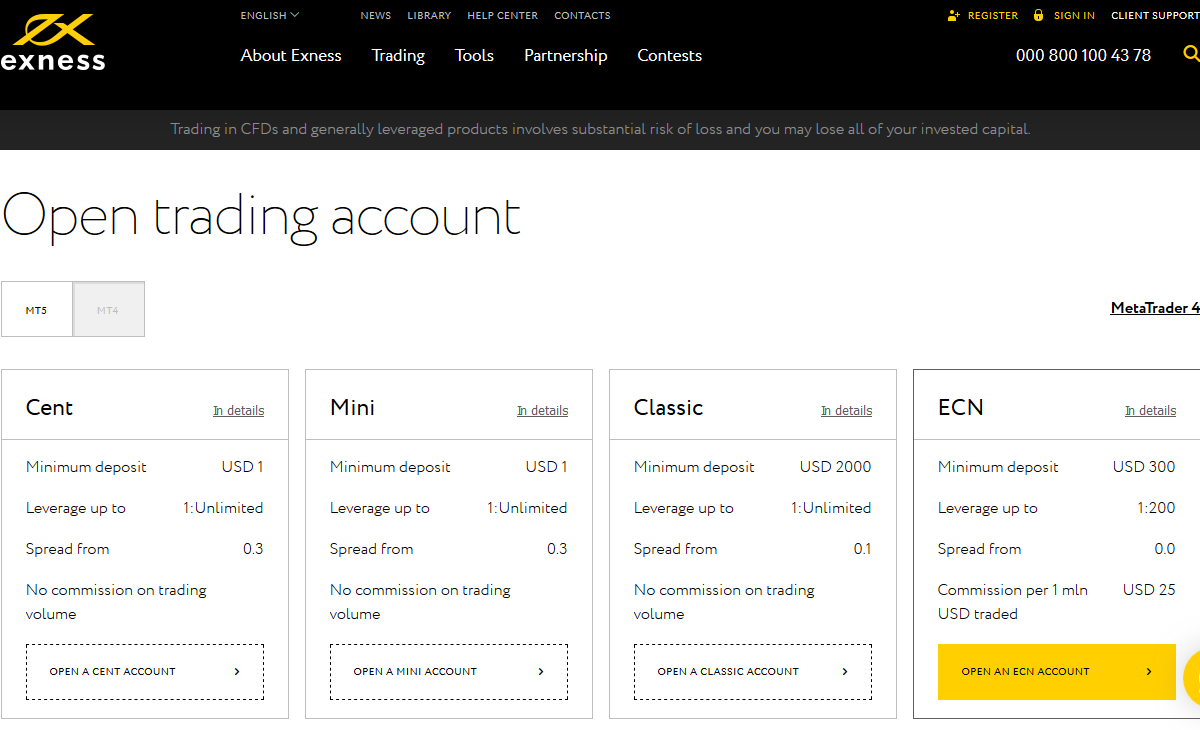

Exness offers 2 types of Live trading accounts on their website. You can choose any one of the trading account as per your requirement & after comparing the features.

Here are the list of detailed features that come with all their Live trading accounts:

$1 Low minimum deposit: The minimum initial deposit depends upon your account type with Exness. The Standard account at Exness has a minimum deposit is 1 USD.

You can also deposit in Rand via Internet Banking in South Africa. The minimum deposit required for Bank Transfers is $10 & there is no extra fees with funding. If your Account is in ZAR Base currency then there will be no currency conversion rates applied.

For eg: If you deposit R1000, then you will receive this full account in your ZAR Trading Account. And during withdrawals as well, you will receive the full amount in your bank account.

Instant & Market Order Execution (depends on your account): Exness offer Instant order execution with Standard accounts.

But with Pro and Zero account they have market execution. So you should carefully choose your account type depending on your order execution requirements.

Negative Balance Protection: Exness offers negative balance protection to their clients in South Adrica, in case your account balance goes into negative.

ZAR Base Currency Accounts: Exness offers trading accounts with ZAR as a base currency option. You can open account in ZAR or USD as well.

Local Deposit & Withdrawals in ZAR: Exness supports local payment methods, so you can deposit via & withdraw to you local bank account in ZAR. There is no extra fees with these payment methods.

Below are all the 4 Trading accounts offered by Exness:

1) Standard Account: For Cent account the minimum deposit is 1 USD. It means you can start trading using this account using only 1 USD.

Using Standard Cent MT4 account you can open the trading position lower trading lots, which is only possible with Exness.

Cent account has very high leverage when compared to accounts of another brokers. You will get upto unlimited leverage in Cent account. But we don’t recommend you to trade with very low balance or use over 1:30 leverage.

2) Pro Account: The minimum deposit for Pro account is 200 USD. You can trade mini lots with this account, and the spread for EUR/USD is as low as 0.6 pips.

The important point is that there is no extra commission per lot with this trading account. The only ‘Trading fees’ are their spread & the Swap charges. The Swap fees depends on the instrument that you are trading.

For example, for GBPUSD, the Swap fees is −0.10756 for Long positions & −0.26187 for Short positions. So, there is negative carry for any overnight positions on this currency pair. Their Swap fees is moderate to high in general with most of the currency pairs.

3) Zero Account: This account is for professional traders who need very low spread, as low as 0 pips spread, but there is commission per lot for each trade. To open Zero & Raw Spreads account you need to make a minimum deposit of $500 which is the initial deposit.

There is $7 commission with Zero & Raw Spread accounts for 1 Standard Lot position. The commission is for overall trade, this means $3.5 for open & $3.5 for close of your trade. So, if you are trading 1 Mini Lot for example, then the overall commission for the trade will be $0.7. Since the spread for most currency pairs is 0 pips with this account type, it would mean the overall fees for the trade is just the commission plus Swap charges.

But overall, for this account type, their commissions per lot for trade is higher than other brokers (with similar account types). There is no limit on maximum volume can trade in this account.

The minimum deposit in Zero account to start trading is USD 200.

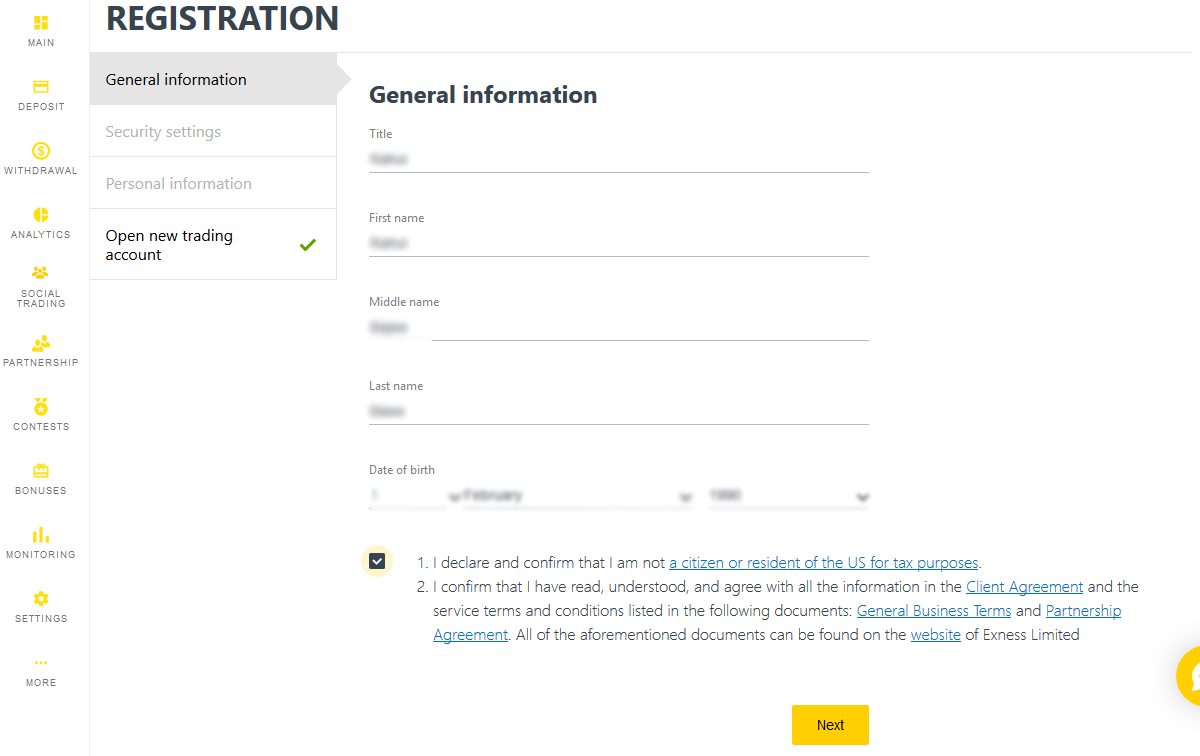

Opening an account with Exness is really fast an simply. It only involves a few steps and does not take much time.

You simply need to follow the below steps to create an account with them to start Trading:

Step 1) Setup New Account: First of all you need to open the home page of Exness and strat filling the details under New Account Section as shown in the below screenshot.

Step 2) Fill Details in Registration Page: Now you will be redirected to Registration page where you need to enter the General & Personal Information.

Step 3) Select Account Type: After finished with filling the details you need to select the Trading account type with which you want to start. You need to click on Open New Real Account and then select the trading account type.

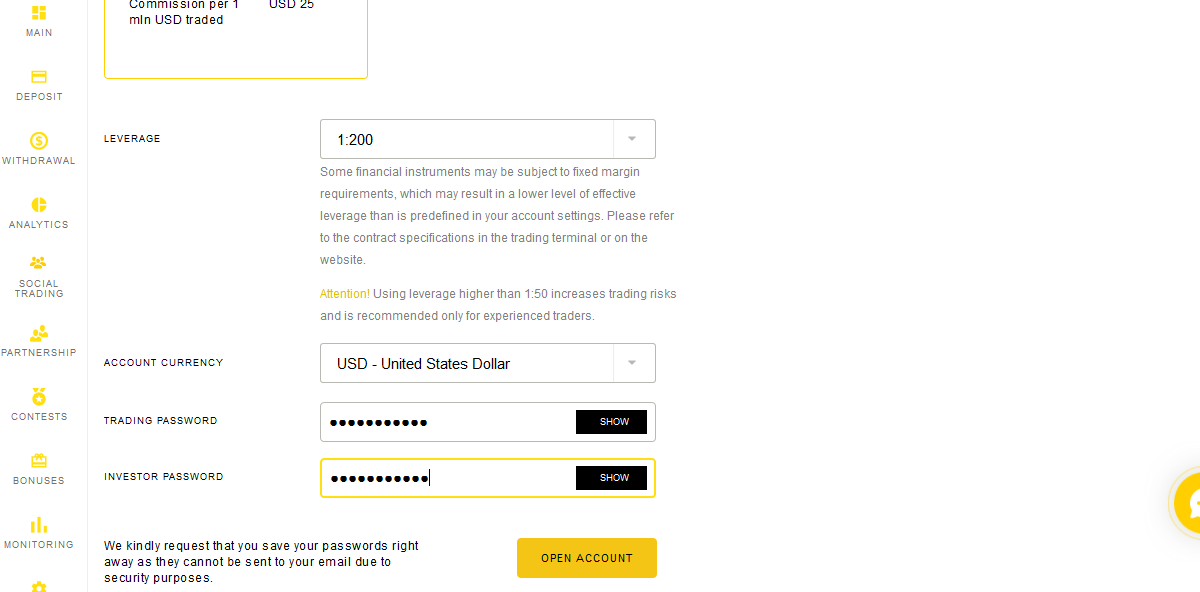

Step 4) Select Leverage and Base Currency: While selecting the trading account type, you also need to select the leverage and Base Currency for your trading.

Step 4) Verify your account: At last you need to verify your account by uploading your documents like ID proof and Address proof.

Note: It can take maximum 24 hours to verify the documents. You will receive a confirmation mail once your account us verified.

Congratulations! Your account has been set up and now you can start trading with them. In case of any issue while registering your account with Exness then you can easily contact them via instant live chat support on their website.

Exness supports 2 Metatrader trading platforms i.e. MetaTrader 4 (MT4) & MetaTrader 5 (MT5), which are developed by MetaQuotes Software Company. Metatrade is probably the best trading platform for technical traders.

Exness’s MT4 can be downloaded from their website and its installation takes few minutes i.e approximately 1-2 minutes.

Here is more information on the Metatrader platforms offered by Exness:

1) MetaTrader 4 (MT4): MetaTrader 4 can be downloaded from the Exness website for the operating system of Linux, Windows, Android, iOS and MAC. You can use charting tools, EAs & even news feed is ibuilt in the platform.

Their MT4 is fast (we did not experience any freezing), has many features.

2) Meta Trader 5 (MT5): MT5 is the latest version of Metatrade & Exness does offer it. Their MT5 platform is available for Mac OS, Linux, Windows, iOS, Android. But their MT5 is only available for Mini & Classic Trading accounts.

Also there is an Exness app available on Android and iOS, which can be useful for Exness clients to trade and manage their account. But we have not tested their app yet.

To sum up on Exness’s platform, they offer the latest & best MT4, MT5 platforms. Some brokers don’t offer the latest MT5 platform, so we consider this to be a pro with Exness.

Exness Go app can be downloaded from the Google Play store. The app has million plus downloads & an average rating of 4.6 stars.

Their app can be used for viewing all instruments Exness have available, place trades, manage your take profits & Stop Loss, make deposits & withdrawals, create real & demo trading accounts.

South African traders can use the Exness App for local ZAR accounts as well, with all the features already there.

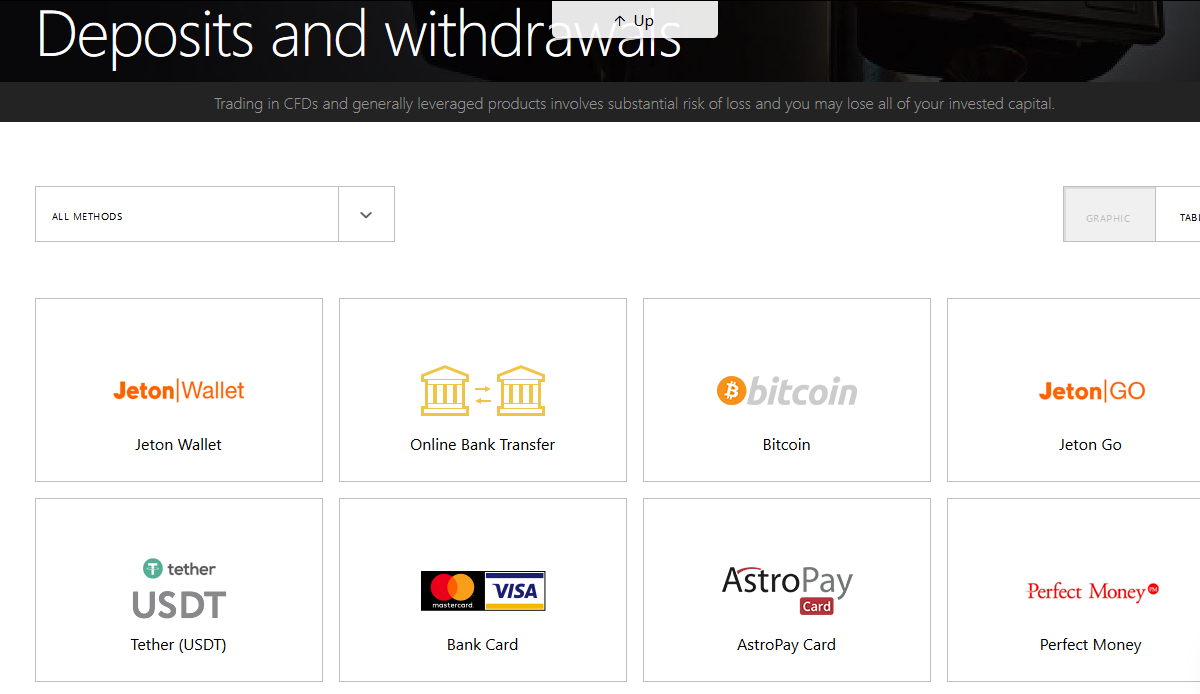

There are multiple options for withdrawing and depositing the funds at Exness.

Here are some common methods that you can use to add or withdraw funds :

1) Credit/Debit Cards: You can use your VISA or Master credit or debit card to add the funds. In case of using the card you will get instant activation. The minimum amount for deposit using the card is $3.

2) E- Wallets: Transfer using various E-Wallets like Neteller, Skrill, Perfect Money, etc. is also accepted. Minimum amount for depositing funds using the E-Wallets vary depends upon the type of E-Wallet that you will choose. You can check all the fees from here.

3) Internet Banking Transfer in Rand: Traders in South Africa can fund their Exness Trading Account in Rand via accounts in ABSA Bank, Standard Bank, FNB, Nedbank, Capitec Bank & Investec Bank.

The minimum withdrawal amount is R20 & the Maximum withdrawal amount is R250,000 (for a single withdrawal) to your bank account. But the withdrawals via this method are very slow.

A minimum of $10 is required for deposit funds using the Bank Transfer. Additionally, if your account currency is in ZAR then there is no commission or conversion fees. But if your account base currency is in another currency like USD, then there will be an exchange rate involved which you will see during depositing of funds. Deposits via Internet Banking Trading method are instant (which means that the funds will be credited within few minutes max.).

1) Credit/Debit Cards: You can receive the withdrawal on your card that you was used while making deposit on their website. The minimum amount of your profits required to receive using the card is USD 3 & maximum amount can be $10,000. There is no commission or fee on it and the process can take 1 min – 7 days to complete.

2) E-Wallets: There is instant withdrawal via E-Wallets. Exness does not charge any commission on withdrawal. You can check the minimum and maximum about that can be withdraw on Exness website.

3) Local Bank Transfer in Rand: You can receive withdrawal in your local bank transfer account in South Africa by going to “Withdrawals > Internet Banking” in your Exness Account.

There is no withdrawal fees with this method, but the withdrawals can take up to 5-7 Business days. This is very slow in comparison to other brokers that offer local bank transfer. If your base currency is in ZAR, then there will be no conversion rates applied, but if your account currency is different then you will see the conversion rate during withdrawal.

Note: During withdrawals, you will be sent a code by Exness via email or SMS which you need to enter to process your withdrawals. This is important for security reasons, so make sure to not share the OTP with anyone, unless you are requesting the withdrawal.

As per our User reviews, some users have complained about the issues with withdrawal at Exness. Many users have complained regarding with slow withdrawals, and long wait time during support for such issues. In any such situation, you should reach out to their support to find the exact issue with the withdrawal not being processed.

You must note that sometimes their support can take some time to respond to queries. You should also raise any issues via their Live Chat support on their website.

The amount depends on the method of your withdrawal. While Exness mentions that there is no minimum withdrawal amount, but in general for bank transfers in ZAR, the minimum is R180.

Exness does not charge any fees on withdrawals in the same currency as your account deposits. But if the account base currency is different, for example, your account is in ZAR, but you are requesting withdrawal in USD, then the currency conversion charges will be charged by Exness.

Note that in the above example, the withdrawal will only be processed provided the terms & conditions of their withdrawal are met.

You should know these important terms of withdrawal at Exness:

a. Before you can request a withdrawal, your account must be verified. Unverified accounts cannot request a withdrawal. This even applies to bank transfers or EFT withdrawals in ZAR.

b. Also, the withdrawals can only be made to the source method. For example, if you’ve made deposit in ZAR via a bank account or EFT to your Exness account, your withdrawal will be sent to the same bank account. You cannot request withdrawal to another payment method or any other bank account.

Exness does not have any bonus available currently for new South African traders or existing clients. They rarely offer any bonus or offers, and this is where they lack.

If they will announce any bonus or promotions in future, we will update it for you. But for now, if you are looking for brokers offering bonus then you should check out Hotforex’s 100% bonus or XM trading’s 50% deposit bonus.

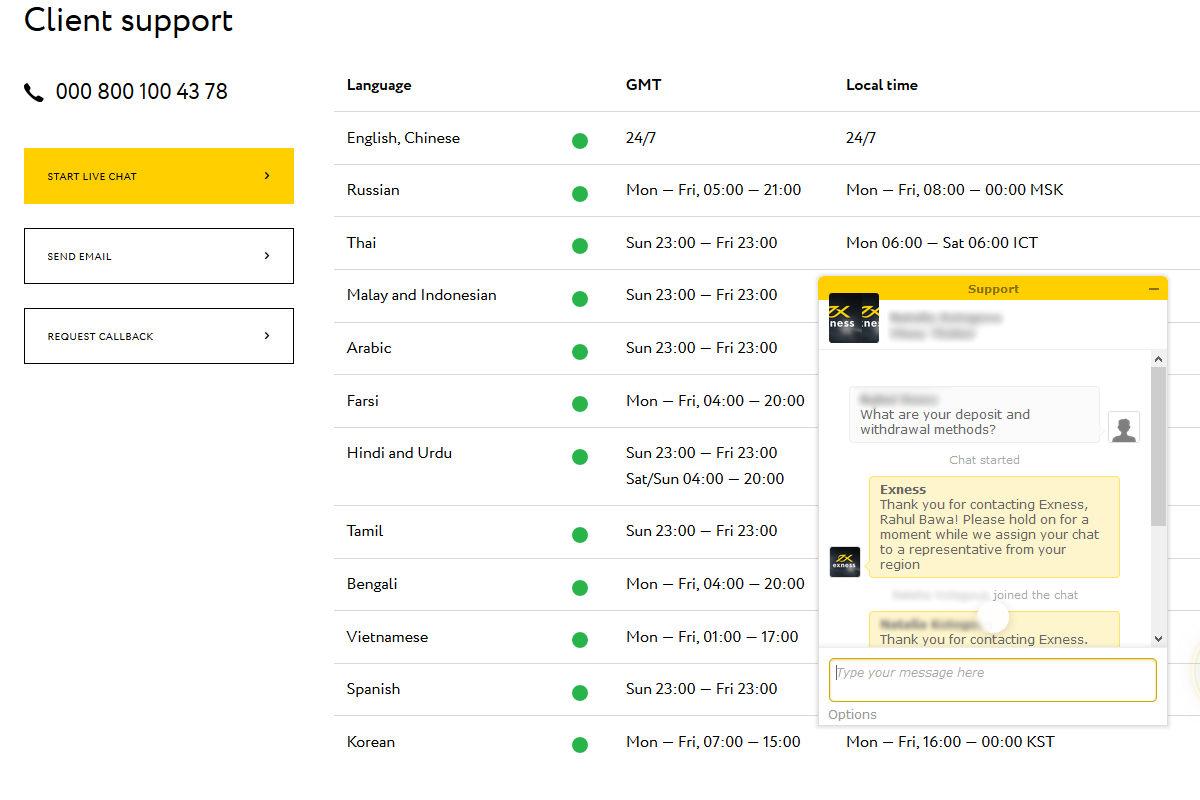

Exness’s customer support is not the best according to our latest tests! The support hours of Exness are 24 hours in a week. Their English support is also available on Saturday and Sunday.

We found during our tests that Exness’s support is very slow in responding to our questions. We tested their Live chat & Email support.

Here is how you can get support at Exness & our test results:

You are first connected to their chat bot which you can use to get answers to most FAQs. But if there is some query that is not resolved, then you can connect to their Live Chat Agent. We found that in general, there is a lot of Hold Time on their chat support

& most of the times there are long queues, so you will have to wait for a few minutes to connect to their chat operators.

Overall, their chat support is not the best.

Exness support is not the best when we compare it to the other brokers in South Africa. We like the fact that the English language chat support is available for 24 hours during all days in a week. Their chat support is okay, and friendly once you are connected. But it took a few minutes to get all the answers to our questions.

Their email support & overall support could do much better. Also, they don’t have a local phone number for support in South Africa on their website.

Yes, we recommend Exness broker to traders based in South Africa looking for low fees forex broker.

Very low spread (as per our tests, it was 0.5-0.6 pips without extra commissions for EUR/USD with Pro Trading Account), FSCA regulated, local deposit/withdrawal options, MetaTrader platform, range of CFD instruments are some of the positive features!

Exness are regulated with FSCA, and they offer ZAR trading accounts.

They have very low typical spread even with their Standard accounts, the spread is even lower with the Pro & Raw Spread accounts. According to us, their Pro account is most favorable in terms of commission, spread & Swap fees (overall trading fees). Moreover, the account types they offer are very diverse to fit all traders.

Their non-trading charges are not high. They don’t charge any extra fees for deposits or withdrawals. The deposit from the bank is free, which means you don’t need to pay any additional charges except charges.

Moreover, they have instant withdrawal options (for some payment methods, not all of them) which is a very unique feature among South African brokers.

On the downside, their withdrawals via local bank transfer in SA are slow, and there are no bonus offers available with Exness currently. Also, they don’t have a local phone number, and their email support is not the best.

Moreover, another negative point is that Exness does not have the license to operate as an ODP, as their license is currently under applied status.

Overall, we think Exness is a really good globally regulated broker if you are looking to trade at low fees and we couldn’t recommend them more!

Exness has a minimum deposit of 1 USD with their Standard Account types. Traders can choose to open ‘Standard Cent’ MT4 account or ‘Standard’ MT5 Account. Their minimum deposit with Pro Accounts is 500 USD, but the spread is much lower with these account types.

Yes, Exness is a market maker forex broker. Their offshore entity Exness (SC) Ltd is the product issuer of the CFDs at Exness South Africa. This entity has ‘applied’ for FSCA’s ODP license, but it is not approved as of now.

Yes, traders at Exness can choose ZAR as the account’s base currency during signup. With this all the deposits made will be converted into ZAR. However the account currency cannot be changed later, but you can open a new account with ZAR currency.

Exness offers bank transfer withdrawals in South Africa. The minimum withdraw amount via this method is Minimum $4 & the maximum is $12,500. This amount will be converted into ZAR during withdrawals via bank. The withdrawal can take 24-72 business hours.

Exness have NAS100 with all their account types. You can trade USTECm i.e. US Tech 100 Index if you are looking to trade NASDAQ at Exness.

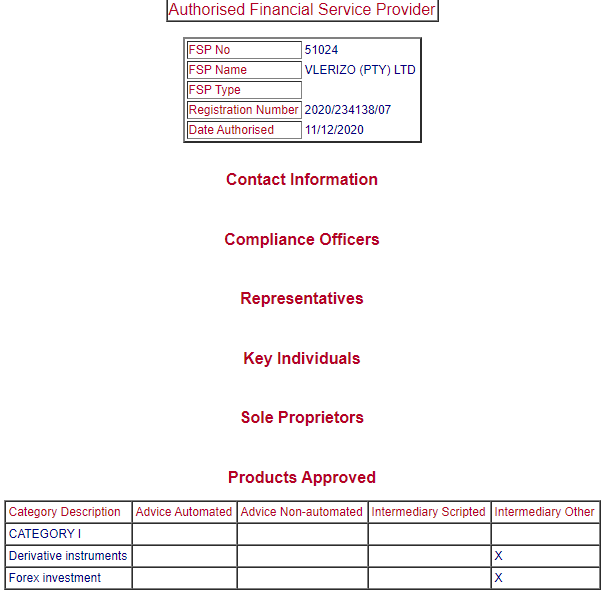

Yes, Exness is a FSCA authorized forex broker licensed for offering ‘Derivative instruments’ as Intermediary Other under Category I. Their FSP no. is 51024 & they were authorized on 11/12/2020. Plus, Exness is also regulated by 2 other top-tier regulations FCA & CySEC.

No, ‘EXNESS SC (LTD)’, which is their entity in the list of Over-the-Counter Derivative Providers published by FSCA. This entity is a Non Banks foreign entity, and it has only applied for the license, but it is not approved as of the latest update. So Exness is not an approved ODP.

The total brokerage at Exness is lowest with the Pro Accounts. There are no account opening charges, no deposit withdrawal fees. The spreads are 0.5-0.6 pips typically (the spreads are variable) during London & New York sessions for EUR/USD, GBP/USD & USD/CHF. Traders under Pro Account don’t pay any commissions per lot.

We consider Exness to be a trusted forex & CFD broker as they are licensed by South Africa’s FSCA, FCA in UK & CySEC in Cyprus. Also, they have been in business for over 10 years. Moreover, they publish quarterly Financial Reports audited by Deloitte. Overall, Exness is a reputed forex broker & considered safe for traders in SA.

"Do you have experience with Exness? Please consider sharing your experience with a review below – good or bad – doesn’t really matter as long as it’s helpful to other traders!"

We only accept user reviews that add value to fellow South African Traders. Unfortunately, not all reviews that you post with us will be published on the website. For your review to be approved, please share your detailed & honest experience with the broker – either positive or negative. Thank you for helping out other traders with your valueable feedback!

Important: We don't accept any payments or kickbacks from any forex broker(s) to delete or change any reviews. We welcome Forex Brokers to reply to reviews on our website & share their side of the story to keep the process honest and fair for both sides.

Comments are closed.

I have a problem withdrawing funds I was told to use same method I used to deposit tried that and also told to deposit on internet banking and use it to withdraw still same problem rejected. Spoke the support team they are useless can’t help me either I am so frustrated will never recommend to anyone.

First I had issues withdrawing my funds…my issue was not resolved ,I contacted support and by then it was too late …

27 Aug 2020 I was long on Gold perfect entry no drawdown….apparently there was news and the trade exceeded my expectations and my account doubled…as I tried to close and modify my orders to scale out it kept saying “request accepted by server” but nothing happened with my orders I screen recorded it …eventually the trade went against me and I’m typing this in 70% loss of account…I repeat I am still unable to modify or do anything to the open positions…the “real” gold tag is not showing…my positions are not appearing on chart either…but they are all still open and in loss.

I’m disappointed by this broker I thought I will be trading using it but because of unresolved withdrawal matters I’m no longer interested yesterday I was checking ratings of exness all people are complaining about withdrawal the main fact of trading , how can you trade and not able to withdraw your profit ???

This broker, I don’t know where to begin to explain how corrupt this broker is. At first glance with the help of alot of forums & advertising Exness claims to be a top broker with low spreads & instant withdrawals.

Opening an account is effortless & is done in 10min,Your trading. Only to find out

(opening & closing price data is incorrect, theres massive gaps in price that appears after every weekend so swing traders get taken out of profitable positions. Spreads are not fixed so even when price moves in your favor spreads grow as you trading @ one point the spreads grew close to 10pips while in a position. So I took a withdrawal only to find out Exness is also incorrect with the exchange rate price per the dollar was 15.45 & Exness paid me out 13.72 per dollar. If you have a larger account this can really hurt your capital.

Nothing good can come from trading with this broker.

Thank you for taking the time to read my review.