We've ranked the best regulated CFD brokers that offer NAS100 or NASDAQ CFD indices. Our comparison is based on broker's fees, regulations & 6 other important factors..

NASDAQ 100 is one of the most popular equity indices of the world. It is the Index of the largest global companies listed on NASDAQ by overall market capitalization. It includes companies like Google (Alphabet), Facebook (Meta), Amazon, Apple, Tesla etc. NAS 100 is also denoted as US TECH 100.

Traders in South Africa can trade with NAS 100 through CFDs without actually owning the securities.

Many forex and CFD brokers in South Africa allow trading on NAS 100 as a CFD instrument with different spreads and features. Traders in South Africa can speculate the US Tech 100 stock index and can go long as well as short through CFDs on a variety of trading instruments.

We’ve listed the best regulated CFD brokers offering CFDs on NASDAQ 100 along with basic details of the capital market.

List of brokers with NASDAQ or NAS100 in South Africa for 2025

We first selected the CFD brokers that are regulated by FSCA or other top-tier regulations. Then checked the CFD trading fees for NAS100 instruments at all these brokers.

Here is the detailed comparison of all the NAS100 offering CFD brokers.

Here is our detailed research on the features: spread, platforms, funding/withdrawals, available trading instruments, support & more on the selected FSCA regulated forex brokers.

Rated #1 NAS100 Broker

Exness is a FSCA authorized forex & CFD broker. They are also regulated by multiple other top-tier regulations including FCA & CySEC. They offer NASDAQ CFD instrument on their platform as USTECm.

Exness is a market maker forex and CFD broker that is regulated by FCA, FSCA, and CySEC. It offers CFDs on the US Tech 100 index (USTECm) with an average typical spread of 2.73 pips per lot (with Pro Account) for 1 Mini Lot Contract and a margin requirement of 1% on the Standard account. The lowest spread for the US Tech 100 index with the commission-based zero Account at Exness is 10.8 pips per lot + $2/Standard lot (These are for Standard Lot). The average spread for NASDAQ CFD instrument is higher at Exness than other brokers.

One positive thing about this fees is that there is no Swap fees mentioned. So, if you are holding overnight positions, there is no extra fees with any account type.

Exness broker also offers ZAR base currency trading account & accepts multiple transaction gateways including local bank transfers in South Africa with a minimum deposit of $1. The deposits via most methods are instant including with Internet banking & withdrawals can take upto 48 hours.

Exness Pros

Exness Cons

Rated #2 NAS100 Broker

Tickmill is a FSCA regulated CFD broker that offers NASDAQ CFD at very low fees. They charge moderate spread for trading NAS100 CFD instrument, but there is holding costs for overnight positions.

Tickmill is a FSCA authorized forex broker in South Africa. NASDAQ is available as ‘USTEC’ on their platform.

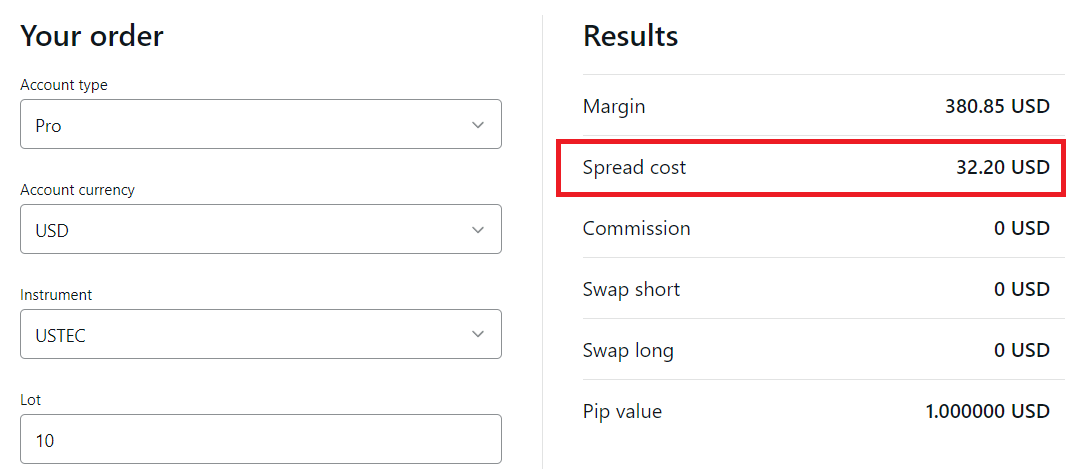

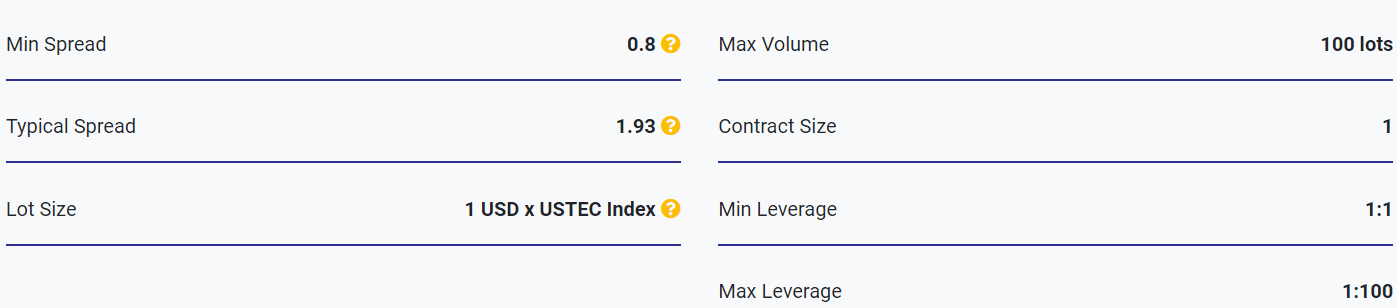

The minimum deposit required to open your account at Tickmill for trading NAS100 is $100. They offer max leverage of 1:100 for this instrument & the typical spread is 1.93 (plus Swap Fees for overnight trades) for 0.01 lot Contract Size, while the minimum spread is 0.8. The minimum contract size can be 0.01 lots.

The typical swap fees for Long positions is -1.516 & it is -0.483 for short positions. If you are holding your positions overnight, then you will be charged this extra fees.

Tickmill has local Bank transfer option available for funding & withdrawals for SA traders. But they don’t have ZAR Base currency option, only USD, GBP & EUR account base currency options are available.

Also read our detailed Tickmill review to know more about their regulations & fees.

Rated #3 NAS100 Broker

FxPro is regulated with FSCA in SA & they offer multiple trading platforms including cTrader, MT4 & MT5 for trading NAS100 CFD instrument.

NASDAQ 100 Spot index is available as the symbol ‘USNDAQ100’ on their CFD trading platform. The typical spread for trading NASDAQ at FxPro depends on your account type. For example, with their cTrader account, the lowest spread is 65 & the typical spread is 112. But if your account is MT5, then the minimum spread is 110 & on average it is 167.91.

So, the makes the fees moderately high. For example, if the NDX is trading at 12,000, then the spread of 110 would nearly be 0.9%. And this can be higher if your account type is MT4. So, you should choose the right account type (between cTrader, MT4, MT5 & MT4 Raw+) for lower fees if you want to trade NAS100 at FxPro.

The max. leverage is 1:500 for NASDAQ 100 CFD at FxPro & the minimum lot size (contract size) is 0.01.

Also read our detailed FxPro review about their instruments, support & more.

Rated #4 NAS100 Broker

HF Markets (HotForex) is a reputed CFD & forex broker regulated by FSCA. They offer CFD trading on NASDAQ 100 (USA100) index.

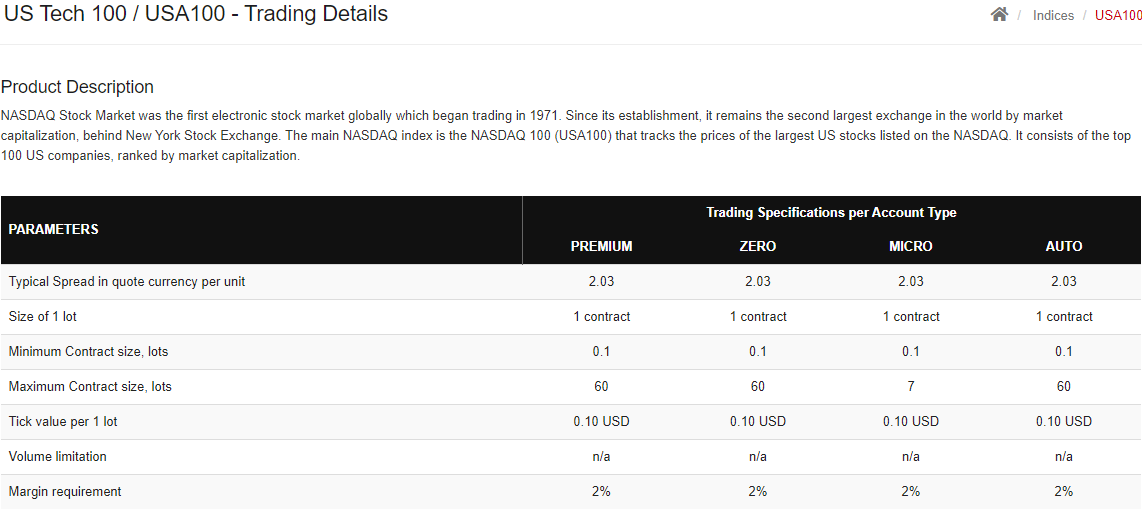

HFM is an STP broker that is regulated by FCA, FSCA, and CySEC. They allow South African traders to trade with CFD as well as futures on the US Tech 100 stock index (USA100). The average typical spread on the CFD of NAS 100 is 2.03 pips per lot with a maximum leverage ratio of 1:50.

The spread for trading USA100 CFD instrument is same with all the 4 Account types at HFM. There is no commission, only spread is charged with this instrument + Swap Fees for overnight positions. The minimum deposit is $5 at HFM.

Local deposits & withdrawals are available via bank transfer in ZAR. You can choose between ZAR or USD as your Account base currency.

The support at HF Markets is good. The Live chat is available on their website during weekdays, and we did not experience any major connection delays or hold time.

HF Markets Pros

HF Markets Cons

also read our detailed HF Markets review

Rated #5 NAS100 Broker

XM is an ASIC regulated forex broker that offers CFD trading on NASDAQ (US100). They only charge spread of as low as 2 pips on this instrument.

XM is a market maker broker & they are not regulated in South Africa, but they are licensed by top tier regulators ASIC & CySEC. The lowest spread on the CFD US100 at is 1 pips per lot & the margin requirement is 1%. The Long Swap is -1.34 & Swap Short is -1.30, so you will be charged extra for any overnight position on this CFD instrument.

Traders based in South Africa are registered under “XM Global Limited” which is regulated with IFSC in Belize. They makes XM a moderate risk CFD broker as they are not regulated with FSCA, and are regulated with only 1 Tier-1 regulation i.e. ASIC.

NASDAQ (US100 Cash) CFD at XM is available as US100 on their platform. The max. leverage with this instrument is 1:500. The minimum deposit required to open account at XM is $5 with all their account types.

XM charges Swap fees for trading CFDs on NASDAQ. The Long Swap is -2.32 & Short Swap is 0.41 (positive). The lowest spreads for trading this instrument is 1 pip. This makes their overall fees on this instrument moderate.

Also read our detailed XM review to know more about their spread & safety.

Rated #6 NAS100 Broker

JustMarkets is a CFD broker that offers trading on NASDAQ 100 with their Pro & Raw Accounts. JustMarkets is authorized by FSCA as an intermediary, but the issuer of the product is not their local entity.

The trading fees for CFDs on NASDAQ at JustMarkets is high compared to other CFD brokers. The minimum spread is 1 pip (which is somewhat more than other CFD brokers) & if you are holding the positions overnight, the Swap charges are -1% for Longs & -2% for shorts.

Their Swap charges are negative regardless of whether you are long or short, which means, you will pay to hold the positions if they are held for a few days.

You can only trade NASDAQ CFD with their Pro & Raw Accounts. This instrument is not available with Standard or Standard Cent Accounts.

Also read our detailed JustMarkets review to know more about CFD Trading conditions.

Rated #7 NAS100 Broker

BDSwiss is not regulated with FSCA in South Africa, but they accept SA based traders. They have moderate spread for trading NAS100 CFD instrument.

BDSwiss offers NAS100 CFD on their platform (MT4, MT5, WebTrader & App). The typical spread with their Classic Account is 0.65 as per the contract specifications on their website & the commission is $2/lot. But the fees is lower at 0.75 & no commission with VIP Account ($3000 deposit required). There is also Swap rates of -4.1706 for Short & -3.2694 for Long positions, which is charged when you hold the position overnight.

Overall, with their Classic Account, their trading fees on NASDAQ CFD is a bit higher than HFM & Tickmill.

The max. leverage available on NAS100 CFD index is 1:100 (1% margin requirement).

Also read our detailed BDSwiss review to know more about their regulations & fees.

NAS 100 is a prominent stock market index that was initiated on 31st Jan 1985 by the NASDAQ. The index was created to promote the NASDAQ and allow the retailers to trade through a non-financial stock index.

NASDAQ 100 includes 102 equity securities of the top 100 non-financial companies listed on NASDAQ. The 100 stocks do not include any corporation that is involved in financial services. The stocks are selected on the basis of market capitalization and the rebalancing of the stocks is done in December of each year.

The index was initially launched with a base price of 250 in 1985 and was later reset to 125 in 1993. It has been a volatile index but has increased consistently apart from the bearish trends in 2001 and 2008. NAS 100 holds the all-time high record of 13,879.77 on 16th Feb 2021 (as of 22nd Feb 2021). In the calendar year of 2020, the index soared by 47.58% despite the volatile market conditions due to covid-19 and the lockdown. NAS 100 is considered more volatile than any other large-cap index in the US.

The volatile movements attract a large number of traders and hence liquidity is not an issue while trading on NAS 100.

NASDAQ 100, also known as US Tech 100 includes various popular stocks like Apple, Tesla, Microsoft, etc. It is primarily a tech index with very high weightage to a few tech stock, the largest being APPL & MSFT. Any big movements in these stocks can cause NASDAQ 100 to have very volatile movements as well.

The daily movement of NASDAQ 100 is more than 200 points on average, which is more than 1.2% daily range. These movements can be higher as well, therefore any intraday trader trading it must adjust position sizing accordingly.

Financial stocks have the ability to steer the stock indices according to market conditions. Trading on an index that does not involve financial stocks can allow traders to speculate the growth in the stock market without the influence of financial stocks.

Traders can trade through futures and options on NAS 100 on a regulated exchange, although trading through CFDs is the most common option with South African traders.

Traders in South Africa can choose from a wide variety of forex and CFD brokers that are regulated by top-tier financial regulatory authorities. These brokers allow trading through CFDs on various capital markets including indices, commodities, cryptocurrencies, etc. The availability of leverage allows traders to open bigger positions with small initial deposits.

By trading CFDs on NASDAQ index, traders do not actually own any of the securities, but the price movements of the concerned security are speculated to find profit-making opportunities. Trading CFDs can be more advantageous compared to physical trading as traders can go long as well as short at any time based on their market sentiment. Most CFD brokers allow trading through multiple supported devices.

Trades on index CFDs are executed in lots where traders can go long as well as short on the concerned index. The lot size can differ from broker to broker but generally, a single lot of CFD on US Tech 100 is 1 unit of the index. The difference between the buy and sell price is called the spread.

CFD trading on indices can be better understood with the help of an example.

Suppose the NASDAQ 100 is currently trading at 13,002.00/13,000.00.

This means that the buy price or the bid price of the index is 13,002.00 and the selling price or the ask price is 130,00.00.

If the lot size is 1 unit of the index, then the spread will simply be the difference between the bid and ask price of a lot i.e. USD 2.

In the below chart of US Tech 100 CFD from Forex.com broker, you can see that their spread is 3.0 (15132.1 – 15129.1) or $3 for 1 Lot. Some brokers like Tickmill allow trading minimum contract size of 0.01 lot for NASDAQ CFD.

If the trader wishes to go long on the index, then he can buy one lot of the index CFD by paying the margin requirement.

If the leverage ratio is 1:5, the trader can buy 1 lot of NAS 100 by paying 13,002/5 = USD 2600.4.

Profits on this trade can only be made when the selling price goes above 13002.00. If the selling price reaches 13102.00, the trader can book a profit of $100 by closing the position.

If the leverage is 1:100, the position on 1 lot of NASDAQ 100 can be opened with $130.02 while the profits will be the same. Although, in case if the selling price goes below $12,800 and the position is closed, the trader will face a loss of $200 which is more than the initial deposit.

The trader will either need to add more balance in his/her account to cover the margin requirements & keep the position open, or the broker will close the position if the account balance falls below the margin required to keep the position open.

Similarly, if the trader wishes to go short on the index CFD, the margin requirement of the selling price needs to be paid and the price of the index needs to go below the selling price to book profits.

For example, if you had placed a sell order on NAS100 CFD at $13,000, and the spread or commission charged by the CFD broker is $2, then the price must go below $12,998 for the trader to book any profits.

Traders must note that significant involvement of leverage can enhance the profits on trade but can also increase the risk factor. Charting and analysis through various indicators and tools on trading platforms can enhance the trading decisions and can increase the probability of profits.

For the new traders, it is advisable to gain experience, understand the risks of leveraged CFDs and learn strategies by trading with virtual currencies on a demo account offered by various CFD brokers in South Africa.

CFD trading on indices and commodities could seem less complex than trading futures and option, but it is not true. The advantage over Option & Futures is that there is no expiry if you are trading Cash component of the underlying instrument, although you can also rollover Options & Futures. But the risks associated with CFD trading are quite high, as the loss can be unlimited.

Let’s understand with an example of Options, about the higher risks of CFDs over options. Let’s say you are expecting the NASDAQ to go higher by more than 10% in the next 3 month. To express this trade, you have either buy Call options or place a buy order in Futures market & place Bid at your CFD broker.

If you buy an OTM (Out of Money) Call option, you only pay the Premium to buy the Call & you loss is limited to the cost you paid for the Call option in case the NASDAQ goes down. But if you have placed a buy trade on CFDs, then your loss can be unlimited depending on your leverage (if the price goes against you).

But let’s say the NASDAQ only goes up buy 2% in the next 3 months, then you OTM Call option would expire worthless, but your CFD trade could still be in profit (if your broker does not charge high holding cost).

But in the same example, if the NASDAQ goes down by 5% during the same month & you are trading 10 lots (which is equivalent of $1 per pip) as CFDs on NASDAQ 100, then your loss will be proportional to the lot size per pip. 5% means a 750 points move in NASDAQ 100 if the index was at 15,000.

In this case, your loss on the trade would be $750 plus spread charged by your CFD broker. Even the brokerage is very high of around 0.2% & higher for every lot traded. And this can add up in your P&L.

If in this example, you are using leverage to trade a higher position sizing on NASDAQ than your account equity, then your drawdown as a percentage of your equity can be very high.

Let’s say you have $2000 account balance, but you are trading 10 lots, which has a notional exposure of around $15,000 on NASDAQ (if the index is at 15,000). If the index moves against you by 10%, then you will lose $1500 on the trade, or 75% of your equity.

So, you need to understand the tradeoffs of the instruments & trade type that you are choosing, and also the risks.

If you are still trading via CFD brokers, traders can have better profits if the spreads are narrow and lesser commission is charged for trades. However, lower pricing should not be the only factor to consider while choosing a NASDAQ CFD broker.

There are few points that must be considered when you are choosing a CFD broker for trading NASDAQ in South Africa.

Here is our checklist that you can follow:

1. Broker Regulation: First & foremost, ensure that the CFD broker must be regulated by a top-tier regulatory authority like FSCA, FCA, etc.

In South Africa, you must only trade with a FSCA regulated broker. In our list, we have only listed the reputed forex & CFD brokers that are regulated by FSCA or FCA or CySEC.

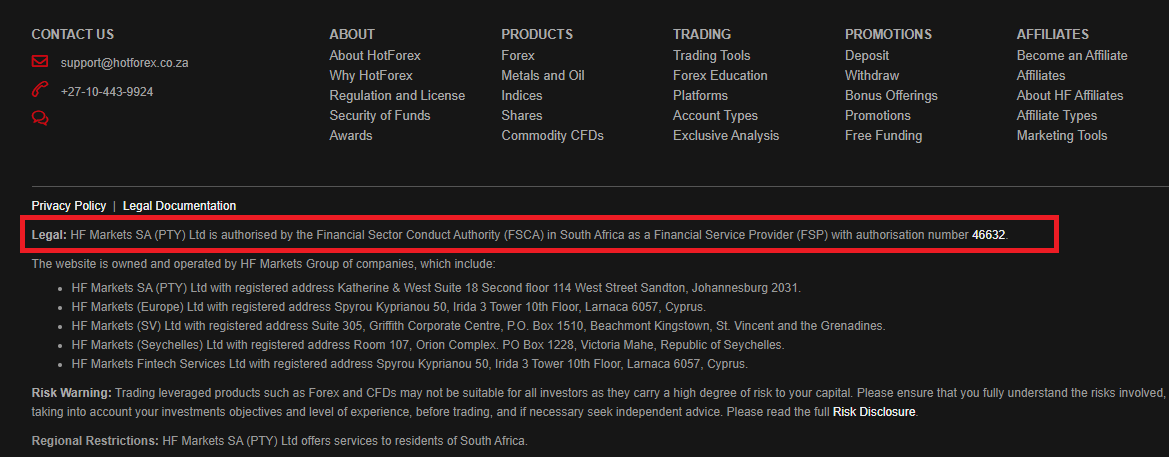

Check the broker’s website for their regulatory FSP number. Most brokers list it on their website. As an example, HFM (HotForex) South Africa have mentioned their FSCA regulation on their website’s footer section.

After that you should verify the FSP number on FSCA’s website as explained in our FSCA regulated brokers guide

It is important to only trade via a regulated CFD broker as this will ensure that your funds are safe & not misused by the broker. An unregulated broker does not have the comply with the policies set by the FSCA & other regulators, which makes them high risk for SA traders.

2. Overall NAS100 fees: Check the overall trading & non-trading fees for trading NASDAQ 100. Most brokers will publicly show their typical spread for each instrument including NAS100. NASDAQ is generally listed as ‘US Tech 100’ on websites of most brokers.

As an example, this instrument comparison page on HFM’s website shows their typical NAS100 spread with all their account types.

The trading, as well as non-trading fees must be checked and compared to choose the most cost-effective broker.

The below table compares the NAS100 spread & commission with Standard Accounts for 1 Contract at major regulated brokers:

| Instrument | HFM (Premium Account) | XM Trading (Ultra Low Account) | Exness (Standard Account) | FXTM (Standard account) | BDSwiss (Classic account) |

|---|---|---|---|---|---|

| NAS100 | 2.03 pips | 1 | 5.67 | 4 | 2 |

It is important to note that these are the typical spreads for trading NASDAQ CFD instrument. The actual spreads could be higher or lower, depending on the market conditions. But the typical or average spreads that brokers list on their website for NAS100 are generally similar to the spreads you will get on the actual platform.

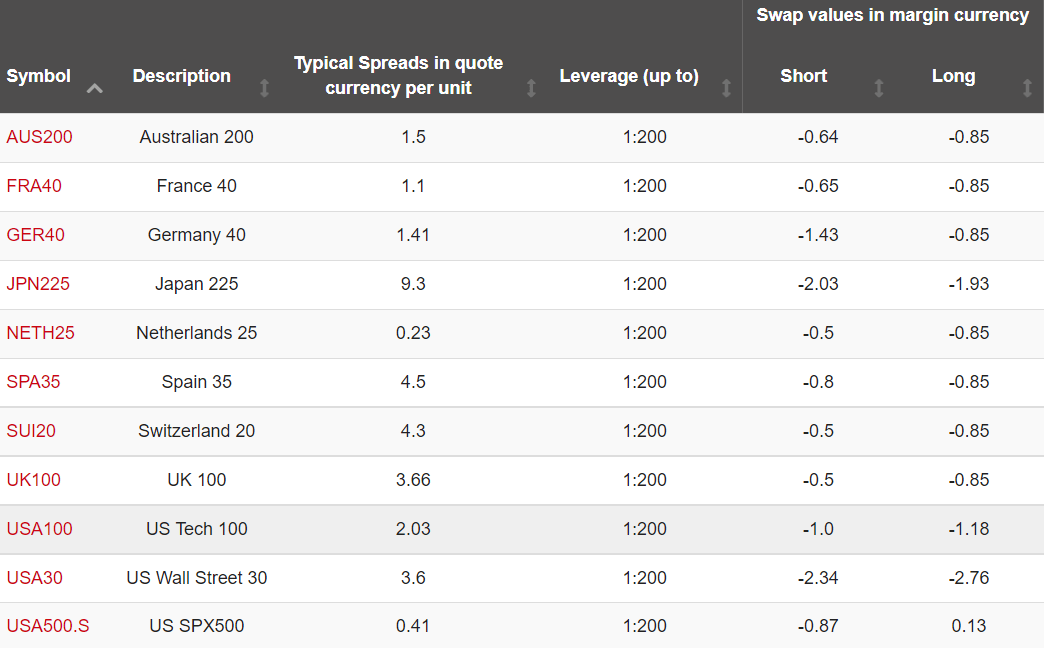

You should also take into account any Swap Fees charged by your CFD broker for Long & Short. This fees will be charged (or sometimes paid to you) when you hold your trading position overnight. In case of NASDAQ CFD, the Swap fees is negative at all brokers that we have compared, which means that you will be charged this fees if you hold the trade/position overnight.

For example, HotForex charges Swap Short fees of 1.74 USD & Swap Long fees of 1.22 USD for 1 Standard Lot position size with USA100 CFD for a trade held overnight for 1 night. Whereas, Tickmill has -1.516 Swap fees for Long & -0.483 for Short. But Exness on the other hand as 0 USD Swap fees (Long or Short) for the same trade.

Note: The Swap charges as as mentioned on the broker’s website as of recent update in August 2022. The swap fees could change overtime (be lower or higher), which can change your costs.

So, you should take into account the Swap fees that you will have to pay if you want to keep your NASDAQ trade open overnight. This fees can add up if your position is open for a few days, hence this should be very important consideration for traders that want to trade NAS100 with overnight positions open.

All CFD brokers list their Swap fees on their Trading conditions page. You should check the Swap fees that you will be charged.

For example, HF Markets South Africa mentions their Swap charges for “US Tech 100” CFD instrument on their trading condition for Indices CFDs. This fees will be charged if your trading order is open overnight, -1.0 for Short & -1.18 for Long positions. This fees is extra, plus the spread.

Another fees that you should take into account is if there is any charge during deposits or withdrawals. We explain this more in the next point below.

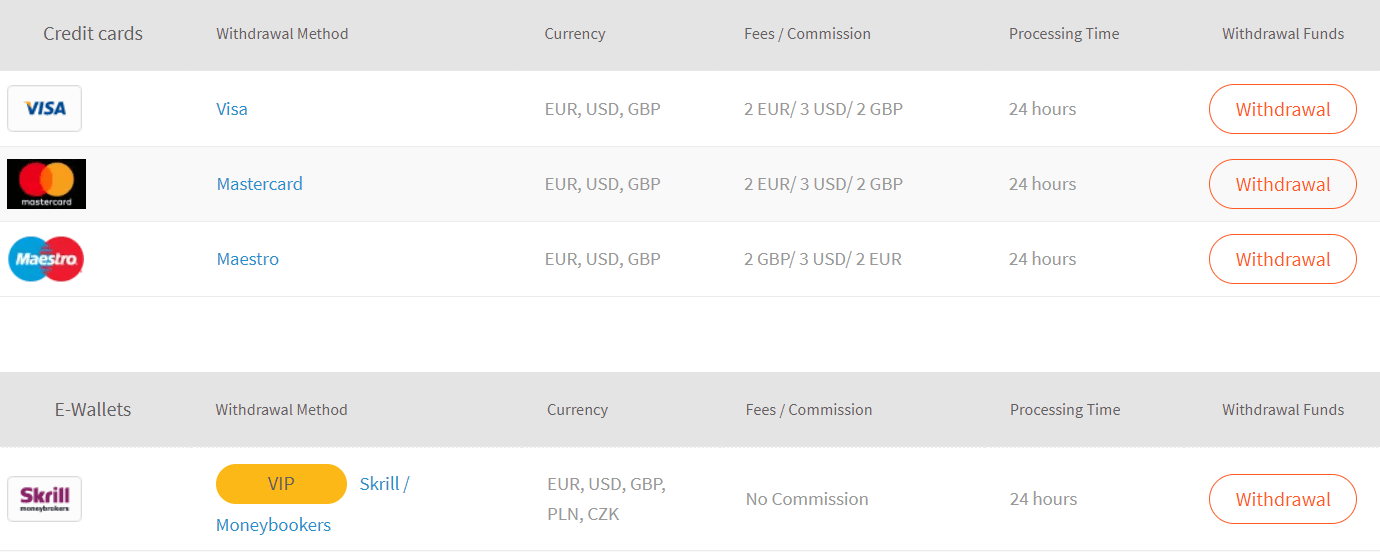

3. Ease of Withdrawals: The convenience of deposits and withdrawal methods must be checked before opening the account. See the reviews & complaints against the broker.

What is the average withdrawal time mentioned on the broker’s website for the withdrawal method that you want to select. All the brokers will list all their deposit & withdrawal methods in the client panel or on their website, including the processing time & fees.

It would be preferred if your broker offers funding & withdrawals via Internet Banking Transfer or EFT in ZAR. It will be easier to fund your Trading account & withdraw funds if there is local payment method.

This below table on FXTM’s website is an example of the time & fees on the withdrawal methods at brokers.

4. Customer Support: The broker must offer a resourceful and helpful customer support staff. This is important as you might run into some issues where you need support, and the broker should be available for you in that case.

Check if the broker has a local phone number in South Africa, 24/5 English Language Live chat support, and quick email support. You can test the email, phone support & live chat by sending queries to a broker & asking them questions, then see how well they respond to your questions & in how much time.

5. Platform’s ease of Use: The trading platform should be user-friendly and include charting and analysis tools. You should be able to easily place new orders & close existing orders.

Most of the NASDAQ CFD brokers in our list offer Metatrader platform (MT4 & MT5), but the execution speed is different from broker to broker. For example, market marker broker like XM offers instant order execution, while Hotforex offers market execution of orders.

You can ask your broker questions like; what is their execution speed, do they offer market execution, is the broker a market maker or a STP/NDD broker.

6. Check the Broker’s Reviews: Traders must also check for the reviews by the existing clients of the broker. We have reviewed all the popular forex & CFD brokers in South Africa, so you should check if the broker you are choosing has some important cons that you must know before opening a Live account.

For example, while Exness is one of the largest CFD brokers & also regulated by FSCA, they don’t have a local phone number for support. Plus, their email & live chat support are not the fastest. So, you should be aware of these concerns if you are choosing Exness broker.

7. Check the Contract Specifications: Another important factor to consider is the contract specifications related to the NASDAQ CFD instrument (and other indices).

In general, you should check the minimum lot size of the contract, the stop levels, trading hours & margin requirements. For example, Exness has a margin requirement of 0.25% (1:400 leverage) for trading USTEC CFD instrument & the minimum lot size is 1 lot.

Most CFD brokers mention their ‘contract specifications’ of every instrument on their instruments page. For example, below is the screenshot from Tickmill’s website where they have mentioned the contract specifications for ‘Nasdaq 100 Stock Index (cash)’ instrument.

If you are not able to find this information, then talk to your broker’s sales & support team, and ask them to share the contract specifications.

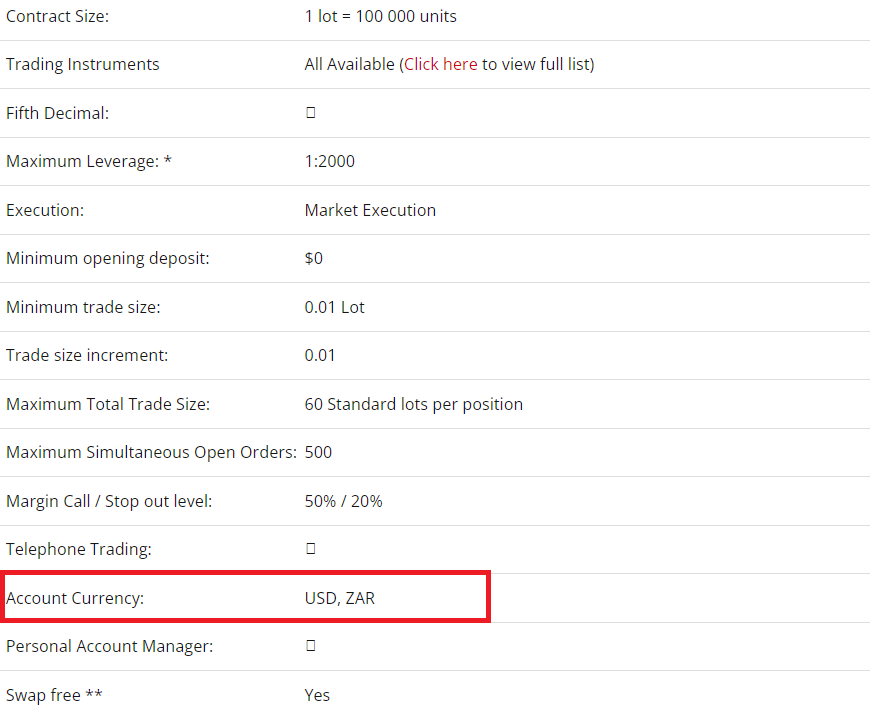

8. Availability of ZAR Account: There are some forex brokers that have option of ZAR as the account base currency. Most forex brokers only support USD, EUR, GBP & other majors as the account currency.

You should check during opening of your account whether the broker support ZAR account currency. Here is an example of HF Market’s Premium Account. They support USD & ZAR account currency for SA traders.

One of the advantages for traders trading NASDAQ 100 (NAS100 or USTEC) with ZAR as the base currency is the saving of transaction costs charged by forex brokers. Since the NASDAQ is quoted & traded in USD, so every P&L when your are trading this CFD instrument is in USD.

But when your account currency is in ZAR, the Mark-to-market P&L of your NASDAQ trade will be shown in ZAR by your broker. If you are using MetaTrader, all your trades will show historical P&L, activity, balance in ZAR. When you are withdrawing this balance, then broker will not charge you any extra currency conversion costs.

Let’s understand this using an example. Let’s assume that you longed NASDAQ at 12,000, with ‘Take profit’ at 12,200. Assuming that the trade was profitable, and you were trading 1 Standard Lot, you would have made a profit of $200 or R3400 approx. (after excluding any Swap charges if the position was overnight) from this trade.

If your profits were held in USD, then your broker could charge fees when you are withdrawing to your South African bank account in Rand via EFT. Some brokers have as high as 5-6% currency conversion costs, which would mean $12 on $200.

But if your account balance & P&L is already in ZAR, then there will be no conversion charges applied. All or part of the balance can be withdrawn via EFT to your local bank account.

Yes, you can trade CFDs on NASDAQ if you are trading through a broker who has been licensed by FSCA. Licensed brokers are allowed to offer CFD instruments on global indices, which includes NASDAQ 100.

But you should be cautious & not confuse leveraged derivatives on NASDAQ 100 with actual ETF. When you are buying & selling NAS100 through a CFD broker, you are making a bet on the price.

If you want to invest for a longer period in tech stocks, trading CFDs on US100 is not the right option. The daily holding costs associated with CFDs & the high commission on each trade could make your returns negative, even if the NASDAQ 100 goes up for the year.

This form of active trading is only suited for professional traders who understand all the risks & cost of trading. So, although you can legally trade NAS 100 CFD, but it does not mean that you should, especially if you are not a professional.

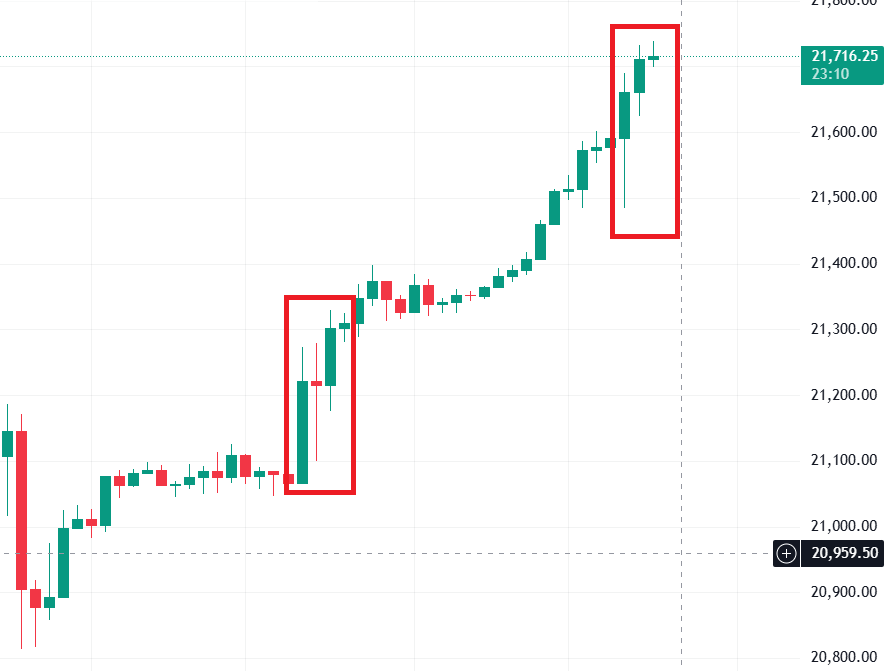

NASDAQ is mostly traded during the US session, that is when you will get the highest volatility. Most South African CFD brokers allow trading on NAS100 for 24 hours during a week, but it is mostly sideways during the Asian session.

During London session, there is some directional movement on some days. But mostly, the most active time to trade NAS100 is the start of US session.

The best time is from 4PM South African time to 7PM. This is when the

For example, attached is the 1H chart of NASDAQ, which these trading hours highlighted. You can notice that most of the breakouts are during these trading hours (4PM – 7PM SA time).

You could in theory trade during any point of the day, but you have to build a strategy around it. Another major point to consider is that your CFD broker will have wider spreads on NASDAQ CFD during inactive trading hours. It could easily by 5-10X higher their typical spreads. For example, if the typical spreads are 3 point on NAS100 CFD, during Asian session it could be 20-30 points.

If the price is not moving much in any direction, it will be much harder for you to make any profit during inactive hours after paying the spreads, other trading costs.

Below is the comparison table of all the brokers that offer NAS100 CFD instrument to traders in South Africa.

| NAS100 Broker | Regulations | Average NAS100 Spread | Leverage | Minimum Deposit | Visit Website |

|---|---|---|---|---|---|

| Exness | FSCA, FCA, CySEC | 5.67 pips with Standard Account | up to 1:100 | $1 | Visit Broker |

| HFM South Africa | FSCA, FCA, CySEC | 2.03 pips | 1:50 | $5 | Visit Broker |

| XM Broker | ASIC, CySEC | As low as 1 pip | 1:100 | $5 | Visit Broker |

| Tickmill | FSCA, FCA | 1.93 | 1:100 | $100 | Visit Broker |

| Avatrade | FSCA, ASIC | 1 over market | 1:200 | $100 | Visit Broker |

| FXTM | FSCA, FCA, CySEC | 4 pips with Standard account | 1:40 | $50 | Visit Broker |

As per our research, HF Markets & Exness & Tickmill are the most competitive FSCA regulated CFD brokers that offer NAS100 or US Tech 100 CFD indices instrument. The typical fees at HFM for NASDAQ 100 CFD is 2.03 pips, at Tickmill it is 1.93, but it is higher at Exness at around 5.67 for contract size with similar number of lots.

There are 70+ FSCA authorized derivatives offering CFD & forex brokers in South Africa. Most of these brokers offer CFD trading on multiple indices including NASDAQ, but not all of them have the same fees, leverage or margin requirements etc.

In this guide, we have compared the most popular regulated brokers that offer NASDAQ CFD trading.

According to our research HFM & Tickmill have the lowest typical spreads for NASDAQ CFD indices. HFM’s typical spread for this instrument is 2.03 pips for 1 Contract with all their account types, and at Tickmill it is 1.93. This is lower in comparison to other similar brokers for 1 Contract (with 0.01 USD Price Fluctuation) like Exness (5.67), FXTM (4), XM Broker (as low as 1).

Also, HF Markets does not charge any extra fees for deposit or withdrawals. So, their overall fees is quite low in comparison to other brokers for trading NASDAQ CFD instrument.

Yes, you can trade NASDAQ 100 as a CFD instrument via an authorized broker. Most FSCA licensed forex brokers offer NAS100 & US Tech CFD instrument. But you must note that trading CFDs is risky & only meant for professional traders. So you must fully understand how CFD trading works before trading NASDAQ 100 (USA100) instrument as a CFD via any FSCA licensed broker.

Exness is the #1 NAS100 CFD Broker

Visit