We've listed the best brokers for trading CFDs on Volatility 75 Index in South Africa. See comparison of fees & regulations.

Volatility 75 or VIX is the real-time index that displays the volatility in the S&P 500 (SPX). It is developed by Chicago Board Options Exchange (CBOE) to indicate the greed and fear sentiment in the US stock market. It is one of the best indicator to predict the volatility of the overall market trends in the near future.

The Volatility 75 Index generally fluctuates between 12 to 30 but has gone up to 80 during severe bear market trends. VIX above 30 depicts highly volatile trends in the market in the near future. Lower VIX signals stability in the trends of the S&P 500 Index.

During the October 2008 and March 2020 stock market crash, VIX surged above 80. Under stable market trends, it has even gone below 9.

VIX can be traded in the derivatives market via futures, options, swaps, and CFDs. Apart from displaying the market sentiments, the Volatility 75 Index also acts as an underlying asset for derivative capital markets in which traders can go long or short.

List of Best Volatility 75 Index Brokers in South Africa

In South Africa, traders can conveniently trade on the Volatility 75 Index via CFDs. The Contract for Difference is quite popular among online retail traders and is constantly gaining popularity among young traders as well. The ease of execution and simple user interface offered by the CFD brokers makes it easier for traders to speculate the fluctuations in VIX. Hedgers, as well as speculators, can use CFD on VIX to mitigate the risk of their conventional stock portfolio and book profits respectively.

CFD trading platforms in South Africa allow traders to go long and short on the Volatility 75 Index. The availability of leverage and smaller margin requirement makes it easier for them to open bigger positions with small initial deposits.

We compared the trading fees for VIX 75 Index at all the regulated CFD brokers in South Africa.

Ranked #1 Volatility 75 Index Broker in South Africa

Hotforex is a well regulated STP forex and CFD broker that is regulated by Financial Sector Conduct Authority (FSCA) in South Africa (FSP number 46632). It is also regulated by the Financial Conduct Authority (FCA) (801701) in the UK and can be considered safe for traders in South Africa. It has a local office in Johannesburg, South Africa, and also offers ZAR-based trading accounts.

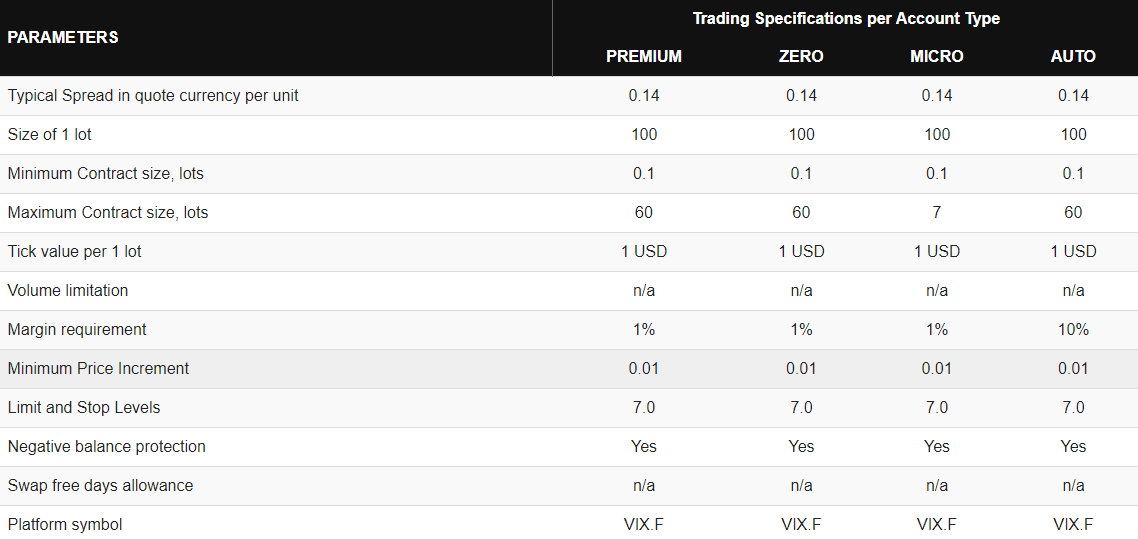

The typical spread for CFD on the Volatility 75 Index at Hotforex SA is 0.14 per lot (100 units). The minimum deposit required to start trading CFDs at Hotforex is $5 with a maximum leverage of 1:100 for CFD on VIX.

Their VIX 75 index CFD trading fees is low in comparison to other brokers. This fees or spread is the same for all their account types, it does not get lower with higher accounts.

Hotforex has a local phone number for customer support (+27 10 443 9924) apart from live chat and email support in South Africa.

Hotforex Pros

Hotforex Cons

read our Hotforex review

Ranked #2 Volatility 75 Index Broker in South Africa

AvaTrade is a well regulated forex broker & Ava Capital Markets Pty. is authorized by FSCA in South Africa. They offer trading on VIX & it is available with the symbol VXXB on their MT4 & MT5 platforms.

The typical spread for trading VIX at AvaTrade is 0.15% & it is as low as 0.21. The max. leverage available on this CFD instrument is 1:20 for traders in South Africa.

The fees for trading Volatility 75 Index at AvaTrade is average (it is not the lowest). They only have a single account type for Retail traders.

AvaTrade does offer local Phone number +(27)105941353 in South Africa for customer support. They also offer chat support & email support. But their Live chat & phone support agents are only available from Monday to Friday, 5 AM to 9 PM GMT.

AvaTrade Pros

AvaTrade Cons

read our AvaTrade review

Ranked #3 Volatility 75 Index Broker in South Africa

Plus500 CFD trading platform is regulated with ASIC & Plus500AU Pty Ltd is an authorized FSP in SA with FSP Number 47546.

Plus500 offers VIX as a CFD instrument on their trading platform. The max. leverage on this CFD instrument is 1:10 for South African traders. The typical spread is 0.23.

You will be charged a Swap fees of -0.0135% for Short positions & -0.0139% for Long if your trade is open overnight. The overall fees would be Swap + spread in this case (and Swap fees is charged by every broker for VIX CFD).

Plus500 does note charge any extra commission per lot with VIX CFD instrument. The only fees is the spread, and the Swap charges for overnight positions.

read our Plus500 review

The origin of VIX dates back to 1989 when two American professors of finance, namely Menachem Brenner and Dan Galai created a series of volatility indices. The volatility index in its initial phase was called the ‘Sigma Index’.

In 1992, CBOE worked upon the volatility index to predict the fluctuations in the market in the near future. Trading on VIX began in March 2004, when CBOE Futures Exchange offered futures contracts with VIX as an underlying asset. The options trading on VIX began in 2006 and later on, CFD trading on VIX was offered by various retail CFD brokers in the world.

Currently, the value of the VIX index shows the annualized movement in S&P 500 index for the next 30 days. The S&P 500 or Standard and Poor’s 500 is the most followed stock index of the US Stock market. It tracks down the performance of the top 500 largest stocks in the United States based on market capitalization.

The value of VIX is calculated by the options market data and several other factors affecting the sentiments of traders and investors. The trading on VIX can also affect its value and may disrupt the functioning of calculating volatility.

Value of Volatility 75 Index indicates the near future volatility in the S&P 500 index of the US. Its relation with the current valuation of the S&P 500 index can have convergence and divergence effects on the market sentiments.

Rising VIX with rising S&P 500 Index suggests a downside trend reversal. Rising VIX with falling S&P 500 signals further downward movement in the market indices. Falling VIX with the falling S&P 500 index suggests an upward trend reversal. Falling VIX with rising S&P 500 index increases the upward moving trend.

Trading through CFDs has no impact on the price movement of VIX as only the value of VIX is speculated to book profits. The fees and trading conditions for CFD trading on VIX are different for each broker available in South Africa.

Each broker offering CFD trading services on the Volatility 75 Index has different trading conditions and offers different features. Certain factors need to be considered before choosing a CFD trading platform in South Africa.

1. Safety of your Funds: The safety of your invested amount needs to be ensured before choosing a CFD trading platform. CFD trading is growth in demand in SA, and each month new brokers offering CFD trading services enter the market. It is important to identify a legitimate, safe, and trustworthy CFD broker for a safe trading experience.

Regulatory licenses play an important role in ensuring the safety of funds at a trading platform. Financial Sector Conduct Authority (FSCA) is the financial regulator in South Africa. Any CFD broker regulated by FSCA can be considered safe for traders in South Africa.

You can check the broker’s license number from their website. Like this example of Hotforex SA’s FSCA regulation.

Some of the foreign-based CFD brokers, regulated by top-tier regulatory authorities like FCA of UK and ASIC of Australia can also be considered safe.

Make sure to check the CFD broker that you are registering with is fully regulated with FSCA or other Tier-1 regulation. Always check the regulation under which your account is being registered.

For example, some brokers like IC Markets register their SA clients under Offshore regulation i.e. ‘Raw Trading Ltd’ which is registered in Seychelles. This would mean that your funds would be help in an offshore bank account, which makes the broker high risk than a broker like HF Markets SA (PTY) Ltd which is licensed with FSCA & holds your funds (segregated) in SA bank account.

2. Fees: The charges incurred while trading CFDs can have a major impact on the outcome of the trade. Higher spread not only reduces the amount of profit on trade but also decreases the probability of making profits.

The spreads and commission for trading CFDs must be thoroughly checked and compared before choosing a CFD broker.

The non-trading fees like inactivity fees, deposit/withdrawal fees, currency conversion fees, account opening fees, etc. also need to be checked before opening an account with any CFD broker.

You can check the trading fees charged for each instrument on the broker’s website. As an example, HotForex SA have a comparison table for fees & trading conditions for VIX CFD with each account types offered by them.

For example, the typical spread for trading Volatility on S&P500 is 0.14 pips at HotForex. They don’t charge any fees for Long or Short Swap, so the total trading fees is not too high. The non-trading fees at HotForex is also low, as there are no withdrawal fees, but there may be some inactivity fees.

All other brokers list the typical fees & trading conditions for instruments available on their platform. You should compare the exact fees for trading VIX (the spread, Swap fees, other charges etc.) before signing up with any broker to get an estimation of the fees involved with each trades.

Don’t just look at the lower spreads & think that it is good, check the overall fees in percentage terms. For example, if the broker charges 0.18 pips spread, and the VIX is at 18, then the total fees in percentage is 1%. So, you position needs to be in 1% profit before you can even be breakeven. If there are other charges involved as well, then it would only make you costs higher.

3. Other Factors: Apart from fees, traders can also check the customer support services, the number of available instruments, trading platforms, research and analysis tools, bonuses, and other features before choosing a CFD broker.

Traders must ensure that the selected broker allows convenient deposit and withdrawal via the preferred transaction method. If you prefer to trade with ZAR as a base currency, you should check whether the broker offers a ZAR account or not.

It must be noted that CFD trading involves high risk and may not be ideal for some traders. It is always advisable to learn the basics of trade and try strategies through a demo account with virtual currency.

| Volatility 75 Index Broker | Regulation(s) | VIX 75 Index CFD Fees | Max. Leverage | Minimum Deposit | Trading Platform(s) | Start Trading |

|---|---|---|---|---|---|---|

| Hotforex SA | FSCA, FCA CySEC | 0.14 pips | up to 1:100 | $5 | Metatrader 4, MT5 | get started |

| Avatrade | FSCA, ASIC | 0.15% | up to 1:20 | $100 | MT4, MT5 & AvatraderGo App. | get started |

| Plus500 | ASIC | 0.23 (Variable) | up to 1:10 | R1500 | Mobile & Webtrader. | get started |

| FXCM | FSCA | 0.6 pips | up to 1:20 | $300 | Trading Station, MT4, Ninjatrader, Zulutrader | get started |

| PepperStone | FCA, ASIC | 0.16 pips | up to 1:100 | $200 | MT4, MT5, cTrader | get started |

| IG Markets | FCA, FSCA | 0.2 pips. | 1:8 | $0 | MetaTrader 4 | get started |

Volatility 75 Index or VIX is the fear and greed gauge that indicates the implied volatility in the S&P 500 (SPX) for the next 30 trading days. Higher VIX indicates higher volatility in the near future, while a lower VIX depicts stability in the market for the next one month.

A higher VIX means that the market participants expect high volatility, and this is generally associated with higher risk sentiment in the markets. The VIX is generally low when the market is trending up.

CFD trading services on the Volatility 75 Index are offered by only a few regulated forex and CFD brokers in South Africa. These are Hotforex, PepperStone, Plus500, IG Markets, and FXCM. Other major brokers like XM, Exness, Tickmill etc. don’t offer CFDs on VIX 75 index.

The lowest minimum deposit at HotForex is R70 to open account & you can trade CFDs on VIX (Volatility Index S&P 500). The typical spread is 0.14 pips & there are no Swap charges.

Contract for Difference (CFD) on Volatility 75 index can be traded by opening an account with a regulated CFD trading platform in South Africa. You must check whether the broker offers VIX instrument or not because not all CFD brokers in SA offer VIX. Traders can go long and short on VIX & use leverage, when trading it as a CFD instrument.

Hotforex is the #1 VIX 75 Index Broker

Visit