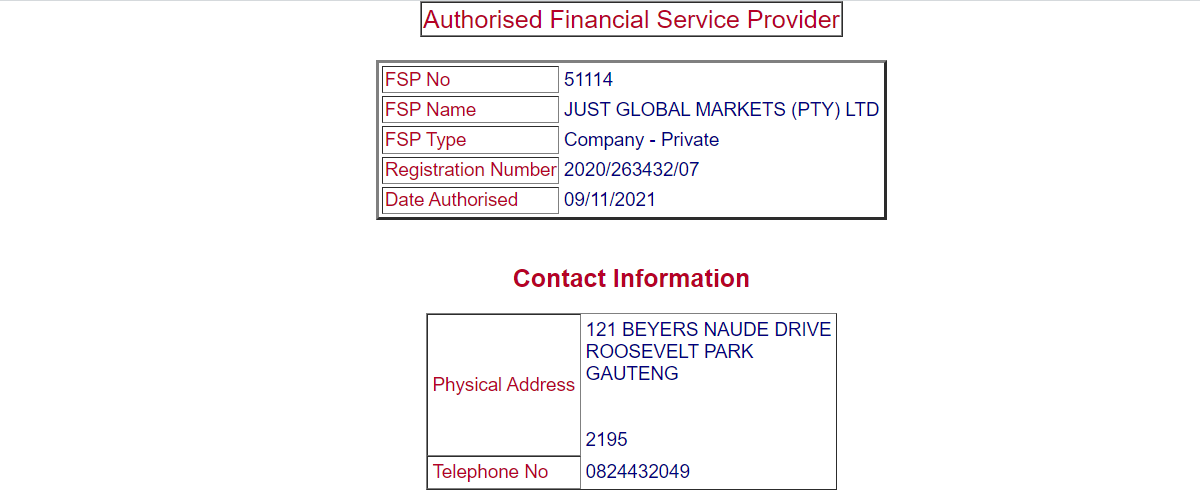

JustMarkets is regulated with Financial Sector Conduct Authority (FSCA) but their SA entity are not the issuer of the products. They offer ZAR base currency accounts and accept local bank transfer via EFT for deposits & withdrawals.

JustMarkets is the brand name of Just Global Markets (PTY) Ltd, and they were formerly known as JustForex. They are an international forex & CFD broker headquartered in Seychelles, but with a global presence.

JustMarkets was founded in 2012, and they have been licensed with FSCA since 2021. They offer trading on range of CFD instruments.

They do offer ZAR base currency accounts & local payment methods for funding & withdrawal via bank transfers. MetaTrader platform is available after you open your account.

Read our below detailed review on JustMarkets to see our full research.

JustMarkets Pros

JustMarkets Cons

| Regulations | FSCA South Africa, FSA, CySEC, FSC |

| Trading Account Types | Standard, Standard Cent, Pro, Raw Spread |

| Account Currency | ZAR, USD, EUR, GBP, JPY, MYR, IDR, THB, VND, KWD, CNY |

| Minimum Deposit | $1 (USD) |

| Funding Methods (SA Traders) | EFT in ZAR, Cards, Crypto, Skrill, Neteller |

| Bonus | Yes |

| Platforms Available | MT4, MT5 |

| Max Leverage | 1:3000 |

| Swap Free Accounts Available | Yes |

| Copy Trading Available | Yes |

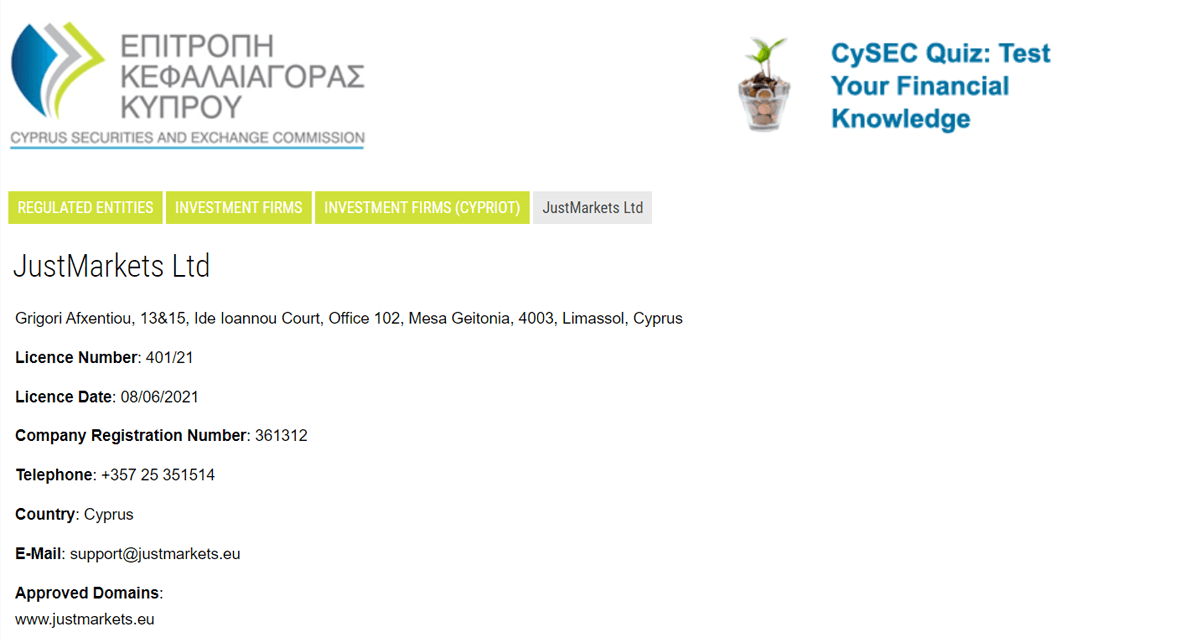

JustMarkets is regulated by the following regulations, including in South Africa.

By virtue of its FSCA regulation, you are protected by South African laws if any dispute arises. But it is important to note that this entity is only an intermediary & not the issuer of the products offered.

| Regulator | Class | Location |

|---|---|---|

| FSCA | Tier 2 | South Africa |

| CySEC | Tier 1 | Cyprus |

| FSA | Tier 3 | Seychelles |

| FSC | Tier 3 | Mauritius |

The broker claims to have segregated client accounts, which is important.

JustMarkets is licensed with multiple regulations, so they are considered a moderate to low risk CFD broker.

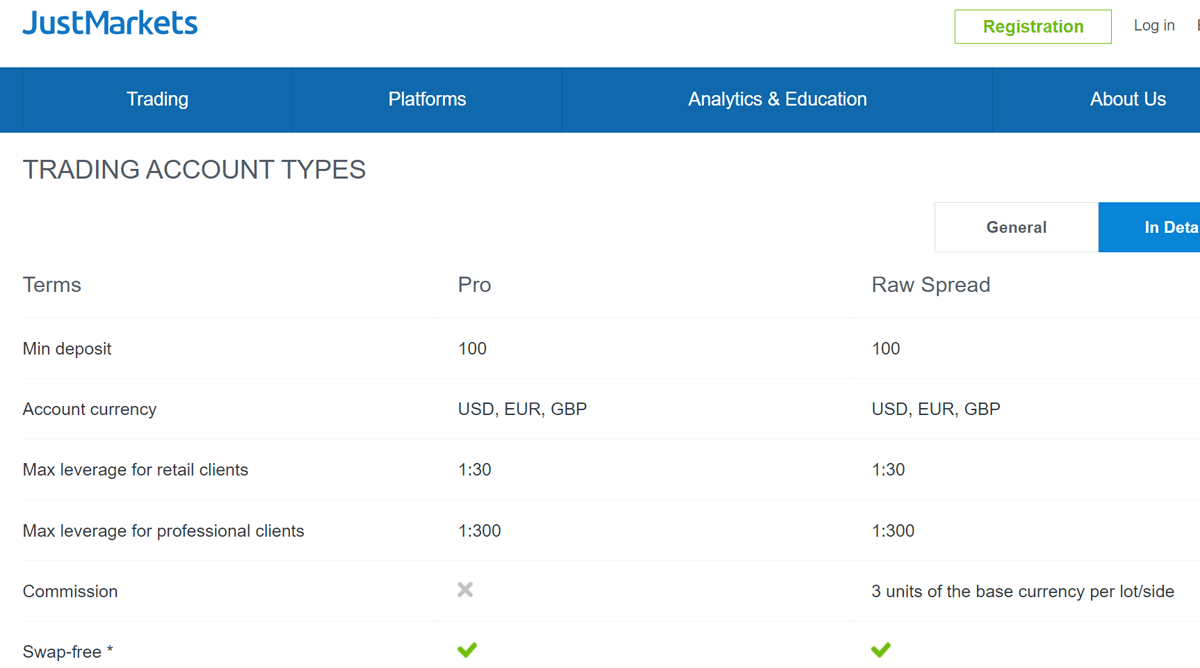

JustMarkets has multiple account types which you can select during the signup proceed. These accounts include a standard account, Pro account, and Raw spread account.

You can open the account in 11 base currency options. The important is that you can open your trading account with JustMarkets in ZAR.

ZAR account base currency is ideal for South African traders as you avoid paying currency conversion fees when you trade in ZAR.

Other account base currencies include the major currencies USD, EUR & GBP. We have not mentioned the other currencies which are not important for South African traders.

| Account Type | Details |

|---|---|

| Standard | Min deposit of 1 USD, zero commission, spread from 0.3, swap free Islamic option |

| Standard Cent | Here you can trade in US cents, and this is ideal for beginners with little capital. |

| Pro | Min deposit of 100 USD, zero commission, spread from 0.1, swap free Islamic option |

| Raw Spread | Min of deposit of 100 USD, 3 ZAR per side commission, zero spread, swap free Islamic option |

JustMarkets has classes of accounts that suit both beginner and expert traders.

Standard cent accounts are cheaper to manage for beginners and Raw spread accounts are ideal for professional traders such as intraday traders & scalpers, who trade large volume & need to lower their brokerage costs.

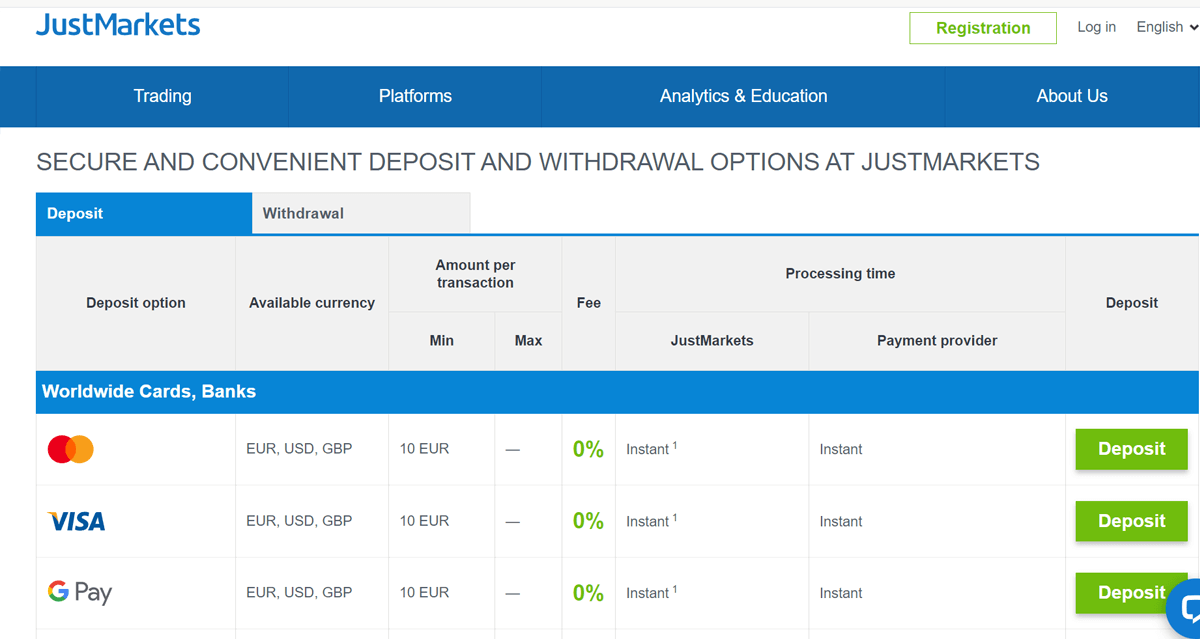

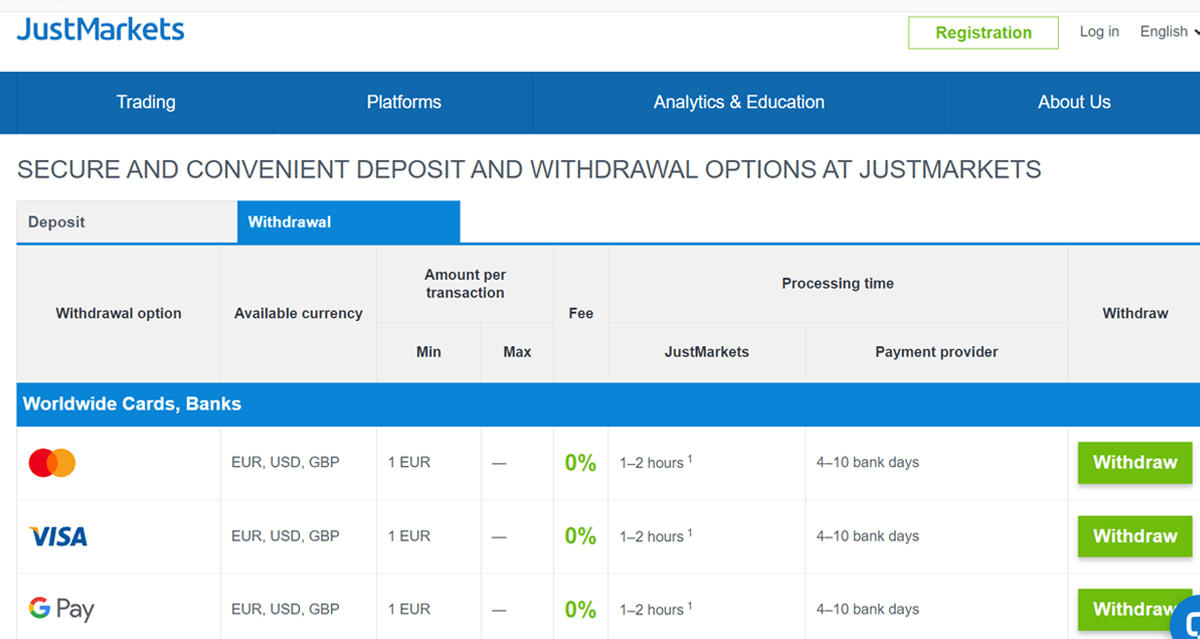

You can fund your account through different methods. There are no extra charges for funding.

JustMarkets funding methods can be categorized into:

Although there are several funding methods, we will focus on the ones applicable to South African traders. Also note that JustMarkets does not charge fees on deposits and withdrawals.

Table of some deposit channels into JustMarkets

| Funding channel | Funding currency | Min deposit | Processing time |

|---|---|---|---|

| South African Electronic Fund Transfer (EFT) | ZAR | 5 USD | Instant |

| Neteller | ZAR, EUR, USD | 5 USD | Instant |

| MasterCard/Visa | EUR, USD | 5 USD | Instant |

| Skrill, Perfectmoney, SticPay | EUR, USD | 5 USD | Instant |

Withdrawals from JustMarkets using South African EFT takes up to 3 days to see in your bank account, while eWallets are instant, and withdrawals via cards take between 4 & 7 days.

Withdrawal processing time via local wallets such as fasapay is instant.

Overall, the availability of local payment methods for deposits & withdrawals in ZAR via bank is considered good. But the withdrawals time via bank is slower than some other CFD brokers, although the good thing is that there are no extra charges.

JustMarkets also accepts funding via a variety of cryptocurrencies such as Bitcoin, Ethereum, & Dogecoin giving you a variety of options to choose from.

Here is a breakdown of the fees involved when trading via JustMarkets:

| Instruments | Average spread on standard account |

|---|---|

| USD/ZAR | 100 |

| EUR/USD | 0.6 |

| EUR/GBP | 2.2 |

| NASDAQ 100 | 1.0 |

| Gold Vs USD (XAU/USD) | 2.2 |

| Bitcoin Vs USD (BTC/USD | 310 |

JustMarkets trading fees are not the lowest, but they are also not too high. The overall fees with the Raw account is low including the commissions. There is zero commission on 3 of its 4 accounts, no deposit & withdrawal fees, and low spread on major currency pairs.

JustMarkets offers both MetaTrader 4 (MT4), and MetaTrader 5 (MT5) platforms which are available on Personal Computer (PC), Android, iOS and Web Trader.

There is also a mobile app which is available on both Google play store and Apple Store.

The JustMarkets (JM) trading app on the Google Playstore was released on 13th December 2022 by JM Technologies, & has only 50,000 downloads, and 273 reviews with average of 4.2 star rating.

The JM app was last updated on 20th June 2023, and supports 2FA and fingerprint scanner. The required operating system is Android 5.0 and above.

JustMarkets mobile trading app specifications:

| JM app release date | 13 Dec 2022 |

|---|---|

| Last updated on | 20 June 2023 |

| Size | 4.9 MB |

| Operating system | Android 5.0 & beyond |

| Downloads | 50,000 |

| Fingerprint scanner | Yes |

JustMarkets offers a demo account where you can learn/practise trading using virtual money in a simulated environment.

Overall, their app has very few downloads in comparison to other brokers. There is also no cTrader platform, so you are restricted to MetaTrader. The mobile app size is small at 4.9MB, which is good.

If you are interested in trading from advanced charting platforms, JustMarkets does not integrate login to TradingView.

JustMarkets supports copy trading, which enables you to automatically copy the positions of traders.

You can join as an investor to copy trades of other traders, or as a trader to get copied. When you copy another trader, you pay them a percentage commission from your trading.

To use Just Markets copy trading, you will have to pick a trader you want to invest in on the leader board and then click “Start copying”. Thereafter, the experienced traders’ position will automatically be copied as yours.

Note that while copy trading is a feature supported by many brokers, there are risks involved. You should be very careful & do your due diligence.

Here are the instruments which you can trade on JustMarkets under their FSA regulation.

| Assets Class | Quantity | Leverage |

|---|---|---|

| Currency Pairs | 60+ Currency Pairs Including Major, Minor and Exotic Pairs. | 1:3000 |

| Commodities | 10 commodities including Brent crude oil, WTI light, US Natural Gas and precious metals such as Gold, Silver and Platinum | 1:3000 |

| Shares | 100+ Stocks including Apple, Tesla, Netflix, Amazon, Coca Cola and Facebook. | 1:3000 |

| Indices | 14 indices including NASDAQ 100, UK 100, US 30, HK50 and DE40 | 1:3000 |

| Crypto | 14 Cryptocurrency assets including Bitcoin, Cardano, Dogecoin, Ethereum, Ripple and Solana. | 1:3000 |

JustMarkets instrument offerings don’t include CFDs on Government bond and treasuries for trading.

The following promotions are available currently at JustMarkets for traders based in South Africa:

To be eligible for Just Markets welcome bonus, you need to sign up with JustMarkets Broker and open a Welcome Account.

To have access to your profit, you are required to trade at least 5 lots within a 30-day period while the profit or loss of a transaction must be at least 6 pips.

| Bonus | Condition |

|---|---|

| 30 USD | Open a welcome account |

| 50% | Deposit up to 100 USD |

| 100% | Deposit between 100 & 500 USD |

| 120% | Deposit above 500 USD |

JustMarkets has multiple promotions, but you must read their terms. If you are a new trader, them you can open a welcome account to qualify for 30 USD welcome bonus.

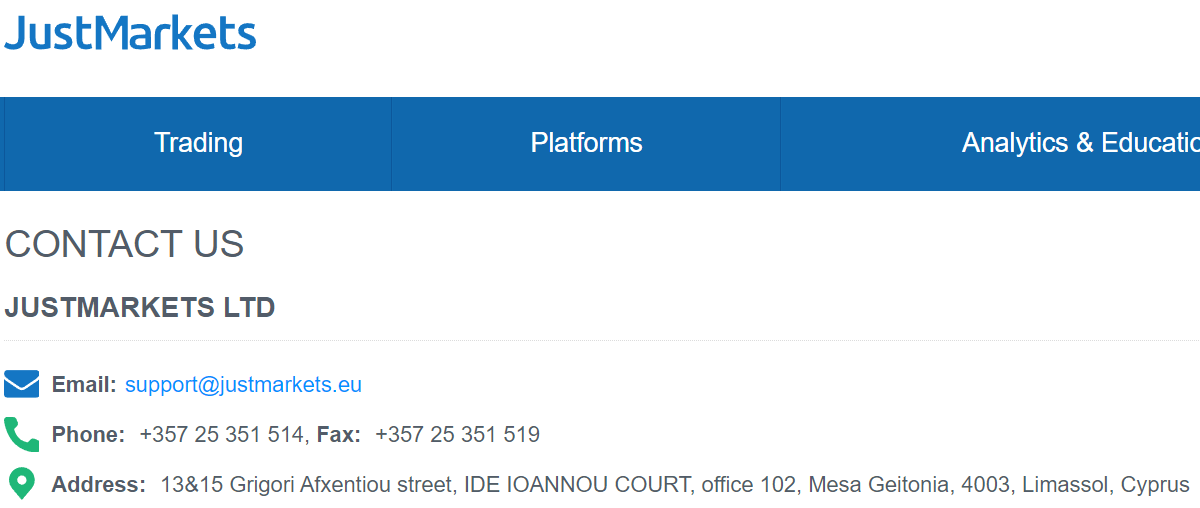

JustMarkets offers customer support through different channels. 24/7 English customer support is available through phone number and email message.

You can also request a call-back on JustMarkets Broker by filling the Call-back Request Form. Just Markets also offers support via live chat, Facebook Messenger, Telegram, Viber, Instagram iMessage and Line.

Overall, JustMarkets is a broker that you can sign up with for trading currencies in South Africa.

Their spreads are moderate, they offer ZAR account & local payment methods. MetaTrader platform is available for trading & you can trade CFDs on multiple asset classes.

But there is unavailability of a local phone number. And while JustMarkets is FSCA regulated, it only acts as an intermediary & is the provider of the product is their foreign entity.

JustMarkets minimum deposit is 1 USD or its ZAR equivalent of approx. R20 on its standard and standard cent accounts. While it is 100 USD on the Pro and Raw Spread accounts.

Minimum deposits further varies on both Standard and Standard Cent Accounts depending on the method used. For instance, minimum deposit via MasterCard is 5 USD while minimum deposit through Bitcoin is 7 USD.

Yes, you can open your trading account at JustMarkets with ZAR as your account’s base currency. There are no extra charges for this.

JustMarkets is registered in South Africa with FSCA under the name Just Global Markets (PTY). They are also licensed with CySEC. But do note that the issuer of their derivative products is their foreign entity under FSA.

This depends on your payment method. Withdrawal via South African Electronic Fund transfer to your bank account through JustMarkets takes about 3 days. Withdrawal via cards takes 4 to 7 days. Withdrawal via international wallets like Skrill & Neteller are instant.

Important Disclaimer: The CySEC regulated entity of JustMarkets doesn’t provide any bonuses or promotions. The trading conditions, products offered, leverage etc. are also different depending on the jurisdiction & are subject to change in the future.

Risk Disclaimer: JustMarkets is a CFD broker. CFDs (Contract for Differences) are complex derivative instruments & it is very risk for traders engaging with it with leverage. A very high percentage of retail traders & investors lose their capital when trading CFD instruments.

Therefore, you should understand the full risks, and only trade CFDs if you have acquired the adequate knowledge.

"Do you have experience with JustMarkets? Please consider sharing your experience with a review below – good or bad – doesn’t really matter as long as it’s helpful to other traders!"

We only accept user reviews that add value to fellow South African Traders. Unfortunately, not all reviews that you post with us will be published on the website. For your review to be approved, please share your detailed & honest experience with the broker – either positive or negative. Thank you for helping out other traders with your valueable feedback!

Important: We don't accept any payments or kickbacks from any forex broker(s) to delete or change any reviews. We welcome Forex Brokers to reply to reviews on our website & share their side of the story to keep the process honest and fair for both sides.