CFD Trading is regulated in South Africa. We checked 27 CFD Trading platforms to find the best CFD brokers with the lowest fees & highest number of regulations.

Contract for Difference (CFD) is a contract between buyer and seller. It is a derivative capital market in which the price difference between the opening and closing prices is cash-settled. CFD does not involve the actual buying and selling of assets but only the prices of the underlying assets are speculated.

Due to significant profit margin, attractive leverage, ease of execution, and simple user interface, the CFD trading figures are on a constant rise in recent years. To serve the increasing demands numerous new forex and CFD brokers have entered the industry offering distinctive features to attract retail traders.

List of Best CFD brokers in South Africa

In South Africa, more than 40 regulated brokers offer CFD trading on a variety of financial instruments. The trading experience can differ from broker to broker. The availability of multiple CFD brokers in South Africa can make the selection process complex for traders.

In this guide, we have analyzed the best CFD brokers in South Africa to assist the retail CFD traders in choosing a good, well regulated & low cost broker.

Let’s compare the features & fees of each CFD broker in our list.

Ranked #1 CFD Broker in South Africa

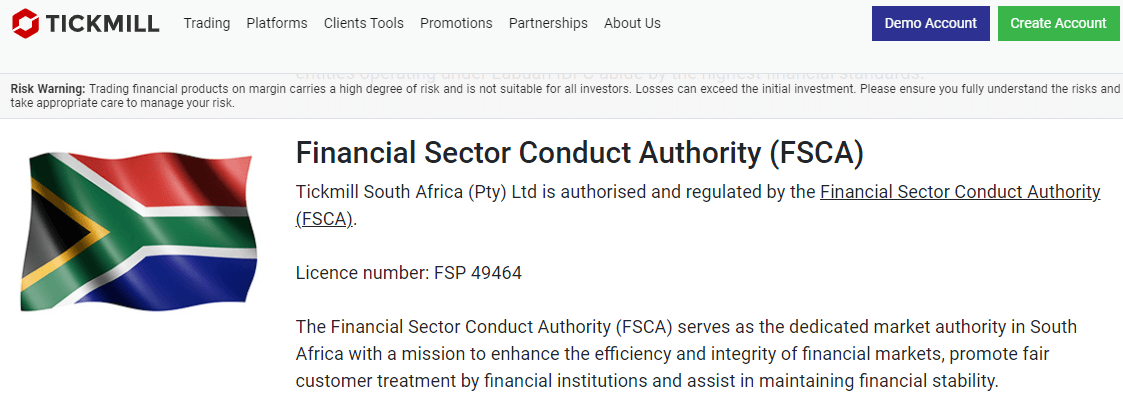

Tickmill is an FSCA regulated (FSP number 49464) forex and CFD broker that is also regulated by FCA (717270) and CySEC (278/15).

Clients can choose between the Pro, Classic, and VIP account types with a minimum deposit of USD 100. The spreads with the commission-free Classic account type start from 1.6 pips per lot. While the Pro and VIP account type incurs a commission of 4$ and 2$ for a round trade respectively. Tickmill does not support ZAR-based trading account as each account can only be opened with USD, EUR, and GBP.

The average typical spreads for XAU/USD CFD and EUR/USD are 0.3 pips and 2.4 pips respectively with the classic account type. These spreads are much lower with the Pro and VIP account types.

Each live trading account gives access to trade on 62 currency pairs and 20 CFDs of indices, metals, and bonds. The minimum deposit requirement is 100$ and the maximum leverage is 1:500.

Traders can deposit and withdraw at Tickmill through bank transfer, Visa/MasterCard, or e-wallets. The customer support service is decent with 24*5 live chat support but local phone support is not available in South Africa.

Tickmill Pros

Tickmill Cons

read our Tickmill review to know about their CFD instruments

Ranked #2 CFD Broker in South Africa

HFM SA (formerly HotForex) is an FSCA (46632) and FCA (801701) regulated forex and CFD broker. They have a local office in Johannesburg, South Africa. HF Markets is a reliable trading platform with low spreads operating for more than a decade in several countries worldwide.

South African traders can choose between 6 trading accounts at HF. The commission-free micro and premium account types have spreads starting from 1 pip. The zero account involves a commission of 6$ per lot for a round trade but the spreads are as low as 0. Each account can be opened with ZAR, USD, EUR, and NGN as a base currency.

For XAU/USD CFD, the average typical spread with all the account types is 0.29 USD per unit. The average spread for EUR/USD is 1.3 pips per lot for Micro and Premium account types.

HFM offers trading on 53 forex pairs and more than 1000 CFDs on indices, commodities, stocks, and cryptocurrency. All this is available with a minimum deposit of 5$ and a maximum leverage ratio of 1:1000.

HFM has a diligent customer support staff that can be reached through 24*5 live chat, email, and a local phone number in South Africa. A wide range of research and educational tools can be used to improve trading strategies. The deposit and withdrawals are fast through bank transfer, credit/debit cards, and e-wallets.

HFM Pros

HFM Cons

read our HFM review

Ranked #3 CFD Broker in South Africa

FxPro is a UK based CFD broker that is also authorized by the FSCA. They offer CFD trading on multiple asset classses.

Their average trading cost depend on the account type you select. Their fees is lowest with the cTrader account (for most CFD instruments).

For example, if you are trading XAU/USD CFD, the average spread with MT4 market execution account is 0.29 USD per unit & the lowest is 0.05. But if you trading on cTrader, the typical cost is USD 0.19 on average + $7 commission per lot roundturn.

You can trade CFDs on currencies, metals like Gold, silver, energies like Brent or Crude, and also Crypto CFDs. Their total cost of trading CFDs is moderate, but their range of asset classes is wide.

SA traders can open account in ZAR & deposit locally via bank transfers. There are no extra fees from FxPro’s side for funding or withdrawals via this method.

read our FxPro review

To find out the best CFD trading platforms out of all the available brokers, it is essential to keep certain factors into consideration.

Following are the major basis of analysis for the trading platforms that must be scrutinized before choosing any.

1) Safety & Regulation of the CFD Trading platform: The safety of your invested amount majorly depends on the regulatory guidelines followed by the trading platforms. The Financial Sector Conduct Authority (FSCA) is the responsible capital market regulator in South Africa for forex and CFD trading platforms.

According to the Financial Advisory and Intermediary Services (FAIS) Act, all financial services providers (FSPs) are required to be registered with FSCA to legally conduct business in South Africa. FSCA is a top-tier financial regulator that safeguards the interest of FSPs and their clients and monitors the flow of funds. FSCA also ensures that required genuine information regarding trades is provided to the traders.

Choosing an FSCA regulated trading platform in South Africa is considered safe. Although, foreign trading platforms offering CFD trading services in South Africa are also regulated by foreign top tier regulators like FCA, ASIC, CySEC, etc.

You can check the CFD broker’s regulatory license number from their website & then check it on FSCA’s search. As an example, Tickmill mentions all their licenses & regulation on their website, with the license numbers.

Similarly all the regulated CFD brokers have a complete list of their regulatory license for view by traders.

Apart from regulations, traders can also check the history of trading platforms and complaints associated with them. The years of operation, ownership, sponsors, and partners can also be checked for further analysis of the safety of the trading platform.

2) CFD Trading Fees: Fees are the most reviewed area by the retail traders as no one wants to pay higher fees. There are multiple ways in which the trading platform can incur charges to traders. Many brokers offer multiple account types with different fee structures.

CFD Trading and non-trading fees are the two components of fees that must be checked and compared thoroughly.

CFD Trading spread & Commissions – All the charges incurred while executing trade orders fall under trading fees. For CFD trading, spreads and commission form the trading fees. Trading fees can be variable and differs for each available instrument.

New traders must check the latitude of spreads and precise details of commission before choosing a trading platform. The spreads and commission should be checked for each available account type as each account has different fees.

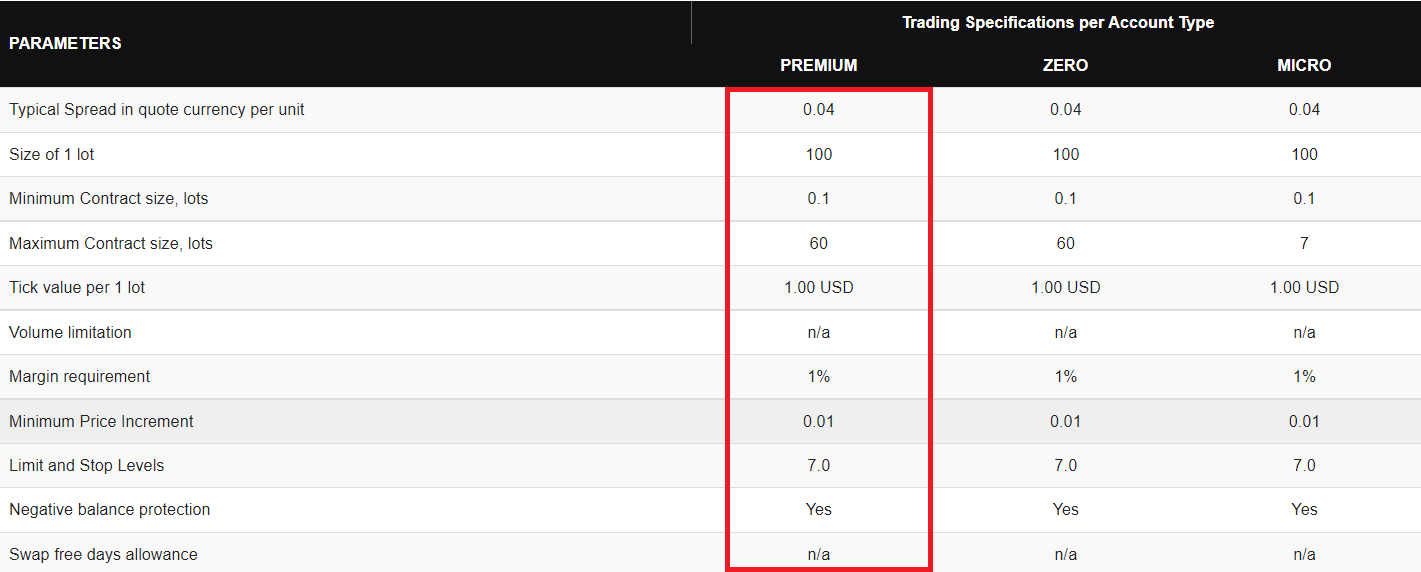

Let’s take an example of HotForex broker to understand how to check the Trading Fees i.e. the spread & commission.

HotForex don’t charge any extra commission for most CFD instruments with their account types. The only charge spread as their commission. See the example screenshot below from their website, where they have explain the fees for USDX CFD Index.

Depending on which instrument you are trading, you should first the exact spread & commission of that CFD instrument. Most brokers list their instruments & their trading conditions publicly on their website.

You should check the fees for that instrument as explain with above example. For example, if you want to open Premium Account at HF & trade CFDs on indices, then you should check the exact fees with this account type.

Non-Trading Charges – This includes the charges that can be levied on traders without executing trade orders. Non-trading fees include inactivity fees, account opening fees, account maintenance fees, deposit/withdrawal fees, currency conversion fees, and other charges that are incurred without executing trades.

3) Support: Customer support is what you will seek whenever you face an issue or have a query. If the queries are resolved efficiently, the trading experience is likely to be better.

One must check the live chat and email support service before choosing a trading platform. Not all brokers offer phone support but having phone support is an advantage.

You should visit the CFD broker’s website to check local contacts, and test by calling that phone number. See how well do they respond to your questions.

4) Number of Instruments:

With a wide range of trading instruments, you can explore more opportunities to make profits on suitable markets. Having more variety of trading instruments is always an advantage for the traders. Although the majority of the forex and CFD trading is done on less than 50 instruments.

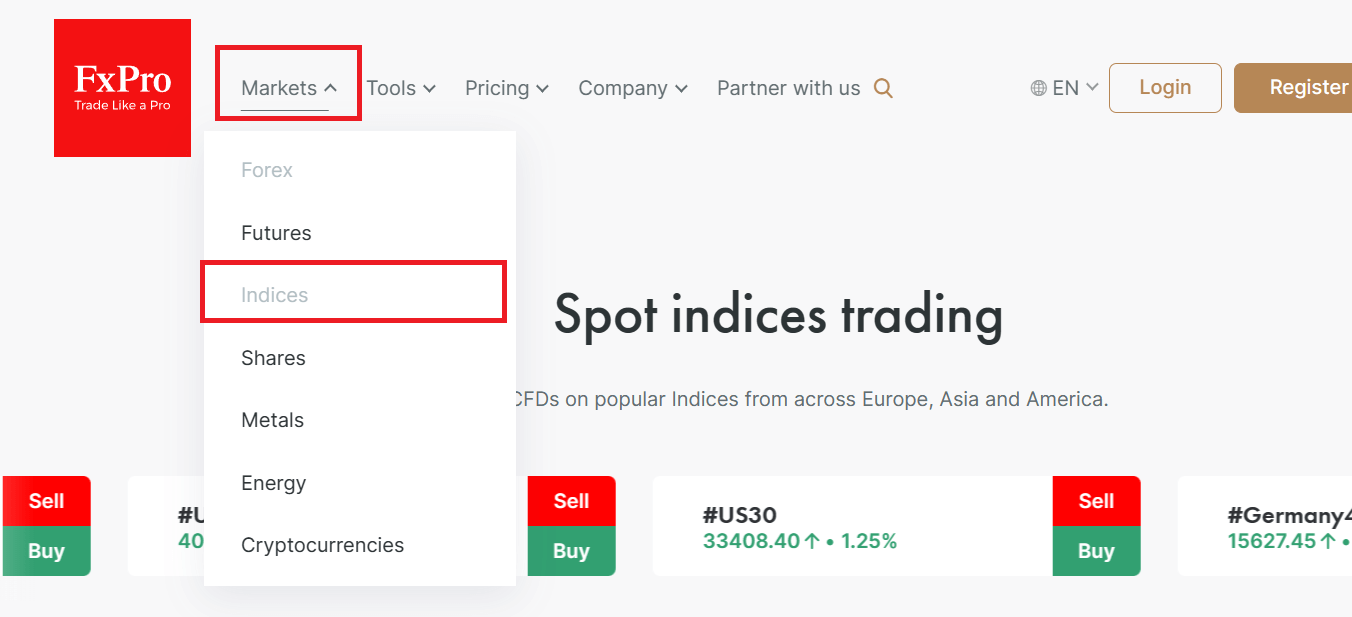

For example, if you are a trader who wants to trade NASDAQ & other stock indices, then you should look for a broker that offer trading on these popular indices.

For example, most of the SA brokers offer trading on NASDAQ as CFD instrument. But there are subtle differences like in terms of total fees, which can increase your trading costs & decrease your probability of profitable trades.

You must compare the exact overall fees being charged for trading a particular CFD instrument. For this, you must first check if your broker does offer the instrument you want to trade.

Most of the CFD brokers will have a page on their website of the products they offer. It is generally in the main menu. For example, below is the screenshot from FxPro’s website, which highlights their Indices products.

If you browse the Indices page, you will find the list of all their CFD trading instruments in a list. You can click on each of these instruments for detailed breakdown of the trading conditions (fees, leverage, trading hours etc.) for every instrument.

Do a comparison of the trading conditions of your favorite/most traded asset class at every broker using the similar search. If the CFD broker does not offer the instrument that you want to trade, or if the fees is much higher than other similar regulated CFD brokers, then you should pick the broker with better suited conditions overall.

5) Deposit & Withdrawals: All other features and facilities would be of no use if the deposit and withdrawal methods are limited or include complexities. It must be checked whether your preferred transaction method is available with the selected trading platform or not.

A free-of-cost local bank deposit and withdrawal is the most preferred method in CFD trading but it depends completely on the client. Some millennial traders also prefer cryptocurrency transactions. It is better to seek every detail regarding the preferred deposit and withdrawal method through customer support or reviews before opening the account.

No, CFD trading is not profitable for most traders, and almost 80-90% traders who trade currencies or other markets as CFDs lose money. So, if you are looking to trade through a CFD broker thinking that you can make money easily, we strongly advice against it.

CFDs are derivative contracts that allow you to speculate on a direction in the markets. Under this contract, you can expose yourself to a high leverage, which makes your position larger that if you were to use no leverage.

For example, let’s say that you are trading NASDAQ as a CFD through your broker, it make only require you to deposit a small margin for a large position.

Let’s assume that 1:100 leverage is allowed by your CFD on equity indices like US500, US3o etc. With only 100 USD (1700 ZAR), you can open position of R170,000. This means you can trade higher number of contracts.

This is how it becomes very risky. The average daily volatility of most equity indices is around 1%, sometimes higher. In one single trade, you could lose your entire capital, and your CFD broker will send you a margin call, requiring you to add more balance into your account.

The overall logic being, CFD trading is very risky. Avoid any CFD broker who doesn’t allow you to set your own leverage.

| CFD Broker | Regulation(s) | XAU/USD CFD Trading Fees | Max. Leverage | Minimum Deposit | CFD Trading Platform(s) | Start Trading |

|---|---|---|---|---|---|---|

| Tickmill | FSCA, FCA CySEC | From 9 pips spread with Pro account + $4/Lot commission | up to 1:500 | $100 | MT4 | get started |

| Hotforex | FSCA, FCA, CySEC | 29 pips & zero commissions. | up to 1:1000 | R70 ($5) | MT4 & MT5. | get started |

| XM Trading | ASIC, CySEC | 25 pips with Ultra Low account. 31 pips with Micro Account. | up to 1:888 | $5 | MT4 | get started |

| Exness | FSCA, FCA | 30 pips with Standard Account | up to 1:2000 | $1 | MT4 & MT5 | get started |

| Avatrade | FSCA | 34 pips. | 1:200 | $100 | MetaTrader 4 & MT5 for all devices | get started |

| FXTM | FSCA, FCA, Cysec | 56 pips with Micro account. | 1:500 | $50 | MetaTrader 4 & MetaTrader 5. | get started |

A Contract for Difference (CFD) is a contract or arrangement between buyer and seller by which the price difference between the opening and closing price of the trade is cash-settled. By trading CFDs, only the price of the underlying asset is speculated. There is no physical buying or selling of the underlying asset.

CFDs can be traded in South Africa through various trading platforms that are regulated by the Financial Sector Conduct Authority (FSCA). Hotforex, Exness & Tickmill are some of the FSCA regulated CFD Trading brokers.

Any individual in South Africa can open an account with CFD brokers by filling in the basic details, completing KYC, and depositing the initial amount.

Hotforex, XM and Exness are some of the platforms that have the lowest commission-free CFD trading fees in South Africa. This includes comparison of their spread & other non-trading charges.

However, the commission-based CFD trading accounts like at Tickmill, FXTM & some other brokers allow trading CFD with spreads as low as 0 pip.

The risk factors involved in CFD trading are substantially high. Due to the involvement of high leverage, traders can sometimes lose more than you invest. Hence, CFDs are instruments for professional traders only.

By taking precautionary steps like choosing a trustworthy broker, analysis of the risks, stop loss, negative balance protection etc., one can mitigate the CFD trading risks to a certain extent.

Tickmill is the #1 CFD Trading platform

Visit