BDSwiss is a European forex broker that offers multiple types of trading accounts. Their Trading Fees is competitive with the Classic account & quite low with Raw account. They also offer ZAR currency accounts & local funding and withdrawals via Local Bank Transfer. Read our detailed review on BDSwiss for South African traders to find where they shine & lack.

BDSwiss is an International Forex and CFD broker that is licensed with FSC & FSA regulations. BDSwiss was launched in 2012 in Zurich but has a physical presence in various countries around the world. They are mainly popular in European countries.

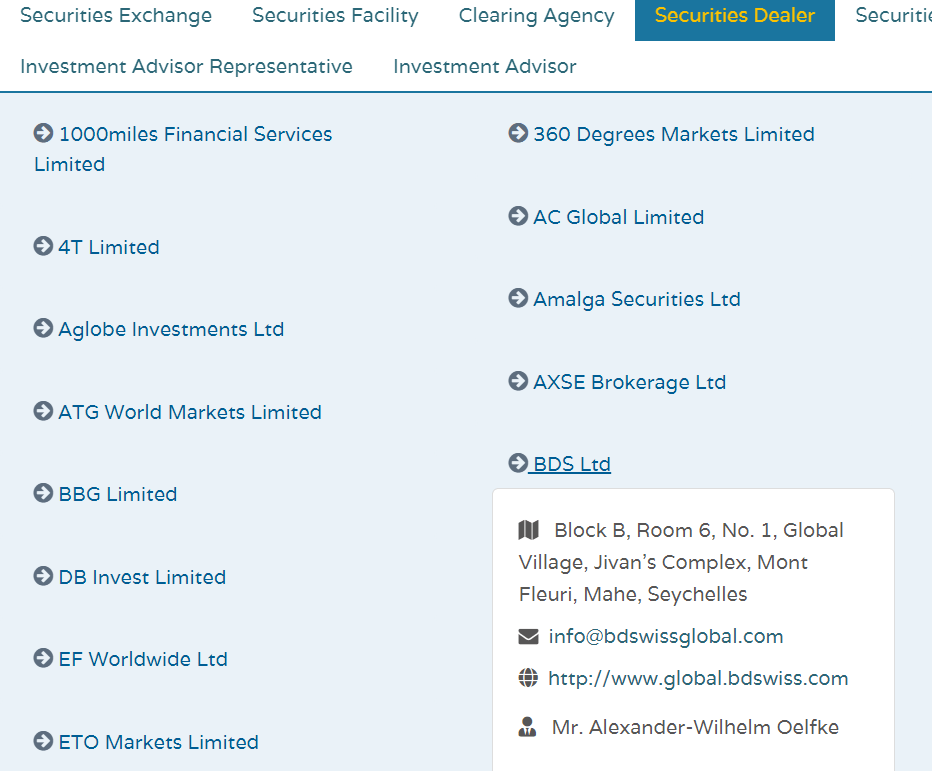

BDSwiss accepts traders from South Africa, but it is not regulated by FSCA and does not have a local office in South Africa currently. The clients from SA are registered under ‘BDS Ltd’.

They are a reputed CFD broker that allows trading on a wide range of CFD trading instruments including 51 currency pairs & 200+ other CFDs on shares, commodities and indices. 1000+ Instruments including stocks and ETFs are offered on their platform.

We liked their responsive customer support services & the variations in types of trading accounts. Also, they don’t charge any extra commission for deposits or withdrawals.

Read our unbiased review of BDSwiss that covers all the pros and cons of choosing this Forex broker for traders in South Africa.

BDSwiss Pros

BDSwiss Cons

| 👌 Our verdict on BDSwiss | #2 Forex Broker in South Africa |

| 🏦 Broker Name | BDSwiss |

| 💵 Average EURUSD Spread | 1.5 pips (Classic Account) but changes according to entity/account type |

| 📅 Year Founded | 2012 |

| 🌐 Website | www.bdswiss.group |

| 💰 BDSwiss Minimum Deposit | $10 (ZAR 160) with Classic Account |

| ⚙️ Maximum Leverage | 1:500 |

| ⚖️ BDSwiss Regulation(s) | FSC, FSA Seychelles |

| 🛍️ Trading Instruments | 51 Currency Pairs, 200 other CFDs on Indices, Cryptos, Shares, Commodities |

| 📱 Trading Platforms | MT4 & MT5 for desktop, web & mobile |

BDSwiss Group are not regulated by FSCA in South Africa, and ‘BDS Ltd.’ are registered under offshore regulation FSA . BDSwiss Broker was launched in 2012 and claims to have more than 1.5 million registered trading accounts to date.

BDSwiss Group currently holds regulatory licenses of the following regulatory authorities:

Traders based in South Africa are registered under BDS Ltd. FSA, Mauritius.

BDSwiss is a popular broker in Europe & UK, but their global entity is not regulated by any Tier-1 regulator. This makes BDSwiss a moderate risk forex broker for traders in South Africa as offshore & cross-border regulations are not as safer as domestic regulation & Tier-1 regulations.

BDSwiss is not listed on any stock exchange and does not hold a banking license. The client’s funds are kept in a segregated bank account.

BDSwiss has a good track record as we couldn’t find any proven scam or complaint against it.

Compared to other Forex brokers in South Africa that are regulated by FSCA, BDSwiss holds a lower safety rating due to them not being regulated locally or with any Tier-1 regulator.

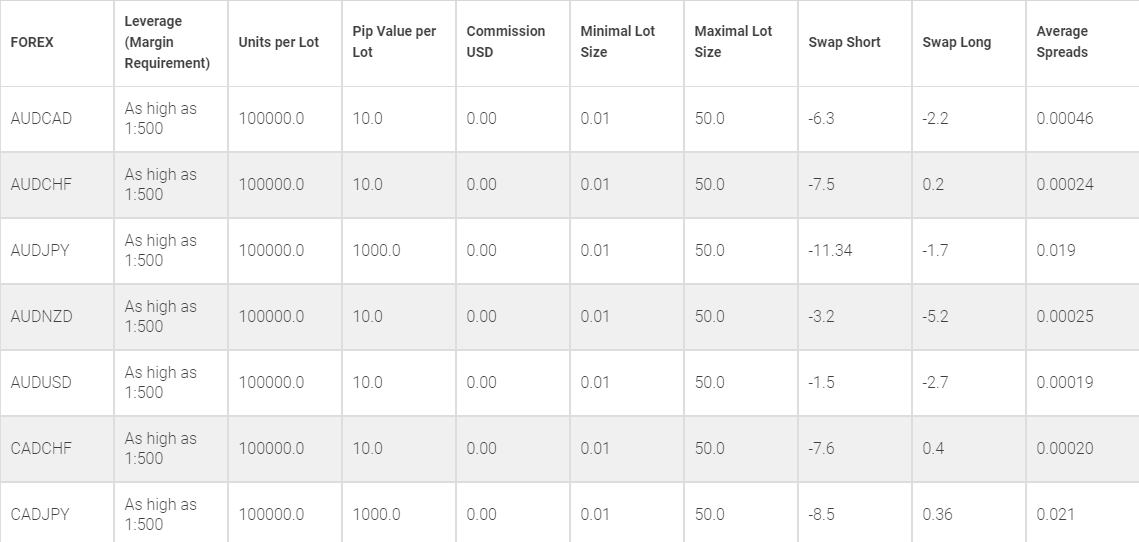

For a comprehensive review of the fee structure at BDSwiss, we have divided it into trading and non-trading fees. The incurred charges at BDSwiss differ for the account type chosen by the trader.

BDSwiss Trading Fees

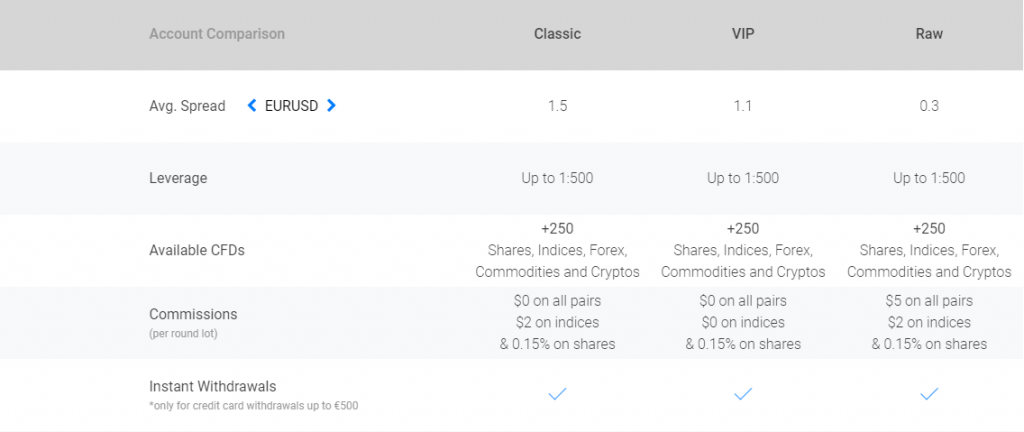

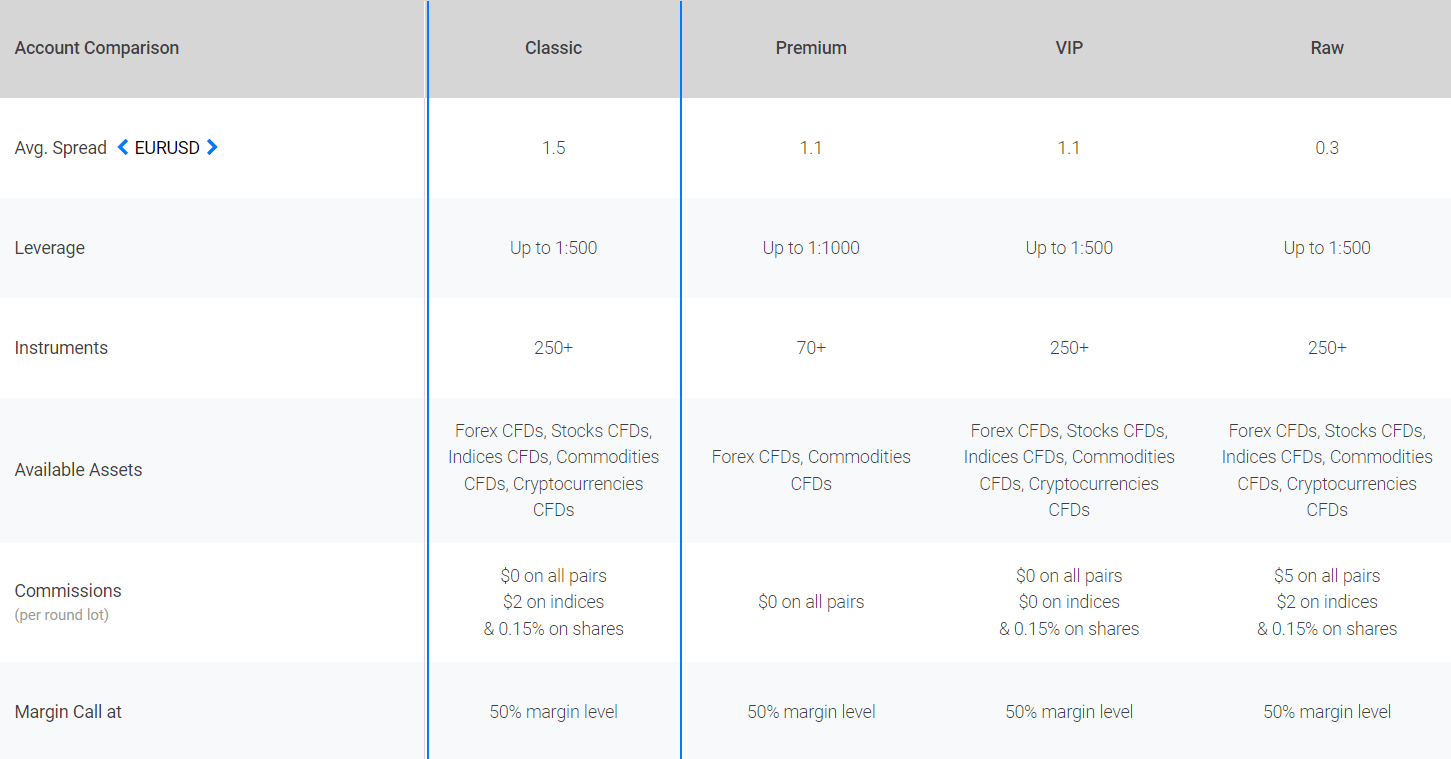

This includes the fees that are incurred while executing trades. BDSwiss offers 4 active trading accounts namely Classic, Premium, VIP & Raw trading accounts.

The Classic, Premium and VIP account types are commission-free for trading currencies while the Raw spread account is a commission-based account with a very tight spread.

Below Table shows the typical spread & commission for major like EUR/USD with different account types on BDSwiss.

| Account Type | EUR/USD Average/Typical Spread |

|---|---|

| Classic Account | 1.5 pips |

| Premium Account | 1.1 pips |

| VIP Account | 1.1 pips |

| Raw Account | 0.3 pips (plus $5/lot) |

Note: There is no extra commission per lot with any account type other than the Raw Account on all currency pairs. There is an extra commission on $5 on all currency pairs, $2 on indices an 0.15% on shares with Raw accounts.

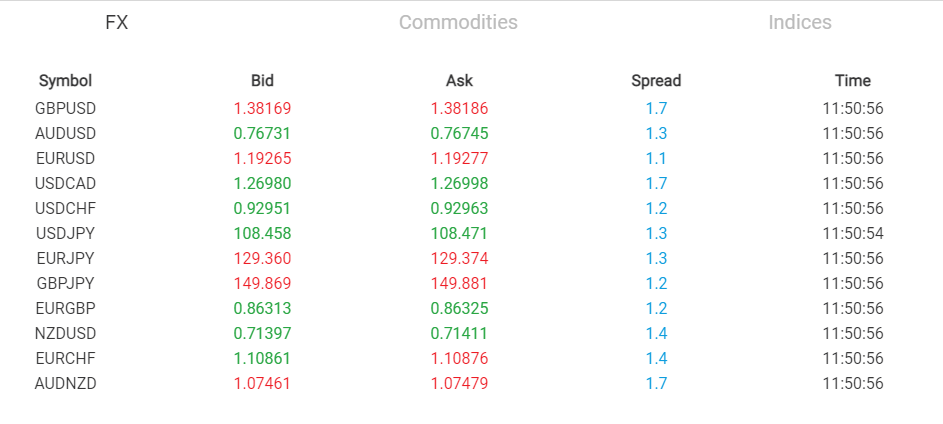

The spreads are variable and fluctuate depending on the market conditions and liquidity in the market. The average typical spread for EUR/USD for the Classic account type is 1.5 pips per lot.

The average typical spread for EUR/USD with the VIP account is 1.1 pips per lot.

The commission for one round trade is $5 for forex and CFDs on commodities and $2 on indices and 0.15% on shares with the Raw account type.

Trading with CFDs on stocks with any of the account types will incur the same fees. A commission of 0.15% is charged for each round trade of CFDs on all the available stocks with any of the account types.

Compared to other regulated forex and CFD brokers in South Africa, we found BDSwiss to be decently priced as the spreads on the classic account are decent. The VIP account spreads are impressive and no commission makes it an ideal choice. The commission on the Raw spread account is lower than a majority of the commission-based account types with a very tight spread.

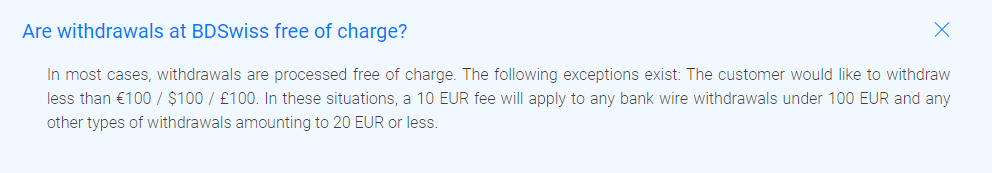

BDSwiss Non-Trading Fees

This includes all the fees that may apply to the fitting trader without executing trade orders.

The account opening at BDSwiss is free while the deposit and withdrawals with credit cards are also free of cost.

Traders might have to pay the following non-trading fees.

Compared to other regulated forex and CFD brokers in South Africa, the non-trading fees at BDSwiss are marginally higher than many of them. The inactivity fees can be very ineffective for the traders who trade occasionally.

But if you are a high volume trader, then the trading fees is low if you trade with Raw Account as the spread + commission is quite low. This will make the overall fees low.

BDSwiss offers a leverage of upto 1:500 with all the account types. But the leverage can be as high as 1:1000 with the Premium account.

Traders based in South Africa have the option to adjust to a lower leverage.

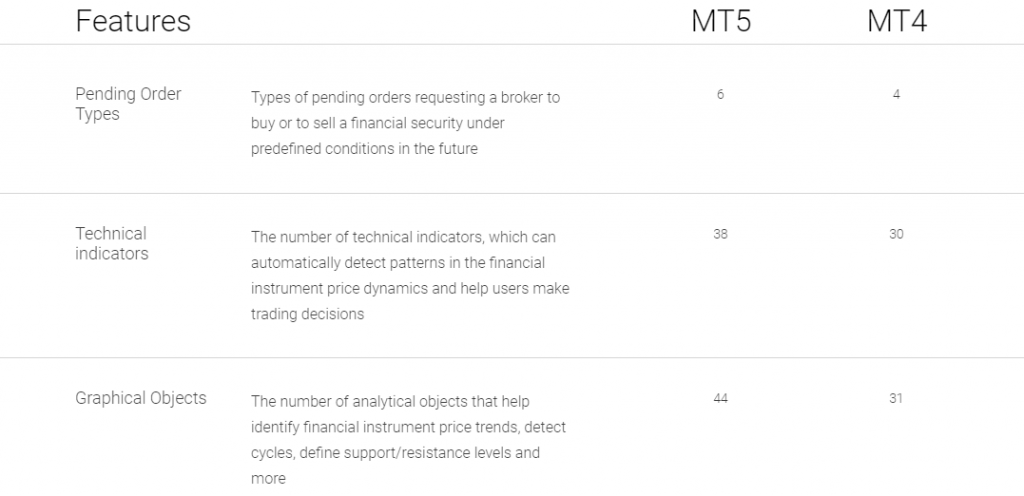

1) MT4 & MT5: BDSwiss provides the most widely used MetaTrader trading application that is available for Windows, macOS, Android, and iOS devices. Traders can choose between MT4 and MT5 trading platforms according to their own convenience and ease of use. The MT4 and MT5 are the most chosen trading platform for forex and CFD trading, so Metatrader is supported by a large number of forex brokers.

2) Forex Web Trader: Apart from MT4 and MT5, BDSwiss also has its WebTrader platform designed by itself. This web trader application provides various technical and analytical features in a user-friendly manner.

3) BDSwiss Mobile App: They also have a mobile app which is available on both Android & iOS.

Overall, their trading platforms are good & supported across all devices.

The customer support executives at BDSwiss can be reached out for assistance at any step in the trading process. Following is the review of all the available methods to connect with the support staff at BDSwiss.

The customer support services at BDSwiss are decent, as their live chat agents were supportive and resourceful during our research. The lack of local phone support in SA or any other official social media platform support limits its ratings in the customer support segment.

BDSwiss offers Free demo trading account for traders in South Africa. Traders can open a demo account at BDSwiss & download MT4 in few minutes from their website. We found the process to be quick & simple.

BDSwiss allows traders to choose from 4 different Live account types according to your own preference & suitability. The minimum deposit at BDSwiss is $100 for SA traders with Classic Account.

BDSwiss provide a ZAR Base Currency Trading Account. So South African traders can open account using ZAR base currency. Moreover If you want to choose different base currency account then you can open with USD, EUR, or GBP as the base currency.

Our below detailed review of the account types will assist South African traders in identifying the best-suited account type at BDSwiss.

The classic account type allows trading on all the available instruments but grants limited access to features like autochartist and trading alerts. With a deposit of more than $500 or equivalent, traders can gain access to the autochartist and with $1000+ deposit you get access to personal account manager features.

Apart from lower spreads and 0 commission on all the available trading instruments, clients with VIP account can avail various other features over the classic account. The VIP account grants access to various features like trend analytical tools, autochartist, personal account manager, VIP trading alerts, etc.

The Classic & VIP account types at BDSwiss can be opened with either MT4 or MT5 trading platforms and the number of available trading instruments is nearly the same. 250+ CFDs on Shares, Indices, Forex, Commodities and Cryptos are available with these 2 account types. Some of the CFD instruments are not available to trade with VIP and Raw account types.

Premium Account is only available on MT4 & you can trade CFDs on Currencies & Commodities with this account type at moderate spreads.

BDSwiss offers different account types to match the suitability of all types of traders. We liked the variations in the account types offered. Although, the high minimum deposit for VIP & Raw accounts is a con. Also, the availability of ZAR-based trading account is a good option for those seeking to trade with ZAR base currency account in South Africa.

BDSwiss offers forex and CFD trading services across wide range of financial trading instruments. The total no. of CFD trading instruments are high at BDSwiss compared to other CFD brokers.

The product offering can be grouped into 5 categories:

Traders must understand that by trading through CFDs, they do not physically own any of the assets but are only speculating on the price movement of the underlying instrument in the concerned financial market.

Compared to other regulated forex and CFD brokers in South Africa, the number of available trading instruments is decent as several regulated brokers offer more trading instruments.

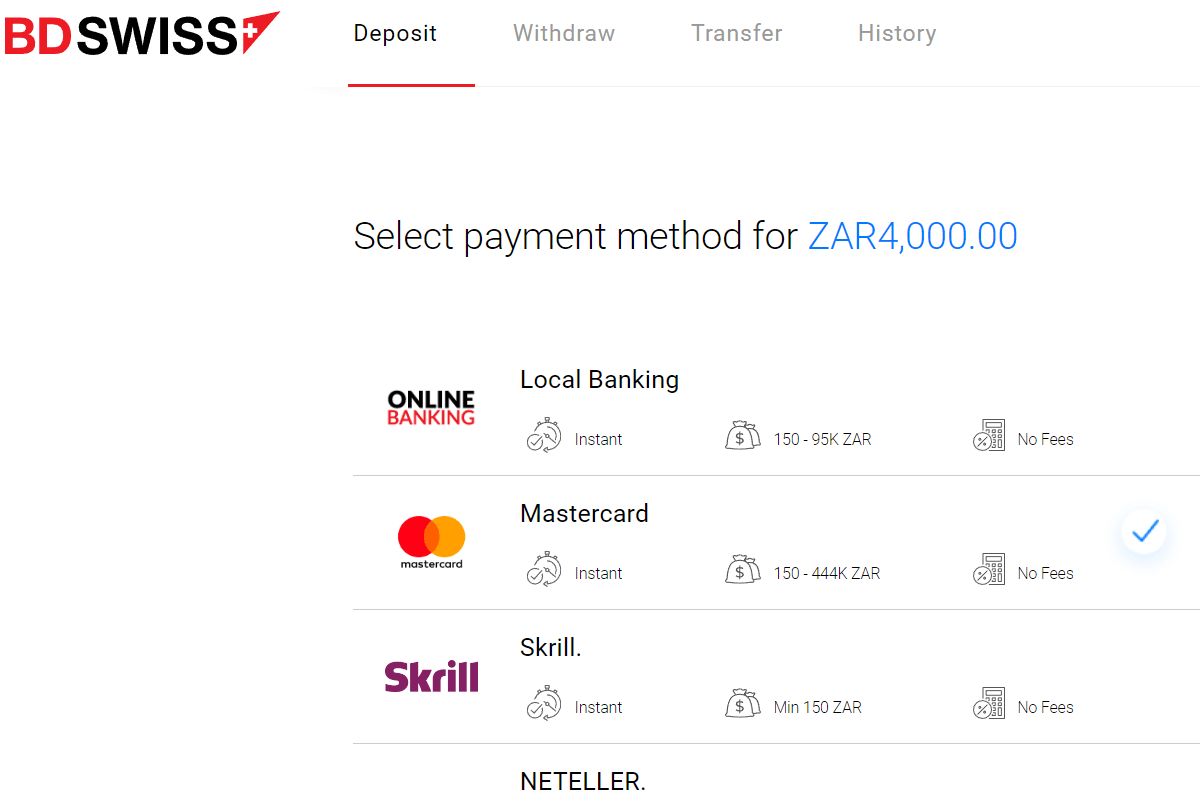

BDSwiss offers multiple local methods of funding and withdrawal for traders in South Africa. But it is important to note that like other brokers, the method you use to deposit should be the same method you use to withdraw.

Withdrawal requests are processed by BDSwiss’s Account Team within one working day. However, the time required for the funds to be transferred to the account may vary, depending on the payment method.

1) Local Banking: BDSwiss don’t have local Bank account in SA currently but you can transfer using your local bank account via internet banking. This is the most simple method for South African traders.

2) Credit & Debit Cards: The credit card is the most convenient method for South African traders at BDSwiss.

3) Wire Transfer & E-Wallets: They also accept bank wire transfers and e-wallets like Skrill, Neteller, and many more.

4) Cryptocurrencies: Traders can also transact through 3 cryptocurrencies namely BTC, BCH, and ETH.

The lower cap on deposit is is 10 USD (or 150ZAR) for all the available methods.

The availability of local bank transfer option in ZAR is a pro.

For example, if your account base currency is in USD, and you are making a deposit of $300 via Bank Wire, then your bank would charge you conversion fees & likely a markup on the exchange rates for conversion to USD.

So, the overall fees would be higher to deposit funds in this example as compared to brokers that offer funding & withdrawals in ZAR with ZAR Base Currency Accounts.

With the the withdrawal fees at BDSwiss?

There is no extra fees on withdrawals with methods at BDSwiss except for card & wire. There is a minimum withdrawal amount which is 25$ and amounts lower than that can not be processed. There is no withdrawal fees when you request a withdrawal higher than these limits.

You can withdraw funds via Bank transfer to your Bank account in South Africa.

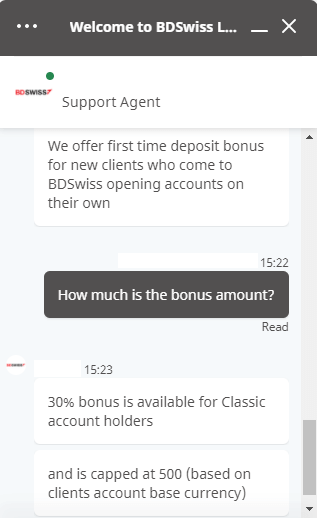

Currently there are no ongoing bonus offers at BDSwiss. We will update this section if there is an update in the future.

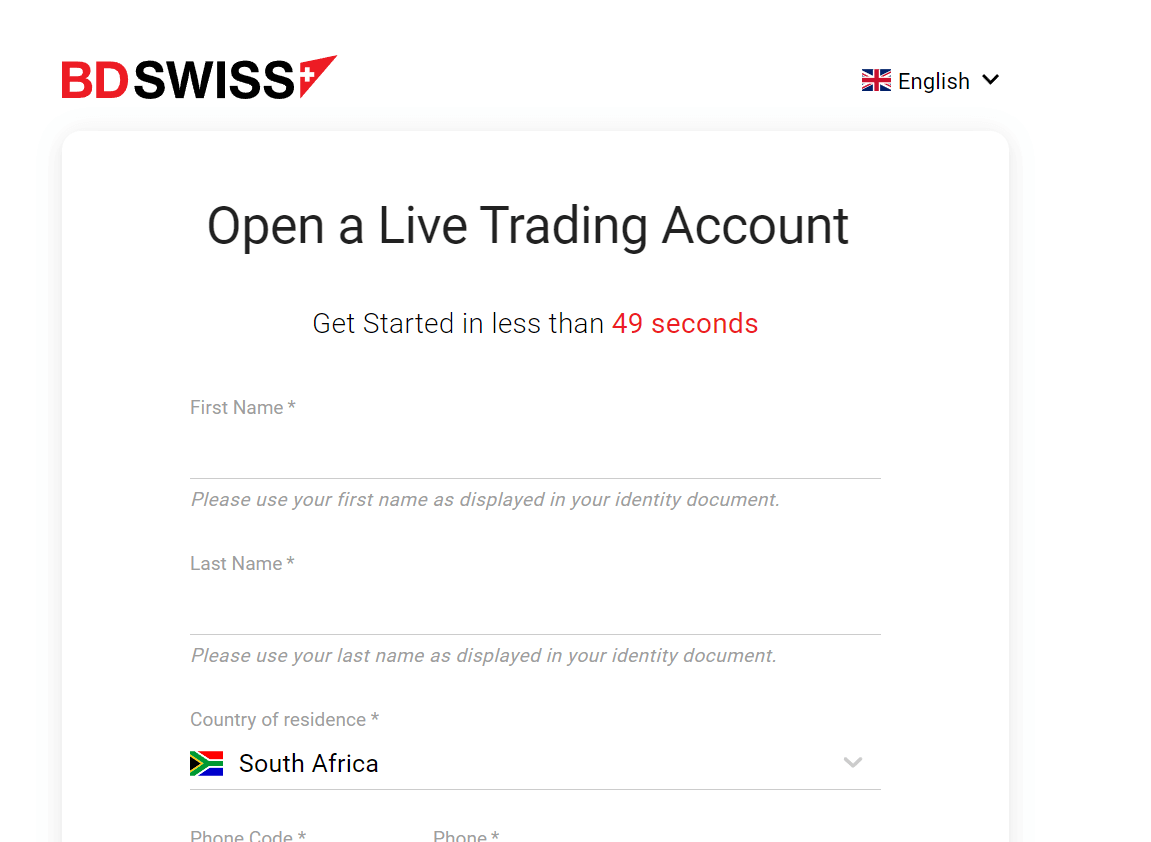

Opening an account with BDSwiss does not have many steps. You can open an account with them within few minutes by following the below steps:

Step 1) Click on the “Sign Up” Button: First of all, visitors need to click on the “Sign Up” button showing at the top right side of the home page of the BDSwiss website.

Step 2) Enter personal details: Now you need to enter some of your personal details like country, address, and date of birth, as shown in the below screenshot.

Step 3) Account Verification: After entering your personal information, you must submit one ID proof and one address proof for account verification.This process can take some time due to manual verification by BDSwiss.

Step 4) Fund your account: After the KYC verification, traders can fund their account using any preferred payment method to start trading.

Yes, BDSwiss is a European forex broker that offers wide range of trading instruments & multiple account types to facilitate multiple types of traders.

For lower volume traders and beginners, their cost can be slightly higher compared to a few regulated brokers in South Africa. Large volume traders can take advantage of the lower spreads and commission with Raw account type. Plus, traders can trade a wider range of CFD instruments at BDSwiss compared to other CFD brokers in SA.

But the lack of FSCA regulation, local phone number, and local office are some of the major drawdown we find for traders in South Africa.

BDSwiss is a FSC & FSA authorized forex & CFD broker. But they are not regulated with FSCA in South Africa. Their global company BDS Ltd. is not regulated with any Top-tier regulation.

The minimum deposit amount is 10 USD (or R150) with the Classic account for South African Trader with ZAR base currency account.

Yes, BDSwiss allow South African Trader to choose ZAR base currency account. You can choose this option when opening your new trading account. You can also open account in USD, EUR or GBP currencies.

BDSwiss has a range of payment methods which include wallets & Bank Wire Transfer. South African traders can also transfer in ZAR using Internet/Local Banking and EFT option, which is available for withdrawals as well.

"Do you have experience with BDSwiss? Please consider sharing your experience with a review below – good or bad – doesn’t really matter as long as it’s helpful to other traders!"

We only accept user reviews that add value to fellow South African Traders. Unfortunately, not all reviews that you post with us will be published on the website. For your review to be approved, please share your detailed & honest experience with the broker – either positive or negative. Thank you for helping out other traders with your valueable feedback!

Important: We don't accept any payments or kickbacks from any forex broker(s) to delete or change any reviews. We welcome Forex Brokers to reply to reviews on our website & share their side of the story to keep the process honest and fair for both sides.

Submit Your Review