We opened account with the forex brokers that have ZAR Trading accounts & tested their account opening, trading costs for majors/ZAR crosses.

ZAR Forex Trading Accounts are quite useful for traders in South Africa. This will help you avoid losses in fees during the conversion of currency on deposits or withdrawals.

Having a ZAR Account implies that all your funds with the broker will be kept in Rand. In most cases, this would mean the broker likely has local bank account in SA, so you can access quick and convenient withdrawals and deposits through bank transfer.

However, only a few brokers in South Africa have ZAR Accounts currently. Most of them claim to provide more or less similar trading environment and features. So choosing the best ZAR account broker is not easy.

List of Best brokers with ZAR accounts for forex traders

For this guide, we have done extensive research of Forex brokers offering ZAR Accounts. After shortlisting, we selected only the highly regulated and reliable brokers working in the South African market.

For the safety of your funds, even if your consideration is ZAR base currency account, you must still trade with only brokers that are regulated with FSCA or other Top tier regulators like FCA, ASIC.

Our research offers a comparison of the top regulated Forex brokers offering ZAR Trading Accounts. We tested the exact pips charged for trading EUR/USD, USD/ZAR & other pairs. We also check their account deposit requirements in Rand, plus the safety of funds your have deposited with the broker.

Ranked #1 ZAR account Forex Broker

Exness is licensed under FSCA for offering forex trading & you can open your trading account with them in ZAR account currency (for all their listed account types).

Fees: The trading fees at Exness is very low compared to other forex brokers. With their Standard account the average spread is 1 pips for a major currency pair EURUSD, and the spread is lower with Pro account at 0.6 pips. Exness also has commission based accounts with Raw spreads from 0 pips on average. With Raw spread account, their commission is $7/lot for roundturn.

The Swap Fees is also competitive for most of the Forex pairs. For example, for EUR/USD the Long Swap is −4.11 USD & it is 0.98 USD for Short positions.

Exness has floating spreads, so the actual spreads that you get during trading can be higher from their typical spreads. Generally their spreads are as per the typical spreads which they have listed on their website. But users in our Exness review have reported higher spreads & gaps in price during certain trading hours.

Wide range of trading Instruments & features: Exness offers over 100+ currency pairs, and CFDs on 100+ Metals, Cryptos, Stocks & Indices.

The highest leverage at Exness is 1:2000. Exness offers MT4 & MT5 trading platforms.

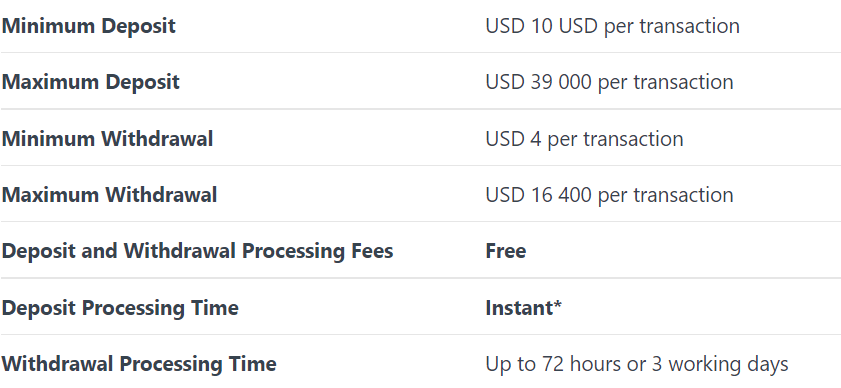

Exness offer free (no extra fees) funding & withdrawals via Internet Banking transfer in South Africa. The deposits are instant, but the withdrawals can take upto 3 Business days.

The minimum deposit with Internet Banking Transfer is USD 10, and the deposits are added instantly (within few minutes). The withdrawals via this method are processed within 72 hours, and the minimum withdrawal amount is USD 4.

But it is important to note that if your account base currency is not in ZAR, but your deposit & withdrawals are in ZAR, then Exness would apply their own exchange rates on which there is generally a markup. Their markup is much higher than other brokera.

Not so Good Customer Support: Customer Support at Exness is not the best. They offer customer support via email, live chat & phone support. But they don’t have a local phone number in South Africa & their responses via email are very slow. During our tests, we received the response in few days on average via email. Most other brokers offer better customer support than Exness.

Exness ZAR Account Pros

Exness ZAR Account Cons

Ranked #2 ZAR account Forex Broker in South Africa

HotForex is a good ZAR account forex broker for traders in South Africa. HFM holds licenses with multiple regulators & is licensed with FSCA. But they are not a licensed ODP.

HotForex offers Direct Market access. This means your orders get straight-through processing with no dealing desk. Orders are placed directly with their liquidity providers. Therefore conflict of interest is absent.

Fees: We compared their fees and found the cost to be quite fair (though not the lowest). In terms of fees for trading, HotForex has the lowest spread with the Zero Account, but there is a roundturn commission of $6/lot (R80) for majors & $8/Standard lot (R110) for all other currency pairs. There is no fee for deposits or withdrawals at HF.

The average USD/ZAR spread with the HF Premium account is around 90 (variable as per market conditions). For a Zero Account, it is usually around 45 pips. Premium Account is a commission-free spread only. Zero Account has a spread of + $6 per 100,000 units (1 standard lot) for majors. For other instruments like XAU/USD (0.29 pips), EUR/USD (1.3 pips), NAS100 (2.03 pips) etc. their average fees is quite competitive compared to other forex brokers. Their fees is lowest with their Zero Account.

Fair Trading Conditions: HotForex offers 53 currency pairs including exotic, minors, and majors. Its trading instruments also include CFDs on 56 shares, 11 Indices globally, 8 Commodities, 3 top global Bonds, Energies such as Crude and Brent Oil, US Natural Gas, and Spot Metals – Silver and Gold. They now also offer crypto CFDs. HF offers trading on the latest MT4 and MT5 platforms for all devices.

In terms of risk management, negative balance protection is available at HotForex. But they don’t offer guaranteed stop loss orders.

The minimum balance for opening an account is ZAR 70-80 approx. & there are no deposit or withdrawal fees. The max. leverage offered is up to 1:1000 and the speed of order execution is fair. HF also allows Scalping, Hedging, EAs, and Swap-Free Accounts.

You can also make a deposit or withdrawal via EFT i.e. local Bank Transfer in SA. There is no fees for deposit or withdrawal with this method. If you open an account with ZAR as your Base currency, then you will not incur any fees or losses on currency conversion.

Good Support: HotForex has a local phone number in South Africa (+27-10-443-9924, 0-800-999-265). The Live Chat Support is quick and helpful available 24X5 on weekdays. We did not experience a hold time of above 1 minute while connecting during working hours at any time.

HotForex Pros

HotForex Cons

Read our detailed Hotforex South Africa review & details of their ZAR Account

Ranked #3 ZAR account broker

FxPro Financial Services Ltd. is authorized by FSCA with FSP. They allow SA traders have ZAR as the account currency. You can also trade ZAR crosses with them.

Fees: Their fees is not the lowest, but it is still quite competitive for most instruments. FxPro offers choice between platforms & execution, and the exact spread varies depending on that. For eg: Their average spread for USDZAR with MT4 platform & market execution is 174.01, whereas it is 203.76 + $4.5 per Standard lot traded on cTrader platform with market execution.

For lower overall fees, you can choose the cTrader account type. Also, the fees is different for different execution models. For example, for major like EURUSD, with MT4 platform, the average spread is 1.40 with the Instant Execution model. But if you are choosing MT4 platform with Market execution, then the average spread is 1.28 & lowest is 0.8. So, you should check which platform & execution model do you prefer, so you can know what the fees will be.

The Swap charges at FxPro for currency CFDs are moderate. But they do not charge any fees on deposits & withdrawals to traders in SA. Overall, their fees is moderate.

Trading Conditions & features: There are multiple account choices at FxPro based on your trading platform. Traders can trade 70 currency pairs & 300+ CFDs on Indices, metals, energies, shares & futures. Crypto CFDs are not available under FxPro Financial Services Ltd.

Fair Customer Support: The support at FxPro is okay. They have a virtual assistant on their website, which is helpful for basic queries. You can fill up the live chart form on their website & connect to their live chat agents. During our test on a weekday, we were connected with a hold time of few minutes.

Ranked #4 ZAR account broker

Tickmill (Tickmill South Africa Pty Ltd) is an authorized FSCA licensed entity. They also have an approved ODP license status & all 3 Tickmill account types have ZAR base currency choice.

Tickmill now also offers South African traders to open & maintain their accounts in ZAR account currency. Prior to this, the only options were USD & EUR. Moreover, there is option to use local bank transfers for deposits & withdrawal in South African Rand.

Fees: The overall trading fees at Tickmill is variable according to your account type. In general, the fees is low with Pro Account. You are charged spreads from 0 pips, but there is a 0.4 USD roundturn commission per mini lot (10,000 units).

This makes their overall fees (spreads + commissions) very low with Pro Account. The typical spreads are 0.1 pips for EUR/USD, 79.2 pips for USD/ZAR, which are lower than other forex brokers.

The Swap charges at Tickmill for currency CFDs are low. For example, they have a positive Swap for Long USD/JPY, while most other forex brokers have zero. Tickmill does not charge any extra fees for deposits & withdrawals, and you can withdraw via EFT in ZAR to your South African Bank Account.

Trading Conditions & features: Tickmill offers CFD trading on 62 currency pairs, 16 stock indices (including USTEC or NASDAQ 100), 6 commodities (including XAU/USD), Bonds & cryptos. They are one of the few CFD brokers that offer CFDs on Bonds, although there are only 4 Bond CFD instruments for trading on their platform.

Fair Customer Support: The overall support offered by Tickmill is good. They have a live chat on their website which is available during the business hours. They also have a local phone number & South African address on their website.

Ranked #5 ZAR account Forex Broker

XMZA has an entity that is licensed in South Africa, but don’t have an ODP approved. They have 3 account types that can be opened in ZAR.

Average Fees: Their trading fees with Ultra Low account is competitive for most instruments. As an example: the average EURUSD spread is 0.8 pips with Ultra Low Standard account. But for minor currency pairs like USDZAR (118 pips) & CFD indices like NASDAQ (5 pips), their spread is higher than HotForex & Exness.

But if you are trading with Micro Account or Standard then their spread is quite high. For ex. XM’s typical spread for major like EUR/USD was around 2 pips during our tests. On average it is around 1.9-2 pips during normal market conditions.

XM’s Swap Fees is also generally higher compared to other forex brokers (as an example, it is around -5.3 USD for EUR/USD Long & -0.9 USD for Short with Standard Lot), so you should take that into account if you want to keep your trade open overnight.

Wide range of CFD trading Instruments: XM had a wide range of CFD trading instruments available on its platform including 57 currency pairs & 1000+ CFDs on stocks, commodities, metals, shares & indices. But Crypto CFDs are not available currently on their platform.

Plus, negative balance protection is available. Traders have choice between MT4 & MT5 platforms. You can deposit & withdraw funds via EFT on XM’s platform.

Responsive Live Chat Support: Customer Support is solid at XM. We tested their live chat support & we found it to be quite responsive & helpful. Their email support is okay & we received their response in 2 hours during our test.

Ranked #6 ZAR account CFD Trading platform

Plus500 is one of the leading forex trading platform. They are well regulated with multiple Top tier regulators including with ASIC, FCA & CySEC. Moreover, the company Plus500 Ltd is also listed on the London Stock Exchange and it is thus considered a relatively safe CFD trading platform for traders in SA.

Fees: Plus500 offers competitive spread to the traders – as low as 0.6 pips for the benchmark EUR/USD. They also do not charge any fees for withdrawals or deposits.

Moreover, there is no other volume/lot based commission on forex trading. The only trading fees that they charge is the variable spread which depends on the instrument that you are trading.

Trading Conditions & features: There is only a single account type for Retail traders at Plus500 South Africa. The minimum deposit is ZAR 1500 and the max. leverage is 1:30 (for forex trading & lower for other CFDs) for SA traders. The broker also provides protection for the negative balance and assured stop-loss protection. These features are included in your trading account without charging any additional fees.

Traders can choose from 71 currency pairs, 1000+ CFDs on stocks. The other asset classes include CFDs on 8 Commodities, 7 Cryptocurrencies, 8 Indices, 6 Energies, and 4 Precious Metals.

Plus500 offers you its proprietary trading platforms for Web and Mobile trading. On the downside, this platform is not accessible in Desktop. Also, Plus500 does not support the popular MetaTrader platform, and they also don’t support the cTrader platform.

Decent Support: Customer Support is available through Live Chat, Email & Whatsapp. There is also a decent FAQs section for self-help. They don’t have a South African phone number listed on their website for support.

Live Chat support can be accessed only when you are logged in. It is necessary to fill Contact Form for availing e-mail support. On testing, we received a response within 1 hour on a weekday from their email (listed on their support page).

Plus500 Pros

Plus500 Cons

Ranked #7 ZAR account Forex Broker

IFX Brokers is a FSCA regulated forex broker that has local presence (they are a local broker). They offer option to choose ZAR as the account’s base currency.

Fees: The trading fees at IFX Brokers depends on the account type. The lowest spreads is with their Premium Account, starting from 1 pips.

They also have a commission based VIP account which has a lower spread, but there is a commission of $6/lot roundturn.

Trading Conditions & features: The minimum deposit is with Standard & Cent Accounts i.e. $10, which is approx. R1500. The deposit requirements are higher at $100 for Premium Account & $1000 for VIP Account.

They offer MT4 & MT5 trading platforms with all account types. The max. leverage offers is 1:500 for currency trading & it can be lower depending on the CFD instruments that you are trading.

There are 53 currency pairs available for trading on their MT4 platform. You can also trade CFDs on Gold, major indices, energies & cryptos.

You can deposit & withdraw funds in ZAR via local methods including EFT via bank accounts in SA.

Local Support: They have an email & local phone number in South Africa listed on their website for support..

IFX Brokers Pros

IFX Brokers Cons

Ranked #8 ZAR account Forex Broker

JustMarkets is a FSCA regulated forex broker, but the counterparty or issuer of the CFDs may be their foreign entity. You can select ZAR base currency when opening any new trading account at Just Markets.

Fees: The overall trading charges at JustMarkets are moderate. Their lowest spreads are with their Raw & Pro accounts on MT4.

There is $6 roundturn extra commission per lot with Raw account type. Other accounts are spread based only.

Trading Conditions & features: The minimum deposit in ZAR at JustMarkets is R18 with the Standard Account. For Pro & Raw accounts, the minimum deposit is approx. R1800 (or equivalent of $100).

You can choose between MT4 or MT5 platforms. They also have an app with Copytrading features. But they don’t offer cTrader or Tradingview platforms.

JustMarkets supports CFD trading on 66 major & minor currency pairs, 14 crypto CFDs, 14 Indices (including US100 or NASDAQ) & 3 commodities, 7 metals & 100+ stock CFDs..

JustMarkets does support payments via bank transfers in ZAR via local bank accounts. The deposits are instant, but bank withdrawals at the broker & payment provider usually takes upto 3 business days.

Non South African Support: There is no local dedicated South African phone number on their website. You can contact them via email, live chat, foreign phone no. or social channels.

read our in-depth JustMarkets review

There are a few advantages to trading with a broker that offers ZAR base currency accounts.

a. Depends on your mostly traded trading instrument:

This is valid if your account is funded through the most frequently traded quote currency.

For instance, if you mostly trade South African Rand pairs with quote currency being ZAR such as USD/ZAR, EUR/ZAR, GBP/ZAR, then there may be certain advantages to opening your trading account in ZAR base currency.

If your account is funded in ZAR, then your account balance will be in Rand, and all your profits too will by default be converted into ZAR (Rand) once you close the trade. In case you are trading mostly ZAR quote currency pairs, then a conversion transaction will not be required. You will also save the commissions if your broker charges commission for the transaction to convert to another base currency like USD or EUR.

It is preferred that your account currency is the same as the quote currency of your mostly traded currency pairs. If not, you will lose during the re-conversion of funds to your funding currency each time you trade.

You may have to pay an extra commission each time you trade if the broker charges for conversion. This could add up to much eventually.

Let’s say that 70% of your monthly trading volume is in currency pairs that involve ZAR, then it is safe to assume that most of your P&L would be in ZAR. So, it makes less sense to have your account denominated in USD or another currency (as your base currency with your broker).

This is because, first, it can get confusing to calculate your trading exposure of positions in your account in different currencies, and second, you will also have to calculate how much you are losing monthly in active currency conversions of your withdrawals & deposits.

Do the calculation of the brokerage & banking fees you will have to pay if you will pay during these conversion to ZAR, from your broker to your local bank account. We explain this in more detail in the section below.

b. Conversion charges during withdrawal (by your bank and/or the broker):

Once you decide on the withdrawal, you will want to get withdrawal from your broker in your South African bank account.

In case you hold a ZAR account, the broker can directly send your withdrawal in Rand. Instead consider a case where you request the withdrawal in USD (if your base currency is US Dollar), then your bank, broker (or both) may charge you fees for the USD wire transfer to your SA based bank account.

Here, the currency conversion fees/spread on exchange rates of anywhere from 2% – 6% could be charged by your bank. If the USD/ZAR exchange rate is 15, your bank will likely charge its fees on the exchange rate and offer you around 14.8 at the very least. Your broker and bank may also levy wire charges for receipt of USD payments.

But in case of ZAR account, it is very likely that the Rand withdrawal transfer by broker will be from the broker’s local bank account in South Africa.

This will save you the Interbank fees for withdrawal that would be incurred during bank wire transfer withdrawals, as well as the exchange rate spread charged by your bank for conversion to Rand from another currency like USD.

Also, there are regulated brokers that accept deposits in ZAR (South African Rand) via Internet Bank transfer in SA, but don’t offer ZAR account. Instead they only have USD, EUR etc. account base currency options. Or these brokers offer ZAR account currency option but you have selected USD (example) as your base currency instead of ZAR.

In such a case, brokers normally have a mark-up on the exchange rates during deposits in ZAR & conversion into your account currency like USD. And similar there is a markup on the exchange rates during withdrawal i.e. conversion from USD back to ZAR in your South African bank account.

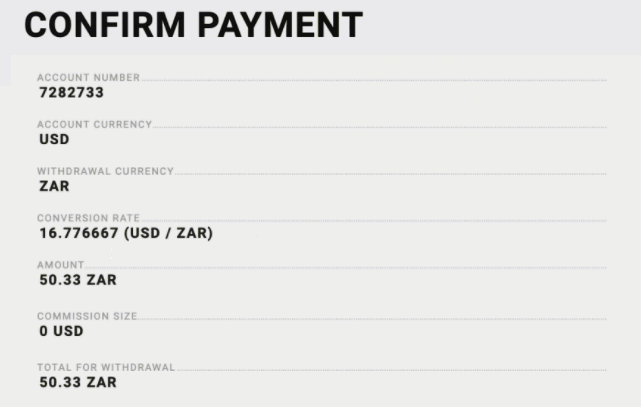

Regulated Brokers will generally show you the exchange rates that were offered during deposit & withdrawal. For example, Exness shows the ‘Conversion Rate‘ that was offered for the withdrawal via Internet Banking in South Africa in ZAR, if your account currency is not in ZAR.

Below is a screenshot from Exness on the conversion fees during this proceed.

You will lose part of your deposits & withdrawals during conversion into another currency. The currency conversion fees can add up, and this could mean lower returns for a trader when you calculate your returns at the end of month or quarter.

But this fees can be avoided by choosing a broker that offers ZAR base currency account & option to fund/withdraw in Rand using local Internet Banking transfer in SA. But one important consideration here is that all your trading activities, including your accounts statement, P&L will be in ZAR.

c. Faster Deposits & Withdrawals

Most of the forex brokers that offer ZAR Base currency option also accept deposit & withdrawals via Internet Banking in SA through most of the major banks.

Generally, this method a lot faster than other methods like wire transfers, which can also be much harder with exchange. For ex. Exness, HotForex & Tickmill have almost instant funding via Internet Banking. Also, the withdrawals are generally quicker than other methods, but can take upto 3 working days at some brokers.

Also, compared to deposit via card, bank transfers at most brokers are free.

For ex. Exness, HotForex, Tickmill etc. offer deposits & withdrawals via EFT in SA without any extra charges. When compared to other methods, those can have extra gateway fees which are normally very high. Also, most brokers support transfer via all the major banks like ABSA, Standard Bank, FNB & Nedbank.

When comparing the withdrawal time for ZAR Transfers via Internet Banking or EFT, the withdrawals at HotForex via Bank Transfer in ZAR can take 2 Days, and at Exness it can take 3 days, and at Tickmill it can take 24 hours. This is generally faster than withdrawals via Bank Wire Transfer which can take upto 7 days.

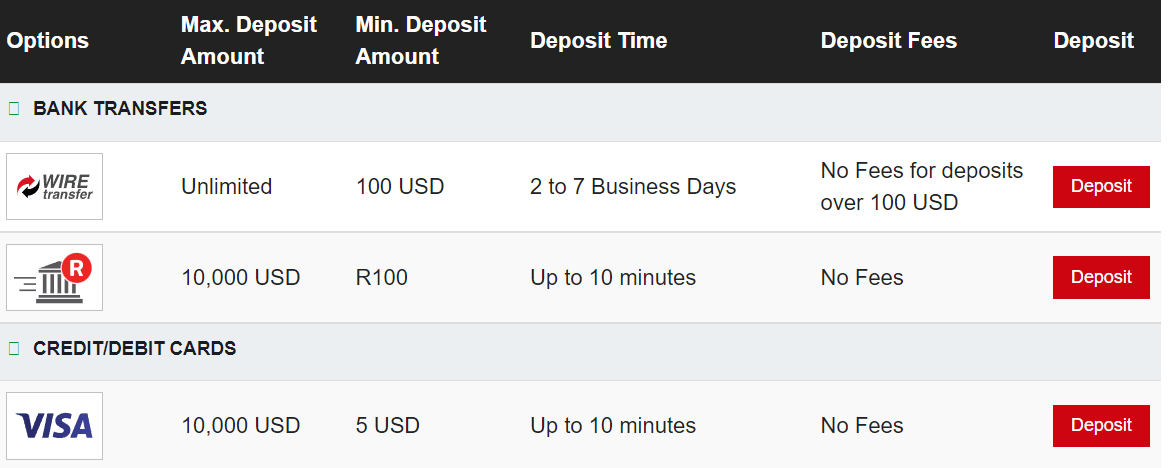

The below example is the typical deposit time & fees for transfers in ZAR via Bank Transfer at HotForex SA.

Normally with most ZAR Account brokers that offer local bank transfers for deposit & withdrawals, your funds via Bank Transfer will be added within a few minutes (compared to few days via Bank wire transfer), and if your base currency is in ZAR then there is no extra conversion fees.

Similarly, the below table shows the specifications of the deposit & withdrawal time in ZAR at Exness with Internet Banking.

On an average, most brokers offer deposits in few minutes via EFT in ZAR, and the withdrawals are generally processed on the same day (if you request it before the broker’s dealing hours).

d. The deposits are held in a South African Bank Account in ZAR

If your forex broker is locally regulated with FSCA, and your account is in ZAR, then the forex broker is required to hold your funds/deposits with a South African bank in ZAR, in segregated account.

For example, your funds deposited into your trading account in ZAR, might be under account with local bank like ABSA, or a subsidiary of a foreign major bank. You broker cannot use those funds for their own use if there is proper regulatory oversight as in case if the broker has the relevant brokerage license from FSCA.

But in case the broker that has kept your deposits offshore in USD goes out of business, then you are less likely to be able to get your funds back. The funds at foreign brokers are not held with local banks in Rand, and are likely to be in some foreign currency.

Therefore, when you choose a ZAR broker, ensure that they are FSCA regulated. Also verify with that broker where your funds will be held. This will help you in case the broker ever goes out of business, as you will have a higher chance of getting your equity back.

The important question comes, how can you check whether the broker offers ZAR base currency trading account or not?

Step 1: If a forex broker does offer ZAR trading account they will mostly tell that clearly on their website. You would normally find this option on account types page & during signup where you can choose the account base currency.

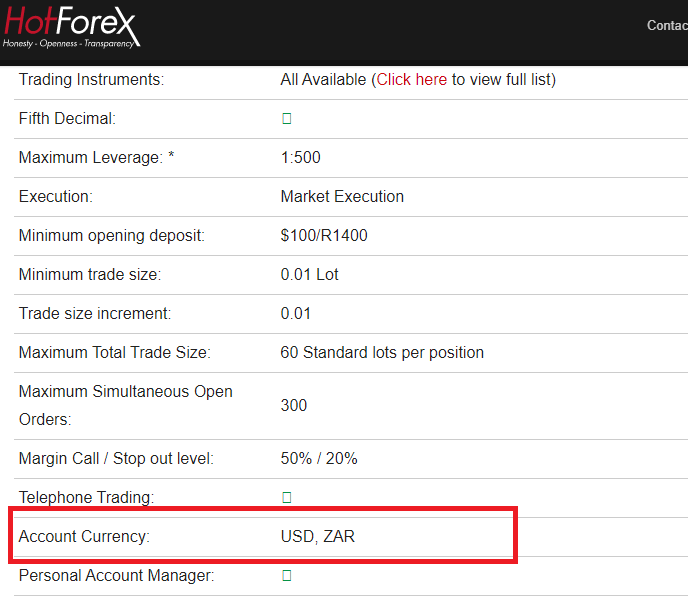

For example: HotForex (HF Markets SA Pty Ltd) shows the ‘Account Currency’ options available for each account type & the minimum deposit in ZAR as well.

The below screenshot of their Premium Account types shows their available base currency options.

Similarly, other brokers like XM list ZAR base currency on their trading account types comparison page. While some brokers have FAQ page to check the support account currency options. All brokers would generally allow you to select the base currency during signup process.

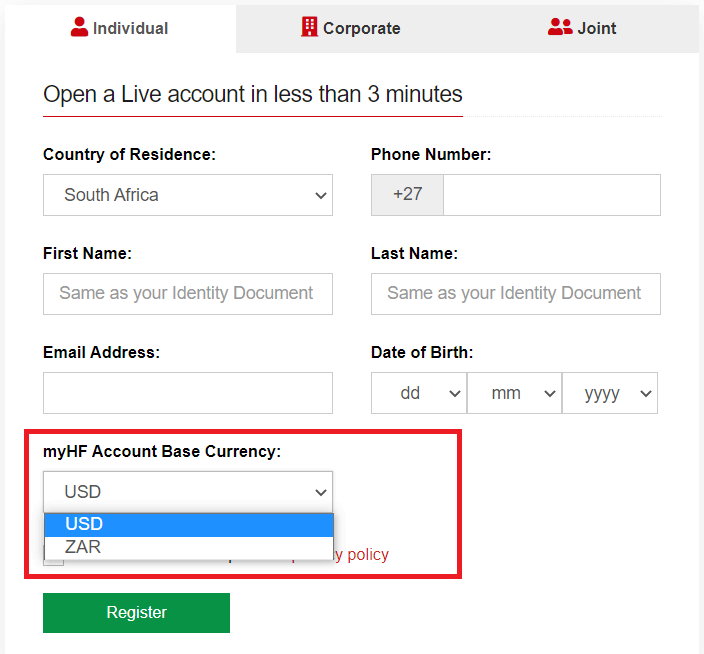

Step 2: Choose the account base currency during Account Opening.

You must note that many forex brokers don’t allow you to change the account base currency once the Live account is opened. So you must carefully select the right account currency during Signup.

For example, Exness does not allow traders to change account currency once the trading account has been opened. But you are allowed to open another trading account with a different base currency. You can open as many trading accounts as you want, there is ‘no limit’ to the number of trading accounts under a single client.

So, you can hold multiple trading accounts, and you can open a second or third trading account from your client dashboard. During this process, you can choose ZAR as your account currency for any account. What this means is that you can have multiple trading accounts with different account currencies under your single customer account.

If ZAR account currency option is available at the broker, then you would most likely find this option during account opening steps.

As an example: HotForex SA requires you to choose your “myHF Account Base Currency” during Account opening. They have 2 currency options i.e. USD & ZAR. So, if you want to open a ZAR base currency account then select the ZAR option here. See the below screenshot on how you can select ZAR as your account currency at HotForex during signup.

The account currency option that you select will be your trading account’s base currency.

Do note that most forex brokers don’t allow clients to update their account currency to ZAR for an existing account with different currency.

But in such a situation where you existing trading account is in different currency, and you want to update to ZAR as the base currency, then you can open another trading account with the same broker from your client panel (most brokers support multiple trading account under single client). You should contact your broker if you don’t find such an option.

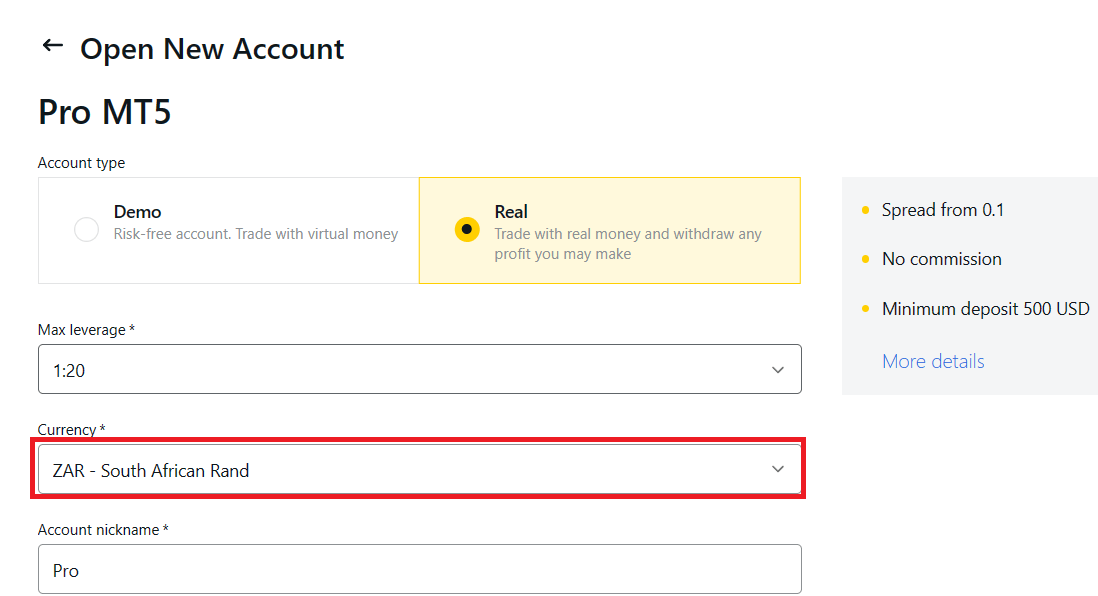

For example, Exness allows clients to open multiple trading accounts from ‘PA (Personal Area)’ or the client dashboard. You first have to select the account type (Standard or Pro), and then you can choose ZAR as your currency.

Also, you will have an option to select the leverage associated with your ZAR Account. You should always select a lower leverage of not more than 1:20 for your currency trading account.

After you have chosen ZAR as your currency, in MetaTrader, your P&L will be visible under ‘Account history’ in ZAR currency. Whatever your choice of base currency is, that is what your P&L will be calculated in.

Also, if you are still unsure whether your broker offer ZAR account of not, then you should contact your forex broker & ask their support team directly. If the broker offers Live Chat support, then you can contact them during their business hours & ask them: “Do you support ZAR as the Account’s Base Currency?”. The chat support should be able to tell you clearly.

For example, we talked to FXTM’s live chat support, and we got the answer that they don’t offer ZAR Base currency accounts.

But if you are not able to get hold of the chat support, then you should search for the contact email listed on the broker’s website (usually on the Contact page) & send them an email to asking about their available Account currencies.

Any brokers that have ZAR as the account currency are ZAR account Brokers. What this means is your trading account, transactions, statements, withdrawals etc. with your broker will all be settled in ZAR, instead of any other currency.

For example, if you are long GBP/USD, and you made a profit of 10 pips on 10,000 units, your profit will be showed to you as R160 instead of $10. Similarly, all your trading losses will also be calculated in Rand.

Most brokers only have USD account currency option, and if you choose that account, your ‘trading account’ will have the trades/activity settled in USD.

You can open ZAR Account for free at forex brokers. But the minimum deposit to trade on a live account will depend.

For example, at Tickmill, the minimum required amount for ZAR Account is R1700 (equivalent of USD 100). The exact deposit that you make should depend on your risk level, like your minimum lot size & risk per trade.

If you are using 1:10 leverage, and you want to trade mini lots, then your deposit will have to be R17,000 or higher. But most ZAR brokers offer the flexibility of leverage & lowest deposit.

Yes, you can open & maintain your trading account in Rand (ZAR). What this does is all your profits, losses, deposits, withdrawals, trading transaction logs etc. will be in ZAR.

For example, if you trade EUR/USD, and place a buy order for 1 Standard lot, you will instantly see your transaction in ZAR. The profit column at your broker’s platform will show you the value in ZAR, which will be calculated automatically based on real time price movements.

But the downside is that you cannot change it later into USD or any other currency.

The process is the same as with opening your normal trading account. The only different is that you will select ‘ZAR’ as your base/account currency.

Normally, during account opening, the broker will ask you to select all the options like leverage, account type, currency. You will not be able to change the account currency once it is set.

The way to change your account currency is to open the new account from your broker dashboard. Note that this new ‘trading account’ will be under your broker account. You are allowed to have multiple trading accounts with a single broker in forex/CFDs.

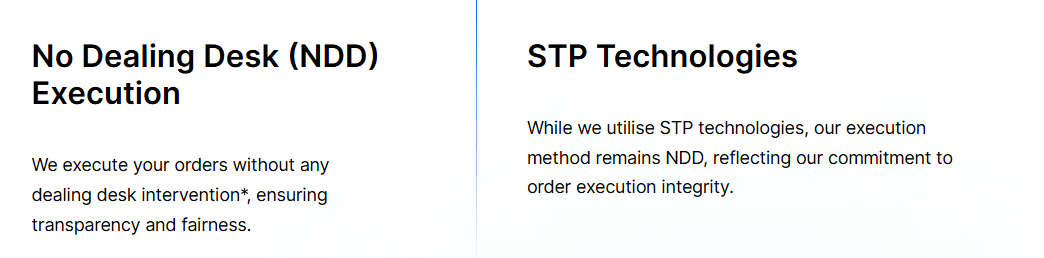

There are no pure ECN brokers that offer ZAR accounts. But there are a few hybrid brokers, also STP brokers, which are broadly NDD brokers.

Refer to the example below on a broker that offers ZAR Account. They explain they are a NDD Broker, but they are not an ECN broker, there is a difference.

For example, Tickmill is a ‘Non-dealing desk’ that has ZAR account. HFM is another STP broker that offers ZAR Account. FxPro is also a hybrid broker that offers ZAR account.

On the other hand, Exness & XM for example are market maker brokers, but they do offer ZAR accounts. Being a market maker is not straightforward a good or a bad thing, if the broker offers genuine trading conditions.

But if your preference is to go for ECN type ZAR account brokers, then Tickmill, FxPro & HFM are the major options. Note that none of these brokers are really 100% ECN brokers, but they do claim that they are NDD brokers, meaning, they don’t act as the counter-party to your trades, and route them to their liquidity providers or the interbank market,

No, brokers don’t allow traders to change the base currency of active trading account from ZAR to any other currency like USD for example. But you have to understand that your trading account currency is different from your broker account.

Your broker will allow you to have multiple trading accounts, each with different base currency unit. For example, you can have one account in ZAR, another in EUR & third in USD. All these accounts are independent of each other.

If you no longer need your ZAR account, what you can do is; transfer the balance from ZAR account to another trading account & then close your ZAR account (this is not required, you can still keep the ZAR account, with zero balance in it).

But in this step, you should ask your broker if they will charge you any currency conversion fees. For example, since your other account is let us say in USD, your broker will be converting ZAR to USD for you, to show your balance in that other account. Your broker could take advantage of this transaction & charge you excessive fees to do the conversion.

The broker will typically charge average spreads + commissions with ZAR accounts depending on the traded instrument. For example, if you are trading EURUSD, and the spread is 1 pip, without any extra commission, then for every 1 Standard lot, you will end up paying approx. R170 in spread.

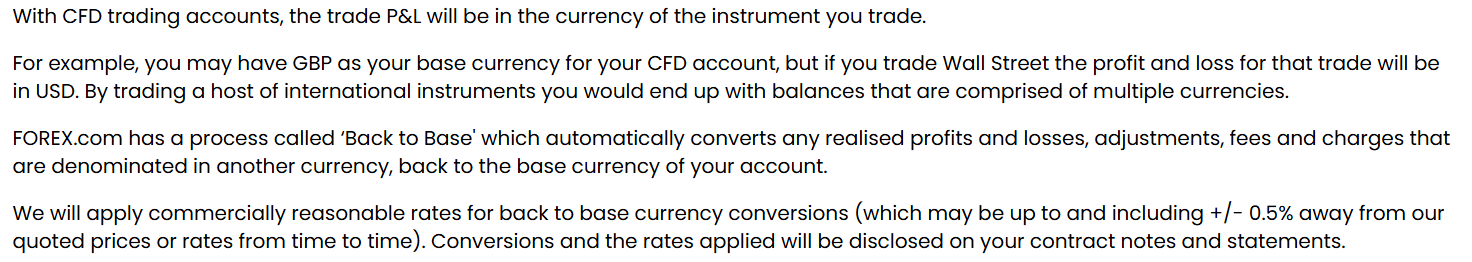

The another charge the broker could apply is for ‘conversion to base’, which in in simple terms is the commission you have to pay for converting your profits or losses on a trade from one currency (for example USD when trading EURUSD) to the base currency of your trading account (ZAR).

For example, if you are trading USD denominated pair like EUSUSD, GBPUSD etc. your P&L is actually in USD. But it will need to be converted back to ZAR because your account is in Rand.

During this conversion, your broker with use the USDZAR conversion rates, plus their markup, whatever it is. Mostly, the brokers have 0.5% markup.

The above screenshot is from a popular broker’s website where they have explained how this conversion fees will be charged. Therefore, you must take this cost into account in your trading on a ZAR account.

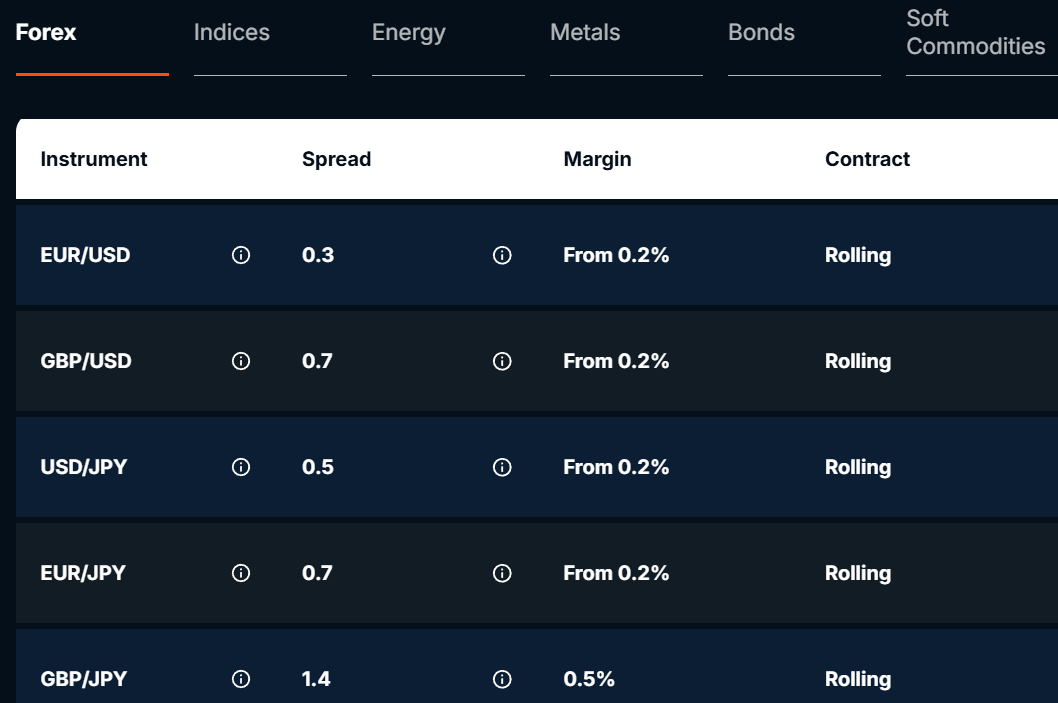

Out of all the forex & CFD brokers we have compared, Trade Nation has the lowest spreads for trading forex & CFDs on indices, and they support ZAR as one of the base currency for your trading accounts.

On average, their fixed spread cost (on TN Trader account) is 0.3 pips for trading EUR/USD during London & NY sessions or equivalent of $3 per lot. Refer to the screenshot below from their website.

By comparison, Exness which many consider as low cost broker, charges equivalent of $6-7 on average per lot with pro accounts during active sessions.

For CFDs on major indices their fixed spreads are almost 50-60% lower than all major CFD brokers. Note that their spreads on MT4 account are much higher. You will only get lower spreads if you signup & trade on their proprietary trading platform.

But one important point to make is that Trade Nation is a market maker broker & it is not an approved ODP. Currently, the status of their application is ‘applied’.

Below comparison table shows the features, fees of SA Forex Brokers that offer ZAR Accounts.

| ZAR Account Forex Broker | Regulation | Average Spread (EUR/USD) | Leverage | Minimum Deposit | Visit Website |

|---|---|---|---|---|---|

| Hotforex ZAR Account | FSCA, FCA, CySEC | 1.3 pips with Premium Account | up to 1:1000 | $5 (R70 with Micro Account) | Visit Broker |

| Exness ZAR Account | FCA, CySEC, FSCA | 1 pips with Standard Account | 1:2000 | $1 | Visit Broker |

| XM ZAR Account | ASIC. CySEC | 0.9 pips | 1:888 | $5 | Visit Broker |

| Plus500 | ASIC, FCA | 0.8 pips | 1:300 | R1500 | Visit Broker |

| FXPro | FCA, FSCA | 1.5 pips | 1:500 | $100 | Visit Broker |

| Trade Nation | FCA, ASIC | NA | 1:100 | $100 | NA |

Yes, there are some benefits but it mostly depends on your choice.

If you mostly trade on Rand pairs like USD/ZAR then it is preferred to open a ZAR account with the broker. As you could save on the conversion losses.

Moreover, another plus point to creating ZAR account over USD or EUR, is that you can make deposits & withdrawals in Rand. In this case, there will be no losses on exchange rates or transfer fees that would be charged by your bank (or broker) if you were to say make transfer to your broker in USD.

Hotforex, Exness & XM broker have ZAR accounts & they also have NASDAQ or NAS100 CFD instrument on their platforms. So you can open account in ZAR currency & trade NAS100 at these 3 CFD broker.

The spread at ZAR Account brokers for NAS 100 are 2.03 pips at Hotforex for USA100, 5 pips at XM & 4.28 pips at Exness for USTEC. By comparison, Hotforex has the lowest spread for this instrument.

The regulated forex brokers HotForex, Exness & Tickmill offer local deposit & withdrawals in ZAR via EFT.

For example, Exness supports withdrawals & funding via local bank accounts in South Africa without and extra fees. Their deposits via this method are instant, but the withdrawals can take a few days to process. But this withdrawals via similar methods are faster at HotForex & Tickmill.

The exact lowest deposit depends on your forex broker. The lowest minimum deposit is R15 at Exness (equivalent of $1) or depending on the currency conversion rates at the time.

Other brokers have different deposit requirements, which also depend on your account type. For example, the minimum deposit in ZAR at HotForex for opening Premium Account is R1400. The fees with this account type is lower than Micro Account.

So you must take into consideration the overall fees (trading & non-trading), not just the minimum deposit at a forex broker.

No, most of the forex brokers don’t allow opening of trading account with ZAR as your base currency. Only a few FSCA regulated brokers & some Tier-2 regulated brokers have option of ZAR as account currency.

Avoid any unregulated brokers even if they claim to have option of ZAR trading account.

Out of the ZAR Brokers which we have checked for this review, only IFX Brokers Holdings is an approved ODP.

There are many other ODPs (brokers that have ZAR accounts also), but we have not compared them for now in our latest research.

As per our research, there are about 10 FSCA regulated forex brokers that offer ZAR accounts. We have listed 3 such brokers here in our list (last updated recently): Hotforex, FxPro & IFX Brokers. We will add more ZAR account offering brokers in this list once we have compared their features & fees.

In terms of fees (USDZAR benchmark) – HotForex has 90 pips spread on average with their Premium Account (1.3 pips for EURUSD). BlackStone Futures has spread as low as 10 points (variable) for USD/ZAR currency pair.

Hotforex is the #1 ZAR Account Broker

Visit