AvaTrade is our #6 rated Forex broker in South Africa. They are regulated with top-tier regulators FSCA (South Africa) & ASIC, so it is considered safe to trade with them. Read our AvaTrade review to know more about their fees, accounts, support & more.

AvaTrade, which operates as an entity ‘Ava Capital Markets Pty’ in South Africa, is a regulated broker which adheres to guidelines laid out by Financial Sector Conduct Authority (FSCA) of South Africa.

The company is headquartered in Dublin, Ireland, has a global presence and is highly regulated by various financial institutions. They offer a wide variety of instruments to trade including Forex and CFDs via stocks, commodities, indices, ETFs, bonds and Cryptos.

Avatrade caters to all kinds of traders by offering MT4 and its own proprietary software AvaTradeGo and AvaOptions to trade. You may use Expert Advisors (EAs) on their MT4 platform offering and their package also includes automated trading in ZuluTrade where you can mirror the trading strategies of successful traders.

Avatrade is a fixed spread forex broker & they offer a single account type to retail traders. We compare their fees, safety, platforms, withdrawal time & also give our verdict on if you should choose them or not.

AvaTrade Pros

AvaTrade Cons

Table of Contents

| 🏦 Broker Name | Avatrade South Africa |

| 📅 Year Founded | 2006 |

| 🌐 Website | www.avatrade.co.za |

| 🏢 Address | Dublin Exchange Facility, International Financial Services Centre (IFSC), Dublin 1, Ireland. |

| 💰 Avatrade Minimum Deposit | $100 |

| ⚙️ Maximum Leverage | 1:400 |

| ⚖️ Regulation | FSCA (South Africa); FSA & FFA (Japan); FSC (BVI); ASIC (Australia); CBI (Ireland) |

| 🛍️ Trading Instruments | Forex, Crypto CFDs, Stock CFDs, Options, Indices CFDs, Commodities CFDs, ETFs CFDs, Bonds CFDs. |

| 📱 Trading Platforms | MT4, proprietary AvaTradeGo for PC, Mac, Android, iOS and web browser |

AvaTrade is licenced and regulated under various jurisdictions:

AvaTrade is a well regulated CFD broker & are licensed by multiple top-tier regulators around the world. They are also regulated with FSCA in South Africa, so we consider them a legit broker & depositing funds with them is considered safe.

The client funds under Ava Capital Markets Pty are held in segregated accounts in ABSA bank. Negative balance protection is also available to clients based in South Africa.

But AvaTrade is not an authorized ODP, and they are not listed under ODP entity details page, which indicates that they may not have applied to be authorized as ODP in South Africa.

Overall, they are still considered moderate risk, because are an authorized FSP for multiple products approved.

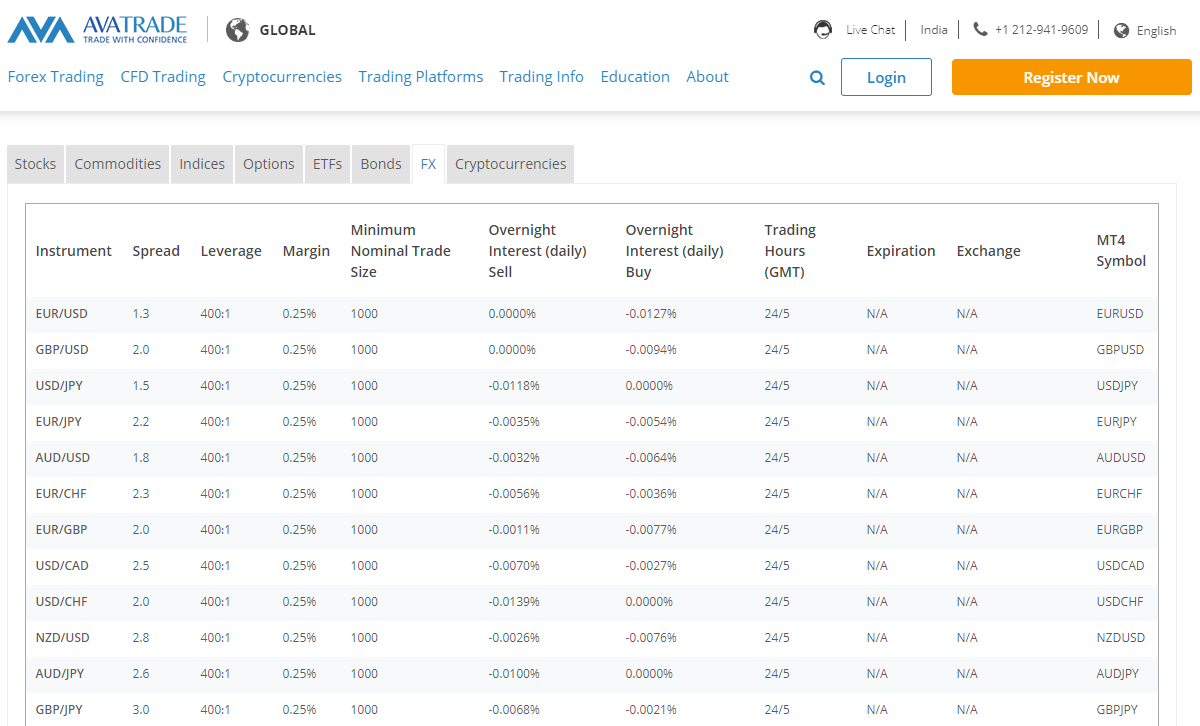

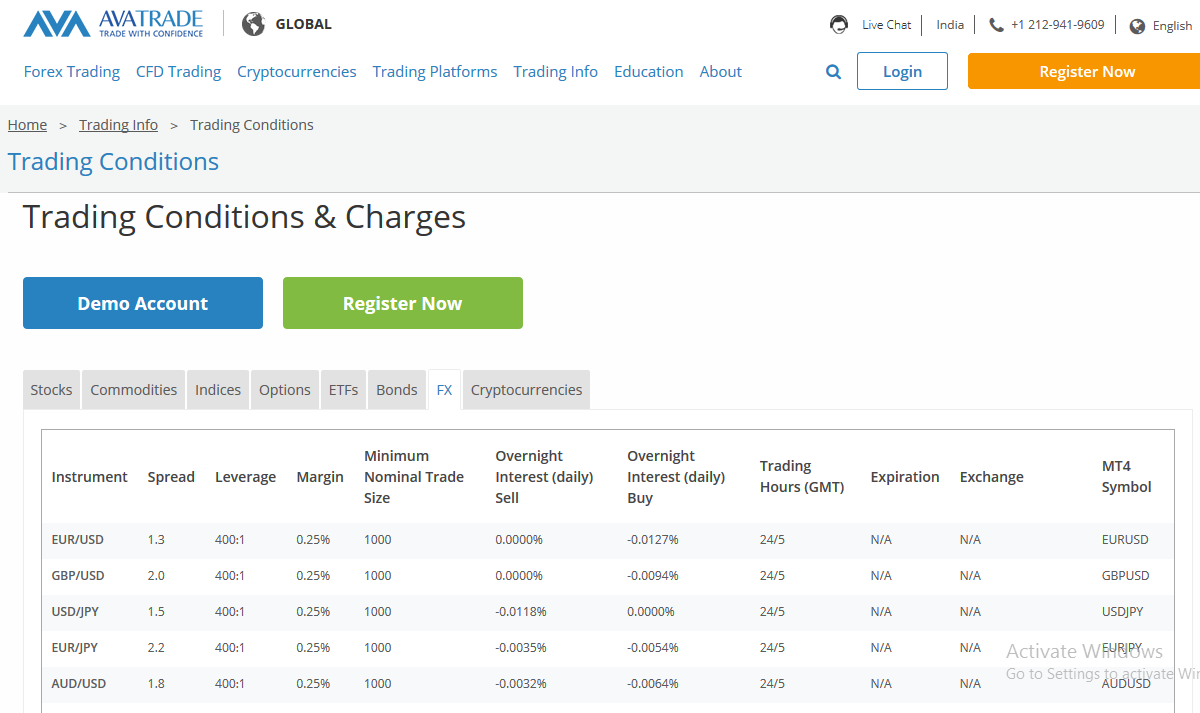

Trading Fees is a really important consideration as this is the cost you have to pay to the broker for every trade. So it is important to make sure that it is a low as possible.

Here is the breakdown of the various fees charges by Avatrade:

Some other regulated brokers like HotForex, XM & Exness offer lower spreads with their ECN type accounts. But for Standard or Micro Accounts the spreads at AvaTrade are comparatively quite low.

If you are planning to hold your positions overnight, it is important to understand the mechanics of how this fee affects your total profitability.

Moreover, after 12 months of non-use, an administration fee of $100 is also charged by AvaTrade.

AvaTrade’s fee is very transparent. They offer competitive fixed spread for Forex, but it is not the lowest. Other brokers like XM & Hotforex offer even lower spread for EUR/USD & other pairs.

Avatrade offers a Demo Account & a Live Account. Below is the description of the account Types available at AvaTrade.

If you are looking to test out your strategy or are learning to trade, then we advise you to open a demo account with Avatrade before trading with your own money.

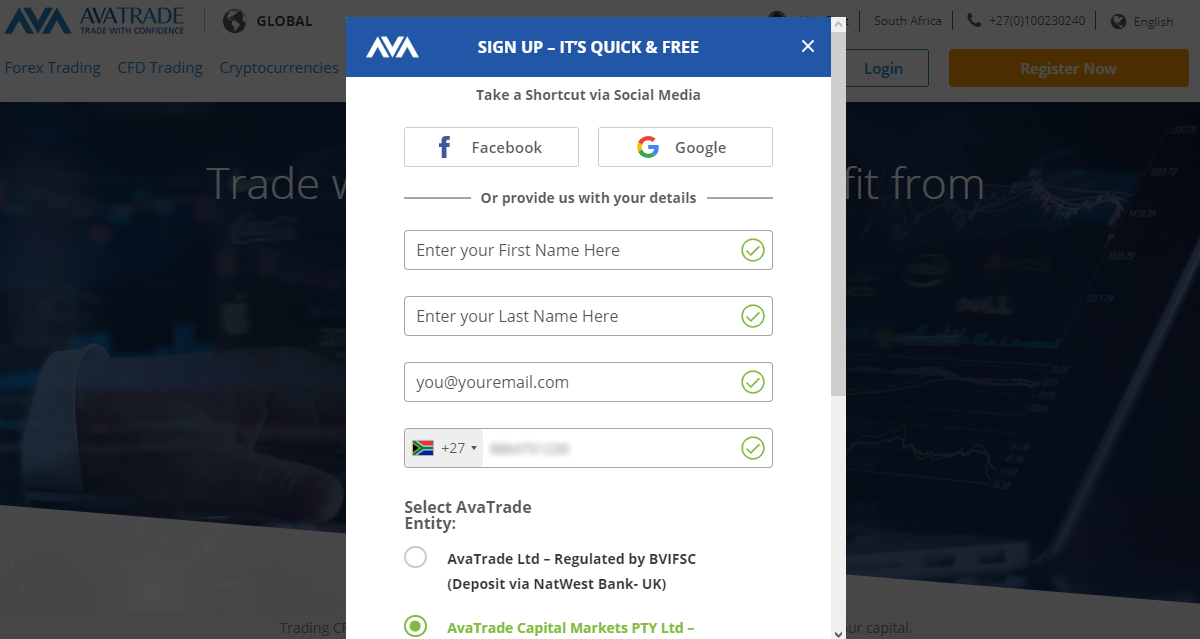

Creating a Demo Account with Avatrade is very easy. You just need to enter Name, email and phone and sign-up. Alternately, you may use the Social Media for login.

Their demo account will replicate their live trading environment & spread, so you can test that before actually trading on their live platform.

Unlike other brokers, Avatrade only has a single Real trading account. So there are no choices or let’s say confusions.

What is the minimum deposit at AvaTrade in ZAR?

The minimum deposit is $100 at AvaTrade South Africa for retail traders. They don’t offer ZAR base currency account, and local bank deposit in ZAR is not available.

Here are the common features of Real account at AvaTrade:

AvaTrade’s accounts are very clear, but the account choices are limited (there is only 1 account). On the positive side, this avoids confusion as there is only a single live account with everything in it.

Opening an account with AvaTrade is very simple and include only few steps only.

Here are list of steps that you need to follow to open account with them.

Step 1) Click on Register Now: Open the home page of AvaTrade website and click on Register Now button at the top left side of the screen.

Step 2) Sign Up for Free: SIGN UP FOR FREE pop will open where you need to enter your details or you can signup using your Facebook or Gmail account.

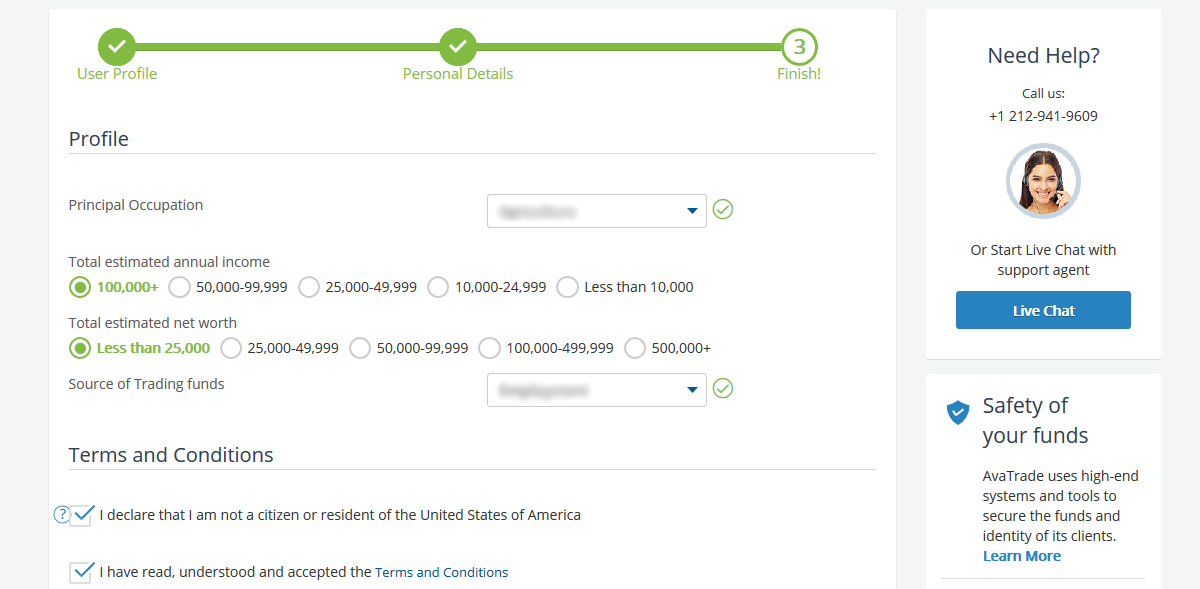

Step 3) Fill Personal Details: Now you need to fill your details as instructed on the screen. You also need to Select the Trading platform and base currency on same page.

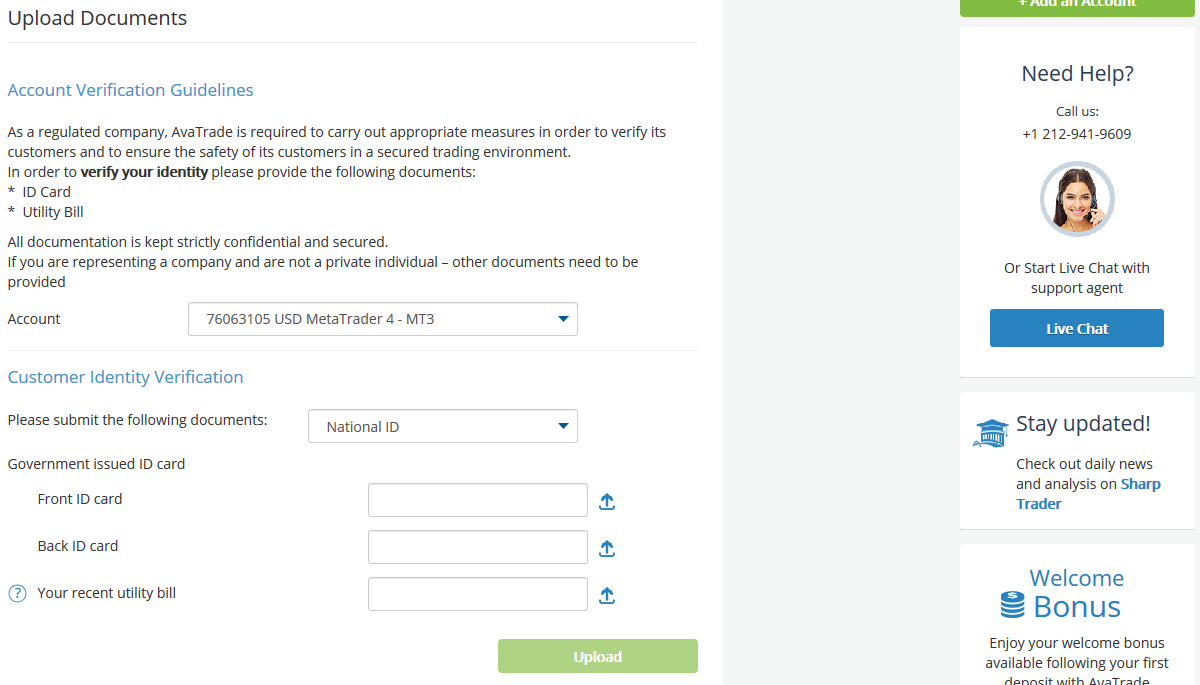

Step 4) Verify your account: After completing the registration form, you need to verify your account. You are required to submit 2 documents for KYC i.e. ID Proof & your Address Proof. The Address proof can be any Utility bill, but it cannot be your Mobile phone bill.

Note: After submitting the documents AvTrade can take maximum 24-48 hours to check and verify the uploaded documents.

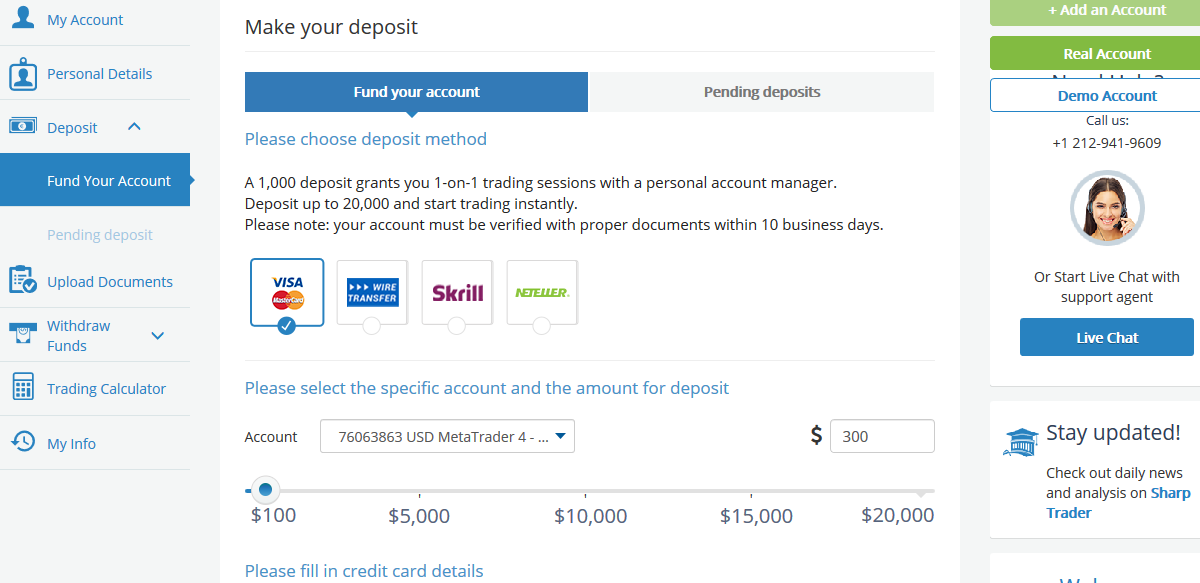

Step 5) Fund your account: When account verification process is completed, you need to add funds in your account to start trading.

Congratulations! Your account will be set up after following the above steps. Please check your email for more details and for login information. You can now start trading after logging in to your account.

AvaTrade offers more than 250 instruments to trade. Apart from Forex trading, it offers trading in Stocks, Commodities, Indices, Options, ETFs, Bonds and Cryptocurrencies via CFDs. CFDs stands for Contracts for Difference.

This type of instruments allows parties to trade the underlying asset without actually owning the asset and profit/loss based on the price fluctuations based on the underlying asset. The underlying asset may be anything like a stock, commodity, ETF, Index etc.

There are advantages to CFDs including low margin requirements, access to global markets, low transaction fee. But they are less regulated than traditional markets, the spread may eat away the profits if there is little movement in the market.

High leverage may also increase potential losses. Let’s have a look at the trading instruments and their number of offerings on AvaTrade:

Instrument (#)

Forex Pairs 55

Crypto CFDs 10

Bond CFDs 2

ETFs CFDs 4

FX Options 42

Spot Metal Options 2

Indices CFDs 19

Commodity CFDs 17

Stock CFDs 64

AvaTrade offers 10 Popular FX pairs and 45 minor pairs.

AvaTrade offers to trade Cryptos via CFDs 24X7, starting from a deposit of $100. There are 10 different crypto instruments to trade, the leverage offered is 1:20 and you can start trading immediately after opening the account.

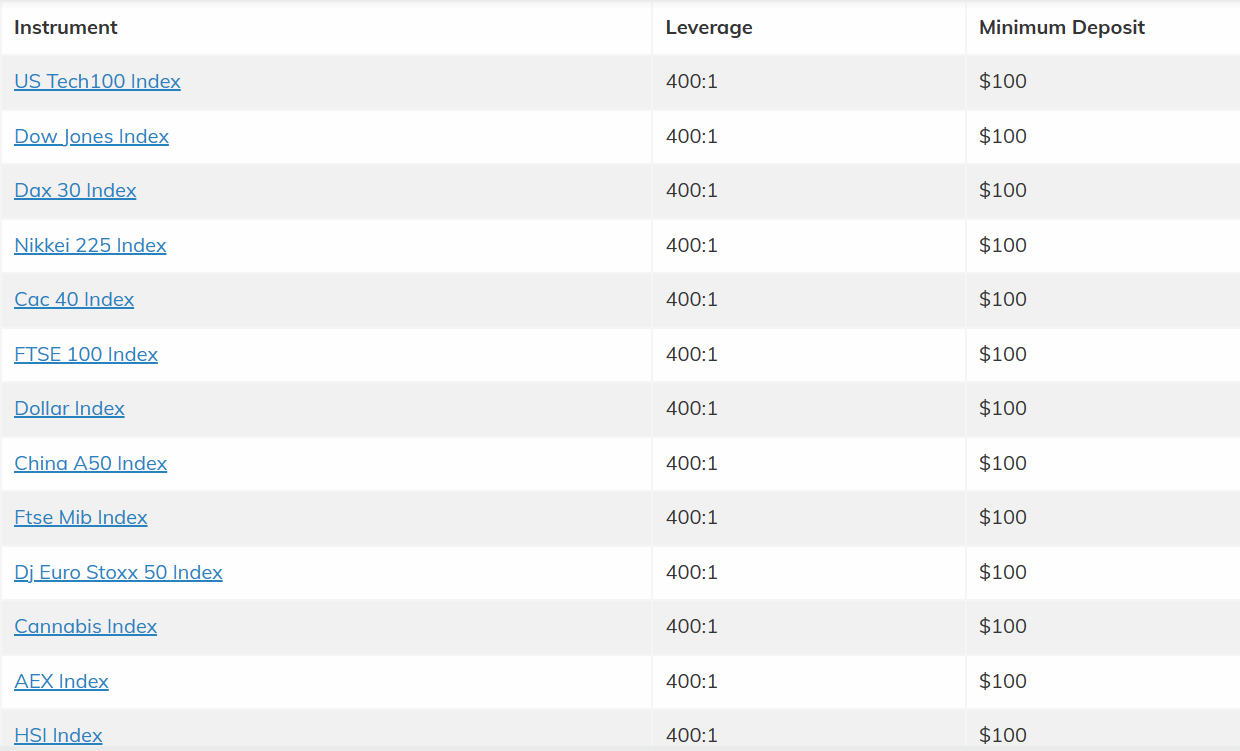

It is important to note that AvaTrade does offer CFD trading on all the major global indices including NASDAQ 100, S&P500, DJI, EuroStoxx, DAX etc. The below is the table of major indices available on their platform & the max. leverage (1:400) for each index CFD.

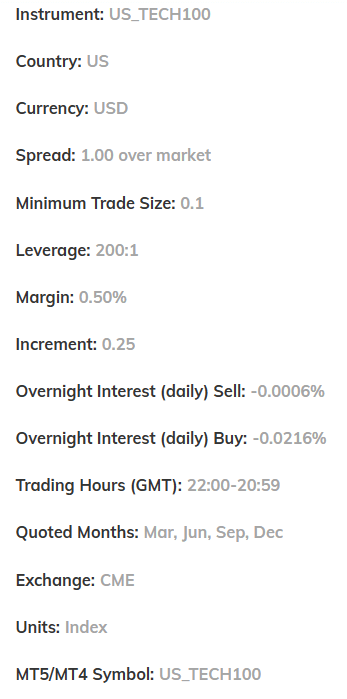

NASDAQ 100 is available as US_TECH100 on AvaTrade’s platform. The max. leverage for this CFD instrument is 1:200 & the minimum contract size is 0.1 lot. The fixed spread at AvaTrade is low for trading on all the major indices.

Let’s take a look at the example of their contract specifications for this instrument. They have a specification page on their website for the trading conditions for every instrument.

AvaTrade offers for ETFs CFDs include VXX and GDX. VXX is the ticker for CBOE volatility Index which is a measure of volatility of S&P500 stock Index options while GDX is a measure which has exposure to global gold mining companies.

Commodity CFDs offers include metals comprising Gold, Silver, Palladium and Copper & Energies including Crude Oil, Natural gas, Heating Oil, Gasoline trading & Agriculture commodities including Corn, Sugar, wheat, coffee, soybean, cocoa and cotton.

Stock Index CFDs tracks and measure basket of related stocks. You can trade as many as 19 Indices on AvaTrade. The major index NASDAQ is available at AvaTrade with the symbol US_TECH100 on their platform. The max. leverage with most of the Indices is 1:200.

Alternately, you may trade stock CFDs of as many as 64 popular global companies and leverage offered is upto 1:20.

Bond CFDs on offer include Japanese and European government bonds on a 1:20 leverage with no commissions on trades.

A small comparison with its competitors reveals AvaTrade offers higher number of trading instruments:

(#) AvaTrade FXCM Pepperstone Oanda

Currency pairs (#) 55 41 80 55

Stock index CFDs (#) 19 12 14 16

Commodity CFDs (#) 17 7 14 32

Cryptos (#) 10 1 5

The maximum leverage is on forex of 1:400 for major currency pairs. For all other instruments the leverage is different. For example, for Crypto CFDs the leverage is the lowest.

Note that the leverage is normally decided according to the average daily volatility of the instrument. For example, even 1:10 leverage would be considered high on crypto CFFs, because these can move 5-10% in a day (not on average, but on many days in a year the volatility is high).

Therefore, you should set the lowest leverage allowed by AvaTrade. They allow you to set your leverage restrictions for your account type.

AvaTrade presents a wide range of platforms for both manual and automated trading.

1) Mobile Platform: AvaTrade has a dedicated platform for both Android and iOS called AvaTradeGo along with the traditional MetaTrader4. There is no offering of MetaTrader5. AvaTradeGo has improved the social trading capacity where you can follow a wide section of traders. Some of the recent customer reviews indicate its proprietary platform, AvaTradeGo has an interactive layout but is buggy and has some limited features.

You can trade spot and options, FX through AvaOptions which is available for Android. It also lacks a lot of features according to the recent reviews.

2) Desktop Platform: AvaTrade offers its own dedicated platform and MetaTrader4 for the desktop trading which is compatible with Windows, Mac and Linux Operating Systems. There is no offering of MetaTrader5 hence we feel the choice is limited for the customer. ZuluTrade, its desktop, web and mobile application offers social trading feature. DupliTrade, is MT4 compatible platform and gives the feature to follow experienced traders’ signals and strategies in real-time.

3) Web Trading: Web Trading is available from MT4 platform as well as the proprietary AvaOptions.

AvaTrade offer 3 options to deposit and withdraw the funds for their customers in South Africa. But option to deposit & withdraw via Internet Banking in South Africa is not available.

Here are the various methods using which you can deposit or withdraw funds with them.

Clients or traders can funds their AvaTrade account using:

You can check the bank account number after login to your account with them.

Withdrawal methods are also same as of deposit methods. But withdrawal can take up to 5 business day to complete the transfer process. You can withdraw the funds using:

Note: Like other brokers, your account must be verified before you can request a withdrawal at AvaTrade. You need to submit your KYC documents i.e. ID proof & Address proof for verification.

But compared to other brokers, the withdrawal at AvaTrade are slow. And unlike other regulated brokers like HotForex & Exness, AvaTrade doesn’t offer local bank transfer option for deposit & withdrawals.

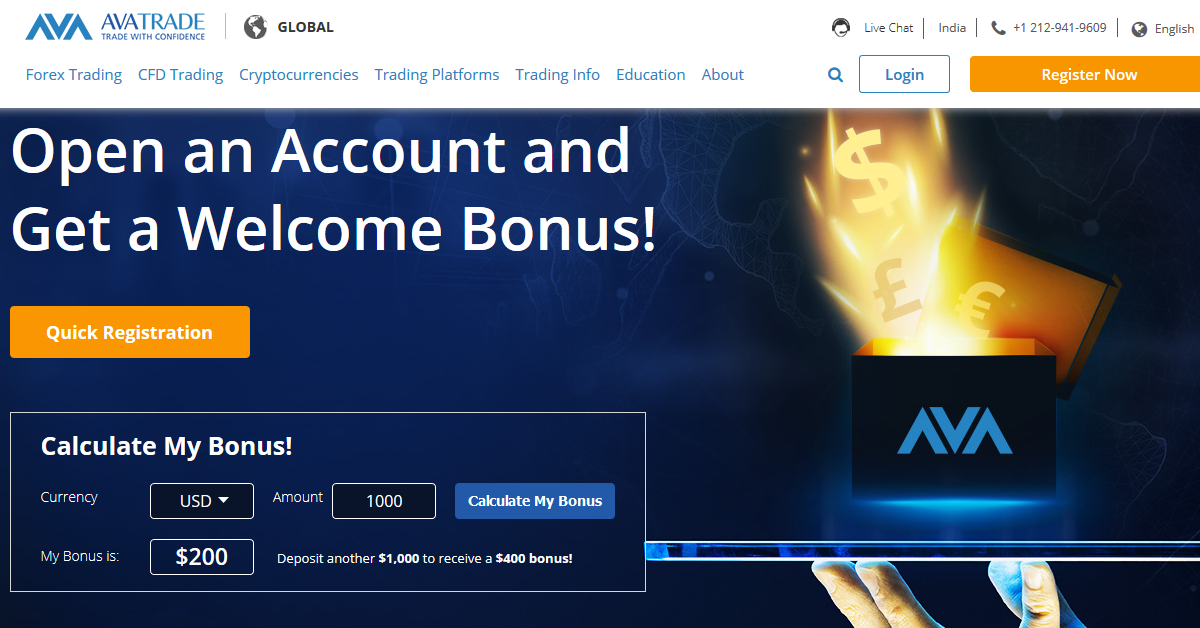

AvaTrade offers deposit bonus for new clients only, and for the 1st time deposit. There is no recurring bonus or offers for existing clients in South Africa.

Here are the bonus offers available at Avatrade currently:

Their bonus offering are very limited & the minimum deposit required to claim the bonus is also really high. Moreover, we also did not find any loyalty program that rewards existing traders.

Avatrade could do better in terms of bonus offerings.

Yes, AvaTrade does have a 20% welcome bonus for SA traders. But it requires a minimum deposit of $200, the bonus is not available for any deposits below the minimum amount.

Note that the welcome bonus is only available to new traders i.e. first time depositing traders at AvaTrade. Existing accounts cannot apply for this bonus.

AvaTrade customer support is only available during their business hours i.e. from 07 AM to 11 PM (South African Time) from Monday to Friday in a week.

You can reach Avatrade’s support via:

Moreover if you will make a deposit of $1000 with them then they can also assign a special support representative to you, who will assist you with any query much faster.

But overall, their support could do better by being available for 24 hours during weekdays.

Yes, AvaTrade is a good forex broker if you are looking for a fixed spread FSCA regulated forex broker.

They are regulated with South Africa’s FSCA and also have competitive fixed spread for forex. Also, local Internet Banking option is available for funding or withdrawals.

But, we have found their support to be lacking in some features, and they are not available 24 hours. Their bonus offers are limited. They also don’t have ZAR accounts. Some users have even complained about very slow withdrawals with them.

Their fees for major forex pairs is very competitive but for CFDs on commodities like XAU/USD & indices & NASDAQ, the fees is a bit higher than other brokers.

There are other regulated brokers in South Africa that offer lower trading fees based on volume for CFDs & have better support. We feel that you can find better brokers, if you need very good support.

P.S. You can look for our recommended forex brokers list to find an AvaTrade alternative.

The minimum deposit amount with AvaTrade South Africa is $100 for opening a Real trading account. Avatrade only has a single trading account type for retail traders & they have fixed spread for each instrument.

No, AvaTrade does not offer ZAR account currency option for South African clients. Currently only USD, EUR & GBP base currency options are available. But clients can make bank wire deposit in ZAR (Rand) to Avatrade’s account and then it will be converted to USD or your account currency on AvaTrade’s platform.

Yes, AvaTrade does offer trading on NASDAQ 100 (not NASDAQ Composite), on their platform. It is available under the symbol US_Tech100. The max leverage for this instrument is 1:200, and the typical spread is 2-3 points.

AvaTrade is considered a safe forex broker for traders in South Africa because they are regulated with FSCA, and under other major Tier-1 & Tier-2 regulations including ASIC & CySEC. If you are considering fixed spread CFD broker, then AvaTrade is considered a safe option for depositing your funds. But do note that CFD trading is risky, and you can lose your capital.

AvaTrade is authorized by Financial Sector Conduct Authority (FSCA) in South Africa with FSP number 45984 since 10/11/2015. Also, Avatrade is regulated by multiple top tier regulators including ASIC in Australia.

After your account is fully verified, you can withdraw funds via the method of deposit. For example, if you had deposited funds via bank transfer, then you can only withdraw it via bank transfer in ZAR, up to the amount of your deposit.

No, AvaTrade is not licensed/approved ODP provider. Under FSCA’s search, their application status is not available, which means they have not applied to be authorized as an Over the Counter Derivatives Provider under FSCA. You should not register with AvaTrade if you are only looking to trade via a licensed ODP.

Yes, AvaTrade offers Metatrader 4 & MT5 platforms for mobile, desktop & web. They also offer their AvatradeGo App for Android & iOS.

"Do you have experience with AvaTrade? Please consider sharing your experience with a review below – good or bad – doesn’t really matter as long as it’s helpful to other traders!"

We only accept user reviews that add value to fellow South African Traders. Unfortunately, not all reviews that you post with us will be published on the website. For your review to be approved, please share your detailed & honest experience with the broker – either positive or negative. Thank you for helping out other traders with your valueable feedback!

Important: We don't accept any payments or kickbacks from any forex broker(s) to delete or change any reviews. We welcome Forex Brokers to reply to reviews on our website & share their side of the story to keep the process honest and fair for both sides.