Octa is a low spread forex broker that accepts traders in South Africa also. Their trading fees is low compared to most other brokers, but are their legit?

Octa is a CFD Broker established in 2011 & they accept clients in South Africa under their local entity.

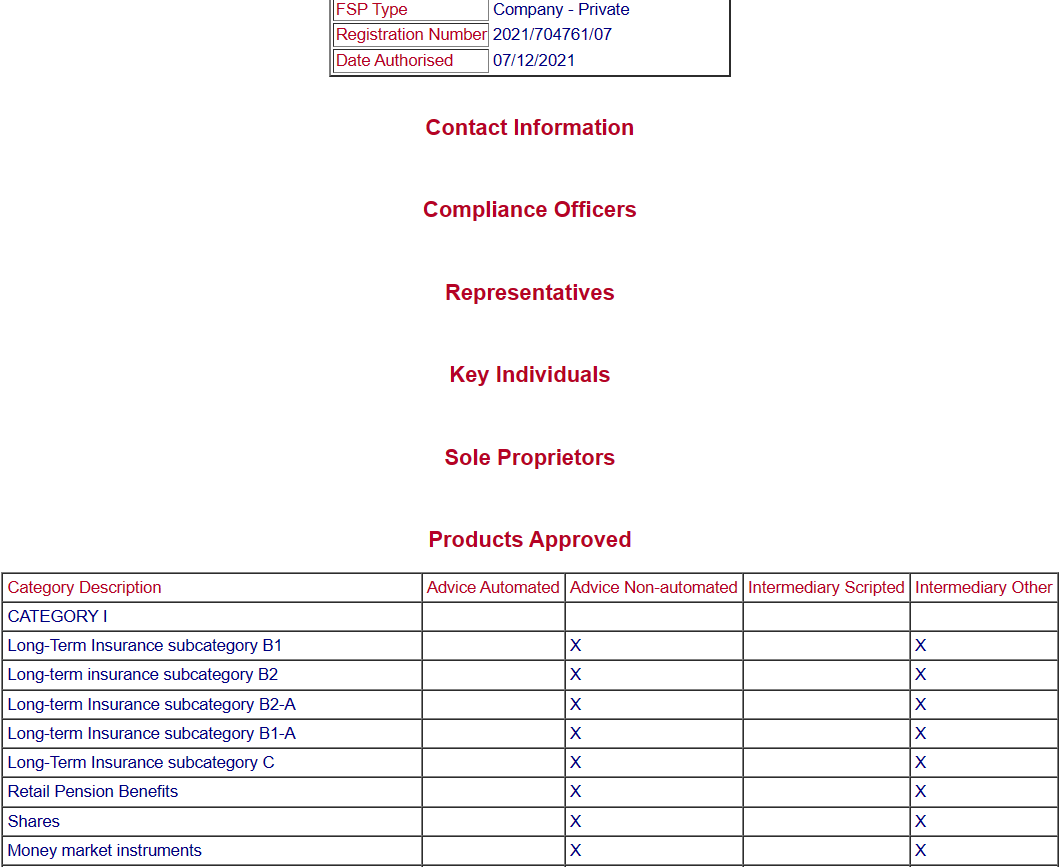

Octa Group is regulated with Tier 2 regulator CySEC – Cyprus Securities and Exchange Commission. One of their entities is also registered in South Africa regulated under FSCA. But their SA entity is not approved as an ODP (their local entity have not applied for ODP licensing).

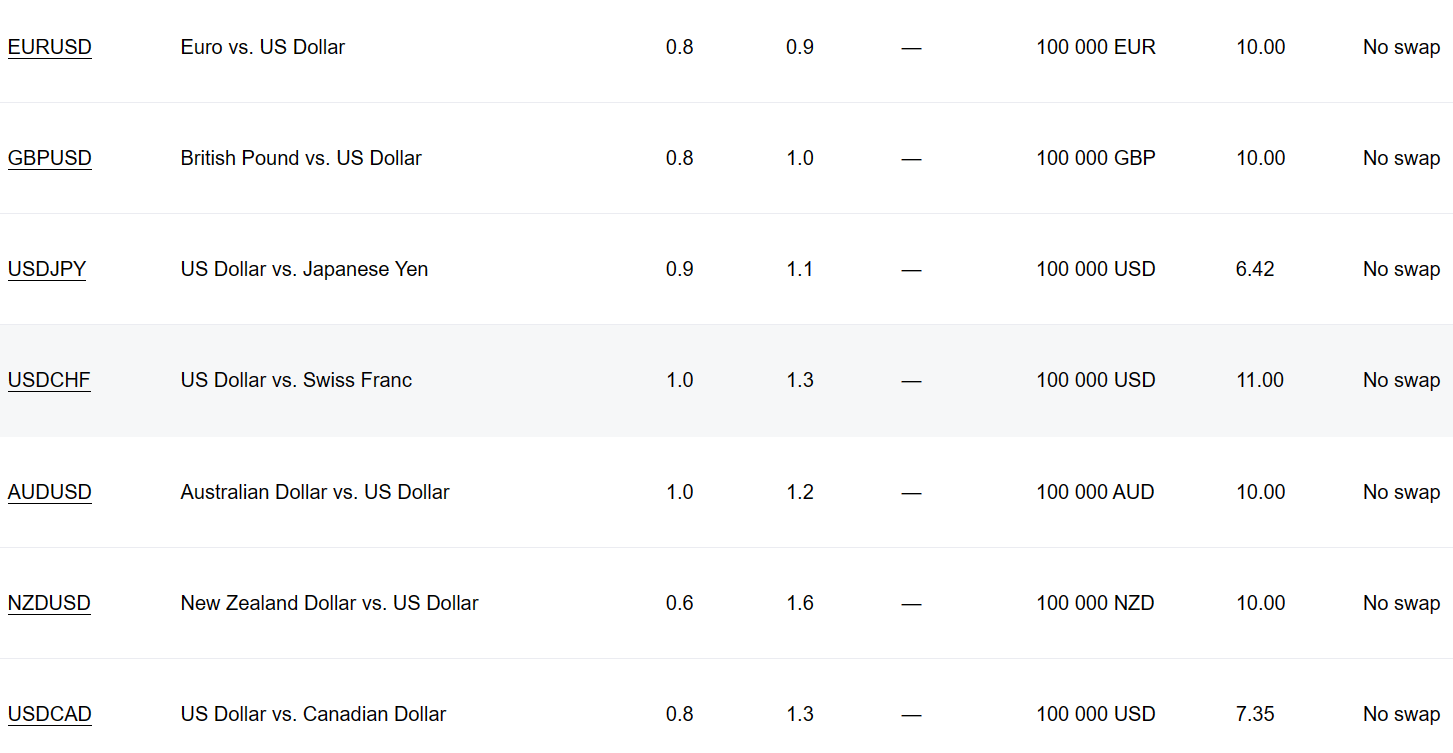

The exact spreads at Octa are variable based on the account type you choose with them. They offer 3 account types based on MT4, MT5 & OctaTrader. Both the accounts have low spreads & no extra commissions per lot. Octa permits EAs, Scalping, and Hedging.

You are not charged any commission for withdrawing or depositing funds at Octa.

Applications for opening a new account are processed online. Trading platforms offered by Octa are MT5 & MT4, and they don’t offer cTrader, but they have their own proprietary platform – OctaTrader. The choice of platform is tied to the type of account chosen.

You can open an Octa Micro Account with a minimum deposit of $25. The instruments offered by the broker include CFD trading in Shares, Forex, Indices, Commodities, and ETFs.

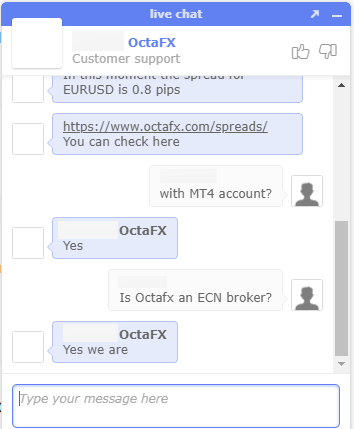

Octa offers traders a range of content for research through the Traders’ Tools section. Customer Support is offered through Live Chat and E-mail from Monday to Friday for 24 hours.

Octa Pros

Octa Cons

Table of Contents

| 🏦 Broker Name | Octa |

| 📅 Year Founded | 2011 |

| 🌐 Website | octafx.com |

| Registered Address (Main HQ Address) | Bonovo Road – Fomboni, Island of Mohéli – Comoros Union |

| 💰 Octa (OctaFX) Minimum Deposit | $25 |

| ⚙️ Maximum Leverage | 1:500 |

| 🗺️ Regulations | FSCA, CySEC, MISA |

| 🛍️ Trading Instruments | 35 Currency Pairs, 11 CFDs on Metals, Cryptos, Indices |

| Trading Platforms | MT4, MT5 & OctaTrader |

Octa is regulated by FSCA (but not an approved ODP) & 1 Top Tier regulator. Here is a breakdown of Octa’s regulations:

Octa was previously acquired regulatory license with FCA, but they are no longer regulated.

You are also offered protection of funds by Octa through the following measures:

Segregated Accounts: Octa uses separate accounts for keeping your funds segregated from the balance sheet of the company. This complies with international regulation standards. Your funds are thus untouched and secure with the broker.

Negative Balance Protection: You are also offered negative balance protection by Octa in case your trading balance goes into negative.

SSL-protected Personal Area: Octa makes use of highly advanced technology for protecting your financial transactions and personal data. This is through SSL-secured Personal Area safeguarded with 128-bit encryption. It ensures the inaccessibility of your data to any third party and safe digital transactions.

South African traders signing up with Octa are registered under FSCA regulation. Their other entity is under offshore regulation. But since they are not approved ODP, this makes them moderate risk broker for SA traders.

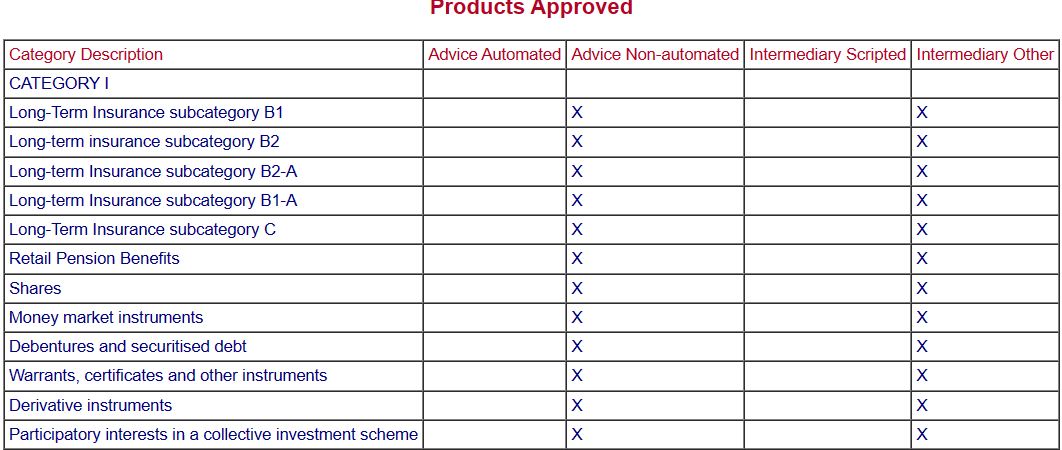

The fees at Octa are moderate in comparison with other Forex brokers. Octa has spreads only accounts for traders (no commission based accounts for FX traders). These are variable depending on the trading account you choose with them.

There are no commissions charged by Octa, and there is zero Swap (you don’t pay it nor do you get paid any positive swap). You only pay the variable spreads on every instrument Octa has on their trading platforms.

Traders in South Africa are also not offered withdrawal or deposit options through Local Bank. The available options include MasterCard/Visa, Bitcoin, Skrill, or Neteller.

Overall, the spreads at Octa are considered quite low & there is no extra commission charged. This makes the account fees simple & straightforward.

If you consider their GBP/USD spreads for example, it is on average 1.1 pips with MT4 & MT5 accounts. Comparably, this is moderately higher than the overall fees charged by Raw spread brokers (we calculated spreads + commission).

The process of opening Account at Octa is fully digitized, quick, and user-friendly. Citizens of more than 185 nations including South Africa can open Forex & CFD trading accounts.

The minimum deposit at Octa (OctaFX) is $25, but they don’t offer any ZAR accounts. The account can only be opened in USD.

Octa offers 3 Account types for South African traders:

There is not much different in these account types other than the platform. If you want to trade on MT4, then choose MT4 account, but if you prefer MT5, then choose MT5 account.

The spreads for most instruments are about the same with both the account types at Octa.

The minimum deposit required to open the Micro Account is $25. You can either choose the floating spread that starts with 0.6 pips. With this account, Octa does not charge you any commission on the trade, only fees is their spread.

The maximum leverage offered is 1:500. Stop out/margin call for this account is 25%/15%. Swaps are optional.

You can open the MT5 Account with Octa with a minimum deposit of $25. This account offers only a floating spread that begins with 0.2 pips. You are not charged any commission for trading with this account.

The leverage offered for Forex trading is 1:200. Stop out/margin call for this account is set at 45% / 30%. Pro-Account does not offer swaps. You are charged overnight commissions after 3 days.

This account is based on Octa’s proprietary trading platform. The minimum deposit is $25, same as MT4 & MT5 accounts. Their spreads with this account are lower compared to the MT5 account.

But the downside is you cannot run EAs on OctaTrader. Also, the stock CFDs are not available for trading with this account.

| Account Feature | OctaTrader Account | MT4 Account | MT5 Account |

|---|---|---|---|

| Review | Octa’s Proprietary platform | For All traders in general | For Stock CFD Traders |

| Platform | Mobile & Web App | MT4 on desktop, mobile & web | MT5 on all devices |

| Execution | NDD, STP | NDD, STP | NDD, STP |

| Spread | Variable (lowest spreads of 0.8 pips on EUR/USD) | Floating | Variable |

| Minimum Deposit | $25 | $25 | $25 |

You are offered a range of financial asset classes to select from by Octa. However, its offerings are limited in comparison with other standard Forex brokers in the market.

Octa offers CFD trading in Forex pairs, Cryptocurrencies, Commodities, and Stock Indices.

28 pairs of Forex currency are offered by Octa. These include the majors as well as crosses amongst EURUSD, GBPUSD, GBPJPY, USDJPY, USDCHF, AUD/USD.

You are offered to trade in 3 Cryptocurrencies by Octa. These include Bitcoin, Bitcoin Cash, Binance, Ethereum, Ethereum Classic, Polkadot, Litecoin, Solana, Dogecoin.

Octa offers CFDs both precious metals and energies for trading in Commodities. These include Copper, Platinum, Silver, Gold, Bent oil, WTI oil, Crude oil, Gold XAGUSD, Silver XAUUSD and Natural Gas.

You can gain profit by trading with the 10 most popular Stock Indices offered by Octa. These include NASDAQ, Dow Jones, Eurostoxx 50, Nikkei, Apple, Google, Amazon, Tesla, Wallmart, Nvidia etc.

| Account Type | Trading Instruments |

|---|---|

| MT4 Account | 35 currency pairs, gold and silver, 3 energies, 4 indices, 30 cryptocurrencies |

| MT5 Account | 52 currency pairs, gold and silver, 3 energies, 10 indices, 30 cryptocurrencies, 150 stocks |

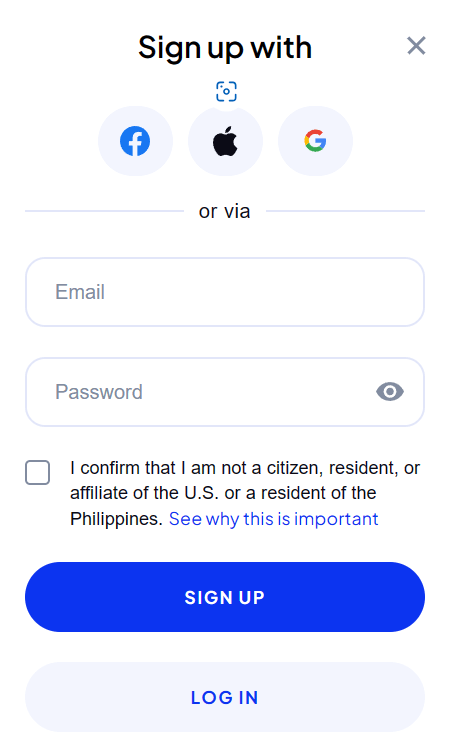

Step1) Open the home page of Octa South Africa and click on OPEN ACCOUNT button at the top of the home page.

Step 2) Enter the Name, Email, password for opening a new account with them. You can also signup using your Gmail or Facebook profile.

Step 3) Once done with entering all the details, click on SIGN UP, the blue button you see on the above screenshot.

Step 4) Verify the authorization by clicking on the link sent to your email.

Step 5) Now you will be redirected to Provide your details page where you need to enter your basic details.

Step 6) Select the account type with which you want to start trading and also select leverage, base currency, etc.

Step 7) Click on Deposit button and select your preferred payment method. You need to make a deposit to start trading.

Congratulations! Your account has been setup and check your registered email for more details.

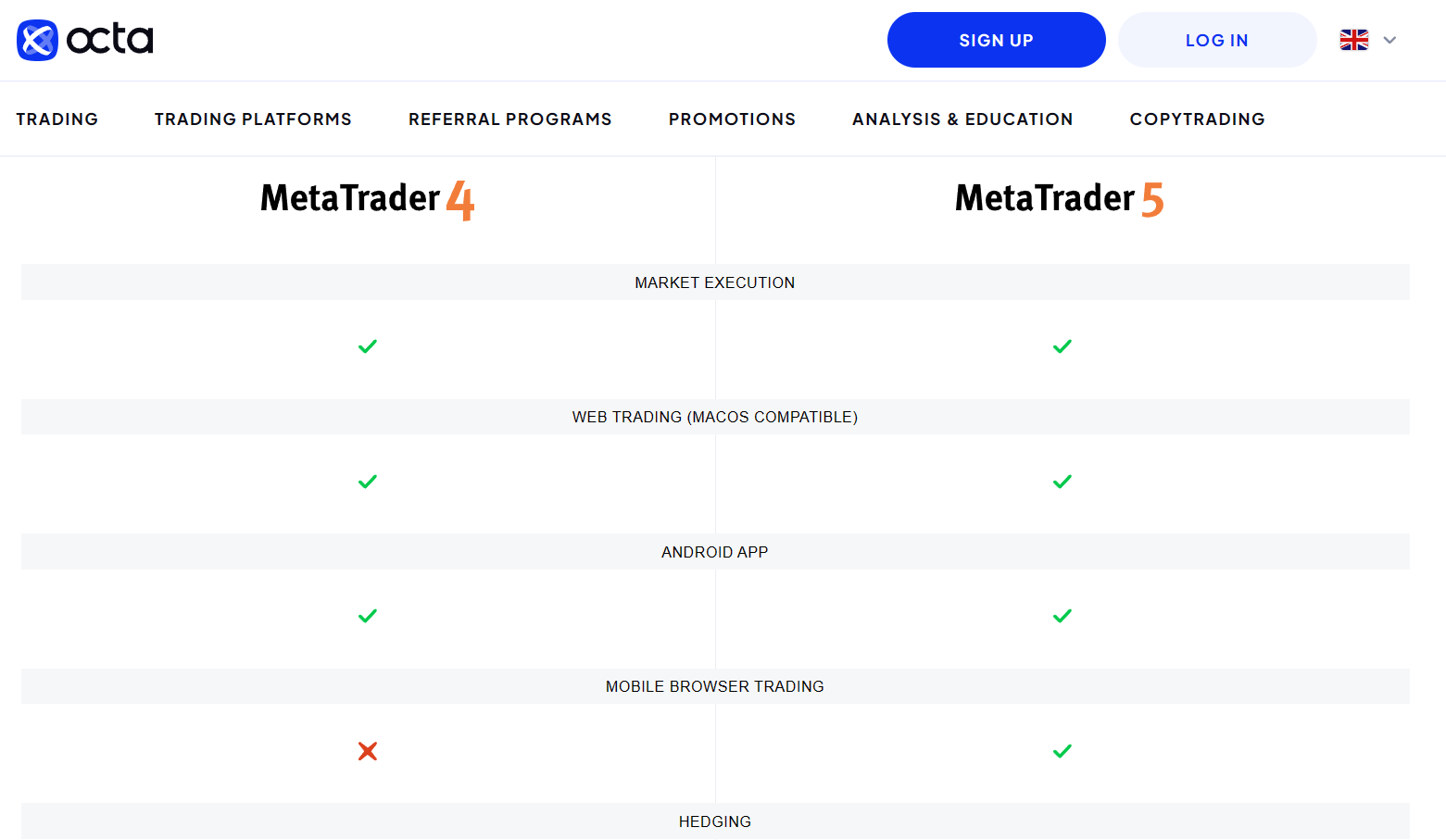

You can trade through Octa with any of the 3 trading platforms that the broker offers. These are OctaTrader, MetaTrader 5 and MetaTrader 4.

This is the most popular trading platform. It has a very comprehensive charting package and several technical indicators. The two-step login process is not available.

MT4 utilizes Expert Advisors that permit it to sustain automated trading. It has versions for Android, WebTrader, Desktop, and iOS.

By and large, the MT4 platform is very simple and easy-to-use. This is suitable for beginner traders.

The globally recognized trading platforms like MetaTrader 5 and MetaTrader 4 are offered by Octa for trading through Web – Windows and Mac and Windows Desktop.

The Web Trading platform provides useful features for advanced traders like single-click trading. Meanwhile, it has limited advanced order functionality and chart views. Thus the web platform is more perfect for beginner traders.

You are offered Mobile trading by Octa through MT4, and MT5 Mobile trading apps for iOS and Android. Through these, you can trade through diverse trading accounts.

Octa also offers you its proprietary mobile app the Octa Trading App. This allows you to manage your trading accounts and finance.

You can download the MT4 and MT5 on iOS and Android mobile trading apps directly from Apple Store or Google Play. Alternatively, you can also download them from the Octa website that offers step-by-step useful installation instructions.

Octa mobile trading apps are useful for both advanced and beginner traders.

Octa offers 50% deposit bonus with every deposit. The bonus is also available to traders in South Africa, we did not find any end date for this promotion.

Unlike many other brokers, the bonus at Octa can be withdrawn once you meet the specified trading requirements of number of lots traded.

Most importantly, traders from South Africa can make local deposits in ZAR in their account at Octa. There is no commission when you use their bank payment option, and it is deposited in your account within few minutes.

The withdrawals are sent to SA bank accounts in few hours, so if you make the withdrawal request to your bank during business hours, it is normally received in the same day.

Other than bank payments, the other options are wallets (Skrill & Neteller). You need to make a minimum deposit of $50 if you choose this method, and you can withdraw a minimum amount of $5.

Octa also accepts & offers withdrawals via major cryptos. You can use BTC, ETH, LTC, DOGE & USDT as your payment method for both side.

It should be made clear that you can only withdraw funds to method that was the source of your deposit. For example, if you made deposit using bank transfer to Octa, then you cannot withdraw to your Skrill wallet.

Octa Customer Support is available to you through diverse channels. This is accessible to you on 5 weekdays for 24 hours through Live Chat, E-mail, and WhatsApp (texts only). You can also make use of the web-form for submitting your queries.

The Finance Department is accessible from 06:00 – 22:00 (Eastern European Time). The Customer Verification Department is available from 08:00 – 17:00 (EET) for troubleshooting and account setup inquires.

Yes, we do recommend Octa for traders in South Africa if you are looking for a low cost NDD broker.

Octa is one of the leading digital Forex trading platforms. Initial deposits are not too high and a variety of instruments for trading. The overall trading fees is quite low with all 3 accounts, plus they are also a CYSEC regulated broker.

Octa also has a 50% deposit bonus which is available for South African traders as well.

Advanced traders will appreciate the narrow spreads, zero commissions, and accessibility for all trading strategies. It includes Scalping, Hedging, and Automated Trading strategies. All traders are offered segregated accounts and negative balance protection by Octa.

Meanwhile, Octa also has certain drawbacks. The modes of making deposits and withdrawals are limited for South African. Their trading assets are also restricted in comparison with other brokers. And they also don’t offer ZAR Trading accounts. The lack of 24X7 Customer Support is another limitation.

Overall, with good support accompanied by low trading fees, abundant tools, Octa offers a great trading platform for beginner traders as well as Pros.

No, Octa does not offering ZAR account currently. Traders from South Africa have option to open only USD base currency account.

Octa has a minimum deposit of $25 with MT4 & MT5 accounts. In ZAR this is ≈ R480 if you are using bank transfer to add funds to your account. There are only 3 account types available at OctaFX, but none of these account types has ZAR as the base currency.

Yes, Octa is regulated by FSCA, but they are not an approved ODP. Octa Group is regulated with 1 Tier-1 regulation CySEC (license number 372/18). Trader from SA are registered under Orinoco Capital (Pty) Ltd, which is registered in SA.

Traders can request initial withdraw to the same source as their initial funding method. Moreover, you can request withdrawal via bank wire or wallet like Netseller or Skrill, etc. depending on which of these methods you used during funding. The withdrawal time depends on the method & can vary upto few hours to 24 hours,

"Do you have experience with OctaFX South Africa? Please consider sharing your experience with a review below – good or bad – doesn’t really matter as long as it’s helpful to other traders!"

We only accept user reviews that add value to fellow South African Traders. Unfortunately, not all reviews that you post with us will be published on the website. For your review to be approved, please share your detailed & honest experience with the broker – either positive or negative. Thank you for helping out other traders with your valueable feedback!

Important: We don't accept any payments or kickbacks from any forex broker(s) to delete or change any reviews. We welcome Forex Brokers to reply to reviews on our website & share their side of the story to keep the process honest and fair for both sides.

Comments are closed.

My name is Bontle Phike, I traded with OctaFX I am still waiting for my withdrawal till today. I was told to pop out R11,600 for delivery . I am still waiting till date, my account manager is Jason and the Agent is Robert Wesley.

I’m still waiting on a withdrawal of R62 000 the broker and expert trader told me before I can receive my profits I need some expenses to pay privately because somehow they can’t deduct it from my profits