FBS Broker is regulated with Top-tier regulators like FSCA, ASIC & CySEC, which makes them a low risk broker for traders in South Africa. Based on our research, they are offering high leverage, and have very low minimum deposit.

FBS is an international CFD broker that has been in operation since 2009. Over the last 12 years, FBS has developed a reputation for being a reliable and safe broker. FBS caters to South African traders and even has a license from the South African financial regulator FSCA.

FBS allows traders to trade a variety of instruments including stocks, metals, indices, bonds, and forex. In addition, FBS is one of the few brokers that offer access to 30 Crypto CFDs.

Overall, FBS is considered to be a relatively expensive broker with spreads averaging 3 pips. However, they do have several types of accounts and some of them are more reasonable than others.

FBS is a good option for new traders. They have a beginner-friendly trading environment and they have lots of educational material for traders to learn from. They also offer demo accounts so that new traders can practice in real-world conditions without losing money. Further, they also offer copy trading services, so that new traders can learn from experts.

In this review, we’ll cover every aspect of trading with FBS including safety and regulation, accounts, trading platforms, bonuses, deposit and withdrawals, and more.

FBS Pros

FBS Cons

| 👌 Our verdict on BDSwiss | #12 Forex Broker in South Africa |

| 🏦 Broker Name | FBS Markets Inc |

| 💵 Average EURUSD Spread | Floating spread from 0.5 pips with Standard account |

| 📅 Year Founded | 2009 |

| 🌐 Website | www.fbs.com |

| 💰 BDSwiss Minimum Deposit | 1 USD |

| ⚙️ Maximum Leverage | 1:3000 with Standard Account |

| ⚖️ BDSwiss Regulation(s) | FSCA, FSC, ASIC, CySEC |

| 🛍️ Trading Instruments | 40 currency pairs, Commodities, Stocks, Indices. |

| 📱 Trading Platforms | MT4, MT5, FBS trader & CopyTrade |

If you’re a CFD trader, then you need to know the importance of trading through a safe and reliable broker. The best way to gauge safety is to see how long the broker has been operating for and which financial authorities have accorded it a license.

FBS is a well-licensed CFD broker and has a strong record of safe performance.

FBS also offers negative balance protection to its traders. This means that an investor or trader cannot lose more money than the amount they have deposited in their trading account.

It’s clear from the above particulars that FBS and its group companies hold licenses from reputed financial authorities. This makes FBS a reliable broker in terms of safety.

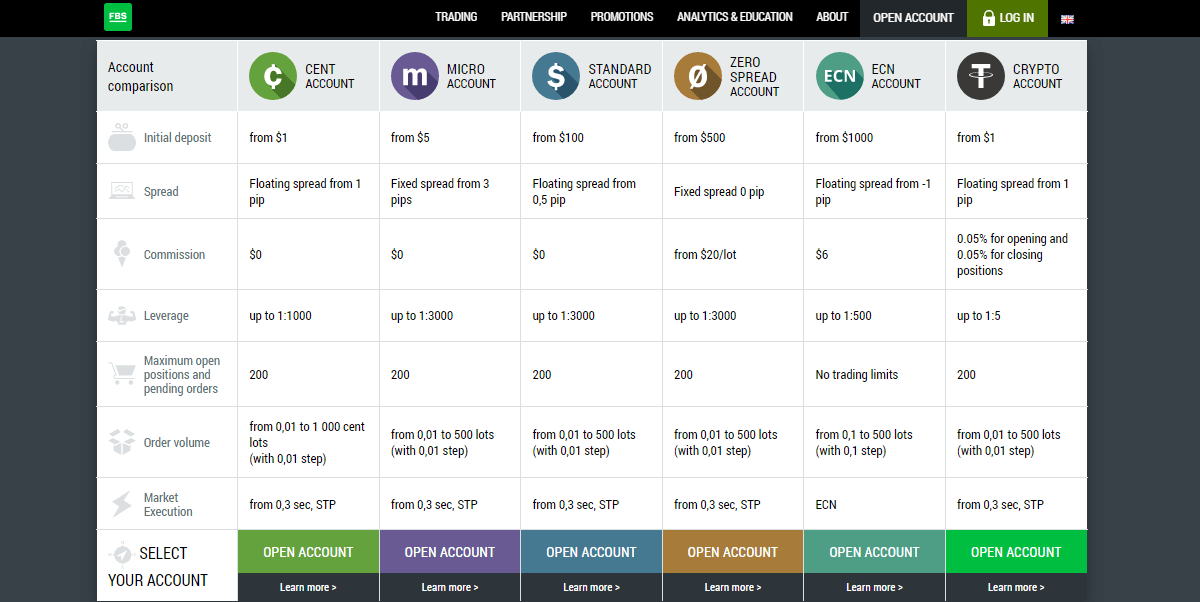

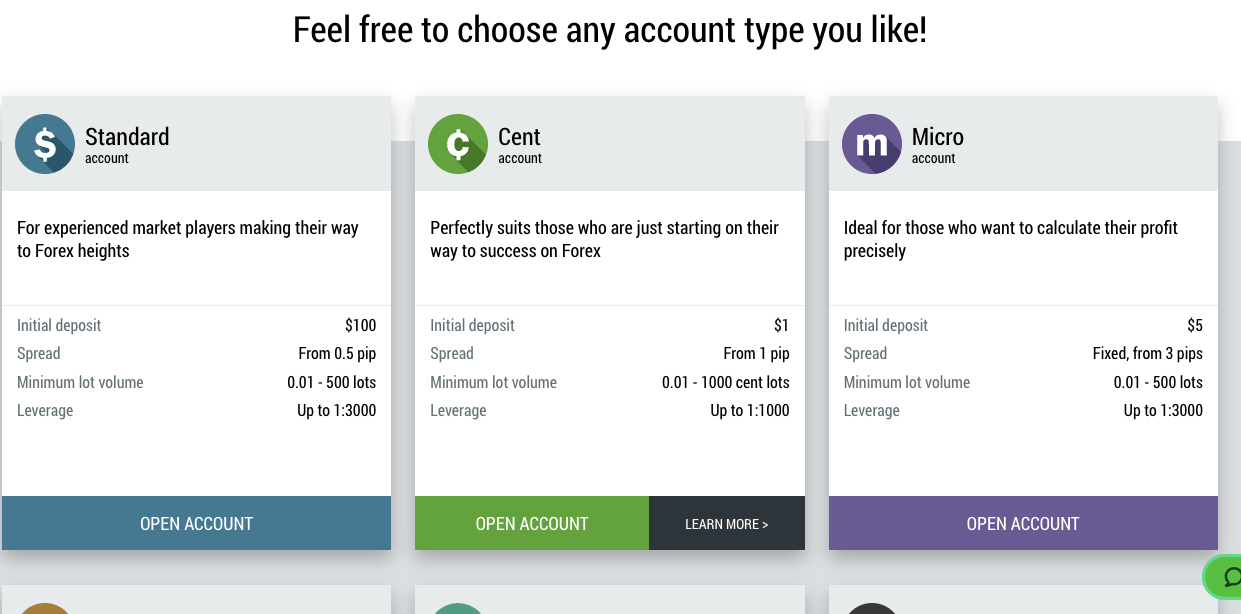

Traders with FBS have the option of choosing between five different account types. These account types are: Standard, Micro, Cent, ECN, and Zero Spread. Each of these accounts are different from each other. They all have their own advantages and disadvantages. For example, traders who trade in high volumes should opt for the Zero Spread account.

The base currency of each account type is either EUR or USD. FBS does not have the option of using ZAR as a base currency, yet. Even though deposits can be made in ZAR, the currency is converted into USD or EUR before you can enter into trades with it.

Here is a breakdown of all five account types:

Even though the spread is kept tight, this account also charges a commission of $6 for every trade. This makes ECN accounts suitable for high-volume traders. This account type allows for a leverage of up to 1:500.

However, traders will also be charged a commission which starts from $20 per lot. You can obtain high leverages through this account which can be up to 1:3000.

Overall, the advantage of opening an account with FBS is that you have a lot of choice in the type of account you can open. There are accounts that are specifically meant for new traders, low-volume traders, scalpers, hedgers, high-volume traders, and more.

FBS offers a large number of promotional programs for traders to take advantage of. Here is a breakdown of some of the most popular promotional offers.

It is credited automatically to your account if you have activated the bonus while making the deposit.

The 100% deposit bonus is a great offer for anyone looking to open an account with FBS. You can instantly double your money through this offer.

There are certain terms and conditions that are attached to this bonus that you should check out before making a deposit.

At the time of writing this review, this promotional offer was inactive. However, it is expected to start participation soon.

This offer is only available for traders who are using the Standard and Zero Spread account types.

To avail of the offer, traders need to activate the cashback offer through the FBS platform. The cashbacks can be up to 20% of the total spread paid.

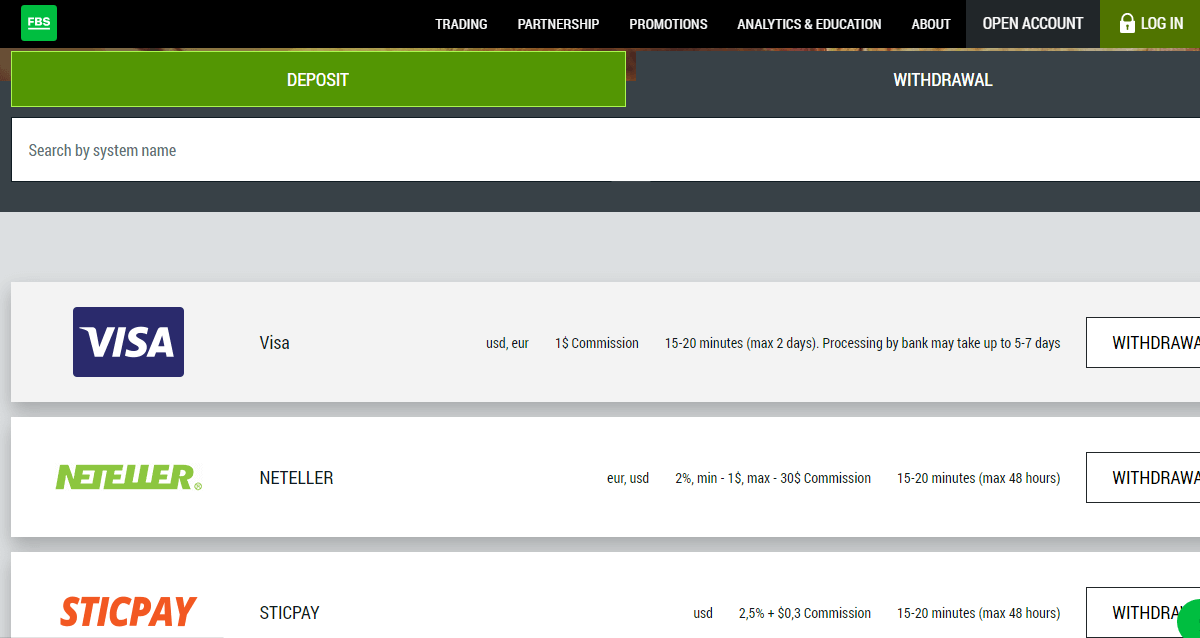

FBS accepts deposits and makes withdrawals in a variety of ways. The exact deposit and withdrawal options vary from country to country.

It should be remembered that FBS does not offer accounts denominated in ZAR. This means that any amount deposited will be converted into USD or EUR before you can make trades with them. The applicable exchange rate and cost of exchange will apply for every deposit and withdrawal.

Deposits can be made instantly to your account, while withdrawals can take up to 48 hours. The exact time period for a complete transfer will depend on the type of payment method.

FBS offers the option of choosing between three trading platforms. These platforms are MetaTrader 4, MetaTrader 5, and FBS Trader. We will discuss each of them in turn.

However, this trading platform is not available for desktop use. Hence, only traders who intend to only trade through their smartphones should opt for this option.

The platform also comes with a few technical indicators so that you can make informed trades. New traders can also avail of a Quickstart bonus which provides $200 to those who have just started using the FBS Trader.

Traders can also deposit and withdraw funds directly through the trading platform. It also allows 24/7 trading services.

A customer support system has been built into the app itself so that traders can get quick help from customer support executives through live chat.

It is a versatile platform that is quite easy to use.

This platform has several technical indicators which can be used to inform your trades. Further, the platform allows you to take advantage of features such as 1-click trading, streaming news, full data back-up, and more.

The added benefit of using the MT5 is that it offers a higher number of technical indicators and more advanced features when compared with the MT4. The MT5 is especially meant for experienced traders.

Overall, we recommend FBS for South African traders.

They are a safe broker to use since they are licensed and regulated by the FSCA of South Africa. They are also regulated by a tier-1 global financial authority for added security.

They have a long track record and they use safety practices such as segregation of funds and negative balance protection.

On the flipside, FBS fees are on the higher end of the scale.

However, there are certain advantages to trading with FBS such as several promotional offers, lots of trading instruments, good customer support, and many ways to make a deposit or withdrawal.

Further, FBS offers several account types for traders to choose from, and it is likely that every kind of trader will find an account type that suits his trading profile.

FBS is a low risk broker choice for South African traders especially since it is regulated by the FSCA.

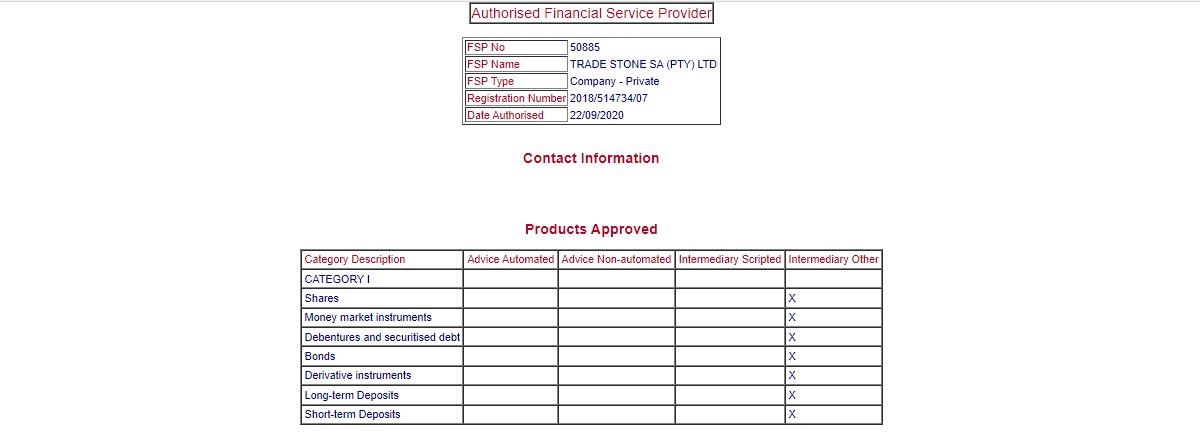

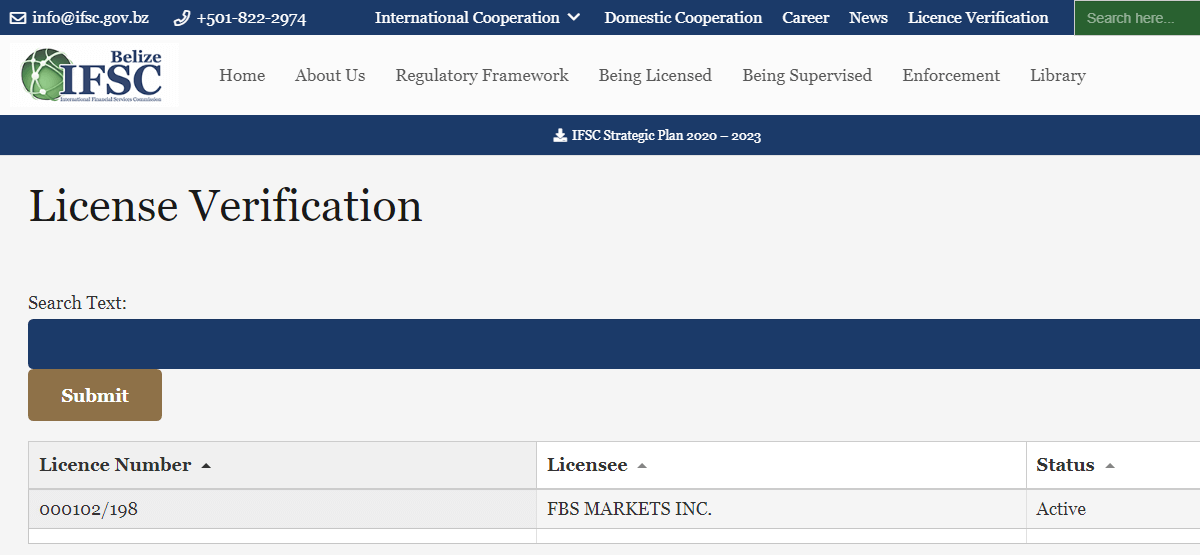

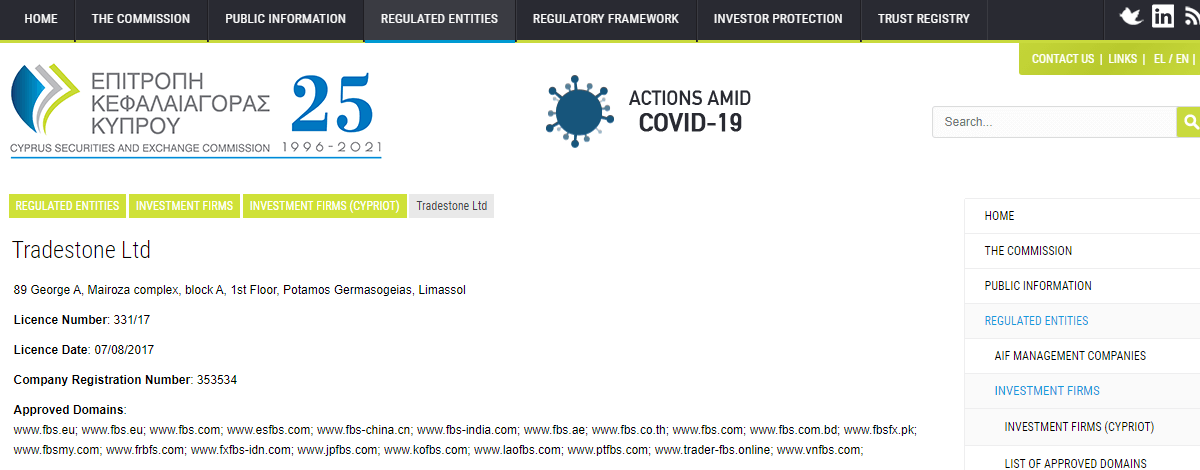

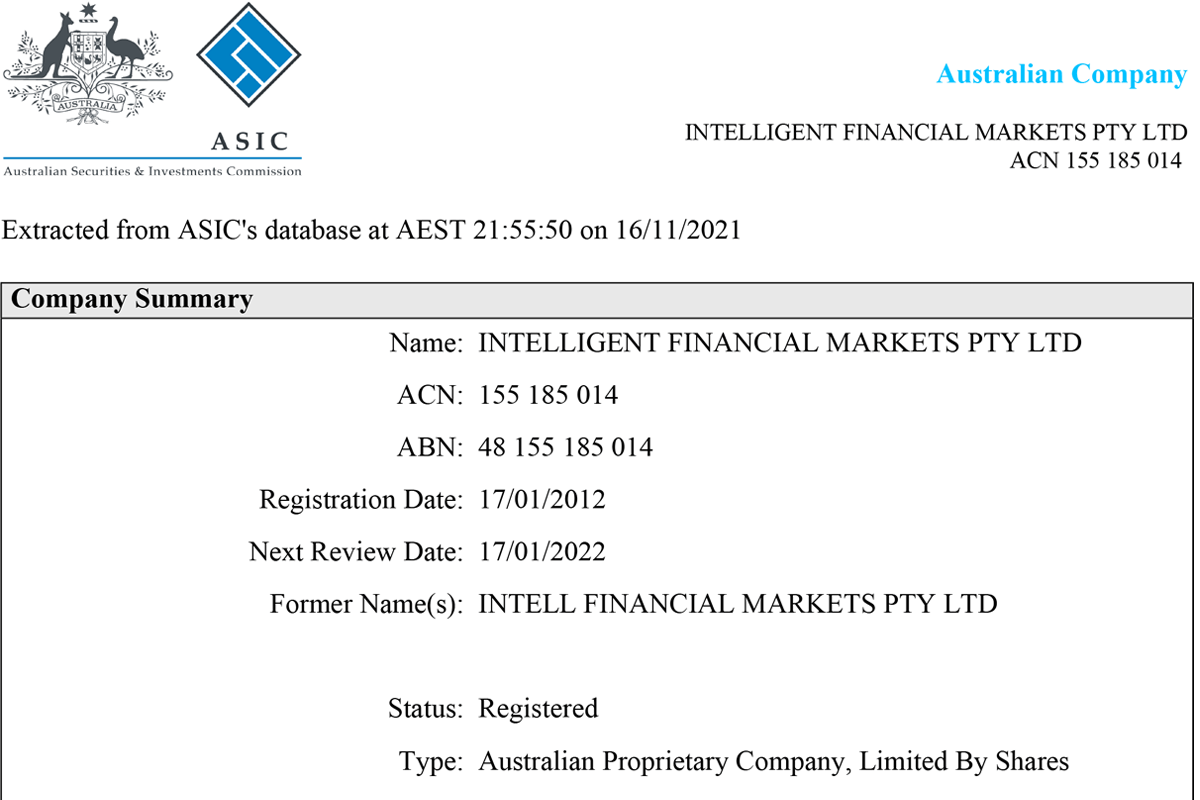

Yes, FBS is regulated with Financial Sector Conduct Authority (FSCA) as FBS Markets Pty Ltd under the licence number 50885. FBS is also regulated with FSC, ASIC, CySEC so we comnsider them a safe broker for traders from South Africa.

Traders with FBS can select ZAR as the base currency account while signup. The minimum deposit is 16 ZAR ($1) with Cent account.

The FBS minimum deposit is $1 (16 ZAR) with Cent trading account. FBS accepts deposist using different payment methods like card, internet banking and E-Wallets without any charges.

"Do you have experience with FBS? Please consider sharing your experience with a review below – good or bad – doesn’t really matter as long as it’s helpful to other traders!"

We only accept user reviews that add value to fellow South African Traders. Unfortunately, not all reviews that you post with us will be published on the website. For your review to be approved, please share your detailed & honest experience with the broker – either positive or negative. Thank you for helping out other traders with your valueable feedback!

Important: We don't accept any payments or kickbacks from any forex broker(s) to delete or change any reviews. We welcome Forex Brokers to reply to reviews on our website & share their side of the story to keep the process honest and fair for both sides.

Submit Your Review