eToro is a reputed forex & CFD broker that accepts traders in SA. They are regulated with top-tier regulators i.e. CySec & FCA in UK & ASIC. They offer zero deposit charges but no bonus for clients. Read our review to decide if you should choose them or not!

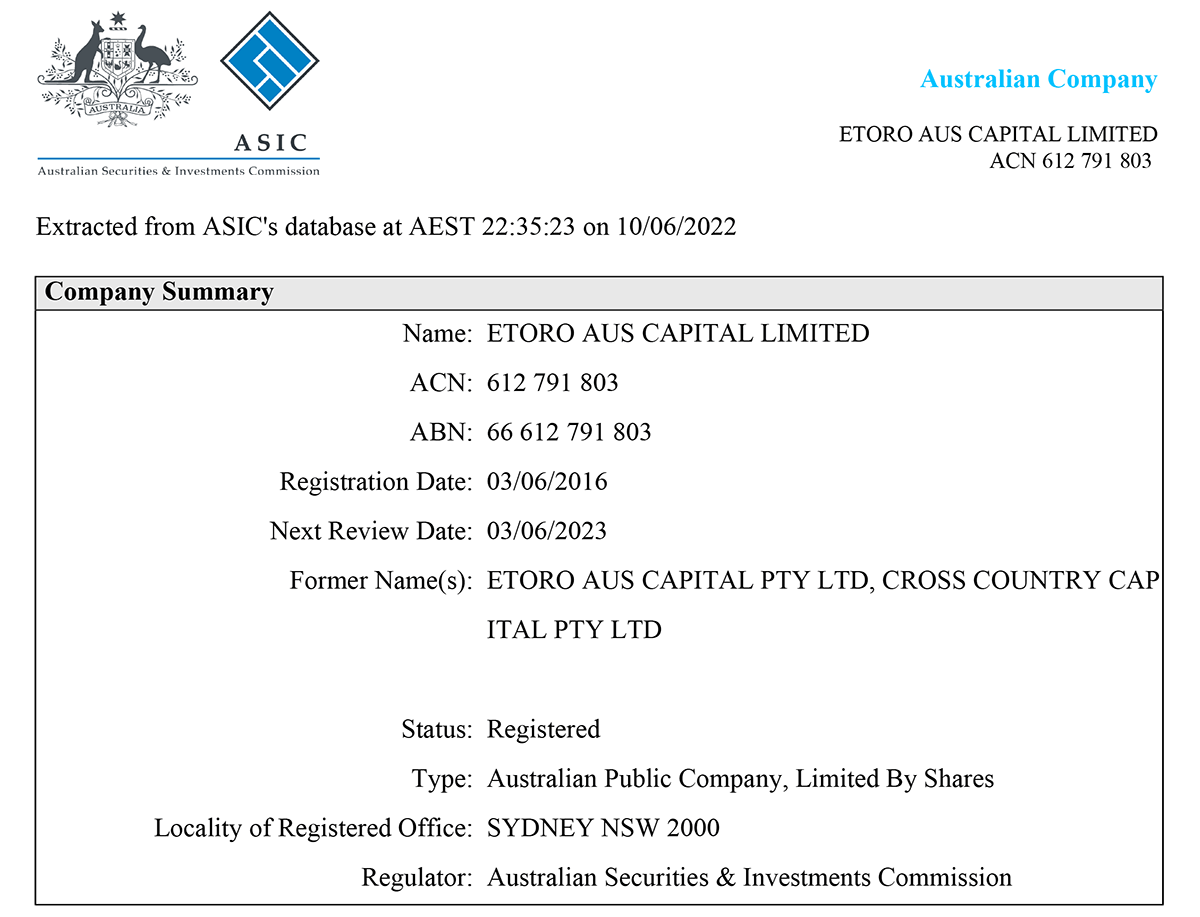

eToro was established in 2007 in Cyprus. And they are regulated with various regulatory such as FCA of UK, Cyprus Securities & Exchange Commission (CySEC), Australian Securities and Investments Commission (ASIC).

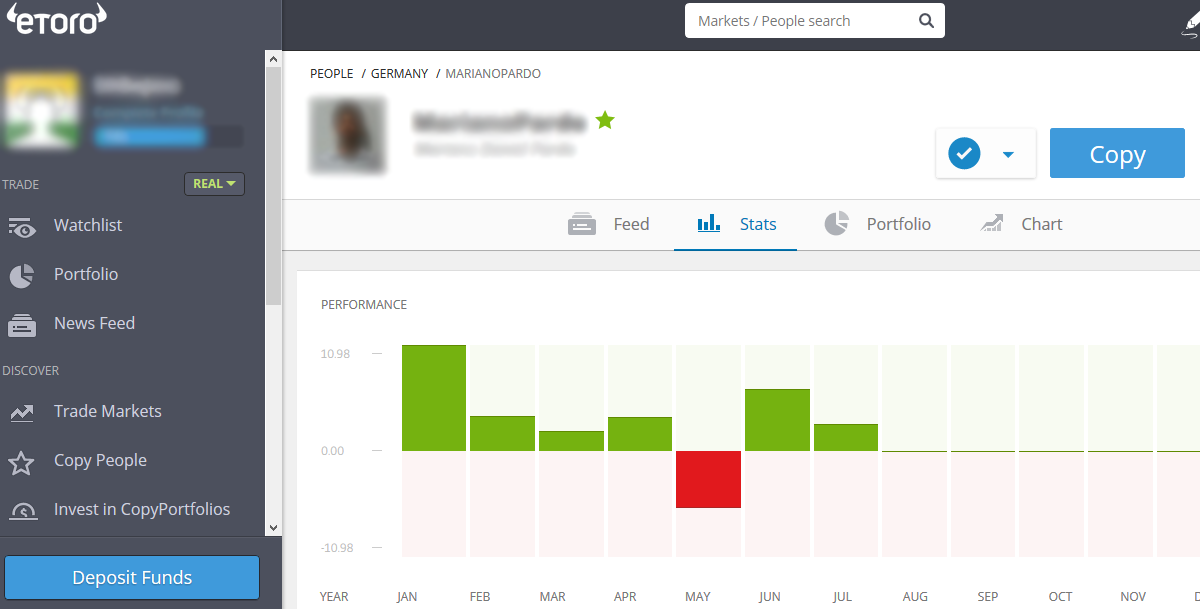

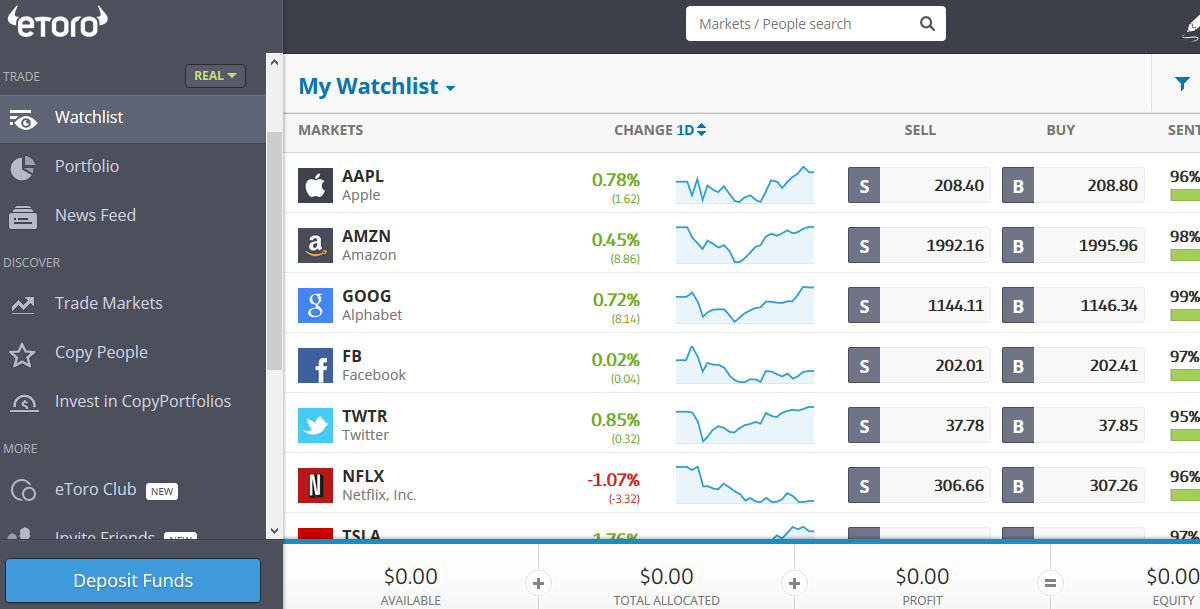

eToro have around 7.1 million clients all around and world and they are known for cryptocurrency CFD trading. They have clean and unique trading platform which makes them different from the other brokers in the South Africa.

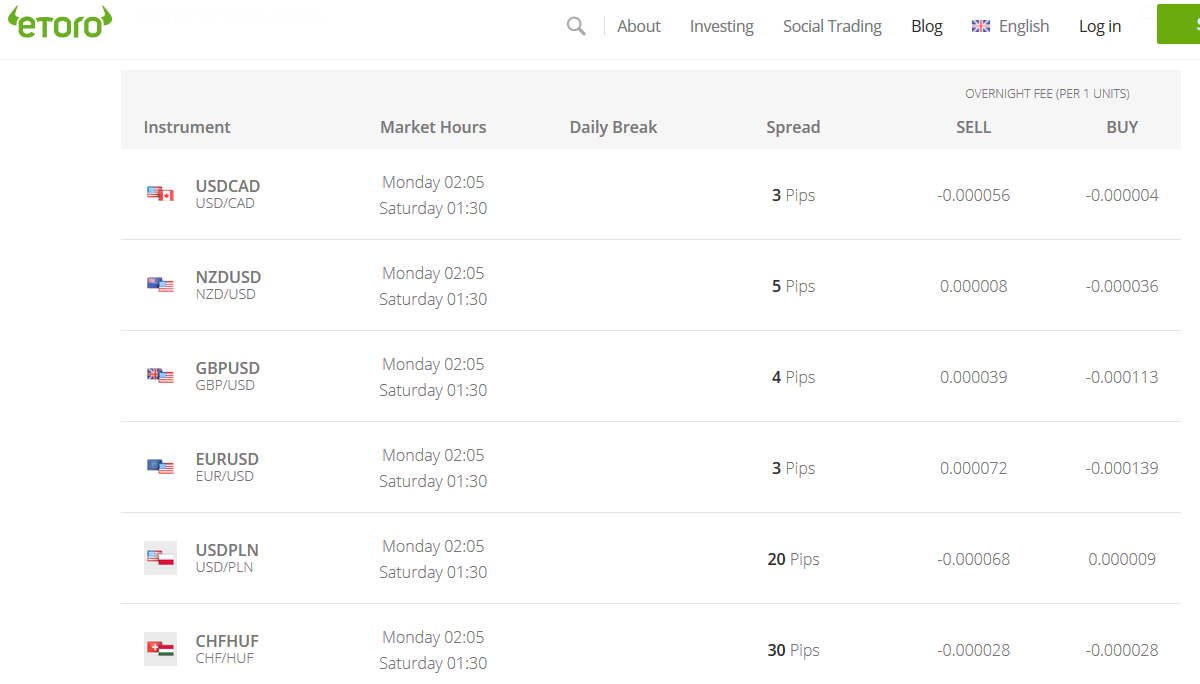

eToro allow traders to invest in Bitcoin and in various cryptocurrencies available on their Trading Instrument page. Plus they offer CFD trading on forex, comodities & shares trading as well at low fees.

Read this our detailed review based upon their trading fees, regulation, commission and deposit and withdrawal methods.

Below is our full review on eToro’s “good & bad side”.

eToro Pros

eToro Cons

Table of Contents

| 🏦 Broker Name | eToro |

| 📅 Year Founded | 2007 |

| 🌐 Website | www.etoro.com |

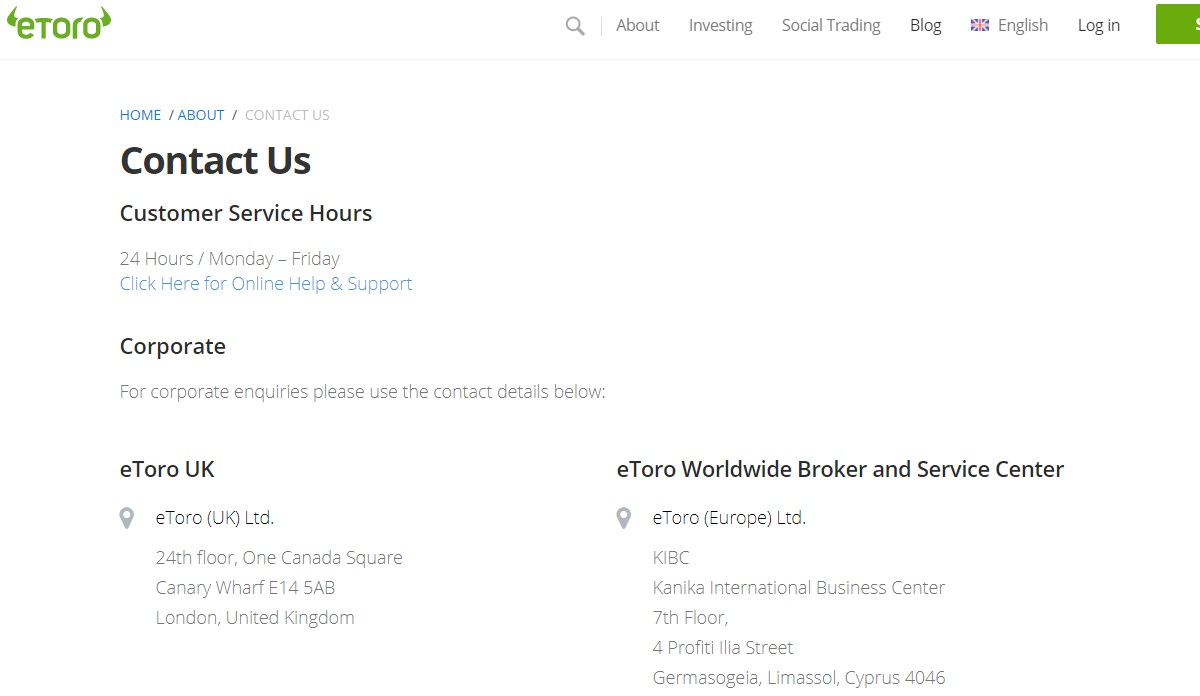

| Registered Address | eToro (Europe) Ltd, KIBC, Kanika International Business Center, 7th Floor, 4 Profiti Ilia Street, Germasogeia, Limassol, Cyprus 4046 |

| 💰 eToro Minimum Deposit | $200 |

| ⚙️ Maximum Leverage | 20:1 |

| 🗺️ Major Regulations | Regulated by FCA, CySEC, ASIC. |

| 🛍️ Trading Instruments | CFDs, ETFs, Forex, Cryptocurrency, Shares, Commodities, Indices |

| 📱 Trading Platforms | Mobile and Web Trading Platform |

Etoro is an established company and they are regulated by FCA, CYSEC and ASIC. Moreover this broker do not hold your money but records of your deposits and earnings. Incase of slippage, insurance comes in handy, to a tune of $20,000. So you funds and trading with them are safe.

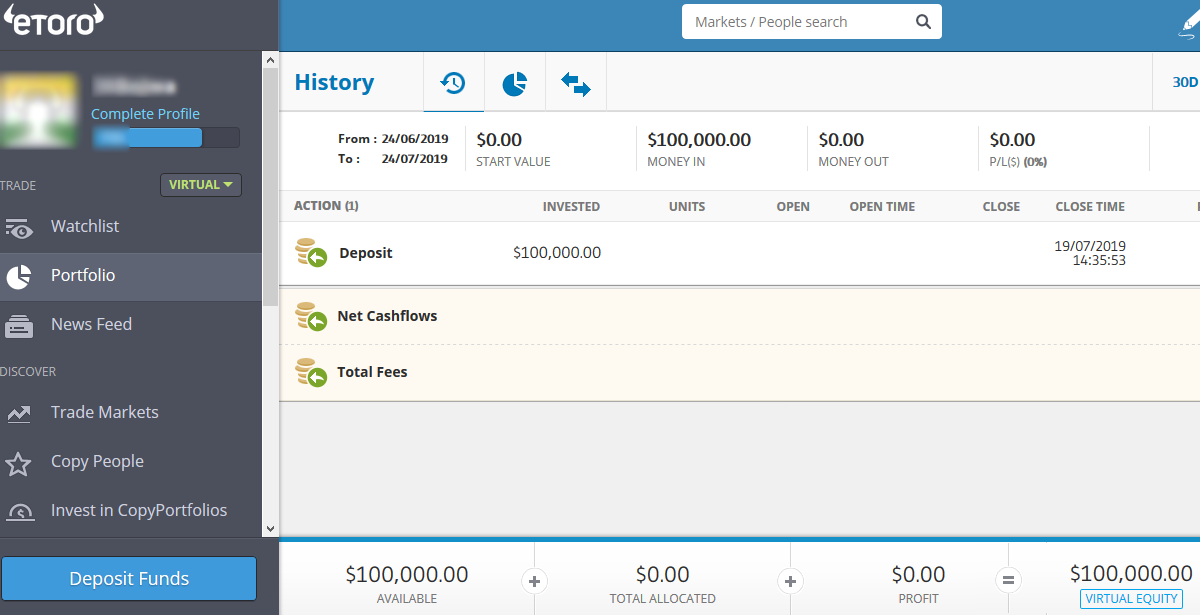

eToro Demo account is one of the best option for the beginner who want to learn or practice a Forex Trading .

In Demo account traders will get free and unlimited access and they can also use $ 100,000 of eToro virtual money.

With eToro demo account doesn’t require and initial deposit as you can use that virtual money by them.

eToro offers a demo account that traders can use to practice and familiarize themself with their platform. Moreover trader can anytime convert his demo account to live account.

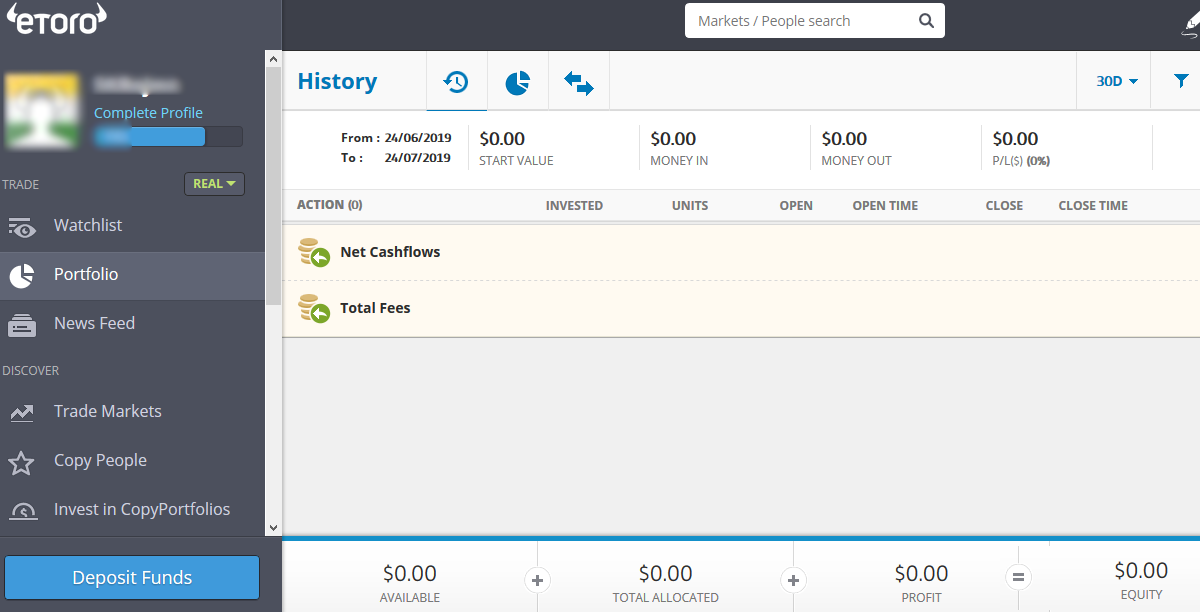

eToro does not have types of live trading account as offer by other brokers. But their live trading account comes with below features:

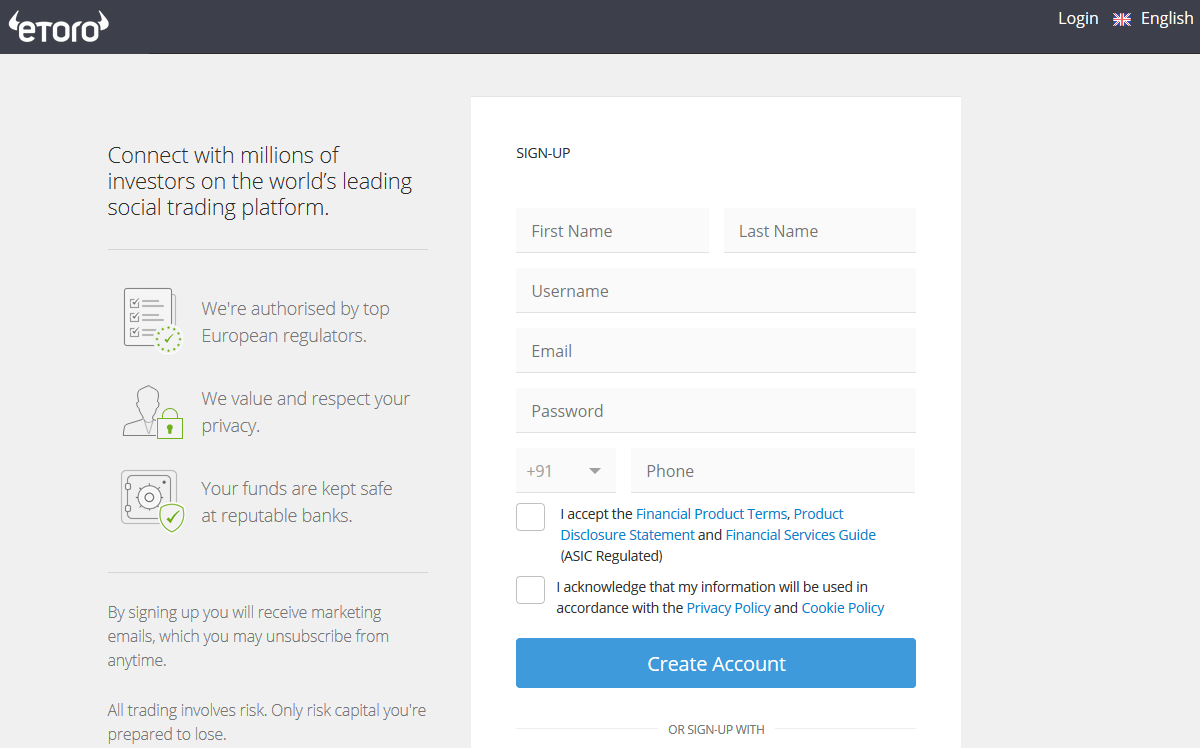

Step 1) Fill your Personal Information: First of all you need to enter your some personal details to create an account with them. You need to enter phone number and email which you need to be verified.

Step 2) Check Account Dashboard: Now you will be in the account dashboard where you can check all the features of eToro Live Trading account.

Step 3) Complete your Profile: Once done with checking with account dashboard, you need to fill the information by following on screen instructions as shown in the below screenshot.

Step 4) Verify Your Account: At last you need to verify you phone number by sending an OTP. And you also need to upload your documents like ID proof such as driving license, passport etc. and you also need to upload Address poof like electricity bill, postpaid mobile bill, etc.

You have completed the all steps to open and live trading account with eToro. Moreover you have also submitted your documents to verify your account. Normally account verification can take upto 24 hours. You will receive account verified email notification once it is done.

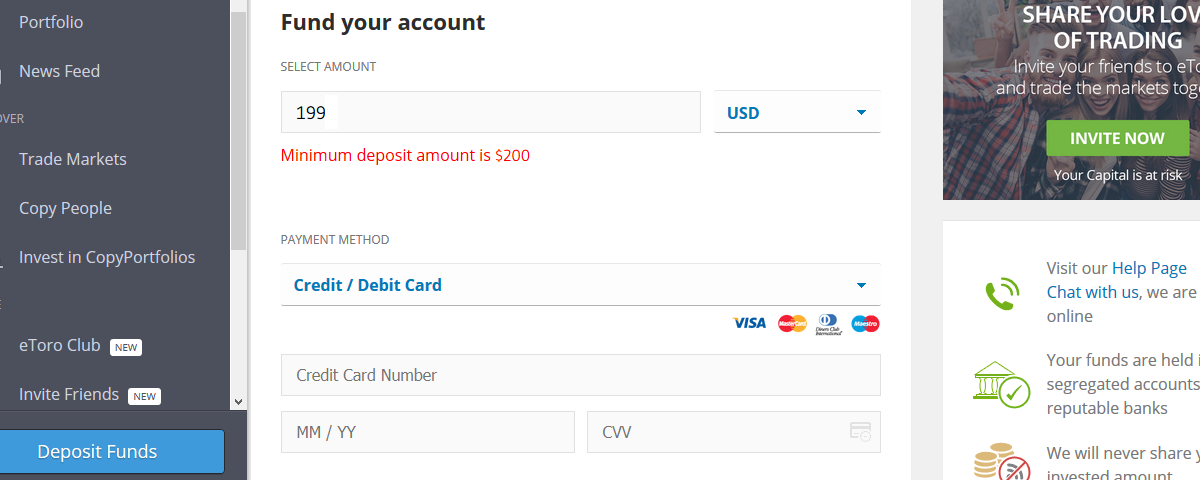

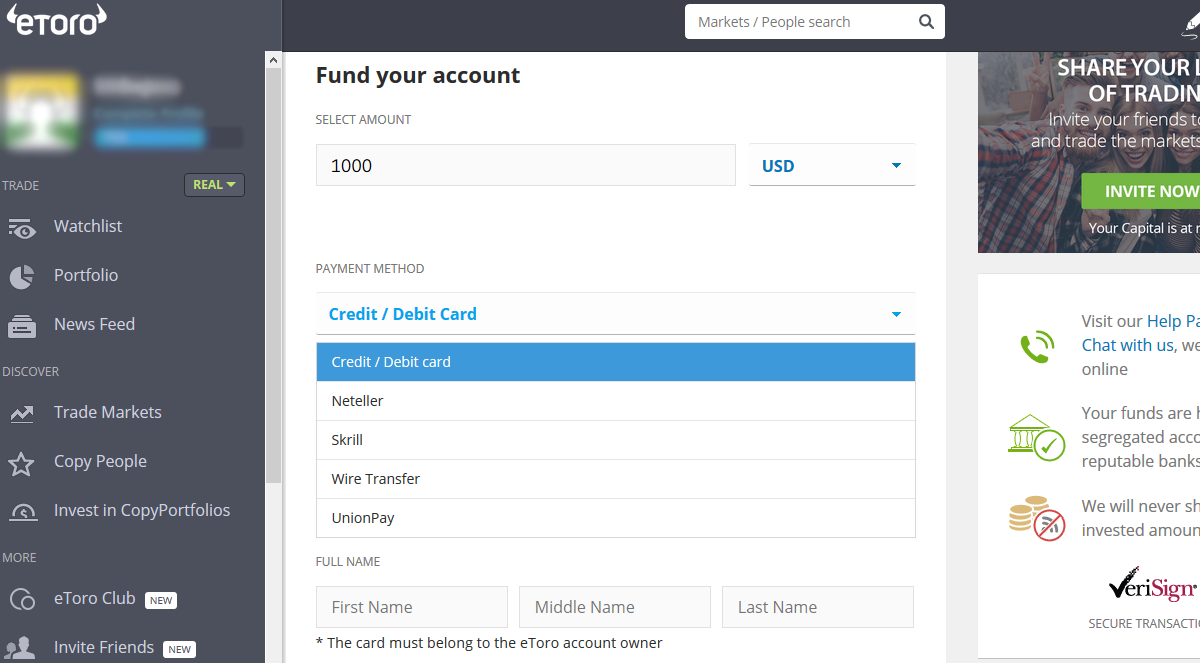

eToro allow their customers to make deposit using the and on of the Bank transfer, Credit/Debit card, Paypal, Skrill, Neteller and Webmoney.

There are no charges if you will make payment in USD. But on case of other currencies they deduct a specified amount of pips from current market rate.

Moreover they do not support ZAR currency but you can deposit in GBP, USD, EUR, AUD and MYR.

eToro always send withdrawals to the original payment method used to deposit.

Moreover withdrawal can take from 3 business days to 8 business days to be received from the day it is processed.

We have already checked it and notice that they do not offer registration bonuses at the moment.

But you can keep checking the post. We will update it once there will be any bonus offered by them.

eToro Chat support is not bad as compared to other brokers. They are offering support during 4 hours a day from Sunday at 17:00 GMT to Friday at 20:00 GMT.

You can contact them via below mediums:

Yes, we do recommend eToro for traders looking to trade Crypto CFDs. They offer social trading and copy trading options, and they also offer Share trading at low fees.

There are also some drawbacks like poor customer support, high spread on most CFD instruments as compared to average fees at other brokers in SA, and no bonus is available for new clients.

Moreover they do not offer ZAR base currency option. You can make deposit in USD only. Overall, we recommend them if you want to trade CFDs on Bitcion & other cryptocurrencies.

The minimum deposit at eToro is $200 for traders in South Africa. But they don’t offer ZAR base currency trading accounts.

Yes, eToro does accept traders based in South Africa. You can open account by signing up on their website.

No, eToro is not regulated in South Africa with FSCA. eToro is a reputed forex broker licensed with3 Top-tier regulators FCA, ASIC & CySEC.

"Do you have experience with eToro? Please consider sharing your experience with a review below – good or bad – doesn’t really matter as long as it’s helpful to other traders!"

We only accept user reviews that add value to fellow South African Traders. Unfortunately, not all reviews that you post with us will be published on the website. For your review to be approved, please share your detailed & honest experience with the broker – either positive or negative. Thank you for helping out other traders with your valueable feedback!

Important: We don't accept any payments or kickbacks from any forex broker(s) to delete or change any reviews. We welcome Forex Brokers to reply to reviews on our website & share their side of the story to keep the process honest and fair for both sides.

Etoro recently updated their verification process. Be warned that the old green SA identity book is not acceptable (not sure about the smart card). I could only use my SA Passport which has recently expired. Covid Level changes / KZN looting resulted in Home Affairs being closed or unable to process the renewal: it has taken two months to renew in a rural area! This means minimal transactions are allowed.