FxPro is a UK based regulated forex broker. They are regulated with top-tier regulators i.e. FSCA & FCA in UK. They offer moderate spread, zero deposit & withdrawal charges. Read our FxPro review to decide whether they are safe for South Africans or not.

Fxpro is a London based forex broker that was founded in 2006. They serve South African clients, and are regulated with top tier regulators including with FSCA, and FCA in UK.

We consider it safe to trade with them as they are highly regulated & have been around for long time.

FxPro’s trading fees is not the lowest but it is still very competitive. They have average spread for most forex pairs (around 1.5 pips for EUR/USD, 2.1 pips for USD/JPY). Plus, their trading platforms are quite wide including cTrader & latest MT5. Their support is also very competent.

Here’s a transparent look at the FxPro’s fees, platforms, regulations, account types, bonus, customer support & more!

FxPro Pros

FxPro Cons

Table of Contents

| 🏦 Broker Name | FxPro Financial Services Limited |

| 📅 Year Founded | 2006 |

| 🌐 Website | www.fxpro.com |

| Registered Address | 13-14 Basinghall str., City of London, EC2V 5BQ, UK |

| 💰 FxPro Minimum Deposit | R1707.34 ($100) |

| ⚙️ Maximum Leverage | 1:200 |

| ⚖️ Major Regulations | Financial Sector Conduct Authority (FSCA), Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), Dubai Financial Services Authority (DFSA), Securities Commission of The Bahamas |

| 🛍️ Trading Instruments | Forex Trading, Metals, Cryptocurrencies |

| 📱 Trading Platforms | MT4, MT5 and cTrader, FxPro Trading Platform |

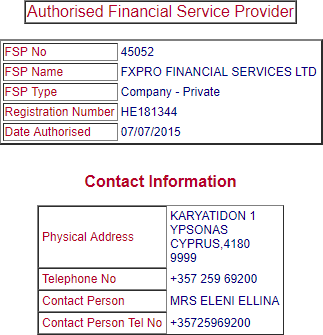

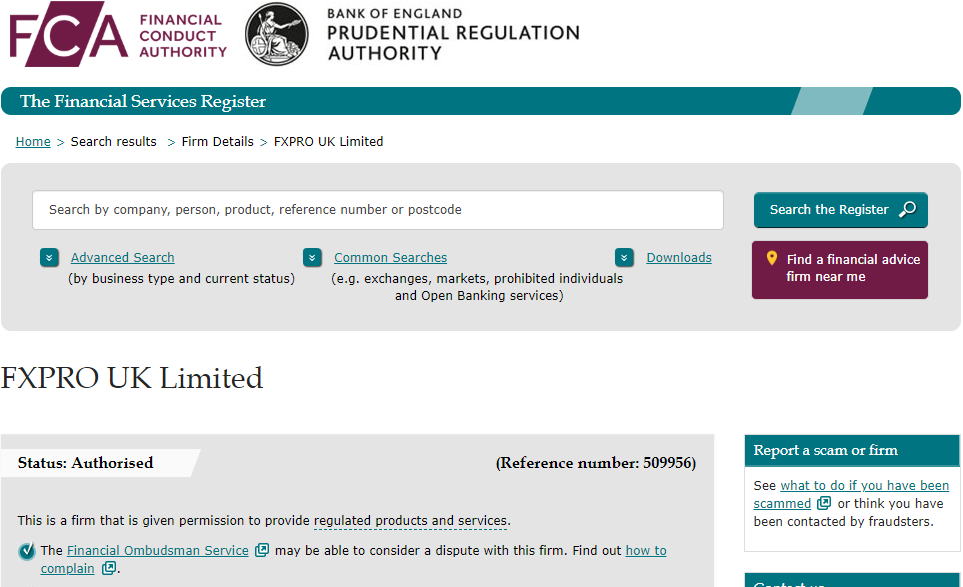

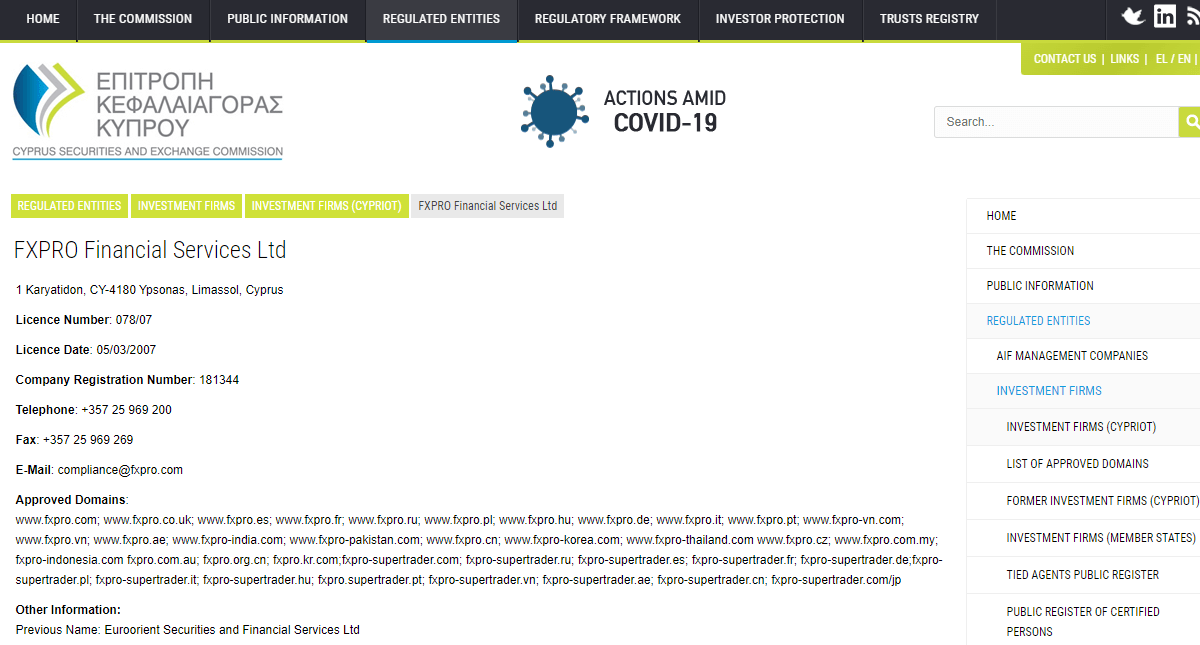

FxPro is regulated in South Africa, UK & with other European regulators. They are regulated under the following regulatory authorities:

The important question, is trading with Fxpro safe?

Yes, FxPro is one of the oldest Forex broker in the world, they have been around for quite a while. Also, they are regulated with 2 of the top-tier regulators i.e. FSCA in South Africa & FCA in UK, so trading with them is safe for South African traders.

But they don’t have ODP license under FSCA. Their application status is not visible under FSCA’s Over the Counter derivative Providers search.

FxPro’s trading fees is not the lowest in comparison with other Forex brokers. Their non-trading fees is also high, but it is ok.

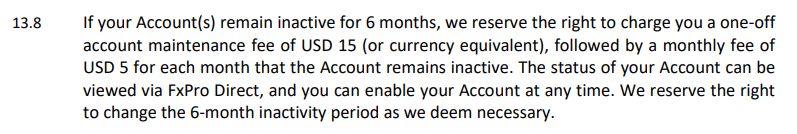

Here is a full breakdown of the 4 fees charged by FxPro:

Below image is the table of FxPro’s spread for some of their currency pairs:

Below is the screenshot of FxPro’s client agreement with the mention to their Inactivity fees:

FxPro’s overall trading fees is not the lowest, but it is still competitive. If you account type is cTrader, then the overall trading charges is moderate. But if you open MT4 or MT5 account, the spread is high, which also depends on the account execution method.

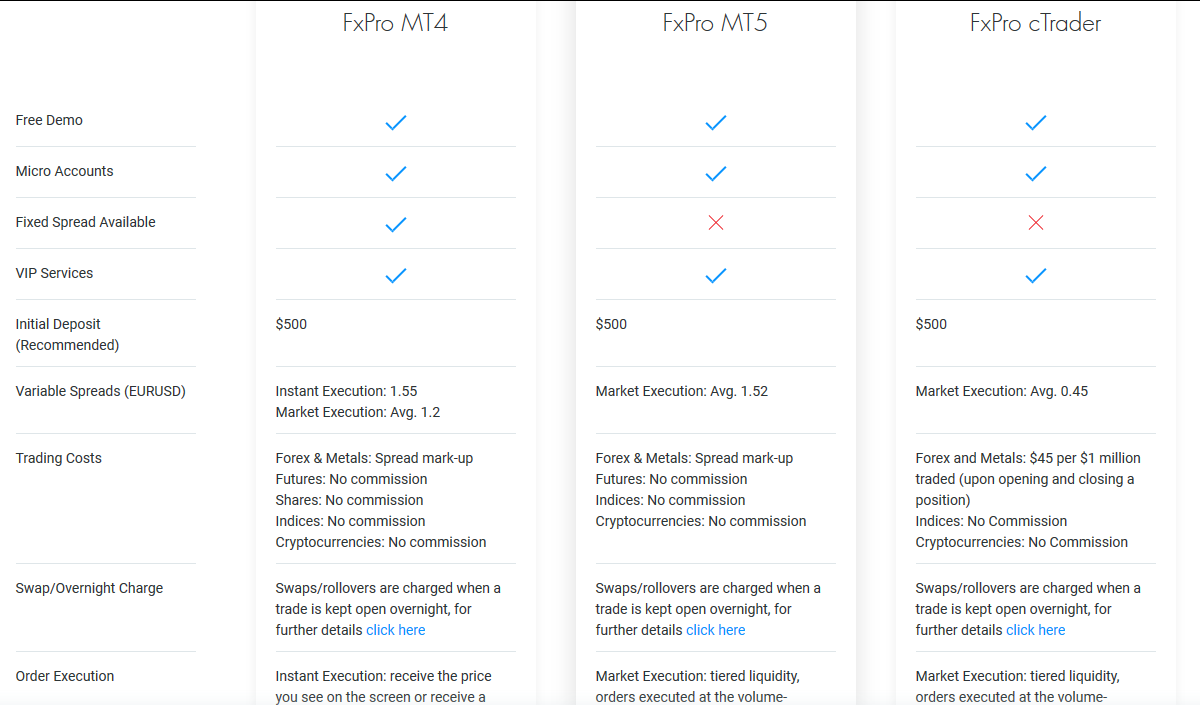

Fxpro offers 3 different account types & they also offer demo accounts for all their accounts. Moreover, special support is available for all account types depending upon your minimum deposit & volume of trade. The minimum account balance for all trading account is R1707.34 ($100).

Now here is the list and description of all the trading account types offered by FxPro:

FxPro offer Demo account which is available for all MT4, MT5 and cTrader account types.

The maximum leverage for Demo account is 1:200 for Major forex pairs.

There are 3 types of live trading accounts offered by FxPro as listed below:

1. MT4 Account: You can choose between instant order execution or market execution with FxPro’s MT4 account. The account minimum is R1707.34 ($100) & the spread is floating.

2. MT5 Account: This account offers market execution, variable spreads, no requotes. The spreads on this account are the same as with the MT4 account, the only difference is that you will get MT5 platform for trading.

3. cTrader Account: FxPro charges commission of $4.5 per Standard Lot on trades with cTrader account. The spread with this account is extremely tight when compared with their MT4 and MT5 accounts. This account is recommended for high volume traders.

Opening an account with them include few steps only. You need to follow the below steps to open an account with them:

Step 1) Click Register Button: First of all, you need visit FxPro.com. There you need to click on Register button at top right side of the home page of their website. This will take you to their sign up form page.

Step 2) Complete your Signup with FxPro: Now you need to fill the basic information to register your email with them. You need to enter your name, country, email and then click on Register > button.

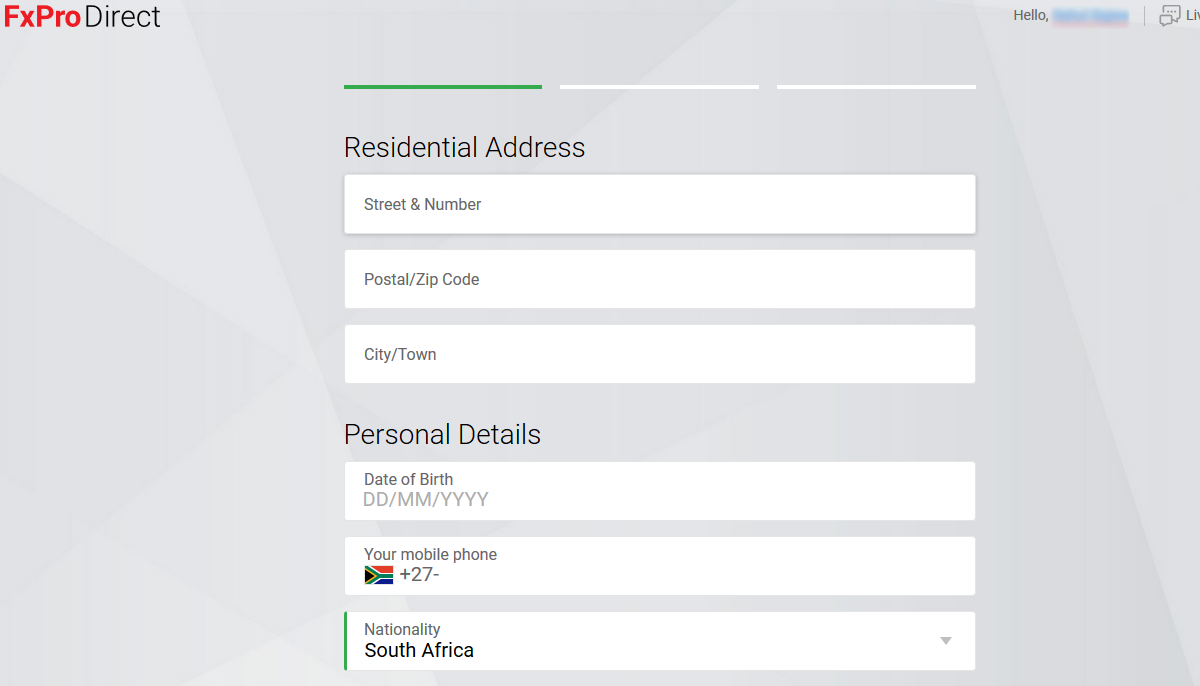

Step 3) Fill your Residential Address information: After entering your personal details, you need to fill your Address, Phone Number, Country of Residence information by following the instructions on the screen.

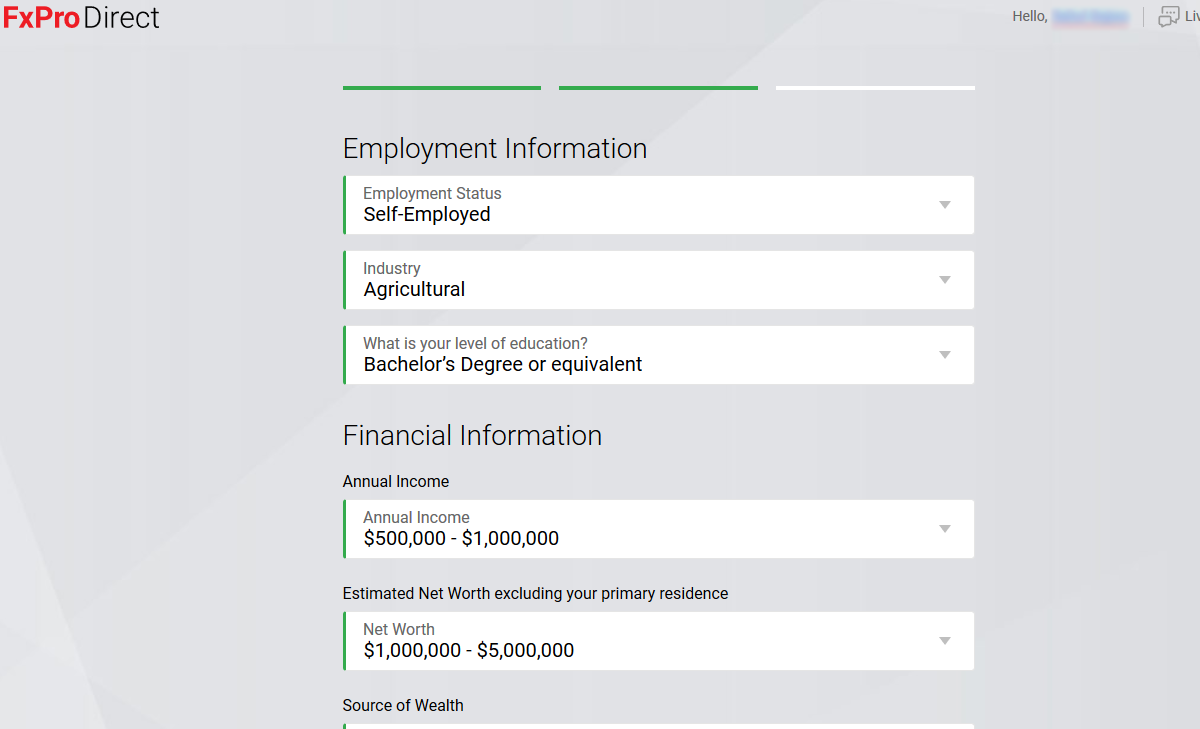

Step 4) Fill Employment Information: On this page you need to fill the basic information related to your source of income and monthly income.

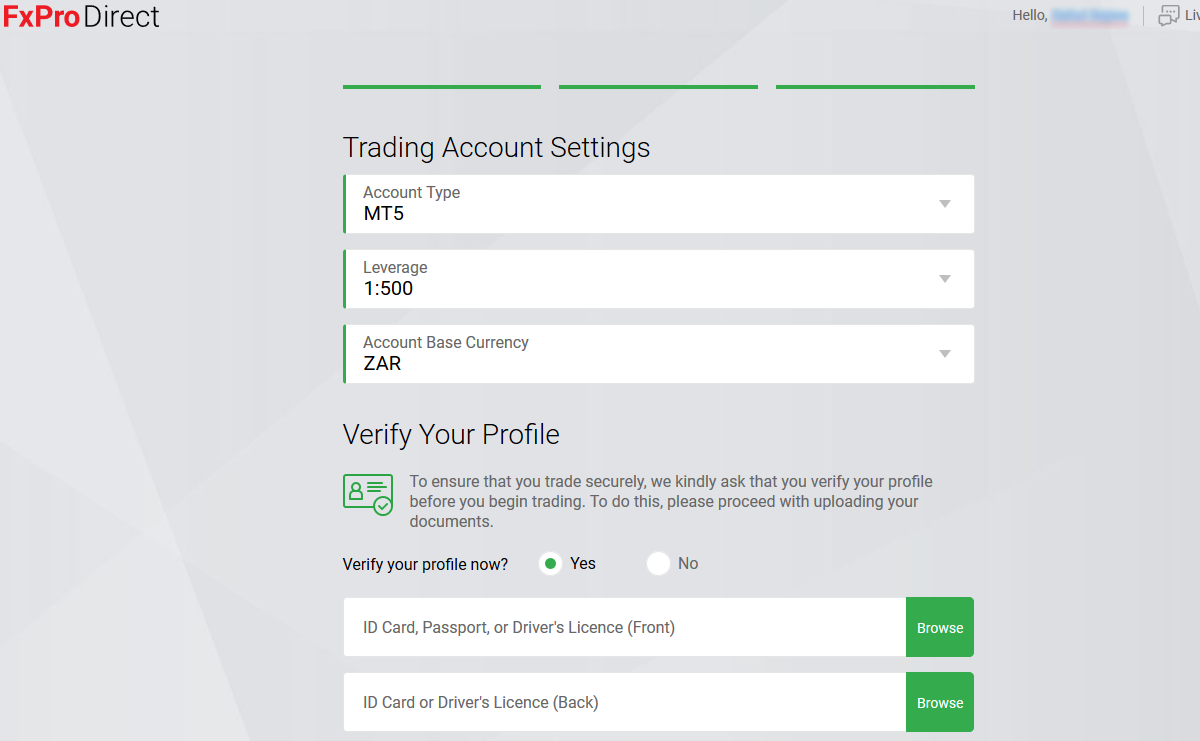

Step 5) Trading Account Setting & Verify your account: Now you will be redirected to a page where you need to select the trading account type. After that, to complete the registration you also need to upload the scanned copy of 2 documents i.e. your ID proof and Address proof for verification.

Note: Once you have submitted these documents to FxPro, it can take upto 24 working hours to verify the documents uploaded by you. Once they have verified your account, you will receive the account verified confirmation message via email from FxPro.

You can check your email for account/platform login details and can start trading with those details.

FxPro offer 4 trading platforms which are MetaTrader 4, Meta Trader 5, cTrader and FxPro Trading Platform (for mobile & desktop).

Below are the FxPro trading platforms available for South African traders:

FxPro offers wide range of CFD trading instruments on multiple asset classes & their overall trading fees for each asset class is moderate to low.

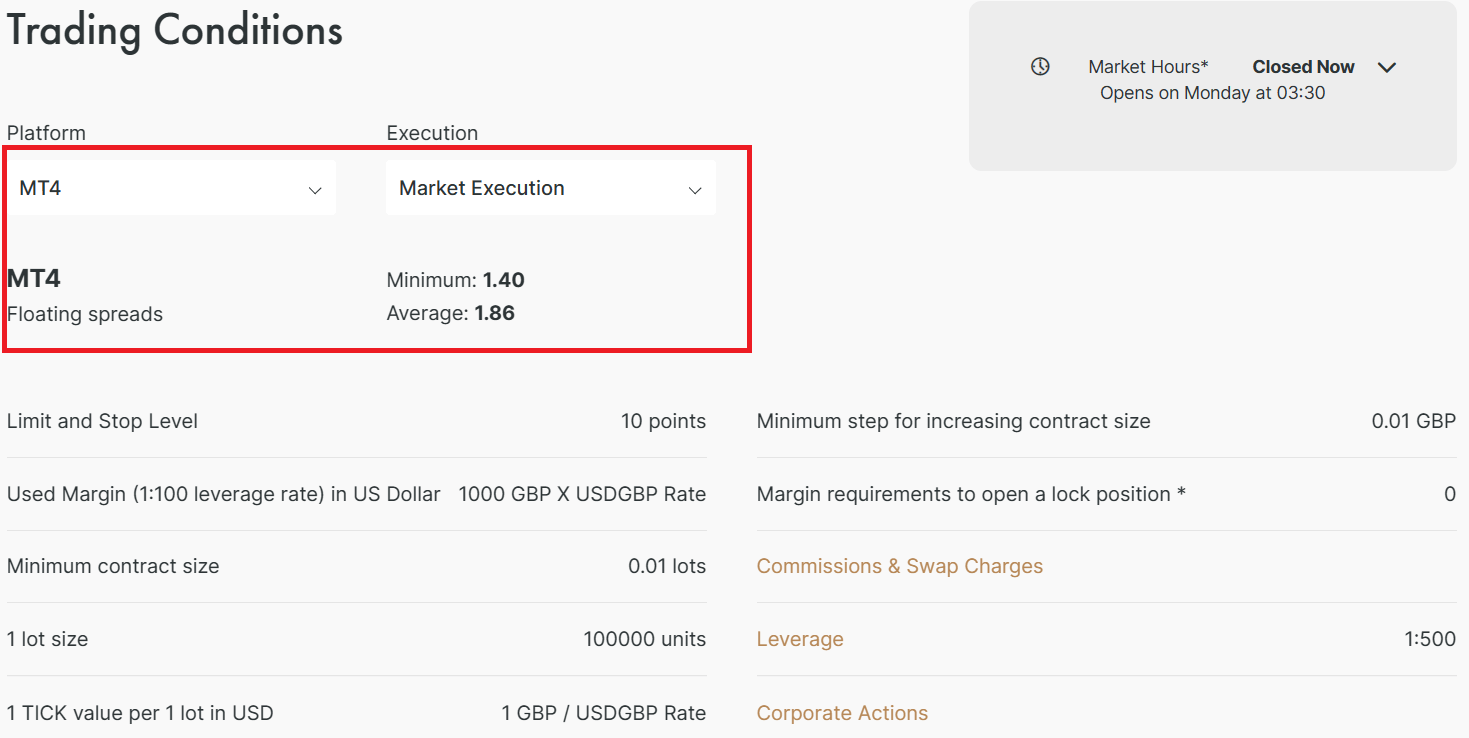

1) 70 Currency Pairs: FxPro offers trading on around 70 major & minor currency pairs. Their typical spreads for trading currencies are moderate to low. For example, for major like GBPUSD is 1.86 (floating spread) with MT4 market execution trading account.

The exact spreads & fees (commission + swap) depends on your account type. You can choose between MT4, cTrader & MT5 accounts. Also, depending on the execution method, the fees varies.

The below is an example of contract specifications for major like GBP/USD. The fees if you notice, depends on your trading platform & the method of execution. So, you should choose this before opening your account.

2) Range of CFDs: FxPro offer trading CFDs on major global indices including Nasdaq 100, S&P500 & DJI. The typical fees for trading the major indices at FxPro is comparatively high.

For example, the typical spreads for S&P500, with MT4 market execution account is 82.11. If the S&P500 is trading at 4000 & you have 1 Standard lot exposure, the fees will be $82.11. This is around 2%. The fees is bit lower with the cTrader account.

The fees for trading NASDAQ 100 CFD contract at FxPro is also higher than some other CFD brokers.

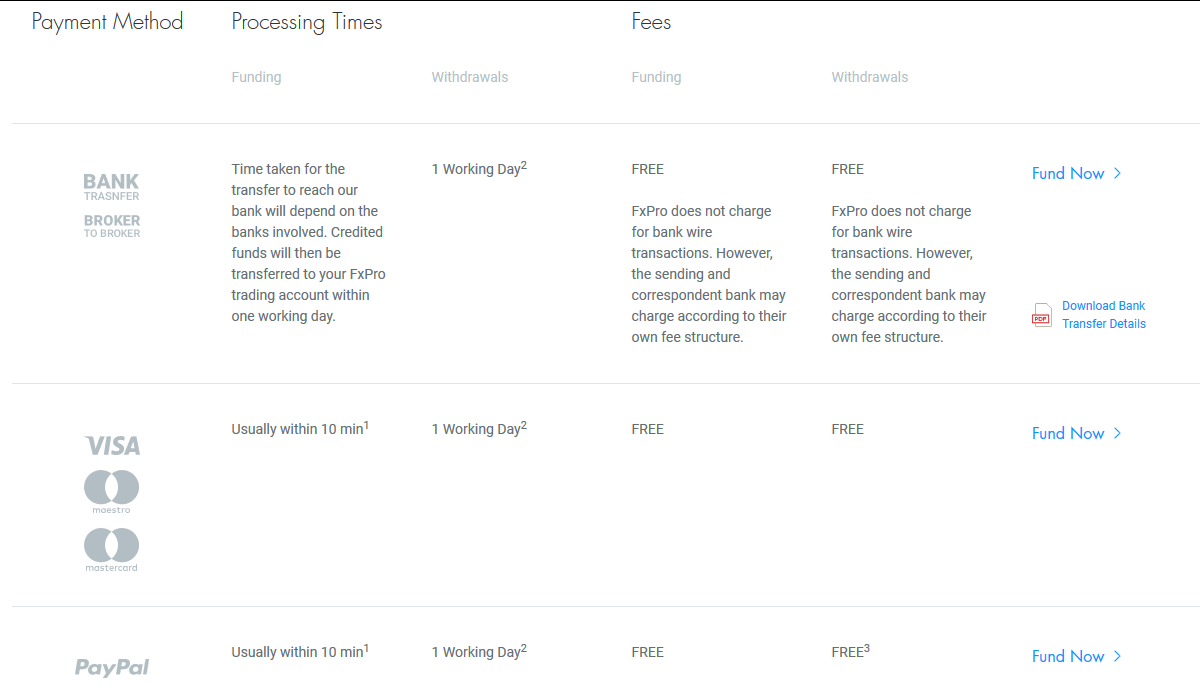

FxPro allow their customers to add funds and withdraw funds with them using various payment methods which are listed below:

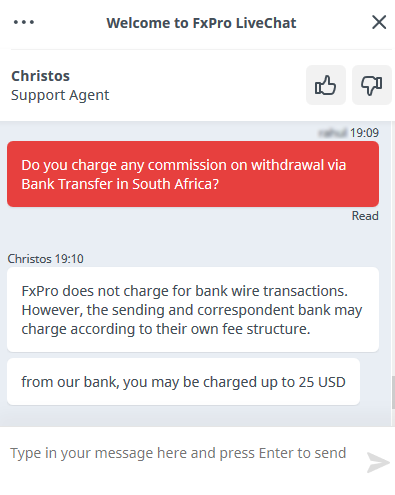

FxPro does not charge anything from their clients in case of withdrawal funds. Most of their withdrawal options are free and take less than 24 hours of processing time.

FxPro does not offer any bonus or promo for existing as well as new clients.

Currently there is no bonus or promo by FxPro for South Africans traders. But if they announce any bonus in future then we will update in this review post. So keep connected for update.

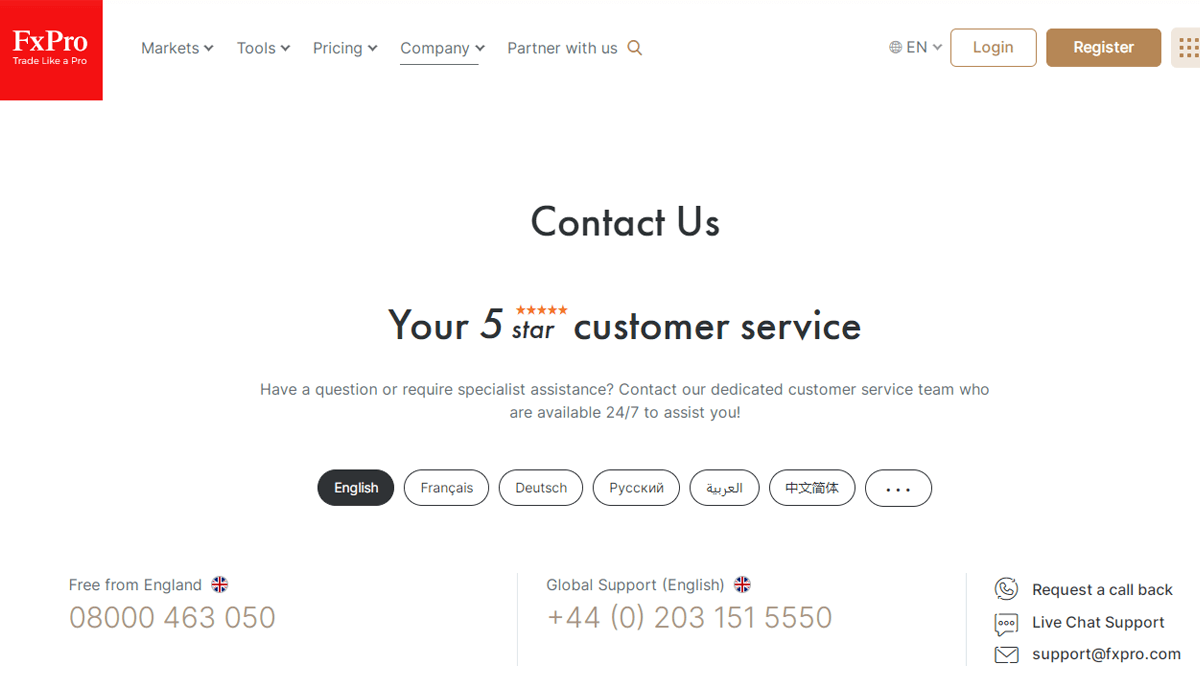

FxPro’s customer support is far better than most other brokers. Their support hours are 24 hours during Monday to Friday via below mediums:

FxPro’s support is very competent & friendly. We found their Live chat support to be is extremely easy to contact during the trading hours.

The only thing we don’t like in their support is that they don’t have a South African phone number. But then again, you can use their chat or request a callback at your preferred time.

Yes, we do recommend FxPro to South African Traders. Also, they are a NDD forex broker, so there is no conflict of interest.

We like them for their local FSCA regulation, their very low spread in cTrader account, great customer support and no deposit and withdrawal charges. Their overall fees is quite low with their cTrader account type.

But on the downside, FxPro does not have local address and phone number in South Africa. Moreover, they do not have educational tools or tutorials to help their customers. Also their spread is a higher with their MetaTrader accounts, but it is not too high to be honest, as we have seen many other brokers with higher spread.

Overall, FxPro is a very reliable and safe forex broker for South African traders. Hence we recommend them.

Yes. With FxPro, Traders from South Africa can select base currency as ZAR with which account selected trading account become ZAR account with minimum deposit of around ZAR 1700.

FxPro has a minimum deposit of R1707.34 ($100) with their basis MT4 account for all traders. But in case of ZAR as base currency the recommended deposit is ZAR 16,751.49 ($1000).

FxPro is regulated as ‘FxPro Financial Services Limited’ with Financial Sector Conduct Authority (FSCA) in South Africa with FSP number 45052 since 2015.

Yes, you can trade NASDAQ 100 as CFD on FxPro. The instrument is available with the symbol USNDAQ100, and the average spreads for this instrument is 100.54 with cTrader account.

You can request for withdrawal from the client panel or by writing to them via support email/. There are no charges by FxPro on withdrawal & processing withdrawal take upto 24 hours.

"Do you have experience with FxPro? Please consider sharing your experience with a review below – good or bad – doesn’t really matter as long as it’s helpful to other traders!"

We only accept user reviews that add value to fellow South African Traders. Unfortunately, not all reviews that you post with us will be published on the website. For your review to be approved, please share your detailed & honest experience with the broker – either positive or negative. Thank you for helping out other traders with your valueable feedback!

Important: We don't accept any payments or kickbacks from any forex broker(s) to delete or change any reviews. We welcome Forex Brokers to reply to reviews on our website & share their side of the story to keep the process honest and fair for both sides.